- Table of Contents

- Introduction

- What Are Carbon Markets?

- Voluntary vs. Compliance Markets

- Carbon Credits and Carbon Offsets: Key Differences

- Carbon Credits

- Carbon Offsets

- Key Differences

- The Importance of Carbon Credits

- Economic Incentives for Emission Reductions

- Flexibility in Meeting Sustainability Goals

- Encouraging Sustainable Practices

- Global Cooperation and Market Efficiency

- Measuring Impact and Progress

- How to Produce Carbon Credits

- 1. Project Identification

- 2. Baseline Assessment

- 3. Methodology Selection

- 4. Implementation

- 5. Monitoring and Verification

- 6. Issuance of Carbon Credits

- What Is Carbon Trading?

- How Carbon Trading Works

- Getting Started with Carbon Trading

- 1. Understand the Basics of Carbon Trading

- 2. Assess Your Organization’s Carbon Footprint

- 3. Set Clear Sustainability Goals

- 4. Explore Carbon Credit Options

- 5. Choose a Carbon Registry

- 6. Monitor and Report Emissions

- 7. Stay Informed About Market Trends

- 8. Engage Stakeholders and Build Partnerships

- Conclusion

Introduction

The urgency of addressing climate change has led to innovative solutions that aim to reduce greenhouse gas emissions. Among these solutions, carbon credits and carbon trading have emerged as pivotal components in the global effort to combat climate change. This blog post explores the intricate world of carbon markets, the distinctions between carbon credits and offsets, their significance, production methods, the mechanics of carbon trading, and practical steps for engaging in this evolving market.

What Are Carbon Markets?

Carbon markets serve as platforms for buying and selling carbon credits, which represent a unit of carbon dioxide (CO2) emissions that has been reduced, avoided, or sequestered. These markets are essential in facilitating the transition to a low-carbon economy by providing financial incentives for emission reductions.

Voluntary vs. Compliance Markets

Carbon markets can be broadly categorized into two types: voluntary and compliance markets.

- Voluntary Markets: These markets allow companies, organizations, and individuals to purchase carbon credits on a voluntary basis. Participants often engage in these markets to enhance their sustainability initiatives, improve corporate responsibility, or meet internal environmental goals. Voluntary markets are characterized by a diverse range of projects, including renewable energy, reforestation, and energy efficiency initiatives. The key feature of voluntary markets is that they operate independently of regulatory requirements, giving participants the flexibility to choose how they offset their emissions.

- Compliance Markets: In contrast, compliance markets are regulated by government entities and require certain industries or companies to adhere to specific emission reduction targets. These markets are often established under national or international laws, such as theEuropean Union Emissions Trading System (EU ETS) or California’s Cap-and-Trade Program. Companies that exceed their emission limits must purchase carbon credits from those who have successfully reduced their emissions below the mandated levels. Compliance markets are typically more structured, with stringent rules and regulations governing the issuance and trading of carbon credits.

Understanding these two types of carbon markets is crucial for comprehending how carbon credits function within the broader context of climate action.

Feature | Voluntary Markets | Compliance Markets |

Regulation | Not regulated by government; operates independently | Regulated by government entities with specific emission reduction targets |

Participation | Open to any individual or organization seeking to offset emissions | Limited to regulated entities required to meet legal obligations |

Purpose | Driven by corporate social responsibility, sustainability goals, and consumer demand | Focused on meeting legal requirements for emission reductions |

Project Types | Diverse range of projects, including renewable energy and conservation | Typically involves projects that comply with specific regulatory standards |

Market Dynamics | Prices determined by supply and demand dynamics; often more flexible | Prices influenced by regulatory caps and allowances; generally more structured |

Carbon Credits and Carbon Offsets: Key Differences

While the terms "carbon credits" and "carbon offsets" are often used interchangeably, they represent distinct concepts within the realm of carbon trading. Understanding these differences is crucial for anyone looking to engage in carbon markets or make informed decisions about their environmental impact.

Carbon Credits

A carbon credit typically represents a reduction of one metric ton of carbon dioxide (CO2) emissions. These credits are generated through specific projects that actively reduce greenhouse gas emissions. For instance, a wind farm that displaces fossil fuel-generated electricity can produce carbon credits based on the amount of CO2 emissions avoided. Each carbon credit is verified and certified by recognized standards, ensuring that the emission reductions are real, measurable, and additional to what would have occurred in the absence of the project.

The verification process often involves third-party audits and adherence to methodologies established by organizations such as theVerified Carbon Standard (VCS) or the Gold Standard. This rigorous certification process lends credibility to carbon credits, making them a reliable tool for companies and organizations seeking to offset their emissions.

Carbon Offsets

Carbon offsets are broader in scope and can include carbon credits, but they also encompass a wider range of compensatory actions. Purchasing a carbon offset might involve investing in projects that absorb CO2 from the atmosphere, such as reforestation or soil carbon sequestration initiatives. Unlike carbon credits, which are tied specifically to quantifiable emission reductions, offsets can represent a variety of strategies aimed at balancing out one’s carbon footprint.

For example, a company may choose to purchase offsets to compensate for its emissions from air travel by funding a tree-planting initiative. While the tree-planting project may not directly correlate to the exact amount of CO2 emitted from the flights, it serves as a compensatory measure to achieve a net-zero impact.

Key Differences

The primary differences between carbon credits and carbon offsets lie in their definitions, verification processes, and the types of projects they support. Carbon credits are strictly tied to verified emission reductions, while carbon offsets can represent a broader range of environmental actions aimed at achieving a net reduction in carbon emissions.

Here’s a comparison table summarizing the key differences between carbon credits and carbon offsets:

Feature | Carbon Credits | Carbon Offsets |

Definition | Represents a verified reduction of 1 metric ton of CO2 emissions | Broader concept, includes various compensatory actions to balance emissions |

Verification | Requires third-party verification and certification | May not always require strict verification; can be based on self-reported data |

Project Types | Specific projects that reduce emissions (e.g., renewable energy) | Includes a variety of projects (e.g., reforestation, conservation) |

Market Usage | Primarily used in compliance and voluntary markets | Commonly used in voluntary markets to offset emissions |

Regulatory Framework | Governed by established standards and regulations | Less regulated, often driven by corporate social responsibility initiatives |

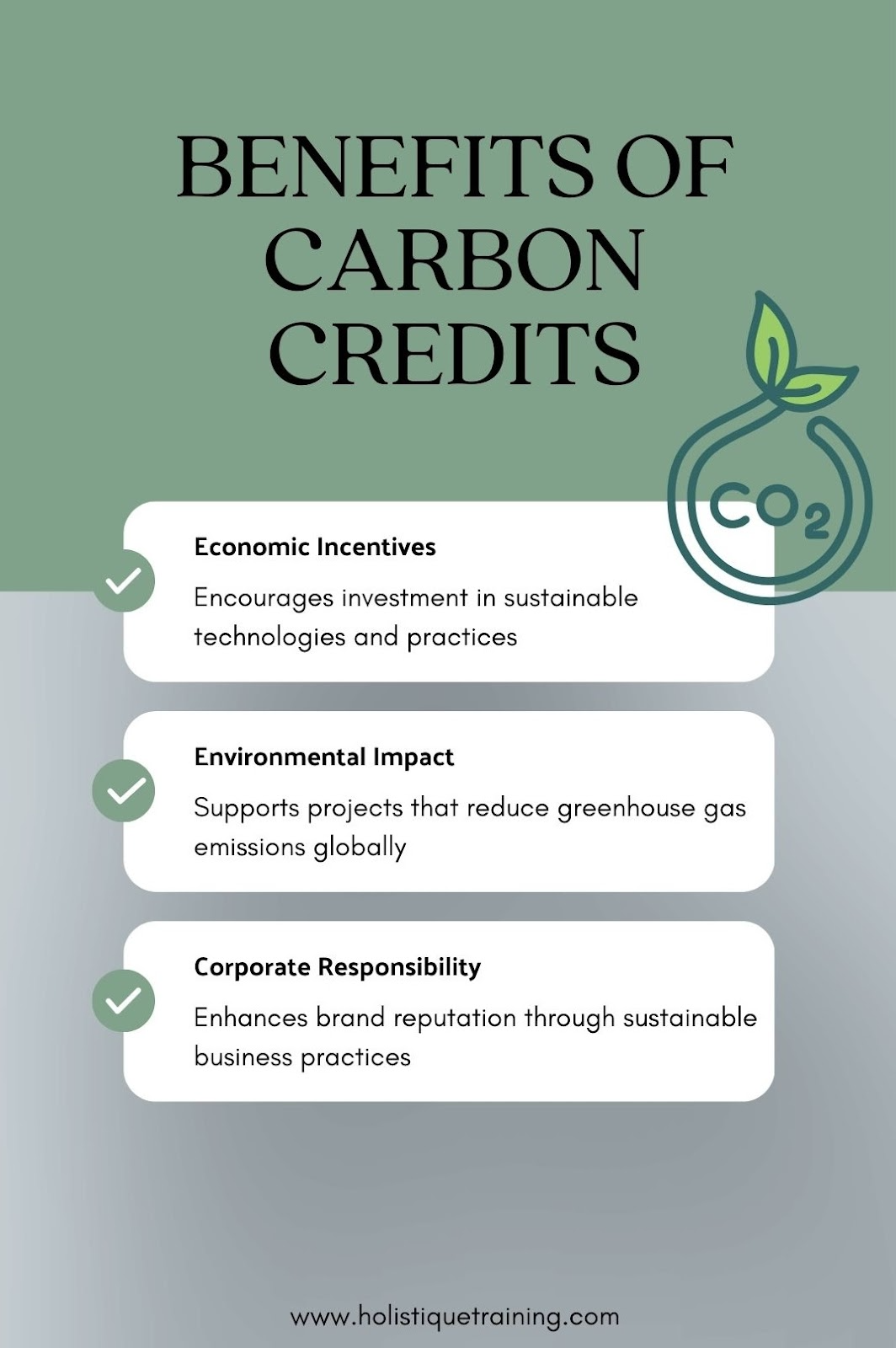

The Importance of Carbon Credits

Carbon credits are not merely financial instruments; they play a crucial role in the global strategy to combat climate change and promote sustainable development. Their significance extends across economic, environmental, and social dimensions, making them a vital component of contemporary climate policy and corporate sustainability initiatives.

Economic Incentives for Emission Reductions

One of the primary functions of carbon credits is to create economic incentives for companies and organizations to reduce their greenhouse gas emissions. By assigning a monetary value to carbon emissions, carbon credits encourage businesses to invest in cleaner technologies and practices.

- Cost-Effectiveness: Companies can choose to reduce emissions internally or purchase carbon credits from others who have successfully lowered their emissions. This flexibility allows businesses to find the most cost-effective solutions for achieving compliance with emission reduction targets. For example, a company might find it cheaper to invest in energy efficiency upgrades rather than implementing a costly new production process.

- Innovation and Investment: The demand for carbon credits fosters innovation in low-carbon technologies. Companies are motivated to develop new solutions that reduce emissions, leading to advancements in renewable energy, energy efficiency, and carbon capture technologies. This innovation not only benefits the environment but also stimulates economic growth and job creation in emerging green sectors.

Flexibility in Meeting Sustainability Goals

Carbon credits offer flexibility to organizations in achieving their sustainability goals. This flexibility is particularly important in a rapidly changing regulatory environment where emission reduction targets may evolve.

- Tailored Strategies: Organizations can tailor their strategies based on their specific circumstances. For instance, a company with limited resources may opt to purchase carbon credits while gradually implementing internal emission reduction measures. This approach allows businesses to balance immediate compliance needs with long-term sustainability objectives.

- Broader Participation: The availability of carbon credits encourages broader participation in climate action. Small and medium-sized enterprises (SMEs), which may lack the resources to implement large-scale emission reduction projects, can still contribute to climate goals by purchasing credits. This inclusivity enhances collective efforts to reduce global emissions.

Encouraging Sustainable Practices

The carbon credit system incentivizes the adoption of sustainable practices and projects that contribute to environmental conservation.

- Support for Green Initiatives: By purchasing carbon credits, companies can support various environmental projects, such as reforestation, renewable energy development, and biodiversity conservation. This funding not only helps mitigate climate change but also promotes ecosystem health and resilience.

- Corporate Responsibility: As consumers increasingly demand sustainable practices from businesses, carbon credits provide a tangible way for companies to demonstrate their commitment to environmental stewardship. Engaging in carbon markets can enhance a company's reputation and brand value, ultimately leading to increased customer loyalty.

Global Cooperation and Market Efficiency

Carbon credits facilitate international cooperation in addressing climate change, allowing countries and companies to collaborate in their efforts to reduce emissions.

- Cross-Border Trading: Carbon markets enable cross-border trading of carbon credits, allowing countries to leverage their unique resources and capabilities. For instance, a country with abundant renewable energy sources can generate credits by exporting clean energy to neighboring countries, helping them meet their emission reduction targets.

- Efficient Resource Allocation: The market-driven nature of carbon credits ensures that resources are allocated efficiently. Companies that can reduce emissions at a lower cost will do so, while those facing higher costs can purchase credits, leading to an overall reduction in emissions at the lowest possible economic cost.

Measuring Impact and Progress

Carbon credits provide a quantifiable measure of progress in reducing greenhouse gas emissions, which is essential for tracking the effectiveness of climate policies and initiatives.

- Transparency and Accountability: The rigorous verification processes associated with carbon credits ensure transparency and accountability in emission reductions. This transparency is crucial for building trust among stakeholders, including investors, regulators, and the public.

- Benchmarking Success: Organizations can use carbon credits as benchmarks to assess their sustainability efforts over time. By tracking the number of credits purchased or generated, companies can evaluate their progress toward meeting their climate goals and adjust strategies as needed.

In summary, the importance of carbon credits lies in their ability to drive economic incentives for emission reductions, provide flexibility in achieving sustainability goals, encourage the adoption of sustainable practices, facilitate global cooperation, and measure progress in combating climate change. As the world continues to grapple with the impacts of climate change, carbon credits will remain a critical tool in the transition to a more sustainable and resilient future.

How to Produce Carbon Credits

Producing carbon credits involves several steps, typically centered around projects designed to reduce or sequester greenhouse gas emissions. Here’s a detailed overview of the process:

1. Project Identification

The first step in producing carbon credits is to identify a project that can effectively reduce greenhouse gas emissions. This project should align with recognized methodologies that outline how emissions reductions can be quantified. Various types of projects can qualify for carbon credits, including:

- Renewable Energy Projects: Initiatives that generate energy from renewable sources, such as solar, wind, or hydroelectric power, can produce carbon credits by displacing fossil fuel-based energy generation.

- Energy Efficiency Improvements: Upgrading facilities or processes to use less energy can lead to significant emissions reductions. For example, retrofitting buildings with energy-efficient lighting and heating systems can qualify for carbon credits.

- Reforestation and Afforestation: Planting trees or restoring forests helps sequester carbon dioxide from the atmosphere, making these projects valuable for generating carbon credits.

- Methane Capture: Projects that capture and utilize methane emissions from landfills or agricultural operations can prevent potent greenhouse gases from entering the atmosphere, thereby producing credits.

2. Baseline Assessment

Once a project is identified, a baseline assessment is conducted to determine the amount of emissions that would occur without the project. This baseline serves as a reference point against which the project's actual emissions reductions will be measured.

- Data Collection: Gathering historical data on emissions from similar operations or activities is essential for establishing a credible baseline. This data can include energy consumption records, production levels, and other relevant metrics.

- Methodology Selection: The project must adhere to specific methodologies that outline how emissions reductions will be calculated and verified. These methodologies are often established by recognized standards, such as the Verified Carbon Standard (VCS) or the Gold Standard.

3. Methodology Selection

Choosing the appropriate methodology is critical for ensuring that the project meets the standards required for generating carbon credits. Methodologies provide detailed guidelines on:

- Calculation of Emission Reductions: They specify how to quantify the reductions achieved by the project compared to the baseline scenario.

- Monitoring Requirements: Methodologies outline the monitoring processes needed to track the project's performance over time, ensuring that emission reductions are sustained.

- Verification Protocols: They detail the verification processes that must be followed to validate the emission reductions claimed by the project.

4. Implementation

Once the project design and methodology are approved, implementation can begin. This phase involves executing the necessary actions to achieve the desired emission reductions.

- Project Execution: Depending on the type of project, this could involve installingrenewable energy systems, upgrading equipment for energy efficiency, or initiating reforestation efforts.

- Stakeholder Engagement: Engaging with local communities, stakeholders, and regulatory authorities is essential for ensuring project success and gaining support.

5. Monitoring and Verification

Ongoing monitoring is essential to ensure that the project continues to deliver the expected emission reductions. This step usually involves:

- Data Collection: Regularly collecting data on project performance, such as energy output, emissions reductions, and other relevant metrics.

- Third-Party Verification: Independent third-party verifiers assess the project’s performance and confirm that the claimed reductions are accurate and credible. This verification process typically involves site visits, document reviews, and interviews with project stakeholders.

6. Issuance of Carbon Credits

After successful verification, carbon credits are issued based on the verified emission reductions. Each credit corresponds to one metric ton of CO2 reduced or sequestered.

- Registry Systems: Carbon credits are typically issued through established registry systems that track the creation, ownership, and retirement of credits. This ensures transparency and prevents double counting.

- Market Availability: Once issued, these credits can be sold or traded in carbon markets, allowing project developers to generate revenue while contributing to global emission reduction efforts.

In summary, producing carbon credits is a multi-step process that requires careful planning, execution, and adherence to rigorous standards. By engaging in this process, organizations can not only contribute to global efforts to mitigate climate change but also create economic opportunities and enhance their sustainability credentials. As the demand for carbon credits continues to grow, understanding how to produce them effectively will be essential for businesses and projects aiming to make a positive environmental impact.

What Is Carbon Trading?

Carbon trading refers to the buying and selling of carbon credits within carbon markets. It is a mechanism that allows entities to trade their emission allowances or credits to achieve compliance with regulatory requirements or voluntary sustainability goals.

How Carbon Trading Works

Cap-and-Trade Systems:

In compliance markets, carbon trading often operates under a cap-and-trade system. Governments set a cap on the total amount of greenhouse gases that can be emitted by regulated entities. Companies receive or purchase allowances that permit them to emit a certain amount of CO2. If a company reduces its emissions below its allowance, it can sell its excess credits to other companies that are struggling to meet their targets. This creates a financial incentive for companies to innovate and reduce emissions.

Voluntary Trading:

In voluntary markets, companies and individuals can buy carbon credits to offset their emissions, regardless of regulatory requirements. This trading is driven by corporate social responsibility, consumer demand for sustainable practices, and individual commitments to reducing carbon footprints.

Price Determination:

The price of carbon credits is influenced by supply and demand dynamics within the market. Factors such as regulatory changes, advancements in technology, and the availability of credible projects can all impact credit prices. Higher demand for credits often leads to increased prices, encouraging more projects to be developed.

Market Platforms:

Carbon trading occurs on various platforms, including exchanges and over-the-counter markets. These platforms facilitate transactions between buyers and sellers, providing transparency and liquidity to the market.

Carbon trading is a critical element of the broader strategy to reduce global greenhouse gas emissions, enabling flexibility and innovation in achieving climate goals.

Getting Started with Carbon Trading

Carbon trading is an increasingly important mechanism for addressing climate change, allowing businesses and organizations to buy and sell carbon credits as a way to offset their greenhouse gas emissions. For those looking to enter the carbon trading market, understanding the fundamentals and taking strategic steps is crucial. Here’s a comprehensive guide to getting started with carbon trading.

1. Understand the Basics of Carbon Trading

Before diving into carbon trading, it’s essential to grasp the fundamental concepts:

- Carbon Credits: Each carbon credit represents one metric ton of carbon dioxide (CO2) emissions that have been reduced, avoided, or sequestered. Companies can earn credits through various projects that lead to verified emissions reductions.

- Carbon Markets: There are two primary types of carbon markets:

- Compliance Markets: Regulated markets where companies are required to meet specific emissions reduction targets set by governmental bodies. Participants must buy credits to comply with these regulations.

- Voluntary Markets: Non-regulated markets where companies voluntarily purchase carbon credits to offset their emissions and demonstrate corporate social responsibility.

2. Assess Your Organization’s Carbon Footprint

Before engaging in carbon trading, organizations should assess their carbon footprint to understand their emissions profile. This involves:

- Data Collection: Gather data on energy consumption, transportation, waste generation, and other activities that contribute to greenhouse gas emissions.

- Emissions Calculation: Use established methodologies and tools, such as the Greenhouse Gas Protocol, to calculate total emissions. This assessment will help identify the quantity of carbon credits needed to offset emissions.

3. Set Clear Sustainability Goals

Establishing clear sustainability goals can guide your organization’s approach to carbon trading:

- Target Setting: Define specific, measurable targets for reducing emissions. These targets should align with broader corporate sustainability objectives and may include commitments to achieve net-zero emissions by a certain date.

- Integration with Business Strategy: Ensure that your carbon trading strategy aligns with your overall business strategy and values. This integration can enhance brand reputation and customer loyalty.

4. Explore Carbon Credit Options

Organizations can acquire carbon credits through various methods:

- Direct Purchase: Buy carbon credits directly from project developers or through carbon credit registries. This option allows organizations to support specific projects that align with their sustainability goals.

- Brokerage Services: Engage with brokers or intermediaries who specialize in carbon trading. They can provide insights into market trends, help identify suitable credits, and facilitate transactions.

- Project Development: Consider developing your own projects to generate carbon credits. This approach can provide additional benefits, such as enhancing your organization’s sustainability profile and creating new revenue streams.

5. Choose a Carbon Registry

A carbon registry is a critical component of the carbon trading system, providing a transparent platform for tracking carbon credits. When getting started, consider:

- Selecting a Registry: Choose a reputable carbon registry that aligns with your goals. Well-known registries include the Verified Carbon Standard (VCS), Gold Standard, and Climate Action Reserve.

- Understanding Registry Functions: Registries track the issuance, transfer, and retirement of carbon credits, ensuring transparency and preventing double counting. Familiarize yourself with the registry’s processes and requirements.

6. Monitor and Report Emissions

Ongoing monitoring and reporting are essential for maintaining credibility in carbon trading:

- Regular Monitoring: Continuously track emissions to assess progress toward sustainability goals. Implement systems for data collection and analysis to ensure accuracy.

- Transparent Reporting: Communicate your carbon trading activities and emissions reductions to stakeholders, including investors, customers, and regulatory bodies. Transparency builds trust and demonstrates commitment to sustainability.

7. Stay Informed About Market Trends

The carbon trading landscape is dynamic, with regulations, market prices, and best practices evolving over time. To succeed in carbon trading:

- Market Research: Stay updated on market trends, regulatory changes, and emerging technologies related to carbon trading. Join industry associations or networks to gain insights and share experiences with peers.

- Training and Education: Consider participating in workshops, webinars, or courses focused on carbon trading and sustainability practices. Continuous education will enhance your understanding and effectiveness in navigating the carbon market.

8. Engage Stakeholders and Build Partnerships

Collaboration is key to successful carbon trading:

- Engage Employees: Involve employees in sustainability initiatives and educate them about the importance of carbon trading. This engagement fosters a culture of sustainability within the organization.

- Build Partnerships: Collaborate with NGOs, governmental bodies, and other organizations involved in carbon trading. Partnerships can provide valuable resources, knowledge, and credibility.

In short, getting started with carbon trading requires a solid understanding of the market, a clear assessment of your organization’s emissions, and a strategic approach to acquiring and managing carbon credits. By following these steps, organizations can effectively engage in carbon trading, contribute to global efforts to combat climate change, and enhance their sustainability profiles. As the demand for carbon credits continues to grow, proactive participation in this market can yield significant environmental and economic benefits.

Conclusion

The concepts of carbon credits and carbon trading are integral to the global effort to mitigate climate change. By understanding the mechanics of carbon markets, the differences between credits and offsets, and the importance of these tools, individuals and organizations can make informed decisions that contribute to a sustainable future.

As we navigate the complexities of this evolving landscape, it becomes increasingly clear that carbon credits and trading are not just financial instruments; they represent a collective commitment to reducing greenhouse gas emissions and fostering a healthier planet. Engaging in carbon trading offers a pathway for individuals and organizations alike to take meaningful action against climate change while reaping the benefits of sustainable practices. The journey towards a low-carbon future is a shared responsibility, and carbon credits and trading are powerful tools in this endeavor.