- Table of Contents

- Introduction

- What Is Cash Flow Optimisation?

- Cash Flow Analysis: What Is It and Why Is It Important?

- Assessing Financial Stability

- Evaluating Cash Conversion Cycles

- Predicting Future Financial Health

- Strategic Decision Making

- Attracting Investors and Creditors

- Best Practices for Cash Flow Optimisation

- Accurate Cash Flow Forecasting

- Streamline Accounts Receivable

- Manage Accounts Payable Strategically

- Monitor Inventory Levels

- Control Operating Expenses

- Diversify Revenue Streams

- Optimise Cash Conversion Cycles

- Maintain a Cash Reserve

- Monitor and Evaluate Performance

- Leverage Technology

- Effective Working Capital Management

- Scenario Planning

- How to Create a Cash Flow Forecast

- Managing Shortage and Liquidity Crises

- Identify the Root Cause

- Develop a Contingency Plan

- Prioritise Cash Flow Management

- Cut Non-Essential Expenses

- Negotiate with Creditors

- Explore Additional Funding Sources

- Accelerate Accounts Receivable Collection

- Reassure Stakeholders

- Renegotiate Contracts and Terms

- Scenario Planning for the Future

- The Psychology of Cash Flow: How Mindset Influences Financial Health

- 1. The Fear Factor

- 2. The Optimism Bias

- Innovations in Cash Flow Management

- Artificial Intelligence and Predictive Analytics

- Blockchain Technology

- Conclusion

Introduction

Managing the financial health of a business is no easy task, and one of the key elements that can make or break an organisation's stability is cash flow. Cash flow optimisation is a strategic approach that helps businesses maintain a healthy balance between incoming and outgoing cash, ensuring they have sufficient funds to meet their operational needs and growth objectives. In this blog post, we will explore cash flow optimisation and its importance, delve into cash flow analysis, discuss best practices to achieve optimal cash flow, understand cash flow forecasting, and learn how to tackle shortfalls and liquidity crises effectively.

What Is Cash Flow Optimisation?

Cash flow optimisation maximises the amount of cash flowing in and out of a business while reducing cash conversion cycles and minimising idle cash. It focuses on managing the timing of cash inflows and outflows to ensure that a company has sufficient liquidity to meet its financial obligations promptly and take advantage of growth opportunities when they arise.

Cash Flow Analysis: What Is It and Why Is It Important?

Cash flow analysis is a fundamental financial management tool that comprehensively examines a company's cash inflows and outflows over a specific period. It goes beyond merely looking at profits and losses on the income statement and delves into the actual cash movement within the organisation. By understanding the intricacies of cash flow, businesses can gain valuable insights into their financial health and make informed decisions to ensure long-term sustainability. Here's a deeper look into why cash flow analysis is crucial for any organisation:

Assessing Financial Stability

Cash flow analysis clearly shows a company's liquidity and financial stability. While a business might appear profitable on paper, without a positive cash flow, it may struggle to meet its short-term obligations, leading to severe consequences such as missed supplier payments, delayed employee salaries, or even bankruptcy. By closely examining cash flow patterns, businesses can identify whether they have enough liquid assets to manage day-to-day operations and weather unexpected financial storms.

Evaluating Cash Conversion Cycles

Cash conversion cycles refer to the time it takes for a company to convert its investments in inventory and other resources into cash from sales. Lengthy cash conversion cycles can tie up cash in working capital and lead to a strain on liquidity. On the other hand, shorter cycles free up cash more quickly, allowing for better cash flow management. By conducting cash flow analysis, businesses can identify areas to streamline processes to reduce cash conversion cycles and enhance overall cash flow efficiency.

Predicting Future Financial Health

Analysing historical cash flow data helps businesses identify trends and patterns that can be used to predict future cash flow scenarios. By projecting future cash flows, companies can plan for potential cash shortages or surpluses and take proactive measures to optimise their cash flow. Accurate forecasting enables better financial planning and reduces the likelihood of being caught off guard by unexpected financial challenges.

Strategic Decision Making

Cash flow analysis provides valuable insights that can influence strategic decision-making. For instance, if a business generates positive cash flow, it might be better positioned to invest in new ventures, expand operations, or explore acquisitions. Conversely, negative cash flow might warrant a more conservative approach, focusing on cost-cutting measures or restructuring debt. With cash flow analysis, companies can make well-informed decisions aligning with their financial objectives and risk appetite.

Attracting Investors and Creditors

Investors and creditors closely scrutinise a company's cash flow when evaluating its financial health and creditworthiness. Positive cash flow demonstrates that a company has a strong operational foundation and can comfortably meet its financial obligations. This instils confidence in potential investors and creditors, making them more likely to provide funding or extend credit. On the other hand, negative or inconsistent cash flow could raise concerns and deter potential investors and creditors, limiting access to vital capital.

Best Practices for Cash Flow Optimisation

Achieving optimal cash flow requires a systematic approach and adherence to best practices. Here are some essential tips to help businesses streamline their cash flow:

Accurate Cash Flow Forecasting

A reliable cash flow forecast is the foundation of effective cash flow optimisation. Use historical financial data, market trends, and sales projections to accurately estimate future cash inflows and outflows. Regularly review and update the forecast to account for changes in the business environment, ensuring it remains a valuable planning tool.

Streamline Accounts Receivable

Delays in receiving payments from customers can disrupt cash flow. Implement efficient billing systems, offer incentives for early payments, and establish clear credit terms. Regularly follow up with customers on outstanding invoices to reduce accounts receivable ageing and improve cash collection.

Manage Accounts Payable Strategically

Negotiate favourable payment terms with suppliers without harming relationships. Take advantage of vendor discounts for early payments, but ensure the timing aligns with the company's cash flow situation. Delay payments only when necessary to avoid harming supplier relationships.

Monitor Inventory Levels

Excess inventory can tie up valuable cash, while inadequate stock levels can lead to lost sales and disruptions. Regularly assess inventory turnover rates and strive to find the optimal balance that minimises holding costs while meeting customer demand.

Control Operating Expenses

Carefully scrutinise all operating expenses to identify areas where cost-cutting is possible without compromising the quality of products or services. To save costs over time, consider renegotiating contracts, exploring bulk purchasing, and investing in energy-efficient solutions.

Diversify Revenue Streams

Overreliance on a single customer or income source exposes a business to significant risks if that source dries up. To diversify revenue streams and reduce cash flow volatility, explore new markets, launch new products or services, or target different customer segments.

Optimise Cash Conversion Cycles

Improve efficiency in inventory management, accounts receivable, and accounts payable processes to shorten the cash conversion cycle. Analyse each cycle stage to identify bottlenecks and streamline operations to enhance overall cash flow.

Maintain a Cash Reserve

Build and maintain a cash reserve to buffer against unforeseen events or emergencies, such as economic downturns or unexpected expenses. Having adequate liquidity provides peace of mind and the ability to navigate crises without jeopardising day-to-day operations.

Monitor and Evaluate Performance

Track and analyse cash flow performance against forecasts and set targets regularly. Use key performance indicators (KPIs) to measure cash flow efficiency and identify areas for improvement. Learn from successes and challenges to continuously refine cash flow optimisation strategies.

Leverage Technology

Embrace cash flow management software and financial tools to automate processes, improve accuracy, and gain real-time visibility into cash flow. These technological solutions can provide actionable insights and facilitate more informed decision-making.

Effective Working Capital Management

Efficiently manage working capital by optimising inventory levels, negotiating favourable payment terms with suppliers, and accelerating accounts receivable collection. A well-balanced working capital management strategy ensures cash is used optimally throughout the business cycle.

Scenario Planning

Conduct scenario planning to anticipate potential cash flow challenges and opportunities. By creating "what-if" scenarios, businesses can develop contingency plans and adapt their strategies to changing market conditions.

Cash Flow Optimisation Steps | Description |

1. Analysis and Assessment | Examine current cash flow and financial health |

2. Strategic Planning | Develop tailored strategies based on analysis |

3. Implementation & Monitoring | Execute plans and track progress consistently |

4. Adaptation & Continuous Improvement | Adjust strategies based on performance, market changes |

Table 1: Steps for effective cash flow optimisation

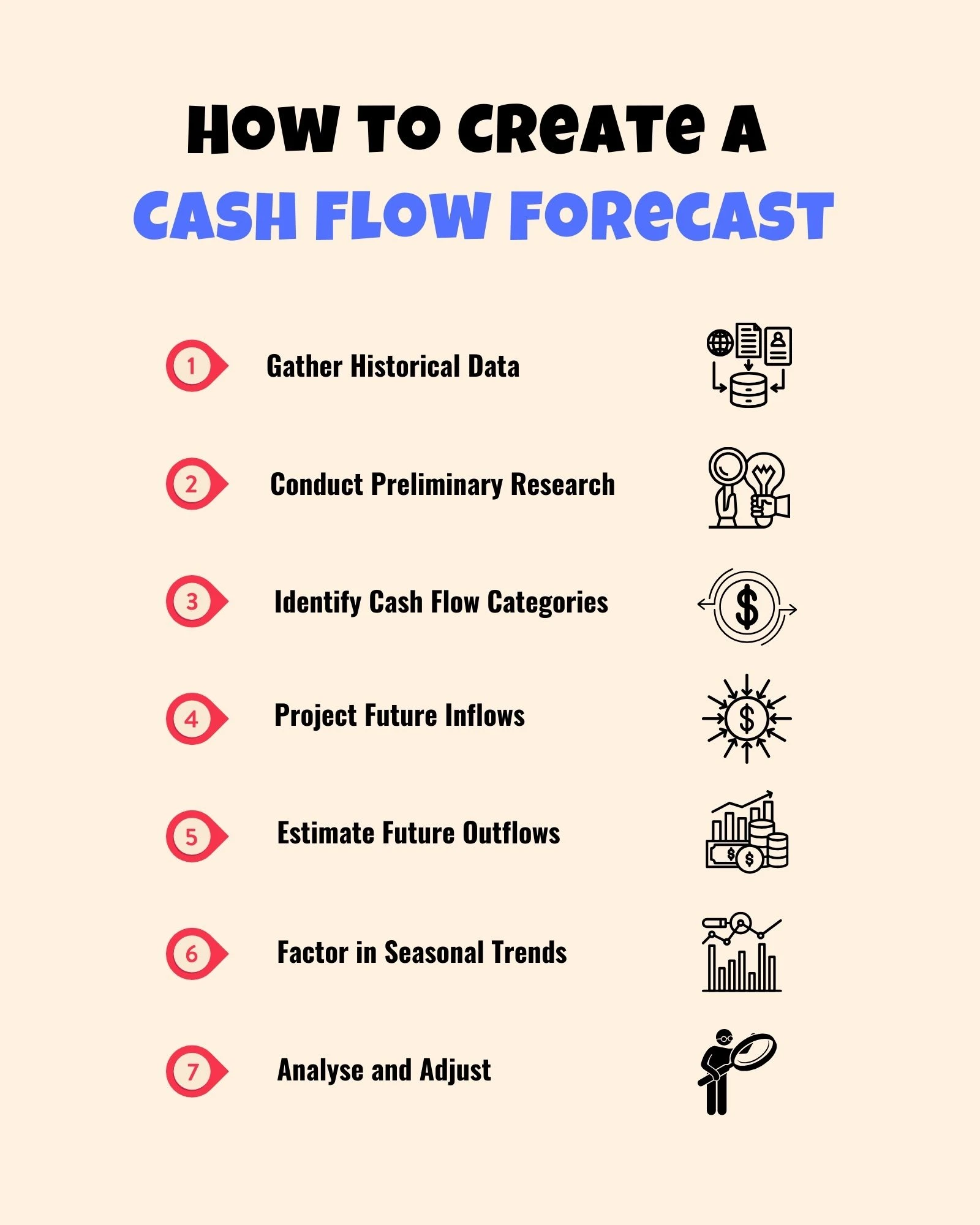

How to Create a Cash Flow Forecast

A cash flow forecast is a powerful tool for predicting future cash movements, allowing businesses to plan ahead and make informed decisions. Follow these steps to create an effective cash flow forecast:

- Gather Historical Data: Collect data on past cash inflows and outflows over a specific period, preferably the last 12 months.

- Identify Cash Flow Categories: Categorise cash flows into different segments, such as operating activities, investing activities, and financing activities.

- Project Future Inflows: Based on historical trends and sales forecasts, estimate future cash inflows from various sources, including customer payments, investments, and loans.

- Estimate Future Outflows: Predict upcoming expenses, including supplier payments, operating costs, loan repayments, and any other financial obligations.

- Factor in Seasonal Trends: Consider any seasonal fluctuations affecting your cash flow, ensuring your forecast remains accurate throughout the year.

- Analyse and Adjust: Regularly review and compare your cash flow forecast with actual results. Adjust your projections as necessary to improve the accuracy of future forecasts.

Managing Shortage and Liquidity Crises

While cash flow optimisation aims to maintain a healthy balance between inflows and outflows, unexpected events and economic downturns can sometimes lead to cash flow shortages and liquidity crises. Navigating through such challenging times requires a combination of strategic planning, swift decision-making, and effective crisis management. Here's a comprehensive guide to managing shortage and liquidity crises:

Identify the Root Cause

The first step in managing any crisis is understanding its origin. Is it a sudden decline in sales due to market shifts? Are unexpected expenses eating into the budget? Is it a delay in customer payments? Pinpointing the root cause is like diagnosing an ailment – it guides the prescription of the right remedy. Thorough financial analysis, market research, and internal audits are essential for this diagnostic process.

Develop a Contingency Plan

A contingency plan is a business's shield in times of crisis. It should encompass various scenarios, outlining specific actions for each situation. This plan should detail potential sources of emergency funding, such as lines of credit or short-term loans. It should also include strategies for reducing expenses, renegotiating contracts, and optimising cash flows promptly. A well-prepared contingency plan serves as a roadmap, ensuring that businesses are never caught off guard.

Prioritise Cash Flow Management

In times of crisis, cash flow management takes centre stage. Regularly updated cash flow forecasts become lifelines, guiding decisions about which expenses are critical and which can be postponed. By prioritising essential payments, businesses ensure that vital operations continue without disruptions. It involves meticulous tracking of cash inflows and outflows, ensuring every penny is allocated where it matters the most.

Cut Non-Essential Expenses

Every non-essential expense becomes a burden when a business faces a liquidity crisis. Trimming unnecessary costs involves a critical evaluation of every expenditure. Common strategies include postponing non-critical projects, renegotiating contracts, and halting discretionary spending. It's not just about saving money but conserving cash to ensure the business stays afloat.

Negotiate with Creditors

Open communication with creditors is vital during a liquidity crisis. Suppliers and lenders are often willing to collaborate if they understand the situation. Proactive communication, explaining the challenges faced, and proposing feasible solutions can lead to renegotiated payment terms, deferred payments, or even short-term extensions on credit. Collaboration can ease the immediate financial burden, giving the business breathing space.

Explore Additional Funding Sources

If the cash shortage is temporary, seeking additional funding becomes crucial. Short-term loans, lines of credit, or investments from existing shareholders can provide the necessary financial bridge. Careful evaluation of the terms and interest rates is essential to ensure that the chosen funding option aligns with the company's long-term financial goals. Exploring these avenues requires a strategic approach, balancing the immediate need for cash with long-term financial sustainability.

Accelerate Accounts Receivable Collection

Expedite the collection of outstanding payments from customers. Offer discounts or incentives for early payments and implement proactive follow-up strategies to reduce accounts receivable ageing. Consider factoring or invoice financing options if needed to obtain immediate cash against outstanding invoices.

Reassure Stakeholders

Stakeholders, including employees, investors, creditors, and suppliers, need reassurance during a crisis. Transparent communication is key. Regular updates on the situation, the actions being taken, and the progress made instil confidence. Maintaining trust is not just about words; it’s about demonstrating a proactive approach to overcoming the crisis. Reassured stakeholders are more likely to stand by the business, providing its essential support.

Renegotiate Contracts and Terms

Reviewing existing contracts and agreements presents opportunities for negotiation. This could involve seeking more favourable terms with suppliers, customers, or landlords. Temporary adjustments, such as rent reductions or extended payment periods, can significantly ease the financial strain. Renegotiation requires diplomacy and flexibility, ensuring that both parties benefit from the adapted terms.

Scenario Planning for the Future

Every crisis offers invaluable lessons. Utilise the experience to develop robust scenario planning for potential future challenges. Implement risk management strategies that allow the company to adapt quickly to changing circumstances while maintaining financial stability. By learning from the crisis, businesses can emerge more resilient and better prepared for future challenges.

Managing shortage and liquidity crises is not just about survival; it’s an opportunity for businesses to showcase their adaptability and resilience. With a strategic playbook in place, businesses can navigate through the storm, emerging on the other side stronger, wiser, and better equipped to face future challenges. Remember, when managed strategically, a crisis can become a stepping stone for growth and long-term success.

The Psychology of Cash Flow: How Mindset Influences Financial Health

Cash flow management isn’t just about numbers but the psychology behind financial decisions. Businesses often face challenges not because they lack the resources, but because they lack the mindset to navigate the complexities of cash flow. Understanding the psychology of cash flow is akin to deciphering a cryptic code, unlocking secrets to sustainable financial health.

1. The Fear Factor

Fear, often stemming from financial uncertainties, can paralyse decision-making. Gripped by the fear of cash shortages, businesses might delay investments or shy away from essential expenditures. This fear-induced hesitation can create a self-fulfilling prophecy, leading to the very shortages they feared. Addressing this fear involves a shift in mindset – viewing cash flow challenges not as threats but as opportunities for strategic innovation. Embracing calculated risks and proactive financial planning can transform fear into a catalyst for growth.

2. The Optimism Bias

Optimism is a double-edged sword. While optimism can drive entrepreneurial spirit and innovation, an excessive optimism bias can lead to overestimating future cash flows and underestimating risks. Businesses might assume that good times will continue indefinitely, leading to imprudent financial decisions. Striking a balance between confidence and prudence involves realistic forecasting, scenario planning, and regular reassessment of financial strategies. It’s about harnessing the optimism to fuel growth while maintaining a realistic understanding of the market and financial risks.

Understanding these psychological nuances is essential for businesses. It’s not just about the numbers on the balance sheet; it’s about the mindset behind those numbers. By addressing fear and balancing optimism, businesses can navigate the turbulent waters of cash flow with confidence and strategic insight.

Innovations in Cash Flow Management

Cash flow management isn’t immune to technological advancements. In an era where data is king, innovative solutions are transforming the financial management landscape. These innovations aren’t just about automating existing processes; they’re about reimagining cash flow management from the ground up, creating a future where businesses can anticipate, adapt, and thrive.

Artificial Intelligence and Predictive Analytics

Artificial intelligence (AI) and predictive analytics are revolutionising cash flow forecasting. By analysing vast datasets and identifying patterns, AI algorithms can predict future cash flows with unprecedented accuracy. Businesses can move beyond historical data, embracing real-time insights to make proactive decisions. Predictive analytics anticipates financial challenges and identifies opportunities, enabling businesses to optimise cash flow strategically.

AI in Cash Flow Management | Description |

| Forecast future cash flows with precision |

| Streamline invoicing, ensuring accuracy |

| Enhance security, identify and prevent fraud |

| Access immediate data for strategic decisions |

| Automate expense tracking, reducing errors |

| Understand payment patterns for proactive actions |

| Adjust budgets instantly based on real-time data |

Table 2: How technology is changing cash flow management

Blockchain Technology

Blockchain technology, renowned for its role in cryptocurrencies, is making waves in financial management. Its decentralised and transparent nature ensures that financial transactions are secure, tamper-proof, and instantly verifiable. This means streamlined invoicing, faster payments, and enhanced security for businesses. Blockchain reduces the risk of fraud, ensuring that every penny is accounted for accurately. It’s not just a technology; it’s a financial revolution, redefining how businesses perceive and manage cash flow.

Embracing these innovations isn’t just a choice; it’s necessary in a competitive landscape. Businesses that integrate these technological advancements into their cash flow strategies are not just adapting to the future; they’re shaping it, ensuring that their financial foundations are robust and future-proof. Cash flow management isn’t static; it’s dynamic, evolving with technology and innovation, ensuring that businesses are always steps ahead in their financial strategies.

Conclusion

Cash flow optimisation is critical to running a successful business, enabling companies to maintain financial stability, invest in growth opportunities, and navigate challenging times. By analysing cash flow, adopting best practices, creating accurate forecasts, and managing crises effectively, businesses can unlock the power of cash flow optimisation and set themselves on a path to sustainable financial success. Remember, mastering cash flow is an ongoing process that requires continuous monitoring and adaptation to stay ahead in a competitive business landscape. For a comprehensive understanding of treasury and cash flow risk management, consider enrolling in our specialised course, ‘Treasury and Cash Flow Risk Management,’ designed to equip you with the knowledge and skills to navigate complex financial landscapes and safeguard your company's financial future.