- Table of Contents

- Introduction

- What Is Cost Analysis?

- Why Is Cost Analysis Important?

- Resource Optimisation

- Informed Decision-Making

- Strategic Planning

- Pricing Strategies

- Financial Planning and Budgeting

- Performance Evaluation

- Risk Management

- Investor Confidence

- Step-by-Step Process of Cost Analysis

- 1- Define the Scope

- 2- Identify Costs

- 3- Allocate Costs

- 4- Calculate Total Costs

- 5- Analyse Cost Drivers

- 6- Compare Alternatives

- 7- Monitor and Review

- The Different Types of Cost Analysis

- 1- Marginal Cost Analysis

- 2- Incremental Cost Analysis

- 3- Life Cycle Cost Analysis

- 4- Activity-Based Costing (ABC)

- 5- Opportunity Cost Analysis

- 6- Cost-Benefit Analysis (CBA)

- Which Type of Cost Analysis Suits Your Organisation?

- Manufacturing Organisations

- Service Industries

- Construction Sector

- Technology and Research

- Retail Sector

- Diverse Operations

- Decision-Making Across Industries

- How Does Cost Analysis Look Like in Different Industries?

- Manufacturing

- Healthcare

- Retail

- Construction

- Technology

- Service Industries

- Agriculture

- Energy

- Financial Services

- Education

- The Role of Technology in Performing Cost Analysis

- Automation of Data Collection

- Data Visualisation

- Cloud-Based Solutions

- Predictive Analytics

- Integration with Enterprise Resource Planning (ERP) Systems

- Conclusion

Introduction

Cost analysis is the cornerstone of sound financial management, a compass guiding organisations through the intricacies of budgeting and resource allocation. It is the process of evaluating the total costs involved in a particular project, process, or decision. In this blog post, we will delve into the multifaceted world of cost analysis, exploring its significance, the step-by-step process, and the diverse types that cater to different organisational needs. Additionally, we will examine the varying landscapes of cost analysis across industries and the pivotal role technology plays in this financial tapestry.

What Is Cost Analysis?

At its essence, cost analysis is the systematic examination of costs associated with a particular endeavour. It goes beyond merely tallying expenses; it involves a meticulous dissection of direct and indirect costs, fixed and variable costs, and explicit and implicit costs. This comprehensive evaluation enables organisations to make informed decisions, ensuring financial sustainability and effective resource utilisation.

Why Is Cost Analysis Important?

Cost analysis is not merely a financial exercise; it is a strategic imperative that underpins the success and sustainability of organisations. Let's explore why cost analysis is of paramount importance in the world of modern business.

Resource Optimisation

In the dynamic landscape of business, where resources are often scarce, cost analysis serves as a compass for organisations seeking to optimise their use of resources. By understanding the intricacies of costs, businesses can identify areas of inefficiency, eliminate redundancies, and streamline operations. This optimisation is not just about cutting costs but about allocating resources judiciously to maximise value.

Informed Decision-Making

The decisions organisations make today have far-reaching implications for their future. Cost analysis provides the necessary insights to make informed decisions across various facets of operations, from product development to marketing strategies. Armed with a comprehensive understanding of costs, decision-makers can weigh the pros and cons of different options, mitigating risks and capitalising on opportunities.

Strategic Planning

Cost analysis is a linchpin in strategic planning. It enables organisations to align their financial goals with broader strategic objectives. By evaluating the costs associated with different projects or initiatives, businesses can ensure that their financial investments are in harmony with their long-term vision. This strategic alignment is crucial for sustained growth and competitiveness in the market.

Pricing Strategies

For businesses,setting the right price for their products or services is a delicate balance. Cost analysis provides a foundation forpricing strategies, ensuring that prices cover production costs while remaining competitive in the market. Whether through marginal cost analysis or life cycle cost analysis, businesses can refine their pricing models to maximise profitability without compromising market share.

Financial Planning and Budgeting

Cost analysis is fundamental to the financial planning and budgeting process. It allows organisations to create realistic budgets by accurately forecasting costs associated with different activities. This, in turn, enables effective financial management, helping businesses stay on track and adapt to changes in the economic landscape.

Performance Evaluation

Assessing the performance of different departments, projects, or products requires a nuanced understanding of costs. Cost analysis provides the metrics needed to evaluate the efficiency and effectiveness of various facets of an organisation. This performance evaluation is instrumental in identifying areas for improvement and fostering a culture of continuous optimisation.

Risk Management

Every business decision involves an element of risk. Cost analysis serves as a risk management tool by providing a thorough understanding of potential costs and uncertainties. This proactive approach allows organisations to anticipate challenges, plan for contingencies, and navigate the complexities of the business environment with resilience.

Investor Confidence

For businesses seeking external investment or operating in the public domain, transparent and well-documented cost analysis instil confidence in investors. It demonstrates a commitment to financial accountability and a strategic approach to resource management, factors that are pivotal in attracting investment and maintaining stakeholder trust.

In essence, cost analysis is the compass that guides organisations through the intricate maze of financial decisions. It is not just a retrospective examination of expenditures; rather, it is a forward-looking tool that empowers organisations to navigate the complexities of the business landscape with foresight, agility, and financial acumen. In a world where financial prudence is synonymous with survival and success, cost analysis stands as a beacon illuminating the path to sustainable growth and prosperity.

Step-by-Step Process of Cost Analysis

Cost analysis is a systematic and structured process that involves a series of steps to comprehensively evaluate the financial aspects of a project, process, or decision. Here's a detailed exploration of each step in the cost analysis process:

1- Define the Scope

The journey of cost analysis begins with a clear definition of the scope. Organisations must precisely outline the boundaries of what they are analysing—whether it's a specific project, a particular process, or a decision to be made. Clearly defining the scope sets the parameters for the subsequent steps, ensuring that the analysis remains focused and relevant.

2- Identify Costs

Once the scope is established, the next step is to identify and categorise costs. Costs are typically classified into various categories, including direct and indirect costs, fixed and variable costs, and explicit and implicit costs. Direct costs are directly attributable to the project or product, while indirect costs are shared across multiple activities. Fixed costs remain constant regardless of production levels, while variable costs fluctuate with production. Explicit costs involve actual cash outflows, whereas implicit costs represent the opportunity cost of resources used.

3- Allocate Costs

After identifying costs, the next step is to allocate indirect costs to specific activities or products. This process, known as cost allocation, ensures a more accurate representation of the true cost associated with each element. For example, in a manufacturing setting, overhead costs such as rent and utilities may be allocated based on the proportion of space or resources utilised by each product line.

4- Calculate Total Costs

With costs identified and allocated, the total cost for the project or process can be calculated. This involves the sum of all relevant direct and indirect costs. The total cost provides a comprehensive view of the financial investment associated with the analysed entity, forming the foundation for further analysis and decision-making.

5- Analyse Cost Drivers

Understanding the factors that drive costs is a crucial aspect of cost analysis. This step involves a deeper dive into the elements influencing cost variations. Identifying cost drivers helps organisations comprehend the dynamics of expenses and pinpoint areas where cost optimisation efforts can be most effective. For instance, in manufacturing, labour costs might be influenced by productivity rates,training programmes, or employee incentives.

6- Compare Alternatives

If the cost analysis involves evaluating different alternatives, this step becomes pivotal. By comparing the costs of various options, organisations can make informed choices that align with their strategic objectives. Whether it's choosing between different suppliers, production methods, or investment opportunities, this step ensures that decisions are based on a thorough understanding of the associated costs and benefits.

7- Monitor and Review

Cost analysis is not a one-time activity; it requires continuous monitoring and periodic reviews. Implementing a system for ongoing oversight ensures that the analysis remains relevant in the face of changing circumstances. Regular reviews also enable organisations to adapt to new information, market dynamics, and internal changes, maintaining the accuracy and efficacy of the cost analysis process over time.

By following this step-by-step process, organisations can navigate the complexities of cost analysis with precision and thoroughness. Each stage contributes to a holistic understanding of financial dynamics, enabling informed decision-making, resource optimisation, and long-term financial sustainability. Cost analysis, when approached systematically, becomes a powerful tool for organisations seeking to navigate the intricate terrain of financial management with acumen and foresight.

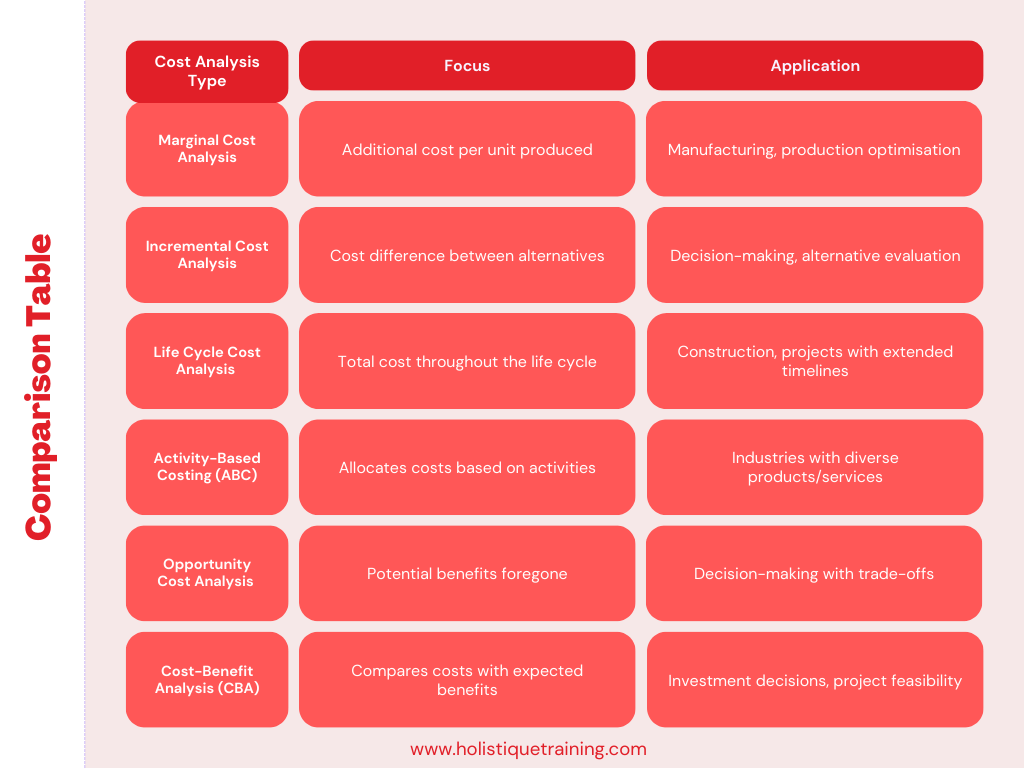

The Different Types of Cost Analysis

Cost analysis is not a one-size-fits-all endeavour; instead, it encompasses various types tailored to address specific organisational needs and objectives. Each type offers a unique perspective on costs, allowing organisations to make nuanced decisions. Let's delve into the each type of cost analysis:

1- Marginal Cost Analysis

Marginal cost analysis focuses on the additional cost incurred by producing one more unit of a product or service. This type of analysis is particularly relevant in industries with high fixed costs and variable production levels. By understanding marginal costs, organisations can optimise production levels to maximise efficiency and profitability. For instance, a manufacturing company may use marginal cost analysis to determine the ideal production quantity that minimises per-unit costs.

2- Incremental Cost Analysis

Incremental cost analysis is centred around evaluating the cost difference between two alternatives. It is instrumental in decision-making processes where organisations need to choose between competing options. By comparing the incremental costs associated with each alternative, businesses can make informed choices that align with their objectives. This type of analysis is valuable in scenarios like selecting suppliers, choosing between production methods, or deciding on the introduction of a new product line.

3- Life Cycle Cost Analysis

Life cycle cost analysis takes a comprehensive approach by considering the total cost of a product or project throughout its entire life cycle. From conception to disposal, this type of analysis accounts for all associated costs, including initial investment, operational expenses, maintenance costs, and eventual decommissioning. Life cycle cost analysis is crucial for industries with long-term assets, such as construction and manufacturing, where understanding the holistic financial impact is essential for strategic decision-making.

4- Activity-Based Costing (ABC)

Activity-Based Costing involves the allocation of indirect costs based on the actual consumption of resources by different activities. This type of cost analysis is particularly beneficial for organisations with diverse products or services and complex operational structures. ABC provides a more accurate picture of costs associated with specific activities, allowing for targeted cost reduction efforts and improved resource allocation.

5- Opportunity Cost Analysis

Opportunity cost analysis delves into the potential benefits foregone by choosing one alternative over another. While not always expressed in monetary terms, opportunity cost represents the value of the next best alternative. This type of analysis is crucial in decision-making processes where the implications extend beyond immediate financial considerations, such as resource allocation, time management, and strategic planning.

6- Cost-Benefit Analysis (CBA)

Cost-Benefit Analysis is a comprehensive approach that compares the costs of a particular decision or project with the expected benefits. CBA is a powerful tool for evaluating the economic feasibility of investments and initiatives. By quantifying both costs and benefits, organisations can make informed decisions that maximise value. This type of analysis is commonly used in public policy, project management, and investment planning.

Choosing the appropriate type of cost analysis, which we will talk about more in depth in a minute, depends on the nature of the decision or project at hand. Organisations may find value in combining multiple types of cost analysis to gain a more holistic understanding of the financial landscape. The flexibility offered by these different types allows businesses to tailor their approach to the intricacies of their industry, operational structure, and strategic goals. As such, cost analysis becomes not just a financial exercise but a nuanced tool for navigating the complexities of modern business with precision and foresight.

Which Type of Cost Analysis Suits Your Organisation?

Selecting the right type of cost analysis is a critical decision for organisations aiming to make informed financial decisions tailored to their specific needs and objectives. The choice depends on the nature of the industry, the characteristics of the project or decision under consideration, and the organisation's strategic goals. Let's explore how different types of cost analysis align with various organisational contexts:

Manufacturing Organisations

For manufacturing organisations, where production efficiency is paramount, Marginal Cost Analysis and Activity-Based Costing (ABC) often prove invaluable. Marginal Cost Analysis helps optimise production levels by determining the most cost-effective quantity to produce. On the other hand, ABC provides a detailed breakdown of costs associated with different production activities, facilitating targeted cost reduction efforts and improved resource allocation.

Service Industries

Service-oriented businesses may benefit from Opportunity Cost Analysis and Incremental Cost Analysis. Opportunity Cost Analysis is relevant when considering alternative service offerings, helping organisations gauge the potential benefits foregone by choosing one service over another. Incremental Cost Analysis aids in decision-making by comparing the additional costs associated with offering new services or expanding existing ones.

Construction Sector

Given the long-term nature of projects in the construction sector, Life Cycle Cost Analysis is crucial. This type of analysis allows organisations to assess the total cost of a construction project, including initial investment, operational expenses, and maintenance costs over the building's lifecycle. Such insights are vital for strategic decision-making in the construction industry.

Technology and Research

Industries driven byinnovation, such as technology and research, often find Cost-Benefit Analysis (CBA) to be an indispensable tool. CBA enables organisations to assess the economic feasibility of research and development initiatives, ensuring that investments align with strategic goals and deliver substantial returns. In these sectors, where uncertainty is prevalent, CBA provides a systematic approach to decision-making.

Retail Sector

Retail organisations frequently leverage Incremental Cost Analysis to make decisions regarding product offerings, pricing strategies, and inventory management. By evaluating the additional costs associated with introducing new products or changing existing ones, retailers can make informed choices that optimise their product mix and profitability.

Diverse Operations

Organisations with diverse operations, spanning different products or services, may find Activity-Based Costing (ABC) to be particularly beneficial. ABC allows for a granular analysis of costs associated with various activities, providing insights into the true costs of each product or service line. This nuanced understanding facilitates better decision-making in resource allocation and pricing strategies.

Decision-Making Across Industries

Opportunity Cost Analysis is a versatile tool applicable across industries. It assists indecision-making scenarios where the consequences extend beyond immediate financial considerations. Organisations can use this type of analysis to evaluate the potential benefits foregone by choosing one strategic direction over another, whether it's allocating resources, entering new markets, or pursuing specific projects.

In determining which type of cost analysis suits an organisation, it is crucial to consider the specific objectives, industry dynamics, and the context of the decision at hand. Often, a combination of different types may be employed to provide a more comprehensive understanding of the financial landscape. The key is to align the chosen method with the organisation's unique characteristics and strategic goals, ensuring that the insights gained contribute to sound financial management and long-term success.

How Does Cost Analysis Look Like in Different Industries?

Cost analysis takes on diverse forms across industries, reflecting the unique characteristics, challenges, and priorities of each sector. Let's explore how cost analysis manifests in various industries, shedding light on the nuanced approaches adopted to address industry-specific considerations:

Manufacturing

In the manufacturing industry, cost analysis is deeply entwined with production efficiency. Marginal Cost Analysis is commonly employed to optimise production levels and determine the ideal quantity to produce. Additionally, Activity-Based Costing (ABC) is instrumental in dissecting the costs associated with different production activities. Manufacturers use ABC to allocate overhead costs more accurately, aiding in the identification of cost drivers and areas for improvement.

Healthcare

The healthcare sector grapples with the unique challenge of balancing patient care with financial sustainability. Cost analysis in healthcare often involves Life Cycle Cost Analysis, especially when evaluating the financial implications of acquiring and maintaining medical equipment. Cost-Benefit Analysis is also prevalent in healthcare decision-making, helping assess the economic feasibility of various interventions and treatments.

Retail

For retailers, Incremental Cost Analysis plays a crucial role in decision-making related to product offerings and inventory management. Retailers analyse the additional costs associated with introducing new products or adjusting existing ones, ensuring that their product mix aligns with market demands and profitability goals.

Construction

In the construction industry, projects have extended timelines, and costs evolve throughout the life cycle of a project. Life Cycle Cost Analysis is paramount for assessing the total cost of construction projects, including initial investment, maintenance, and operational expenses. This type of analysis aids in making decisions that optimise long-term value and sustainability.

Technology

The dynamic nature of the technology sector demands a forward-looking approach to cost analysis. Cost-Benefit Analysis is prevalent in technology and research-driven industries, helping organisations evaluate the potential returns on investments in research and development. This type of analysis guides decisions on innovation, ensuring that technological advancements align with both strategic goals and financial feasibility.

Service Industries

In service-oriented industries, Opportunity Cost Analysis is frequently used. Service providers weigh the potential benefits foregone by choosing one service over another, guiding decisions on service offerings and resource allocation. Incremental Cost Analysis is also relevant when expanding service portfolios or making changes to existing offerings.

Agriculture

Agriculture involves unique cost considerations, including factors such as land, labour, and equipment. Marginal Cost Analysis is valuable for optimising production levels, especially when deciding on the quantity of crops to plant. Life Cycle Cost Analysis may be applied to assess the long-term financial implications of investments in agricultural machinery.

Energy

Cost analysis in the energy sector extends to evaluating the life cycle costs of energy production methods. Life Cycle Cost Analysis is essential for comparing the total costs associated with different energy sources, considering factors such as installation, maintenance, and decommissioning expenses.

Financial Services

Financial institutions often rely on Cost-Benefit Analysis for evaluating the potential returns on investments and strategic initiatives. This includes decisions related to the introduction of new financial products, technology upgrades, or expansions into new markets.

Education

Educational institutions may use cost analysis, such as Life Cycle Cost Analysis, when considering long-term investments in infrastructure or technology. Additionally, Opportunity Cost Analysis can aid in decisions regarding resource allocation, curriculum development, and expansion plans.

In summary, the manifestation of cost analysis in different industries is a testament to its adaptability and versatility. Whether optimising production in manufacturing, ensuring patient care in healthcare, or evaluating the long-term sustainability of construction projects, cost analysis serves as a guiding light, tailored to address the unique financial landscapes of diverse sectors. Each industry adopts specific types of cost analysis that align with its priorities and challenges, contributing to more informed decision-making and financial resilience.

The Role of Technology in Performing Cost Analysis

The digital era has ushered in a new age of efficiency and accuracy in cost analysis through the integration of technology. Various tools and software solutions are designed to streamline the process, enhance data accuracy, and provide real-time insights. Here are some ways technology is reshaping cost analysis:

Automation of Data Collection

Advanced software automates the collection of financial data, reducing the risk of errors associated with manual entry. This not only saves time but also improves the accuracy of cost analysis.

Data Visualisation

Technology enables the creation of interactive and visually engagingdashboards, making it easier for stakeholders to comprehend complex cost data. Visual representations facilitate quicker and more informed decision-making.

Cloud-Based Solutions

Cloud computing allows for the seamless collaboration of teams, ensuring that everyone is working with the most up-to-date cost data. This accessibility enhances communication and coordination in the cost analysis process.

Table 1: Software/tools for effective cost analysis

Software/Tool Name | Description | Key Features |

Tableau | Data visualisation and business intelligence | Dynamic dashboards and interactive reports |

QuickBooks | Accounting software for small businesses | Invoicing, expense tracking, and financial reports |

SAP ERP | Enterprise resource planning | Integrated modules for comprehensive cost analysis |

Solver | Corporate performance management | Budgeting, forecasting, and scenario analysis |

Costimator | Cost estimating software for manufacturing | Detailed cost breakdowns for accurate analysis |

Predictive Analytics

Cutting-edge technologies like machine learning enable organisations to predict future costs based on historical data. This proactive approach empowers businesses to anticipate challenges and plan for potential cost fluctuations.

Integration with Enterprise Resource Planning (ERP) Systems

Integration withERP systems ensures a unified approach to financial data management. This linkage streamlines the flow of information between different departments, creating a more cohesive and accurate representation of costs.

In short, technology has revolutionised the landscape of cost analysis, offering tools and solutions that enhance efficiency, accuracy, and decision-making capabilities. The integration of advanced technologies into the cost analysis process empowers organisations to navigate the complexities of modern business with agility, precision, and a forward-looking perspective. As technology continues to evolve, its role in cost analysis is likely to become even more central, shaping the future of financial management and strategic decision-making.

Conclusion

In the intricate web of organisational finances, cost analysis serves as a guiding light, illuminating the path to prudent decision-making and financial success. By understanding the nuances of different cost analysis types, organisations can tailor their approach to meet specific needs. Whether in manufacturing, healthcare, retail, construction, or technology, cost analysis is a universal tool that adapts to diverse industries, ensuring financial resilience and sustainable growth. Embracing technology further elevates the efficiency and accuracy of cost analysis, paving the way for a future where financial decisions are not just informed but also optimised for success.

Ready to elevate your financial prowess? Explore our course, ‘Financial Planning & Feasibility Analysis,’ where you'll delve deeper into these strategies, gaining practical insights for optimal decision-making and financial success. Transform your approach to finances and unlock a pathway to unparalleled financial resilience and growth. Enrol now or contact us for more information.