It’s important to aim for continuous improvement in all organisations. In this current economic climate, customers are always asking for more for their money, and you’ll be pressured to improve your services and products with a limited budget.

To focus on your business growth and reputation while maintaining low spending, you’ll need to fully understand accounts payable best practices and tools to create efficient and organized processes. Learning how to develop a balance sheet, streamline your processes, and reduce your costs while enhancing your service is a tough task, so project planning, strict management, and organisation are key.

Accounts payable is just one of the many departments responsible for a business's success. They can assess the financial situation, balance cash flow, and flag any potential risk areas that may cause concern. This leaves other departments in a more informed position to move forward with new and improved project plans and apply for further investment opportunities to mitigate against risks and support the company’s overall financial position for the future.

Upon completion of this course, participants will be able to:

- Understand how important accounts payable is regarding managing a supply chain and other cost functions.

- Create new cost-saving projects based on inventory, stock control, and purchasing to solve budgetary issues.

- Effectively manage cash flow using tools and techniques to maintain working capital.

- Identify financial risks to the organisation and place them in mitigation plans to retain good financial standing.

- Understand the fundamentals of accounts payable processes, tools, and terminology.

- Create accurate forecasting models based on previous accounts payable reporting.

- Maintain secure data and financial records to aid future planning.

- Advise other departments on budgets and financial stability to maintain a positive reputation and increase sales.

This course is designed for anyone responsible for the accounts payable department or taking part in project planning and decision-making processes from a financial perspective. It would be most beneficial for:

- Accountants

- Chief Financial Officers

- HR Professionals

- Finance Advisors

- Business Owners

- Accounts Payable Managers

- Accounts Payable Supervisors

- Accounts Payable Personnel

This course uses various adult learning methods to aid full understanding and comprehension. Participants will review current best practices for accounts payable teams and understand how essential accounting practices are to companies through real-world case studies and video examples.

They will learn to use financial planning tools and techniques and work in groups to develop an understanding of risk areas and identify them using mock scenarios. They will then plan contingency methods and develop projects that work towards cost reductions, brainstorming project ideas to improve business practices, profits, productivity, and reputation within set budgets.

Day 5 of each course is reserved for a Q&A session, which may occur off-site. For 10-day courses, this also applies to day 10

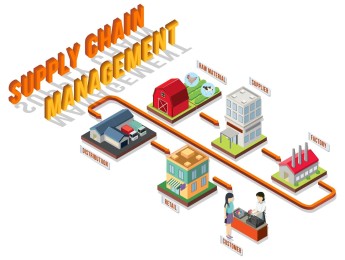

Section 1: Supply Chain Management & Prominent Accounting Procedures

- The context of accounts payable for the wider business.

- Sources of internal and external finance.

- Supply chain management.

- Financial performance management and monitoring.

- Cash flow and working capital tracking.

- Why managing cash flow is so important.

Section 2: Best Practice Accounts Payable Solutions

- Determining best practices in accounts payable.

- P2P development and change.

- Identifying and managing financial risk.

- Financial contingency planning.

- End-to-end accounts payable processing.

- Defining accounts payable issues and developing project plans.

Section 3: Operational Management & Project Planning

- Assessing large financial developments.

- Forecasting and road mapping based on previous financial statements.

- Making the most of your resources.

- Tightening your processes to maintain productivity.

- Travel and entertainment costs.

Section 4: Invoicing Against Budget

- Handling invoices and approvals processes.

- Low-value vs. high-value item payments.

- Dealing with new suppliers.

- Petty cash and accounts payable relationships.

- Vendor relationships and file management.

Section 5: IT Solutions for Automation

- Spreadsheet transformation.

- IT systems that flag and monitor financial issues.

- Managing expenses.

- Policy changes and tweaks.

- Cash advancement through automation.

- Storing accurate records and personal data.

- Accounts payable cloud services.

- Managing automated workflows and remote teams.

Section 6: Maintaining Professional Relationships

- Communicating your project plans.

- Customer relations and management.

- Payments for internal employees and external stakeholders

- The Procure to Pay (P2P) system and processes.

- Payment solutions for treasury approval.

Upon successful completion of this training course, delegates will be awarded a Holistique Training Certificate of Completion. For those who attend and complete the online training course, a Holistique Training e-Certificate will be provided.

Holistique Training Certificates are accredited by the British Assessment Council (BAC) and The CPD Certification Service (CPD), and are certified under ISO 9001, ISO 21001, and ISO 29993 standards.

CPD credits for this course are granted by our Certificates and will be reflected on the Holistique Training Certificate of Completion. In accordance with the standards of The CPD Certification Service, one CPD credit is awarded per hour of course attendance. A maximum of 50 CPD credits can be claimed for any single course we currently offer.

- Course Code PF1-120

- Course Format Classroom, Online,

- Duration 5 days