- Table of Contents

- Introduction

- What is Forensic Accounting?

- When is Forensic Accounting Useful?

- 1. Fraud Investigations

- 2. Litigation Support

- 3. Divorce Proceedings

- 4. Bankruptcy Cases

- 5. Insurance Claims

- 6. Regulatory Compliance

- 7. Mergers and Acquisitions

- 8. Corporate Governance and Risk Management

- 9. Whistleblower Investigations

- Forensic Accounting vs. Forensic Auditing: Key Differences

- Forensic Accounting

- Forensic Auditing

- Why is Forensic Accounting Important?

- Fraud Prevention and Detection

- Legal Support and Expert Testimony

- Financial Transparency and Integrity

- Risk Management and Compliance

- Restitution and Recovery of Assets

- Enhancing Corporate Governance

- Facilitating Mergers and Acquisitions

- Supporting Whistleblower Protections

- Adapting to Evolving Financial Crimes

- Limitations of Forensic Accounting

- Resource Intensive

- Complexity of Financial Systems

- Legal Constraints

- Subjectivity and Interpretation

- Evolving Fraud Tactics

- Dependence on Cooperation

- Potential for Bias

- Limited Scope of Investigation

- Time Constraints

- The Process in a Forensic Accounting Investigation

- 1. Engagement and Planning

- 2. Data Collection

- 3. Data Analysis

- 4. Investigation and Testing

- 5. Reporting

- 6. Expert Testimony

- 7. Follow-Up Actions

- How to Become a Forensic Accountant (Certifications, Education, Skills)

- 1. Educational Background

- 2. Certifications

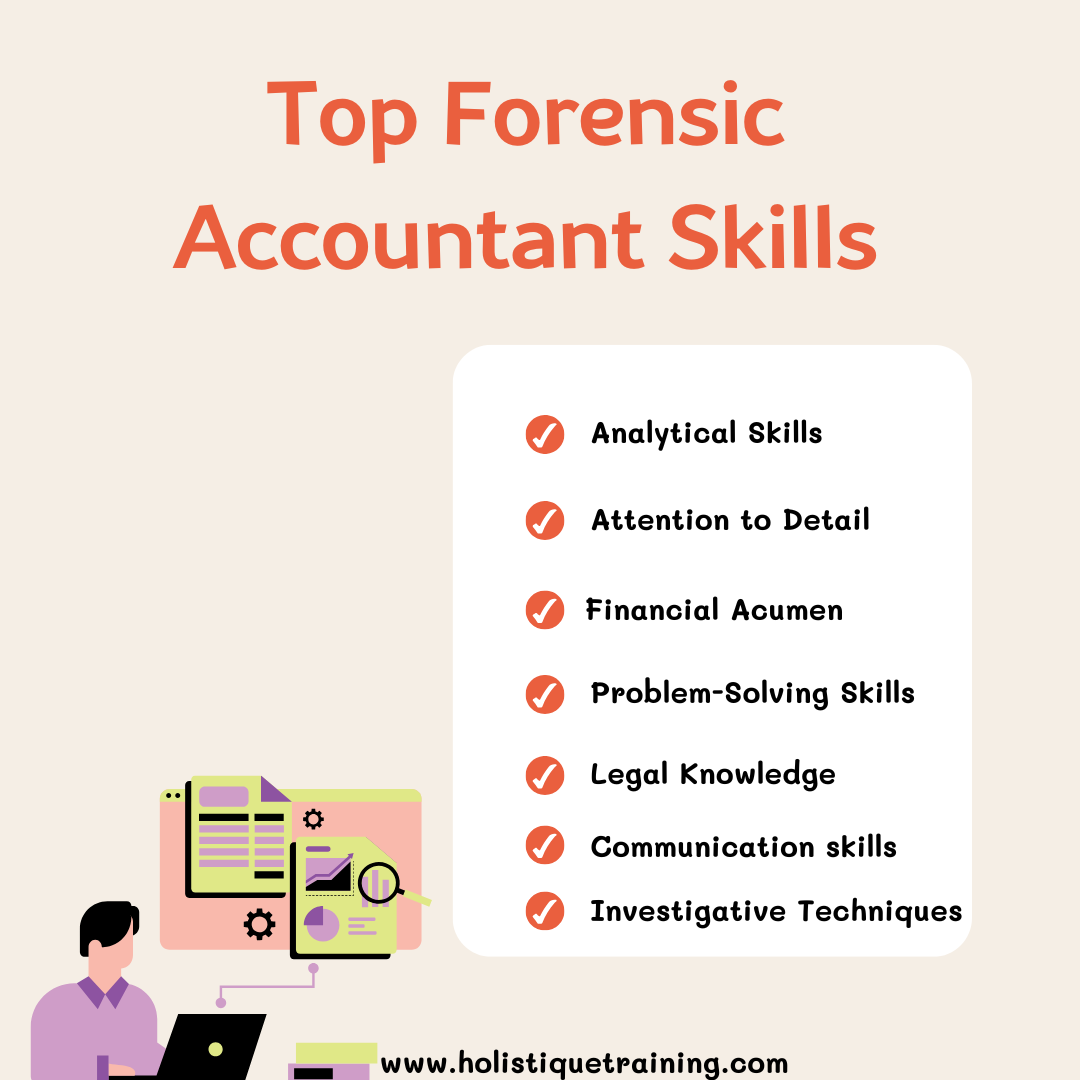

- 3. Skills Development

- 4. Gaining Experience

- 5. Networking and Professional Development

- Conclusion

Introduction

Forensic accounting stands at the intersection of finance, law, and investigative skills, offering a unique blend of expertise that is increasingly vital in today's complex financial landscape. This blog post delves into the multifaceted world of forensic accounting, exploring its definition, applications, and significance. We will also examine the differences between forensic accounting and forensic auditing, discuss the limitations of this discipline, and outline the process involved in forensic investigations. Finally, we will provide guidance on how to pursue a career in forensic accounting, including necessary certifications, education, and skills.

What is Forensic Accounting?

Forensic accounting is a specialized field that involves the application of accounting principles, techniques, and investigative skills to analyze financial information for use in legal proceedings. It combines the knowledge of accounting, auditing, and investigative skills to assess financial data in a way that can be used in court. Forensic accountants are often called upon to investigate fraud, embezzlement, money laundering, and other financial crimes. Their findings can provide crucial evidence in legal cases, helping to establish the financial truth behind complex situations.

The term "forensic" comes from the Latin word "forensis," which means "of the forum," referring to the public place where legal matters are discussed and resolved. In essence, forensic accounting is about uncovering the truth in financial matters and presenting that truth in a manner that is understandable to judges, juries, and other legal professionals.

When is Forensic Accounting Useful?

Forensic accounting is an essential tool in various situations where financial integrity is questioned or where legal disputes arise. Its utility spans numerous contexts, each highlighting the importance of thorough financial analysis and investigative skills. Below are some key scenarios where forensic accounting proves particularly useful:

1. Fraud Investigations

Fraud is a pervasive issue that can affect organizations of all sizes. When there are suspicions of fraudulent activity—such as embezzlement, kickbacks, or financial misrepresentation—organizations often turn to forensic accountants. These professionals employ specialized techniques to analyze financial records, trace funds, and identify anomalies that may indicate fraudulent behavior. Their expertise enables them to uncover hidden transactions and provide evidence that can lead to legal action against perpetrators.

2. Litigation Support

In legal disputes involving financial matters, forensic accountants play a crucial role in providing expert analysis and testimony. Whether it's a breach of contract, shareholder dispute, or intellectual property case, forensic accountants can assess financial damages, calculate lost profits, and analyze financial statements to support claims or defenses. Their ability to present complex financial data in a clear and comprehensible manner is invaluable in court, helping judges and juries understand the financial implications of the case.

3. Divorce Proceedings

Divorce cases, particularly those involving significant assets or complicated financial situations, often require forensic accounting. During the property division phase, forensic accountants can help uncover hidden assets or income that one spouse may be attempting to conceal. By conducting a thorough analysis of financial records, they ensure a fair division of assets, which is crucial for achieving an equitable settlement. Their findings can also provide insights into financial misconduct, such as spending habits or undisclosed income.

4. Bankruptcy Cases

In bankruptcy proceedings, forensic accountants can investigate the financial history of individuals or businesses to determine the causes of financial distress. They analyze transactions leading up to the bankruptcy to identify any fraudulent transfers or mismanagement of funds. This analysis is essential for creditors and the court to understand the financial situation and make informed decisions regarding asset recovery and debt repayment.

5. Insurance Claims

Forensic accountants are frequently called upon to investigate insurance claims, particularly in cases of suspected fraud. Whether it's a property damage claim, workers' compensation case, or liability insurance claim, forensic accountants analyze the financial aspects of the claim to determine its legitimacy. They assess the accuracy of reported losses and expenses, helping insurance companies avoid paying out fraudulent claims while ensuring that legitimate claims are handled fairly.

6. Regulatory Compliance

Organizations must adhere to various financial regulations and standards. Forensic accountants can assist in ensuring compliance with these regulations by conducting internal audits and assessments. They identify potential areas of risk and recommend improvements to internal controls, helping organizations prevent financial misconduct and reduce the likelihood of regulatory penalties. Their expertise in compliance can also be instrumental during regulatory investigations or audits.

7. Mergers and Acquisitions

During mergers and acquisitions, forensic accountants conduct due diligence to assess the financial health of the target company. They analyze financial statements, tax records, and other relevant documents to identify any financial discrepancies or risks that could affect the deal. This analysis is critical for making informed decisions about the transaction and negotiating fair terms.

8. Corporate Governance and Risk Management

Forensic accountants contribute to effective corporate governance by providing insights into financial practices and risk management strategies. By examining financial operations and identifying vulnerabilities, they help organizations implement stronger internal controls and ethical practices. This proactive approach can prevent fraud and enhance overall financial integrity.

9. Whistleblower Investigations

When employees report suspected fraud or misconduct, forensic accountants are often engaged to investigate the claims. They conduct independent inquiries to substantiate the allegations and provide a detailed report of their findings. This process not only helps organizations address potential issues but also protects whistleblowers from retaliation by ensuring that claims are handled professionally and confidentially.

The versatility of forensic accounting makes it an invaluable resource across various sectors, including corporate, legal, and governmental entities. Its applications extend beyond mere investigation; it also plays a proactive role in preventing financial misconduct. As organizations face increasing pressure to maintain transparency and accountability, the demand for forensic accounting expertise will continue to grow, underscoring its significance in safeguarding financial integrity.

Forensic Accounting vs. Forensic Auditing: Key Differences

While forensic accounting and forensic auditing share similarities, they are distinct fields with different focuses and methodologies. Understanding these differences is crucial for professionals and organizations navigating financial investigations.

Forensic Accounting

- Focus: Forensic accounting encompasses a broad range of activities, including fraud detection, financial analysis, and litigation support. It involves not only examining financial data but also understanding the context in which that data exists.

- Outcome: The primary goal of forensic accounting is to provide a comprehensive analysis of financial information that can be used in legal proceedings. This may include expert testimony, detailed reports, and recommendations for future actions.

Forensic Auditing

- Focus: Forensic auditing is a subset of forensic accounting that specifically focuses on the examination and evaluation of an organization’s financial statements and records to detect fraud and misrepresentation. It is more narrowly defined than forensic accounting.

- Outcome: The outcome of aforensic audit typically involves identifying specific instances of fraud or financial mismanagement and providing evidence to support legal action or corrective measures.

In summary, while both fields aim to uncover financial truth, forensic accounting takes a broader approach that includes legal, investigative, and analytical components, whereas forensic auditing is primarily concerned with the integrity of financial statements.

Here’s a table summarizing these differences:

Aspect | Forensic Accounting | Forensic Auditing |

Definition | A comprehensive field that encompasses various financial investigations, including fraud detection, litigation support, and financial analysis. | A specialized audit process focused specifically on detecting and preventing fraud within financial statements. |

Scope of Work | Broader scope, including financial analysis, litigation support, and investigative services beyond traditional audits. | Narrower focus primarily on verifying the accuracy of financial statements and identifying fraudulent activities. |

Skills Required | Requires a diverse skill set, including accounting, finance, investigative techniques, and legal knowledge. | Primarily relies on auditing skills, knowledge of accounting principles, and familiarity with regulatory standards. |

Outcome | Produces detailed reports and analyses that may be used in legal proceedings, highlighting findings and recommendations. | Produces audit reports that assess the fairness and accuracy of financial statements, often leading to compliance recommendations. |

Engagement Context | Engaged in situations involving suspected fraud, legal disputes, or complex financial issues requiring in-depth analysis. | Engaged primarily in routine audits, compliance checks, and assessments of financial statements for accuracy and integrity. |

Why is Forensic Accounting Important?

Forensic accounting plays a critical role in today’s financial landscape, where the complexities of transactions and the increasing prevalence of financial crimes necessitate specialized expertise. Understanding the importance of forensic accounting goes beyond recognizing its utility in fraud detection; it encompasses its broader impact on organizations, legal systems, and society as a whole. Here are several key reasons why forensic accounting is vital:

Fraud Prevention and Detection

One of the primary functions of forensic accounting is to prevent and detect fraud. Organizations face significant risks from internal and external fraud, which can lead to substantial financial losses, reputational damage, and legal consequences. Forensic accountants utilize their skills to assess vulnerabilities in financial systems and internal controls, helping organizations identify potential weaknesses before they can be exploited. By conducting regular audits and risk assessments, they establish a proactive approach to fraud prevention, significantly reducing the likelihood of fraudulent activities occurring.

Legal Support and Expert Testimony

Forensic accountants provide essential support in legal proceedings involving financial disputes. Their expertise allows them to analyze complex financial data and present findings in a manner that is understandable to judges, juries, and legal professionals. In cases of litigation, their ability to provide expert testimony can be pivotal in establishing the facts of a case, substantiating claims, and influencing the outcome of legal battles. This role not only enhances the integrity of the legal process but also ensures that justice is served based on accurate financial evidence.

Financial Transparency and Integrity

In an era where corporate scandals and financial mismanagement are increasingly scrutinized, forensic accounting promotes transparency and integrity in financial reporting. By conducting thorough investigations and audits, forensic accountants help organizations maintain accurate financial records and adhere to ethical standards. This commitment to transparency fosters trust among stakeholders, including investors, customers, and regulatory bodies, which is crucial for maintaining a positive reputation and sustaining business operations.

Risk Management and Compliance

Forensic accountants play a vital role in risk management by identifying potential financial risks and recommending strategies to mitigate them. Their expertise extends to ensuring compliance with various financial regulations and standards, which is essential for avoiding legal penalties and maintaining operational legitimacy. By implementing robust internal controls and compliance programs, organizations can safeguard against fraud and financial mismanagement, ultimately enhancing their overall stability and resilience.

Restitution and Recovery of Assets

In cases of financial fraud or misconduct, forensic accountants are instrumental in recovering lost funds and assets. Their investigative skills allow them to trace the flow of money, identify hidden assets, and gather evidence that can be used to pursue restitution. This recovery process is crucial for victims of fraud, as it not only helps restore financial losses but also serves as a deterrent against future fraudulent activities. The ability to recover assets reinforces the notion that financial crimes will not go unpunished.

Enhancing Corporate Governance

Forensic accounting contributes to effective corporate governance by providing insights into financial practices and accountability measures. By examining financial operations and identifying areas for improvement, forensic accountants help organizations implement stronger governance frameworks. This includes establishing clear policies and procedures for financial reporting, risk management, and ethical conduct. A robust governance structure enhances organizational integrity and fosters a culture of accountability, which is essential for long-term success.

Facilitating Mergers and Acquisitions

During mergers and acquisitions, forensic accountants conduct due diligence to assess the financial health of the target company. Their analysis helps identify any financial discrepancies, potential liabilities, or risks that could impact the transaction. This thorough examination is critical for making informed decisions about the acquisition and negotiating fair terms. By ensuring that all financial aspects are transparent and accurately represented, forensic accountants play a key role in facilitating successful mergers and acquisitions.

Supporting Whistleblower Protections

Forensic accountants often assist in investigating claims made by whistleblowers, providing an independent and objective assessment of the allegations. Their involvement helps ensure that whistleblower claims are taken seriously and addressed appropriately. By protecting whistleblowers and fostering a culture of reporting unethical behavior, forensic accountants contribute to an organizational environment that prioritizes integrity and accountability.

Adapting to Evolving Financial Crimes

As financial crimes become more sophisticated, the importance of forensic accounting continues to grow. Forensic accountants stay abreast of emerging trends and technologies in fraud schemes, enabling them to adapt their methodologies accordingly. This adaptability is crucial for effectively combating new forms of financial misconduct, such as cyber fraud and digital asset manipulation. By remaining vigilant and proactive, forensic accountants help organizations navigate the evolving landscape of financial crime.

The importance of forensic accounting extends far beyond its role in investigating fraud. It encompasses a wide range of functions that contribute to financial integrity, transparency, and accountability. As organizations face increasing pressures to uphold ethical standards and comply with regulations, the demand for forensic accounting expertise will continue to rise. By promoting trust and safeguarding against financial misconduct, forensic accounting serves as a cornerstone of responsible financial management and effective governance in today’s complex business environment.

Limitations of Forensic Accounting

Despite its numerous benefits, forensic accounting has its limitations. Understanding these constraints is crucial for organizations seeking to utilize forensic accounting effectively:

Resource Intensive

Forensic accounting investigations can be highly resource-intensive, requiring significant time, personnel, and financial investment. The process often involves extensive data collection, detailed analysis, and thorough documentation, which can stretch an organization’s resources. Smaller firms or those with limited budgets may find it challenging to allocate the necessary resources for a comprehensive forensic investigation. This limitation can lead to incomplete analyses or the inability to pursue investigations fully, potentially allowing fraudulent activities to go undetected.

Complexity of Financial Systems

Modern financial systems are increasingly complex, integrating various technologies and processes that can complicate the forensic accounting process. Forensic accountants must navigate intricate accounting practices, diverse financial instruments, and multiple regulatory frameworks. This complexity can make it difficult to trace transactions or identify fraudulent activities, particularly in large organizations with extensive operations. The intricacies of these systems may also hinder the ability to gather relevant data efficiently, prolonging the investigation process.

Legal Constraints

Forensic accountants operate within a framework of legal regulations and ethical standards that can limit their investigative capabilities. For instance, they must adhere to privacy laws and confidentiality agreements, which may restrict access to certain documents or information. Additionally, any evidence collected must be obtained legally to be admissible in court. These legal constraints can complicate investigations and may prevent forensic accountants from obtaining critical information necessary for a thorough analysis.

Subjectivity and Interpretation

The interpretation of financial data can sometimes be subjective, leading to differing conclusions based on the same set of facts. Forensic accountants may arrive at varying interpretations depending on their methodologies, experiences, and perspectives. This subjectivity can complicate legal proceedings, as opposing parties may present conflicting analyses of the same financial situation. The potential for differing interpretations underscores the importance of maintaining objectivity and rigor in forensic accounting practices.

Evolving Fraud Tactics

As fraudsters develop new tactics and technologies, forensic accountants must continuously update their skills and methodologies to keep pace with these changes. The dynamic nature of financial crimes means that forensic accountants face the ongoing challenge of staying informed about emerging threats, such as cyber fraud, digital asset manipulation, and sophisticated money laundering schemes. This need for continuous education and adaptation can be resource-intensive and may not always keep up with the rapid evolution of fraud tactics.

Dependence on Cooperation

The success of a forensic investigation often hinges on the cooperation of various stakeholders, including employees, management, and external parties. If key individuals are uncooperative or obstructive, it can significantly hinder the investigation process. For example, if employees refuse to provide access to necessary documents or if management is reluctant to share information, forensic accountants may struggle to gather the evidence needed for a comprehensive analysis. This dependence on cooperation can create obstacles and may result in incomplete findings.

Potential for Bias

Forensic accountants must remain impartial and objective throughout the investigation process. However, there is always a risk of bias, whether conscious or unconscious. For example, if a forensic accountant has a preconceived notion about a particular individual or organization, it may influence their analysis and conclusions. Maintaining objectivity is essential for ensuring the credibility of the findings, but the potential for bias remains a limitation that professionals must actively manage.

Limited Scope of Investigation

Forensic accounting investigations are typically focused on specific allegations or areas of concern. This limited scope can mean that other potential issues remain unexamined. For instance, if an investigation is initiated to address a suspected case of embezzlement, the forensic accountant may not delve into other areas of financial performance or compliance that could also present risks. As a result, organizations may miss broader financial issues that could affect their overall health and stability.

Time Constraints

Forensic accounting investigations can be time-consuming, particularly when dealing with large volumes of data or complex financial structures. In some cases, organizations may face external pressures to resolve issues quickly, such as regulatory deadlines or ongoing litigation. These time constraints can compromise the thoroughness of an investigation, leading to rushed conclusions or overlooked evidence. The need for timely resolutions can conflict with the meticulous nature of forensic accounting, making it challenging to achieve comprehensive results.

While forensic accounting is a powerful tool for uncovering financial truths and supporting legal processes, it is essential to recognize its limitations. Resource intensity, complexity, legal constraints, subjectivity, and dependence on cooperation are just a few of the challenges that forensic accountants face. Understanding these limitations can help organizations set realistic expectations and approach forensic investigations with a balanced perspective. By acknowledging these constraints, organizations can better navigate the complexities of financial investigations and enhance their overall financial integrity.

The Process in a Forensic Accounting Investigation

The process of a forensic accounting investigation typically involves several key steps, each designed to uncover financial truths and provide actionable insights. Here’s an overview of the typical stages involved:

1. Engagement and Planning

The investigation begins with an engagement, where the forensic accountant meets with the client to understand the scope of the investigation and the specific concerns that need to be addressed. During this phase, the accountant will outline the objectives, methodologies, and timelines for the investigation.

2. Data Collection

The next step involves collecting relevant financial data and documentation. This may include bank statements, invoices, contracts, financial statements, and any other records pertinent to the investigation. Forensic accountants may also conduct interviews with key personnel to gather additional insights.

3. Data Analysis

Once the data is collected, forensic accountants analyze it for inconsistencies, anomalies, and patterns that may indicate fraudulent activity. This analysis often involves the use of advanced software tools and techniques to sift through large volumes of data efficiently.

4. Investigation and Testing

In this phase, forensic accountants perform detailed testing of transactions and financial records to verify their accuracy and legitimacy. This may involve tracing funds, examining internal controls, and testing compliance with relevant regulations.

5. Reporting

After completing the analysis and testing, forensic accountants compile their findings into a comprehensive report. This report includes detailed documentation of the investigation process, evidence gathered, and conclusions drawn. The report is often tailored to meet the needs of the client and may be used in legal proceedings.

6. Expert Testimony

In cases where the findings are disputed or require further clarification, forensic accountants may be called upon to provide expert testimony in court. This involves presenting the findings in a clear and understandable manner, often using visual aids to help convey complex financial information.

7. Follow-Up Actions

Finally, the forensic accountant may assist the client in implementing recommendations based on the investigation's findings. This could involve improving internal controls, conducting training for employees, or taking legal action against perpetrators of fraud.

This structured approach ensures that forensic investigations are thorough, systematic, and effective in uncovering financial truths.

Table: Metrics to measure the effectiveness of a forensic accounting investigation

Metric | Description |

Resolution Rate | The percentage of cases successfully resolved or closed |

Time to Resolution | The average duration taken to complete investigations |

Cost Efficiency | The ratio of investigation costs to recovered assets or fraud amounts |

Quality of Findings | The number of actionable recommendations or findings presented in reports |

Legal Outcomes | The success rate of findings leading to legal actions or convictions |

How to Become a Forensic Accountant (Certifications, Education, Skills)

Pursuing a career in forensic accounting requires a combination of education, certifications, and skills. Here’s a roadmap for aspiring forensic accountants:

1. Educational Background

A bachelor's degree in accounting, finance, or a related field is typically the first step toward a career in forensic accounting. Many employers prefer candidates with advanced degrees, such as a Master of Business Administration (MBA) or a Master of Science in Accounting.

2. Certifications

Obtaining relevant certifications can enhance career prospects and demonstrate expertise in forensic accounting. Some of the most recognized certifications include:

- Certified Public Accountant(CPA): This certification is essential for accountants and is highly regarded in the field.

- Certified Fraud Examiner (CFE): Offered by the Association of Certified Fraud Examiners, this certification focuses specifically on fraud detection and prevention.

- Certified Forensic Accountant (Cr.FA): This certification emphasizes the skills required for forensic accounting and is offered by various professional organizations.

- Certified Information Systems Auditor (CISA): This certification is beneficial for those interested in the intersection of information technology and forensic accounting.

3. Skills Development

Successful forensic accountants possess a unique blend of skills, including:

- Analytical Skills: The ability to analyze complex financial data and identify patterns or anomalies is crucial.

- Attention to Detail: Forensic accountants must pay close attention to detail to uncover discrepancies and ensure accuracy in their work.

- Communication Skills: Strong written and verbal communication skills are essential for presenting findings clearly and effectively.

- Investigative Skills: A knack for investigation and problem-solving is vital for uncovering financial fraud and misconduct.

- Technical Proficiency: Familiarity with accounting software, data analysis tools, and forensic technologies is increasingly important in the field.

4. Gaining Experience

Practical experience is invaluable for aspiring forensic accountants. Internships or entry-level positions in accounting firms, law firms, or corporate finance departments can provide exposure to real-world financial investigations and enhance skills.

5. Networking and Professional Development

Joining professional organizations, attending industry conferences, and participating in workshops can help forensic accountants build a network of contacts and stay updated on industry trends and best practices.

By following this roadmap, aspiring forensic accountants can position themselves for a rewarding career in this dynamic and impactful field.

Conclusion

Forensic accounting is a vital discipline that plays a crucial role in uncovering financial truths and supporting the legal process. Its applications span various sectors, from fraud investigations to litigation support, making it an indispensable resource in today's financial landscape. While forensic accounting presents certain limitations, its importance in promoting transparency, preventing fraud, and ensuring accountability cannot be overstated.

The journey to becoming a forensic accountant is both challenging and rewarding, requiring a commitment to education, certification, and skill development. As financial crimes continue to evolve, the demand for skilled forensic accountants will only increase, offering promising career opportunities for those willing to navigate this complex and fascinating field.