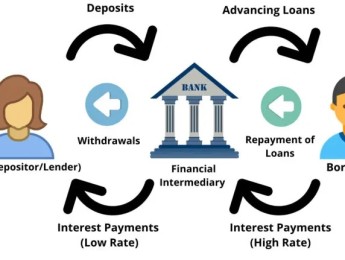

Creating a constructive loan isn’t easy. It’s important to meet the borrower's needs and ensure that they have the means to repay the loan while protecting the lender.

The loan needs to have just the right strategic repayment set up to allow the borrower to pay it back steadily without falling into financial hardship. However, the lender needs to receive just enough interest to justify paying out the loan and be assured that they will receive a return on their investment.

A loan agreement depends on various factors, including the payment amount and dates, the purpose of the loan, the collateral against the loan, and the consequences of failure to make payment.

Lenders will also need to do their homework regarding risk and mitigation tactics to avoid earnings loss. Loan structuring within a business is a complex area, and financial professionals must understand the inner workings of capital management, loan structuring, and covenants to lend and take advantage of sensible investment opportunities strategically.

Upon completion of this course, participants will be able to:

- Identify the key risk areas when embarking on a loan.

- Develop accurate insights into strategic loaning to avoid risk.

- Understand the terminology surrounding modern loan assessments.

- Create a cash flow chart for your organisation.

- Measure and quantify the borrowing needs of others.

- Benchmark your organisation against competitors regarding lending.

- Understand the differences between short-term and long-term loaning.

- Select the appropriate lending structure for the borrower.

- Manage a loan throughout its term.

- Accurately and legally document each section of the loan agreement.

This course is designed for anyone responsible for making financial decisions within an organisation. It would be most beneficial for:

- Business Owners

- Chief Financial Officers

- Financial Professionals

- Operations Managers

- Directors

- Risk Assessors

- Accountants

- Account Managers

- Auditors

- Treasurers

- Funding Managers

- Bond Credit Analysts

- Data Analysts

- Management Consultants

- Investment Managers

- Lenders

- Compliance Officers

- Bank Managers

This course uses various adult learning methods to aid full understanding and comprehension. Participants will review the structure of several real-life loans and work together to identify the most appropriate people to lend to and structure their repayment strategy.

They will review some of the most up-to-date tools used in the financial sector and use them to understand how much return their organisation could get from investing in loan practices at short-term, medium-term, and long-term levels.

Day 5 of each course is reserved for a Q&A session, which may occur off-site. For 10-day courses, this also applies to day 10

Section 1: Credit & Lending Risks

- What is credit risk, and how to identify it?

- The various types of risk.

- Sovereign, counterpart, corporate, retail, and systemic risks.

- The current lending environment and associated risk elements.

- Assessing, measuring, and managing risks.

- IFRS impacts.

- Basic lending definitions.

- Your policies, procedures, and strategies.

- Data collection, monitoring, and approval processes.

Section 2: Utilising Specific Financial Products

- Long-term loans and overdrafts.

- Project and construction financing.

- Private vs. public partnerships.

- Government bonds.

- Equity and mezzanine debt.

- Working with derivatives and exposures.

- Off-balance sheets.

- Trade financing, mortgages, and credit cards.

Section 3: Understanding the Working Capital Cycle

- Understanding the mechanics and terminology.

- Seasonal cycle management.

- The role of banking finance and overdraft management.

- Break-even and cash flow analysis.

- Lending in support of the capital cycle.

- Managing multiple cycles simultaneously.

Section 4: Basic Lending Principles Against Borrower Needs

- Appraisals and credit assessments.

- Understanding the different types of clients.

- Development finance and project finance.

- Budgets and cash flow measurements.

- SWOT analysis.

- Determining the length of the loan.

- Data collection and evaluation.

- Understanding collateral.

- Recovery mechanisms.

Section 5: Credit Risk Strategies

- Measuring credit risk on specific loan types.

- Contagion and liquidity assumption risks.

- Short-term and long-term finance options.

- Working capital.

- The importance of time.

Section 6: Cash Flow Management

- The Rule of 72.

- NPV & PDV discounted cash flows.

- Pitfalls and stress testing your strategy.

- Scenario analysis against banker’s cash flow.

Section 7: Lending Structures & What Works for Your Organisation

- What facilities can you offer?

- What does your client need?

- Matching lending to cash flow and securing against collateral.

- Lending cycles in the current economic climate.

- Recovery management and monitoring.

Section 8: Bank Security & Adequate Documentation

- Bank safety nets and risk transfers.

- Guarantees and other security methods.

- Best practice lending and post-draw-down techniques.

- Security management and perfection.

Section 9: Seeing Your Investment Grow

- Undertakings and managing your loan agreement.

- Reporting processes and regular monitoring.

- Securing accurate data and intelligence.

- Covenants and the ideal.

- Employing the best systems and CRM.

- Credit risk management processes, procedures, and auditing.

Upon successful completion of this training course, delegates will be awarded a Holistique Training Certificate of Completion. For those who attend and complete the online training course, a Holistique Training e-Certificate will be provided.

Holistique Training Certificates are accredited by the British Assessment Council (BAC) and The CPD Certification Service (CPD), and are certified under ISO 9001, ISO 21001, and ISO 29993 standards.

CPD credits for this course are granted by our Certificates and will be reflected on the Holistique Training Certificate of Completion. In accordance with the standards of The CPD Certification Service, one CPD credit is awarded per hour of course attendance. A maximum of 50 CPD credits can be claimed for any single course we currently offer.

Tags

Budgeting, Cash Flow, finance, risk, Accounting, budget, credit, investment, bank, Transaction, Loan,- Course Code IND12-107

- Course Format Classroom,

- Duration 5 days