- Table of Contents

- Introduction

- What Is Modern Portfolio Theory (MPT)?

- Benefits of Modern Portfolio Theory

- Risk Reduction Through Diversification

- Enhanced Returns Through Strategic Allocation

- Scientific Decision-Making

- Balancing Short-term Volatility with Long-term Objectives

- Adaptability to Individual Risk Tolerance

- Promoting Informed Decision-making

- How Modern Portfolio Theory Works

- 1. Asset Allocation

- 2. Risk and Return Assessment

- 3. Correlation Analysis

- 4. Efficient Frontier

- 5. Dynamic Rebalancing

- 6. Stress Testing

- What Is the Efficient Frontier?

- More on the Efficient Frontier

- Portfolio Optimisation

- Diversification Benefits

- Risk Tolerance and Efficient Frontier

- The Challenges of Using Modern Portfolio Theory

- 1. Assumptions and Limitations

- 2. Estimation Error

- 3. Black Swan Events

- 4. Correlation Breakdown

- 5. Behavioural Biases

- 6. Shortcomings in Portfolio Optimisation

- 7. Ongoing Monitoring and Adaptation

- Sustainable and Socially Responsible Investing (SRI)

- 1. Environmental Considerations

- 2. Social Impact

- 3. Governance Standards

- 4. Impact Investing

- 5. Long-Term Sustainability

- 6. Creating Positive Change

- 7. Risk Management and Resilience

- Conclusion

Introduction

Investing is a delicate art that requires careful consideration of various factors. One such factor is the construction of an optimal investment portfolio that maximises returns while minimising risks. Modern Portfolio Theory (MPT), developed by Harry Markowitz in the 1950s, revolutionised how investors approach portfolio management. This groundbreaking concept paved the way for a more scientific and systematic portfolio construction approach. In this blog post, we will delve into the depths of Modern Portfolio Theory, exploring its benefits, workings, the concept of efficient frontier, and the challenges associated with its application.

What Is Modern Portfolio Theory (MPT)?

Modern Portfolio Theory (MPT) is a framework that aims to optimise investment portfolios based on the principles of diversification and risk management. It recognises that investors face trade-offs between an investment's expected returns and the associated risks. MPT emphasises the importance of constructing a well-diversified portfolio that balances risk and returns to achieve the investor's financial objectives.

Benefits of Modern Portfolio Theory

Modern Portfolio Theory (MPT) is a cornerstone in the world of finance, offering several compelling benefits to investors. Let's examine these advantages and understand why MPT has gained such prominence in the investment community.

Risk Reduction Through Diversification

At the heart of MPT lies the concept of diversification, a powerful strategy for mitigating risk. By spreading investments across different asset classes, sectors, and geographical regions, MPT effectively reduces the impact of a poor-performing investment on the overall portfolio. For instance, if a portion of the portfolio invested in technology stocks faces a downturn, the potential losses can be offset by the stable performance of healthcare or real estate investments. This diversification cushions the portfolio against significant losses and promotes stability, even in volatile market conditions.

Enhanced Returns Through Strategic Allocation

MPT recognises that different assets exhibit varying levels of risk and return. Investors can potentially enhance their returns by strategically allocating assets based on their historical performance and expected future trends. For example, during periods of economic growth, stocks might outperform other asset classes, leading to higher returns. In contrast, during economic downturns, bonds or commodities might provide a safer haven for investors, ensuring consistent returns even in challenging market environments.

Scientific Decision-Making

One of the revolutionary aspects of MPT is its reliance on quantitative models and statistical analysis. By employing sophisticated tools, investors can make data-driven decisions, minimising the influence of emotional biases that often lead to impulsive choices. This scientific approach enhances the precision of portfolio construction, enabling investors to optimise their asset allocation based on historical data and statistical measures. Consequently, investors can navigate the complexities of the market with a higher degree of confidence and accuracy.

Balancing Short-term Volatility with Long-term Objectives

MPT encourages investors to focus on the long-term horizon rather than being swayed by short-term market fluctuations. While short-term volatility is inevitable, MPT advocates for a diversified portfolio that can withstand these fluctuations, allowing investors to ride out market storms with patience and resilience. By aligning investments with long-term objectives, such as retirement planning or funding a child's education, investors can maintain their commitment to their financial goals, irrespective of the market's day-to-day turbulence.

Adaptability to Individual Risk Tolerance

Every investor has a unique risk tolerance level, representing their comfort with taking risks in pursuit of higher returns. MPT caters to this diversity by allowing investors to customise their portfolios according to their risk appetite. Conservative investors can opt for a more balanced allocation, emphasising stable assets like bonds and dividend-paying stocks. In contrast, aggressive investors can venture into riskier assets like growth stocks and emerging markets. This adaptability ensures that MPT is accessible and beneficial for many investors, regardless of their risk preferences.

Promoting Informed Decision-making

MPT empowers investors with knowledge and understanding. Through in-depth analysis and historical data, investors can assess the potential risks and rewards associated with different asset classes. This informed decision-making process enhances confidence and encourages active participation in managing one's financial portfolio. In an era where financial literacy is paramount, MPT is an educational tool, equipping investors with the skills needed to navigate the complex landscape of investments.

In short, the benefits of Modern Portfolio Theory extend far beyond mere risk reduction and return enhancement. It offers a holistic approach to investment management, encompassing strategic decision-making, adaptability, and financial education. By embracing MPT, investors can pave the way for a more secure and prosperous financial future, built on the foundations of diversification, knowledge, and rational decision-making.

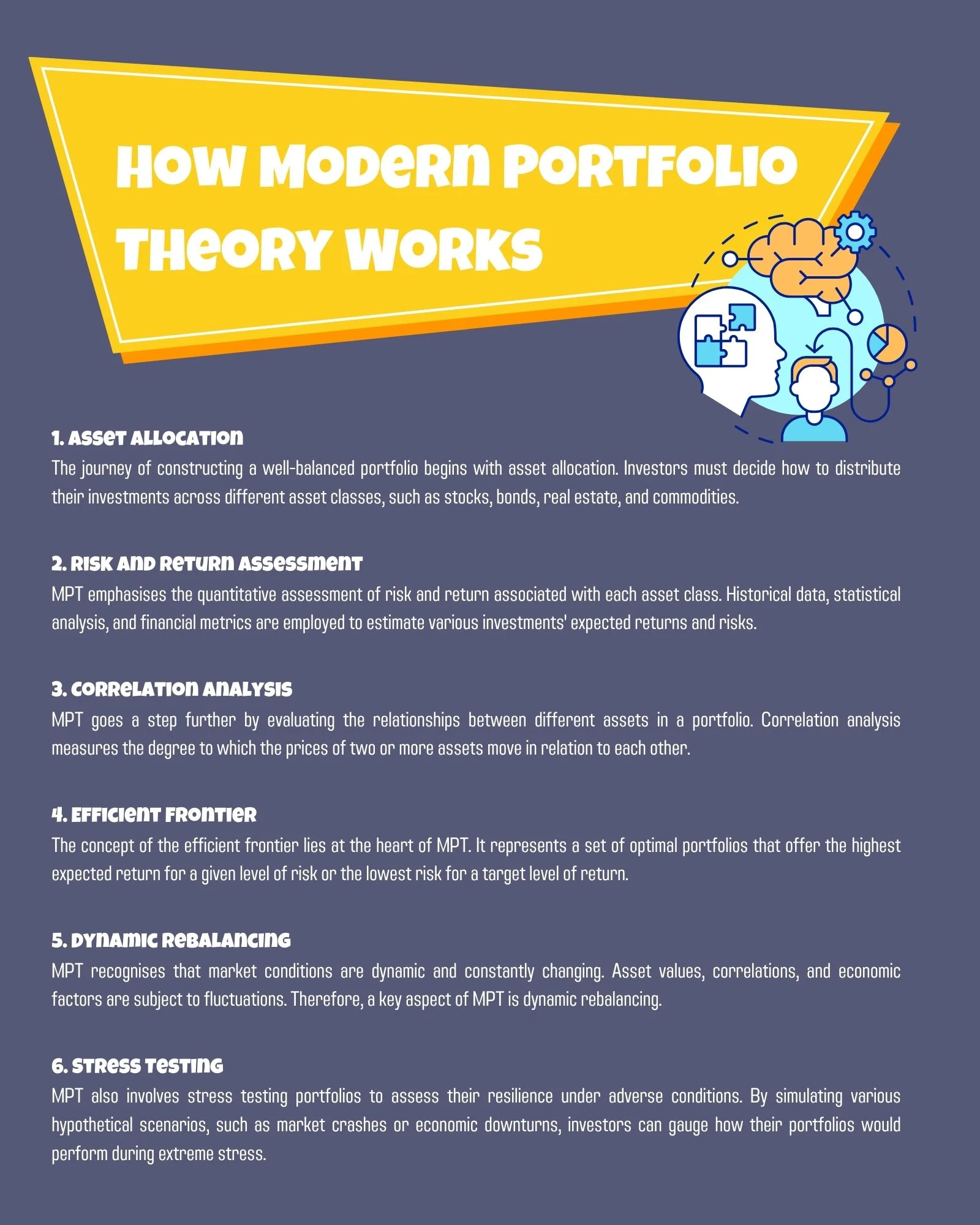

How Modern Portfolio Theory Works

Modern Portfolio Theory (MPT) is not merely a theoretical concept; it provides a practical framework for investors to optimise their portfolios. Let's delve into the intricacies of how MPT operates, breaking down its core components and demonstrating its application in real-world scenarios.

1. Asset Allocation

The journey of constructing a well-balanced portfolio begins with asset allocation. Investors must decide how to distribute their investments across different asset classes, such as stocks, bonds, real estate, and commodities. This decision is not arbitrary; it depends on the investor's risk tolerance, financial goals, and time horizon. For instance, a young investor with a long investment horizon might allocate a larger portion of their portfolio to stocks, aiming for higher long-term returns despite the short-term volatility associated with the stock market.

2. Risk and Return Assessment

MPT emphasises the quantitative assessment of risk and return associated with each asset class. Historical data, statistical analysis, and financial metrics are employed to estimate various investments' expected returns and risks. Standard deviation, a measure of the dispersion of a set of values, is often used to quantify the level of uncertainty or volatility associated with an investment. By understanding the potential risks, investors can make informed decisions about how much risk they are willing to take to achieve their desired level of return.

3. Correlation Analysis

MPT goes a step further by evaluating the relationships between different assets in a portfolio. Correlation analysis measures the degree to which the prices of two or more assets move in relation to each other. Assets that have a low or negative correlation tend to move independently of each other. Including assets with low correlation in a portfolio can effectively reduce overall risk. For example, if stocks and bonds have a negative correlation, bonds might increase in value when stocks decline, providing a hedge against stock market downturns.

4. Efficient Frontier

The concept of the efficient frontier lies at the heart of MPT. It represents a set of optimal portfolios that offer the highest expected return for a given level of risk or the lowest risk for a target level of return. The efficient frontier is derived by plotting various portfolio combinations on a graph, with expected return on the vertical axis and portfolio risk (standard deviation) on the horizontal axis.

Investors aim to position their portfolios on the efficient frontier or as close to it as possible. Portfolios falling below the efficient frontier are suboptimal because they either offer lower returns for the same level of risk or carry higher risk for a given level of return. The efficient frontier provides a clear visual representation of the trade-offs between risk and return, allowing investors to make strategic decisions aligned with their risk preferences.

5. Dynamic Rebalancing

MPT recognises that market conditions are dynamic and constantly changing. Asset values, correlations, and economic factors are subject to fluctuations. Therefore, a key aspect of MPT is dynamic rebalancing. Investors periodically reassess their portfolios, adjusting to maintain the desired asset allocation in line with the efficient frontier. For instance, if stocks have performed exceptionally well and now represent a higher percentage of the portfolio than intended, investors might rebalance by selling some stocks and investing in other asset classes to restore the optimal allocation.

6. Stress Testing

MPT also involves stress testing portfolios to assess their resilience under adverse conditions. By simulating various hypothetical scenarios, such as market crashes or economic downturns, investors can gauge how their portfolios would perform during extreme stress. Stress testing allows investors to identify potential portfolio weaknesses and make adjustments to enhance their robustness, ensuring they are better prepared to weather unforeseen market challenges.

In conclusion, Modern Portfolio Theory operates as a systematic and scientific approach to portfolio construction. By carefully considering asset allocation, conducting risk and return assessments, analysing correlations, understanding the efficient frontier, engaging in dynamic rebalancing, and stress testing, investors can optimise their portfolios to balance risk and return. MPT equips investors with the tools and insights necessary to navigate the complexities of the financial markets, enhancing their ability to make strategic investment decisions and achieve their long-term financial objectives.

What Is the Efficient Frontier?

The efficient frontier is a graphical representation of the possible combinations of assets that offer the highest expected returns for a given level of risk or the lowest risk for a target level of return. It allows investors to visualise the trade-offs between risk and return and select the portfolio allocation that aligns with their risk preferences.

The efficient frontier is derived from the statistical analysis of different asset classes historical returns and risk measures. The curve is constructed by plotting various portfolio allocations on a graph, each with a different mix of assets. The vertical axis represents the expected return, while the horizontal axis represents the portfolio risk (measured as standard deviation).

Investors seek to position their portfolios on the efficient frontier, as it represents the optimal combination of risk and return. Portfolios falling below the efficient frontier are considered suboptimal, as they either offer lower returns for the same level of risk or carry higher risk for a given level of return. According to SmartAsset, this helps them figure out whether they should pull their funds from an investment or not.

More on the Efficient Frontier

The efficient frontier is a critical concept within Modern Portfolio Theory, offering valuable insights into portfolio optimisation. Here, we'll delve deeper into this concept and how it helps investors make informed decisions.

Portfolio Optimisation

The efficient frontier essentially provides a roadmap for investors to optimise their portfolios. It offers different portfolio options, each with a specific risk-return profile. The key is selecting a portfolio that aligns with an investor's financial goals and risk tolerance.

Investors can use this concept to determine the trade-offs between risk and return. For example, an investor seeking lower risk might choose a portfolio on the left side of the efficient frontier, while one aiming for higher returns may opt for a portfolio on the right side.

Diversification Benefits

The efficient frontier highlights the importance of diversification. As we move along the curve from left to right, portfolios become more diversified. Diversification involves spreading investments across various asset classes, reducing the reliance on a single investment's performance, and reducing overall portfolio risk.

By selecting a diversified portfolio along the efficient frontier, an investor can achieve a certain level of return with less risk. Diversification can significantly improve risk-adjusted returns, which is a key goal for many investors.

Asset Classes | Diversified Portfolio Returns | Portfolio Stability |

Stocks and Bonds | Steady growth over long term | Cushion against market downturns |

Real Estate and Gold | Hedge against inflation | Stable, appreciating investments |

International Funds | Exposure to global opportunities | Reduces dependency on local markets |

Table 1: Diversification impact on portfolio performance

Risk Tolerance and Efficient Frontier

Investors have different risk tolerances based on their financial situations, goals, and personal preferences. The efficient frontier caters to this by offering portfolios at various risk levels. Investors can choose a portfolio that aligns with their comfort level, ensuring they stay within their risk tolerance boundaries.

For instance, a conservative investor might opt for a portfolio with lower risk, while an aggressive investor might select a portfolio with higher expected returns and, consequently, higher risk.

The Challenges of Using Modern Portfolio Theory

While Modern Portfolio Theory has greatly influenced portfolio management, it also faces several challenges in its practical application:

1. Assumptions and Limitations

MPT relies on several assumptions, some of which may not hold true in the real world. These assumptions include the normal distribution of returns, stable correlations, and the ability to estimate risk and return for assets accurately. However, financial markets are complex and often exhibit behaviour that deviates from these assumptions. For example, asset correlations tend to increase during financial crises, violating the assumption of stable correlations. Additionally, asset returns may not always follow a normal distribution, leading to inaccurate risk and return estimates.

2. Estimation Error

MPT heavily relies on historical data to estimate risk and return for assets. While historical data can provide valuable insights, it may not always accurately reflect future market conditions. Economic factors, technological advancements, and changes in market dynamics can lead to estimation errors. For instance, a sudden change in government policy, a disruptive technological breakthrough, or a global health crisis like the COVID-19 pandemic can significantly impact asset values and returns, rendering historical data less relevant for future projections.

3. Black Swan Events

MPT assumes that investment returns follow a normal distribution, which implies that extreme events with low probability but high impact are not adequately captured. These rare, unpredictable events are often called "black swan" events. Examples include the global financial crisis of 2008, the dot-com bubble burst, or the 2020 market turbulence caused by the pandemic. Such events can lead to substantial market volatility, asset price crashes, and sudden losses that MPT may not fully account for in its risk assessment.

4. Correlation Breakdown

MPT assumes stable correlations between asset classes. However, during times of market stress or financial crises, correlations between asset classes can increase. This means that assets that were expected to provide diversification may start moving in tandem, leading to simultaneous losses across seemingly uncorrelated assets. The breakdown of correlations can challenge MPT's effectiveness in achieving diversification benefits during turbulent times.

5. Behavioural Biases

MPT assumes that investors are rational and decide based on expected returns and risk. However, behavioural biases, such as overconfidence, loss aversion, and herd behaviour, can lead investors to deviate from rational decision-making. These biases may cause investors to buy or sell assets based on emotions rather than objective analysis, potentially impacting the effectiveness of MPT in practice.

6. Shortcomings in Portfolio Optimisation

While the efficient frontier is a powerful concept in MPT, it has limitations. In reality, finding the optimal portfolio on the efficient frontier can be challenging due to the complexities of markets. Portfolio optimisation models might not always account for transaction costs, taxes, liquidity constraints, or regulatory considerations, which are vital aspects of real-world investing.

7. Ongoing Monitoring and Adaptation

MPT requires continuous portfolio monitoring and adaptation to maintain alignment with the efficient frontier. Investors must regularly rebalance their portfolios to account for changing market conditions and ensure optimal asset allocation. This process can be time-consuming and may require active management, which some investors may find challenging.

In summary, the challenges associated with using Modern Portfolio Theory highlight the need for investors to approach it with a degree of caution and realism. While MPT provides valuable insights into portfolio construction, it is essential to recognise its limitations and supplement it with complementary strategies, such as risk management techniques and a thorough understanding of investor behaviour. By doing so, investors can navigate the complexities of financial markets more effectively and achieve their long-term financial goals with greater resilience.

Sustainable and Socially Responsible Investing (SRI)

There has been a paradigm shift in the investing world in recent years, with an increasing emphasis on sustainability, social responsibility, and ethical considerations. Sustainable and Socially Responsible Investing (SRI) is a specialised approach that integrates environmental, social, and governance (ESG) criteria into investment decisions. This approach acknowledges that investments have far-reaching implications beyond financial returns and seeks to align investors' values with their portfolios. Let's delve deeper into the world of SRI and explore its significance in contemporary finance.

1. Environmental Considerations

SRI evaluates how companies impact the planet, taking environmental factors into account. Investors interested in environmental sustainability often look for companies committed to renewable energy, carbon footprint reduction, water conservation, and eco-friendly practices. By supporting environmentally responsible companies, SRI investors contribute to a greener future while potentially benefiting from the growth of sustainable industries.

2. Social Impact

Socially responsible investing emphasises the social implications of investments. This aspect involves considering factors such as labour practices, human rights, diversity and inclusion, and community engagement. Companies that prioritise fair labour practices, gender equality, and community development are favoured by SRI investors. Investing in socially responsible companies promotes positive social change and fosters a corporate culture that values stakeholders' well-being.

3. Governance Standards

Governance plays a crucial role in SRI by assessing how companies are managed and governed. Investors focus on corporate transparency, ethical leadership, anti-corruption policies, and shareholder rights. Companies with strong governance structures tend to be more accountable and are better positioned to navigate challenges, making them attractive choices for socially conscious investors. SRI investors promote ethical business practices and foster corporate integrity by supporting companies with high governance standards.

ESG Factors | Social Impact | Investment Attractiveness |

Ethical Labour | Promotes fair employment | Attracts socially conscious investors |

Environmental | Supports eco-friendly | Encourages sustainable business practices |

Corporate Ethics | Fosters ethical conduct | Enhances long-term brand reputation |

Community Engagement | Supports local communities | Builds positive public relations |

Board Diversity | Fosters inclusivity | Reflects diverse perspectives in decision-making |

Table 2: Key criteria for socially responsible investing

4. Impact Investing

A subset of SRI known as impact investing goes a step further. Impact investors actively seek opportunities to invest in projects, businesses, or initiatives that generate positive social or environmental outcomes. These investments are intended to create measurable, beneficial impacts alongside financial returns. Impact investing allows investors to directly contribute to solving societal challenges, such as poverty alleviation, clean energy adoption, or healthcare access, while still expecting competitive financial performance.

5. Long-Term Sustainability

One key advantage of SRI is its focus on long-term sustainability. By investing in companies that prioritise ESG factors, investors promote practices conducive to long-term success. Businesses with a strong sense of corporate responsibility are more likely to adapt to changing market dynamics, regulatory requirements, and societal expectations. This adaptability enhances their resilience, making them potentially sound investments for the future.

6. Creating Positive Change

SRI enables investors to leverage their financial influence to create positive global change. By directing capital toward sustainable and socially responsible initiatives, investors can drive innovation and support industries that are essential for a more equitable and sustainable future. Additionally, SRI encourages companies to improve their ESG performance to attract responsible investors, fostering a cycle of continuous improvement in corporate practices.

7. Risk Management and Resilience

Companies with robust ESG practices often demonstrate superior risk management capabilities. By considering environmental risks, social factors, and governance standards, SRI investors can identify businesses better equipped to handle emerging challenges. This risk-aware approach enhances the resilience of SRI portfolios, making them well-positioned to weather market uncertainties and global crises.

In summary, Sustainable and Socially Responsible Investing represents a powerful fusion of financial objectives and ethical principles. By aligning investments with values, SRI investors play a pivotal role in shaping a more sustainable and equitable world. This approach offers the potential for financial returns and contributes to positive social and environmental outcomes, making it a compelling choice for socially conscious individuals and institutions seeking to make a difference through their investments. As SRI continues to gain momentum, it stands as a testament to the transformative power of finance in driving positive change on a global scale.

Conclusion

Modern Portfolio Theory has revolutionised the way investors approach portfolio management. By emphasising diversification and risk management, MPT offers a systematic framework to construct portfolios that balance risk and return. The efficient frontier concept enables investors to optimise their portfolios based on their risk preferences and financial goals.

However, it is essential to acknowledge the challenges associated with MPT's practical application. Deviations from assumptions, estimation errors, black swan events, and correlation breakdowns can impact MPT's effectiveness in real-world scenarios.

Ultimately, MPT is a valuable tool for investors, but it should not be the sole determinant of portfolio construction. Combining MPT with active risk management, qualitative analysis, and ongoing monitoring can enhance the resilience and adaptability of investment portfolios in an ever-changing market landscape.

In navigating the complexities of Modern Portfolio Theory, staying ahead of the curve is essential. Our comprehensive course, ‘Portfolio & Asset Management,’ not only demystifies the challenges posed by MPT but equips you with practical skills to master its application. Unlock the secrets to constructing robust portfolios, mitigating risks, and maximising returns. Enrol now to transform your investment strategies and thrive in today's dynamic financial landscape. Don't just invest – invest wisely with the knowledge that empowers success!