Developing a successful and profitable business requires a wide array of financial understanding to create a cost-effective roadmap for future developments, forecasting, and change. Risk management goes hand in hand with financial planning, as a foolproof framework will allow you to make sound, strategic decisions to move forward while maintaining your profit margins.

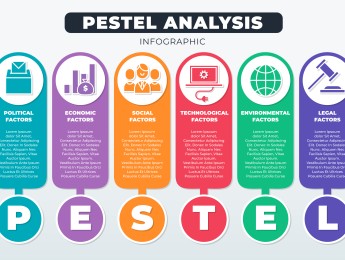

Many factors can affect business profits, including technology, staffing, contingency processes, health and safety procedures, and new policies. It’s essential that project planners or business owners fully understand the implications of progression and changes within the business and their short-term and longer-term effects on the company finances.

Creating a risk assessment and effective SWOT analysis will allow you to prioritise changes and mitigate risks in the financial structure based on their potential outcomes. Because the demands on businesses from their customers, clients, and stakeholders are increasing yearly, it’s important to focus more on the potential end results of each change to determine an accurate cost-benefit analysis and maintain your obligations and corporate governance.

Upon completion of this course, participants will be able to:

- Discover valuable tools and systems to help with accurate financial planning.

- Understand your goals and prioritise your aims based on a SWOT analysis.

- To evaluate your current corporate finance structure and identify pain points.

- Apply good corporate governance principles to future change models.

- Conduct regular financial risk assessments to identify challenges in your future framework and mitigate issues.

- Identify new sources of potential capital and profit and create achievable goals to reach them.

- Develop financial reporting and monitoring mechanisms to stay on top of your corporate data.

This course is aimed at anyone involved in financial planning, scoping for a business, or controlling a departmental budget. It would be particularly beneficial for:

- Finance Managers

- CFOs

- Business Owners

- Financial Support Team

- Project Managers

- Operations Managers

- Risk Managers

- Change & Control Managers

This course will use a variety of learning styles, including presentations to understand financial planning obligations against corporate governance, practical exercises involving real-life case studies to identify where risks occur and how to mitigate them, and group discussions to create accurate frameworks and monitoring platforms for real-world use.

Day 5 of each course is reserved for a Q&A session, which may occur off-site. For 10-day courses, this also applies to day 10

Section 1: Finding Financial Information

- Creating a viable strategic plan.

- Finding accurate financial information internally and externally.

- Monitor your information for trends.

- Identifying the best times to act.

- Developing cash flow statements and keeping accurate records.

- Determining the most profitable financial moves.

Section 2: Calculating Capital & Equity

- Short-term vs. long-term equity.

- Sourcing your finances.

- The optimum capital structure - equity vs. debt

- The cost of floating debt against fixed debt.

- WACC - Weighted Average Cost of Capital.

- CAPM - Capital Asset Pricing Model.

Section 3: Making the Right Investment Decisions

- Evaluating your current financial performance.

- Managing shareholder expectations.

- CAPEX analysis.

- Identifying your strategic issues.

- Your cash flow forecast.

- Accounting rate of return (ARR) and payback.

- NPV and IRR appraisal techniques.

- Understanding the profitability index (PI).

Section 4: Managing Financial Risk

- Creating a financial risk assessment.

- Understanding priorities.

- Reducing your costs while maintaining quality and productivity.

- SWOT analysis.

- 80/20 rule and how it applies to finance.

- Your risk assessment appraisal RAROC.

- Effective ways of controlling financial risk.

- Risks of financial currency.

- The 4 Ts of risk management.

Section 5: Corporate Governance

- Pleasing your stakeholders and customers.

- Understanding staff requirements and maintaining a consistent and happy workforce.

- The role of your directors in applying the budget fairly.

- External and internal audit preparation.

- International corporate governance. OECD.

- Do you need an auditing committee to assign finances to projects?

- Trending corporate governance problems and potential resolutions.

Upon successful completion of this training course, delegates will be awarded a Holistique Training Certificate of Completion. For those who attend and complete the online training course, a Holistique Training e-Certificate will be provided.

Holistique Training Certificates are accredited by the British Assessment Council (BAC) and The CPD Certification Service (CPD), and are certified under ISO 9001, ISO 21001, and ISO 29993 standards.

CPD credits for this course are granted by our Certificates and will be reflected on the Holistique Training Certificate of Completion. In accordance with the standards of The CPD Certification Service, one CPD credit is awarded per hour of course attendance. A maximum of 50 CPD credits can be claimed for any single course we currently offer.

- Course Code PF1-147

- Course Format Classroom, Online,

- Duration 5 days