Introduction

Debt is a common financial burden that many individuals and households face. It can stem from various sources, such as credit cards, loans, or medical expenses. Uncontrolled debt can be overwhelming, affecting your financial stability and overall well-being. However, with effective debt management strategies, you can regain control over your finances and pave the way to a debt-free future. In this blog post, we will delve into the intricacies of debt management, exploring how it works, who handles it, the pros and cons of debt management plans, whether it's the right choice for you, the concept of debt consolidation, and alternative options you can consider.

What Is Debt Management?

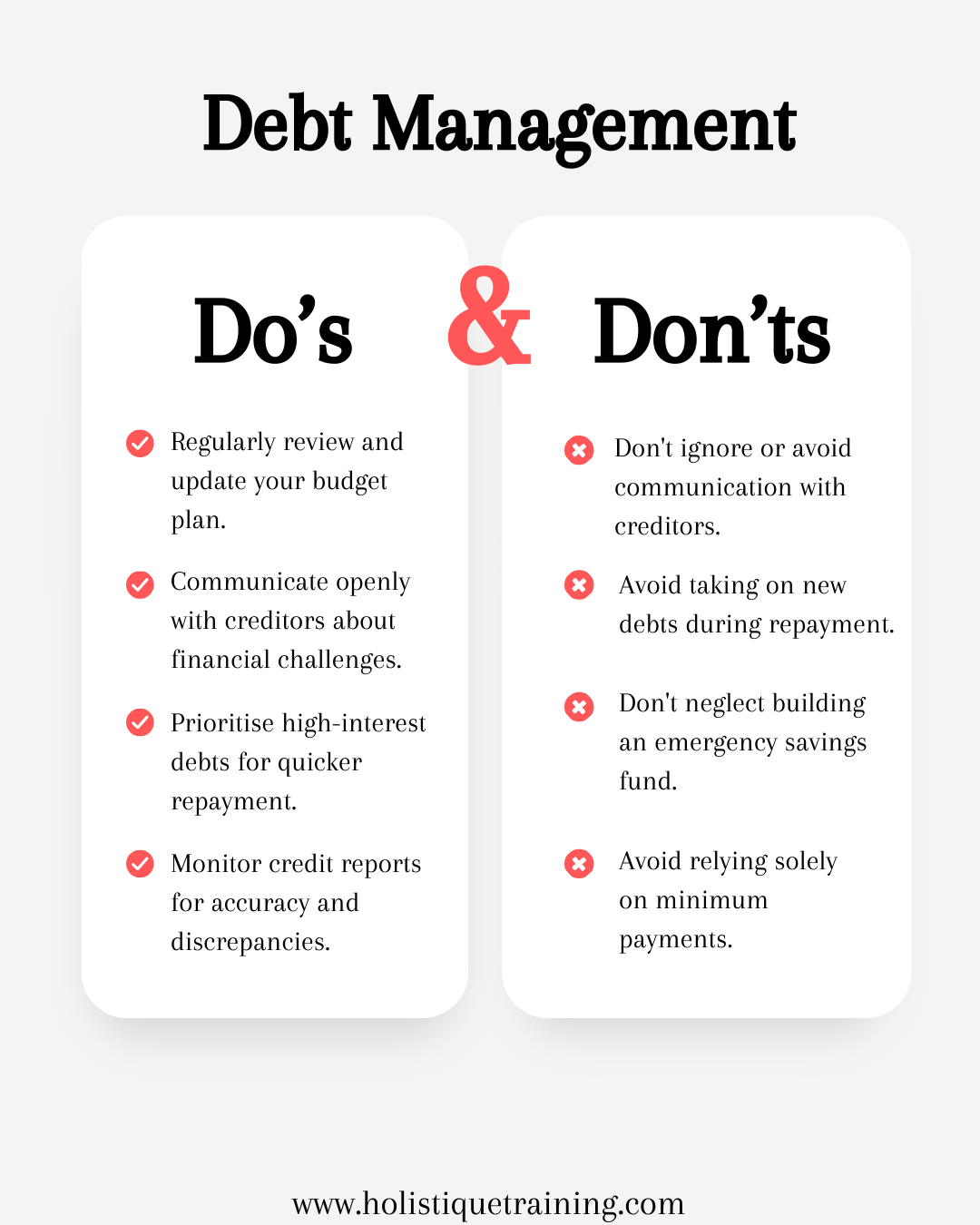

Debt management refers to the process of effectively managing and repaying outstanding debts. It involves developing a comprehensive plan to address your financial obligations while minimising the impact on your monthly budget. Debt management strategies typically aim to negotiate with creditors to lower interest rates, establish affordable repayment plans, and ultimately eliminate the debt within a specified timeframe.

How Does Debt Management Work?

The process of debt management is a strategic and systematic approach aimed at empowering individuals to address and eliminate outstanding debts. To comprehend the nuances of how debt management works, we must delve into the key stages involved in this comprehensive financial strategy.

Stage 1: Financial Assessment

The journey towards effective debt management commences with a thorough financial assessment. Individuals need to compile a comprehensive list of their debts, including credit card balances, personal loans, and any other outstanding financial obligations. This list should encompass accurate information about the amounts owed, interest rates, and repayment terms for each debt.

This stage acts as a diagnostic tool, providing a clear overview of the financial landscape. It allows individuals to understand the extent of their debt, identify high-interest obligations, and determine the most effective course of action. Armed with this information, they can proceed to the next critical step.

Stage 2: Seeking Professional Guidance

Navigating the complexities of debt management often requires the expertise of professionals. This is where reputable credit counselling agencies come into play. These non-profit organisations are dedicated to providing financial education and assistance.

Upon reaching out to a credit counselling agency, individuals are connected with trained professionals who review their financial information. This includes an analysis of income, expenses, and existing debts. The goal is to create a personalised debt management plan that aligns with the individual's specific circumstances.

Stage 3: Crafting a Personalised Debt Management Plan

The cornerstone of effective debt management is a personalised debt management plan. This plan is meticulously designed based on the individual's financial situation and goals. The credit counsellor, in collaboration with the individual, negotiates with creditors to secure more favourable terms.

Negotiations may include:

1. Lowering Interest Rates

By advocating on behalf of the debtor, credit counsellors aim to reduce the burden of high-interest rates. Lower interest rates can result in substantial long-term savings for the individual.

2. Waiving Late Fees

Late fees can significantly contribute to the escalation of debt. Credit counsellors work to negotiate with creditors to waive or reduce late fees, providing immediate relief to the debtor.

3. Structuring a Repayment Schedule

Instead of dealing with multiple creditors, individuals enrolled in a debt management plan make a single monthly payment to the credit counselling agency. The agency then distributes these funds among creditors according to the agreed-upon plan.

This structured repayment schedule ensures consistency and progress towards becoming debt-free. The negotiation process may involve concessions from both parties, fostering a cooperative approach to debt resolution.

Stage 4: Implementation and Adherence

Once the personalised debt management plan is finalised, it's time for implementation. The individual begins making the agreed-upon monthly payments to the credit counselling agency. The agency, in turn, disburses these funds to the respective creditors.

Consistency and discipline are paramount during this stage. Adhering to the structured repayment schedule is key to the success of the debt management plan. Regular check-ins with the credit counsellor help monitor progress and address any challenges that may arise.

Stage 5: Gradual Rebuilding of Credit

Enrolling in a debt management plan may have an initial impact on the individual's credit score. This is because it signals to creditors that external assistance is being sought. However, with diligent adherence to the plan, individuals can gradually rebuild their creditworthiness.

As payments are made consistently and debts are reduced, the positive impact on the credit score becomes more pronounced. The ultimate goal is to emerge from the debt management plan with improved financial health and a strengthened credit profile.

In essence, the process of debt management is a multifaceted journey that combines financial assessment, professional guidance, strategic negotiation, disciplined implementation, and gradual credit rebuilding. Each stage is interconnected, forming a comprehensive strategy to tackle and eliminate debt effectively. By understanding how debt management works, individuals can embark on this transformative path towards financial freedom.

Who Handles Your Debt Management?

Debt management is a complex process that often requires professional guidance to navigate successfully. The entities responsible for overseeing and facilitating debt management are credit counselling agencies. These non-profit organisations play a pivotal role in assisting individuals facing financial challenges by offering expert advice and tailored solutions.

The Role of Credit Counseling Agencies

1- Educational Outreach

Credit counselling agencies are committed to financial education. They conduct outreach programmes and workshops to enhance financial literacy, empowering individuals to make informed decisions about their money.

2- Professional Expertise

Within credit counselling agencies, individuals seeking help are connected with trained professionals. These professionals, often certified credit counsellors, have in-depth knowledge of financial matters and debt management strategies. They leverage their expertise to guide individuals through the complexities of debt resolution.

3- Comprehensive Financial Assessment

One of the initial steps undertaken by credit counsellors is a thorough financial assessment. This involves a detailed review of the individual's financial situation, including income, expenses, and existing debts. This comprehensive analysis serves as the foundation for crafting a personalised debt management plan.

4- Personalised Debt Management Plans

Credit counsellors work collaboratively with individuals to design debt management plans that suit their unique circumstances. These plans take into account the individual's financial goals, obligations, and capacity to repay. Negotiations with creditors are a critical component of this process, aiming to secure more favourable terms for the debtor.

5- Negotiating with Creditors

Armed with a deep understanding of the individual's financial situation, credit counsellors engage in negotiations with creditors. The goal is to secure concessions that can alleviate the burden on the debtor. This may include lower interest rates, waived late fees, or the establishment of a structured repayment schedule.

6- Structured Repayment Process

Perhaps one of the most significant contributions of credit counselling agencies is the establishment of a structured repayment process. Instead of managing multiple payments to various creditors, individuals enrolled in a debt management plan make a single monthly payment to the credit counselling agency. The agency, in turn, allocates these funds among the creditors as per the negotiated terms.

7- Ongoing Support and Monitoring

The relationship with a credit counselling agency is not limited to the initial stages of debt management. Throughout the implementation of the debt management plan, credit counsellors provide ongoing support and monitoring. Regular check-ins ensure that individuals are adhering to the plan and making progress towards becoming debt-free.

Selecting a Reputable Credit Counseling Agency

Choosing the right credit counselling agency is crucial for a successful debt management journey. Consider the following factors when selecting an agency:

Accreditation

Ensure that the agency is accredited by reputable organisations. Accreditation signifies adherence to industry standards and a commitment to ethical practices.

Track Record

Research the agency's track record. A proven history of success and positive testimonials from past clients are indicators of reliability.

Transparency

Transparency is key. The agency should provide clear information about its services, fees, and the entire debt management process.

Educational Resources

A commitment to financial education is a positive sign. Look for agencies that offer educational resources to empower individuals to make sound financial decisions beyond the debt management process.

In summary, credit counselling agencies serve as invaluable partners in the debt management journey. Through educational outreach, professional expertise, and personalised debt management plans, these agencies empower individuals to regain control of their finances. When choosing an agency, diligence and research are essential to ensure a positive and effective debt management experience.

Pros and Cons of Debt Management Plans

Debt management plans offer several advantages, but it's crucial to weigh them against potential drawbacks to make an informed decision:

Pros

Lower Interest Rates

One of the primary benefits of a DMP is the potential for negotiating lower interest rates. Credit counsellors, working on behalf of the debtor, engage in discussions with creditors to secure more favourable terms. This can result in substantial savings over the course of the repayment period.

Simplified Payments

Managing multiple debts can be overwhelming. A DMP simplifies this process by consolidating various payments into a single monthly instalment. Individuals make a single payment to the credit counselling agency, which then distributes the funds to creditors according to the negotiated plan. This streamlined approach reduces the risk of missed payments and simplifies financial management.

Professional Guidance

Enrolling in a DMP provides access to professional guidance from certified credit counsellors. These experts offer insights into effective debt management strategies, provide financial education, and act as a support system throughout the repayment journey. The knowledge and expertise of credit counsellors can significantly contribute to the success of the DMP.

Structured Repayment

DMPs establish a structured and disciplined repayment schedule. This structure ensures that individuals make consistent and timely payments towards their debts. Having a clear roadmap for debt repayment enables individuals to monitor progress and stay focused on the goal of becoming debt-free.

Cons

Credit Score Impact

One of the notable drawbacks of enrolling in a DMP is its initial impact on the individual's credit score. Creditors may view participation in a DMP as an indication that the debtor is seeking external assistance with their debts. While this impact is temporary, it's important to be aware that credit scores may be negatively affected during the early stages of the plan.

Limited Debt Types

DMPs primarily focus on unsecured debts, such as credit cards and personal loans. Secured debts, such as mortgages or auto loans, are not typically included in these plans. This limitation means that individuals with diverse types of debts may need to explore alternative strategies for managing secured obligations..

Potential Lengthy Repayment

The duration of a DMP varies depending on factors such as the total amount of debt and negotiated terms. However, it's essential to recognise that DMPs can span several years, requiring a long-term commitment and financial discipline. Individuals must be prepared for the dedication required to see the plan through to completion.

Not Applicable to Everyone

DMPs are not suitable for individuals facing severe financial hardships or those with minimal disposable income. In situations where financial challenges are particularly acute, alternative options may need to be explored. DMPs work best for those with a steady income and a commitment to changing their spending habits.

Is Debt Management Right for You?

The decision to enrol in a debt management plan (DMP) is a significant financial choice that requires careful consideration of individual circumstances. While DMPs offer valuable benefits, they may not be the ideal solution for everyone. Determining whether a debt management plan is right for you involves assessing your financial situation, commitments, and long-term goals.

1. Stable Income

A key consideration when contemplating a debt management plan is the stability of your income. DMPs work best for individuals with a consistent and reliable income source. This stability ensures that you can make the agreed-upon monthly payments to the credit counselling agency, contributing to the success of the plan. If your income is erratic or you're facing imminent job changes, it may be prudent to evaluate other debt management options.

2. Commitment to Financial Change

Enrolling in a debt management plan is not only about repaying current debts but also about instigating lasting financial change. Success in a DMP requires a commitment to altering spending habits, budgeting effectively, and avoiding accumulating new debts. If you're genuinely dedicated to making sustainable changes in your financial behaviour, a DMP can serve as a structured pathway towards achieving those goals.

3. Determination to Repay Debts Structurally

Debt management plans are designed for individuals who are determined to repay their debts in a structured and disciplined manner. If you prefer a systematic approach to tackling your debts rather than dealing with the stress of multiple payments and varying interest rates, a DMP aligns with this goal. The structured repayment schedule offered by a DMP simplifies the process, allowing you to make consistent progress towards becoming debt-free.

4. Facing Significant Financial Hardship

While DMPs are effective for many, they may not be suitable for individuals facing severe financial hardships. If your financial challenges are particularly acute, such as unemployment, substantial medical expenses, or other emergencies, a DMP may not be the most appropriate option. In such cases, exploring alternative solutions, including consulting with a bankruptcy attorney or seeking financial assistance programmes, may be necessary.

5. Assessment of Alternative Options

Before committing to a debt management plan, it's essential to explore alternative debt management strategies. This includes considering the debt snowball or avalanche methods, debt settlement, or in extreme cases, exploring bankruptcy, which we will talk about in a minute. Each option has its own set of advantages and considerations, and the right choice depends on your specific financial circumstances and goals.

6. Understanding the Temporary Credit Impact

Enrolling in a DMP may have a temporary impact on your credit score. This is due to the indication that you are seeking external assistance with your debts. However, understanding that this impact is a short-term consequence and that diligent adherence to the plan can contribute to gradual credit score improvement is crucial. If you anticipate needing to access new credit in the near future, it's important to factor in this temporary credit score impact.

7. Long-Term Commitment and Discipline

Debt management plans are not quick fixes; they require a long-term commitment and financial discipline. Depending on the amount of debt and negotiated terms, DMPs can span several years. It's crucial to assess whether you have the commitment and discipline to see the plan through to completion. Regular check-ins with credit counsellors and periodic reviews of the plan ensure that it remains aligned with your evolving financial situation.

In Short

The decision to enrol in a debt management plan is a significant step towards financial recovery. It's a strategy that can be highly effective for individuals with stable incomes, a commitment to financial change, and a determination to repay debts systematically. However, it may not be suitable for those facing severe financial hardships or those who prefer alternative approaches to debt management.

Before making a decision, it's crucial to conduct a thorough self-assessment, consider alternative options, and seek professional advice from credit counsellors. Understanding the trade-offs, such as the temporary impact on credit scores and the need for long-term commitment, empowers individuals to make informed choices that align with their unique financial circumstances and goals.

Remember, the journey towards financial freedom is personal, and the right solution is the one that best suits your individual needs and aspirations.

Table 1: Comparative overview of debt management apps

App Name | Key Features | Considerations |

Debt Payoff Planner | Customisable repayment plans | Ad-supported with optional in-app purchases |

Credit Karma | Credit score monitoring | Ad-supported with optional financial product recommendations |

Debt Free | Debt snowball and avalanche tools | Paid app with no free version |

PocketGuard | Automatic debt tracking | Monthly subscription for premium features |

Debt Manager | Interactive progress tracking | Ad-free experience with a one-time purchase |

What Is Debt Consolidation?

Debt consolidation is another debt management strategy that involves combining multiple debts into a single loan or credit account. This approach aims to simplify repayment by reducing the number of creditors and potentially securing a lower interest rate. Debt consolidation can be achieved through various means, such as taking out a personal loan, obtaining a home equity loan, or transferring balances to a low-interest credit card.

Alternatives to Debt Management Plans

While debt management plans can be effective for many individuals, they are not the only option available. Depending on your circumstances and goals, you may consider alternative debt management strategies:

1- Debt Snowball or Avalanche Method

These methods involve prioritising and repaying debts either from the smallest to the largest balance (debt snowball) or from the highest to the lowest interest rate (debt avalanche).

2- Debt Settlement

This option involves negotiating with creditors to settle your debts for less than the total amount owed. It can be suitable for individuals facing significant financial hardships, although it may have a more significant impact on credit scores.

3- Bankruptcy

Bankruptcy is a legal process that provides individuals with a fresh financial start by eliminating or restructuring their debts. It should be considered as a last resort, as it has long-term implications on creditworthiness.

4. Increasing Income and Budgeting

Sometimes, a proactive approach to increasing income and implementing strict budgeting can be a powerful strategy for debt management. This may involve seeking additional sources of income, negotiating salary raises, or finding ways to cut unnecessary expenses.

5. Financial Counseling and Education

Engaging in financial counselling and education can be instrumental in developing a deeper understanding of personal finances and effective money management. Non-profit organisations and community resources often offer financial education programmes.

When exploring alternatives to debt management plans, individuals should carefully assess their unique financial situations, goals, and preferences. The right solution depends on factors such as the type and amount of debt, the urgency of financial challenges, and long-term objectives.

Before making a decision, seeking professional advice from financial counsellors, considering the potential impact on credit scores, and understanding the commitment required for each strategy is essential. Additionally, combining multiple approaches, such as budgeting and increasing income alongside a strategic debt repayment method, may offer a comprehensive solution.

Ultimately, the journey to financial freedom is personal, and the right path is the one that aligns with individual values and circumstances. By exploring these alternatives and making informed decisions, individuals can take significant steps towards achieving their financial goals and creating a stable and secure financial future.

Conclusion

Debt management is a valuable tool that can help individuals regain control over their finances and pave the way to a debt-free future. By enrolling in a debt management plan, working with credit counselling agencies, and implementing effective strategies, you can establish a structured repayment plan, reduce interest rates, and ultimately achieve financial freedom. However, it's essential to carefully assess your situation, explore alternative options, and consult with professionals to determine the best course of action for your specific circumstances.

For business owners seeking comprehensive knowledge and strategies in capital and debtors management, consider enrolling in our course, ‘Capital and Debtors Management,’ where you can gain practical insights and techniques to effectively manage business debts and ensure financial stability for your enterprise. Remember, with determination and the right skills, you can take charge of your financial well-being and create a brighter future for your business.