- Table of Contents

- Introduction

- What Is Cost Control?

- Understanding the Cost Structure

- Why Cost Control Matters

- Improved Profitability

- Financial Stability and Long-term Growth

- Informed Decision-Making and Adaptability

- Strategic Resource Allocation and Innovation

- Customer Value and Competitive Edge

- Ethical and Social Responsibility

- Maintaining Competitive Pricing

- Cost Control Software

- Automating Mundane Tasks

- Real-time Insights and Data Analytics

- Streamlining Communication and Collaboration

- Customisation and Scalability

- Enhanced Compliance and Security

- Integration Capabilities

- Cost Efficiency and Rapid ROI

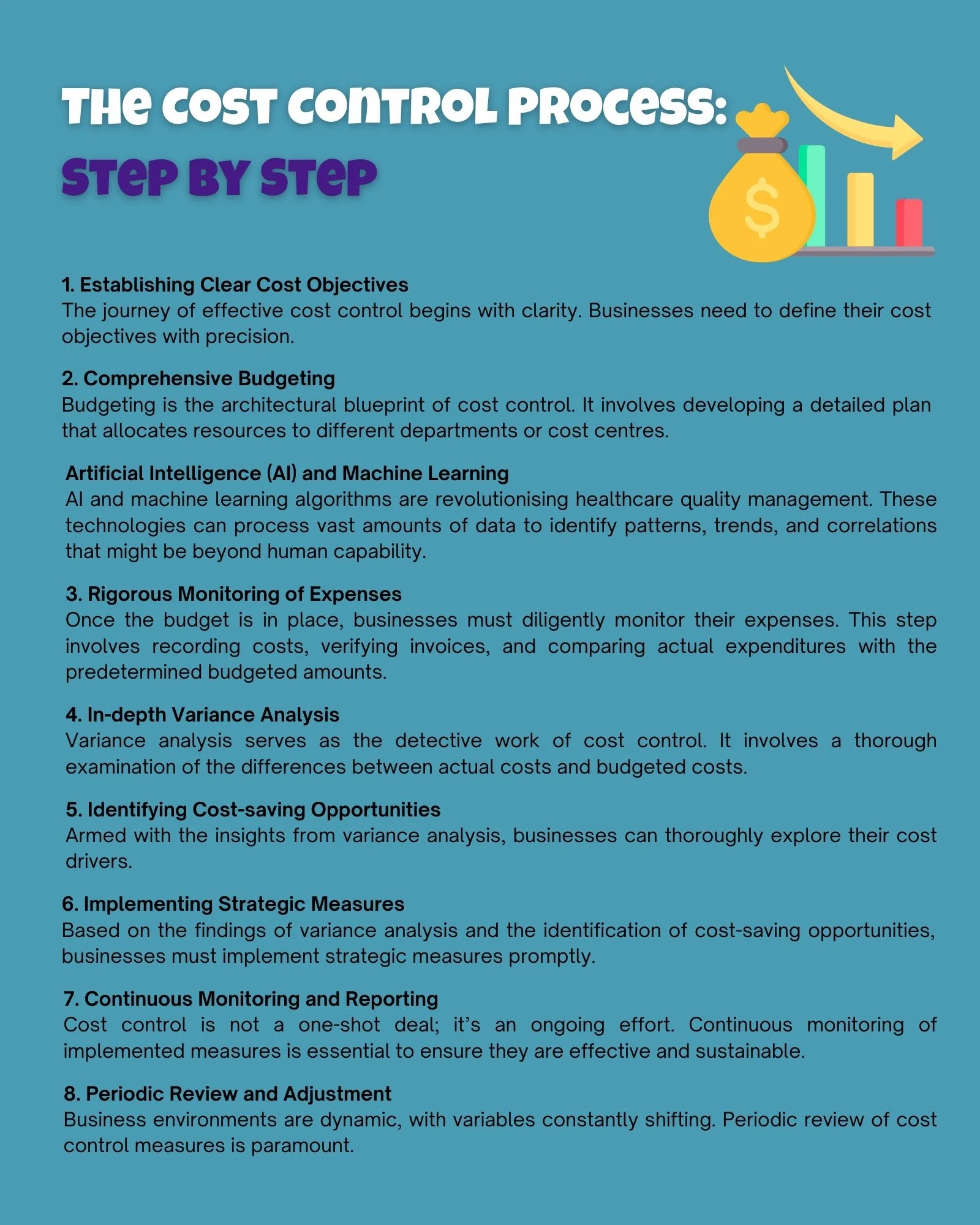

- The Cost Control Process: Step by Step

- 1. Establishing Clear Cost Objectives

- 2. Comprehensive Budgeting

- 3. Rigorous Monitoring of Expenses

- 4. In-depth Variance Analysis

- 5. Identifying Cost-saving Opportunities

- 6. Implementing Strategic Measures

- 7. Continuous Monitoring and Reporting

- 8. Periodic Review and Adjustment

- The Human Element in Cost Control

- Employee Training and Awareness

- Cultivating a Cost-Conscious Culture

- Incentivising Cost-Saving Initiatives

- Fostering Cross-Departmental Collaboration

- Employee Empowerment Through Technology

- Continuous Learning and Skill Development

- Conclusion

Introduction

Maintaining financial stability is crucial for long-term success in today's competitive business landscape. One key aspect of achieving this stability is effective cost control. Cost control empowers businesses to monitor and manage their expenses, optimise resource allocation, and maximise profitability. This blog post delves into the fundamentals of cost control, explores its significance in business operations, highlights the role of cost control software, and outlines the essential steps in the cost control process.

What Is Cost Control?

Cost control is a management strategy that regulates and minimises organisational expenses. It involves monitoring and managing various cost factors, including production costs, labour costs, overhead expenses, and operational expenditures. The primary objective of cost control is to maintain expenses within predetermined budgets or targets while ensuring the delivery of quality products or services.

Understanding the Cost Structure

The first step towards effective cost control is a profound understanding of the organisation's cost structure. Businesses must meticulously analyse every cost element, discerning areas where reductions or optimisations are plausible. Through this analysis, businesses can identify cost drivers such as material, labour, or indirect costs, opening doors for strategic decision-making and cost efficiency.

Why Cost Control Matters

Effective cost control is the bedrock upon which successful enterprises are built in the vast and ever-changing business landscape. It is not merely a financial strategy; rather, it embodies the essence of prudent management and foresight. Understanding why cost control is pivotal for businesses requires delving into its multifaceted significance.

Improved Profitability

By monitoring and managing costs, businesses can identify wasteful expenditures and redirect resources to more productive areas, ultimately boosting profitability. This ensures that revenue surpasses project expenses, accumulating financial resources for the company's growth and stability.

Financial Stability and Long-term Growth

Imagine a business as a towering skyscraper, its financial stability forming the solid foundation upon which the entire structure rests. Effective cost control ensures this foundation is rock-solid. By meticulously regulating expenditures, businesses avoid the quicksand of financial instability, preventing debt accumulation, cash flow issues, or even bankruptcy. Financial stability, thus achieved, isn't just a momentary relief; it paves the way for sustained growth. Stable finances provide the confidence necessary to invest in research, development, and market expansion. This stability cushions during economic downturns, allowing businesses to maintain operations when others falter. It’s not just about surviving; it's about thriving, even in the face of adversity.

Informed Decision-Making and Adaptability

Cost control isn’t confined to number crunching; it's about insights. It empowers businesses with a comprehensive understanding of their financial terrain. Picture a seasoned captain steering a ship through a storm; that captain is akin to a business leader armed with knowledge about their organisation's cost structures. This knowledge facilitates informed decision-making. Armed with precise financial data, leaders can confidently navigate the complex waters of the market.

Moreover, in today’s dynamic business environment, adaptability is key. Cost control equips businesses with the agility to respond swiftly to market fluctuations, technological advancements, or changing customer preferences. It's the difference between a sailboat adrift and a sailboat harnessing the winds of change to its advantage.

Strategic Resource Allocation and Innovation

Within any business, resources are finite. Think of these resources as puzzle pieces. Cost control helps optimise these pieces, add new ones, and foster innovation. By understanding where resources are best utilised, businesses can strategically allocate them. This allocation isn’t just about saving money; it’s about investing wisely. Funds saved through cost control initiatives can be funnelled into research and development, fostering innovation and driving product or service enhancements. It’s not just about doing the same things more efficiently; it’s about doing new things that redefine the market and create new revenue streams.

Customer Value and Competitive Edge

Picture a customer walking into a store. In their hands, they hold not just money but also expectations. Effective cost control ensures that these expectations are not just met but exceeded. By managing costs efficiently, businesses can provide value to customers. This value isn’t just in terms of price; it’s about the quality of the product or service offered. Cost control ensures that products remain competitively priced without compromising on quality. This balance between cost and quality attracts and retains customers, fostering brand loyalty. In a competitive market, where choices are abundant, such loyalty can be the key differentiator, giving a business the edge it needs to stay ahead.

Ethical and Social Responsibility

Cost control isn’t just internal; it reflects a business's ethical and social responsibility. Wasteful spending isn’t just detrimental to the company's bottom line; it’s also environmentally and socially irresponsible. Resources are finite, and excessive consumption affects the environment and deprives others of these resources. Responsible cost control, therefore, isn’t just a financial obligation; it’s a moral imperative. Businesses that engage in responsible cost control contribute positively to society by reducing their ecological footprint and promoting sustainable practices, setting an example for others in the industry to follow.

Benefit | Description |

Cost Savings | Reduced procurement costs through efficiency |

Environmental Impact Reduction | Lower carbon footprint by using eco-friendly suppliers |

Positive Brand Image | Attract eco-conscious customers and partners |

Long-term Resilience | Prepare for stricter environmental regulations |

Ethical Sourcing | Support responsible business practices |

Table 1: Benefits of sustainable procurement practices

Maintaining Competitive Pricing

Effective cost control ensures that products or services are priced competitively without compromising quality. This helps businesses remain competitive in the market and attract customers.

Cost control isn’t a mere financial practice; it’s a philosophy that shapes a business's very essence. It ensures financial stability, guides strategic decisions, fuels innovation, adds value to customers, and upholds ethical standards. It's not just about saving pennies; it’s about securing the business's future, ensuring its longevity and relevance in a dynamic and ever-evolving world. Businesses that recognise the profound importance of cost control aren’t just managing their finances; they are sculpting their destinies.

Cost Control Software

In the contemporary digital age, businesses increasingly use technology to optimise their operations. Cost control, a critical aspect of financial management, has undergone a transformative revolution with the advent of sophisticated cost control software. These digital solutions have redefined how businesses perceive, manage, and leverage their financial resources. Let’s explore how cost control software is reshaping the landscape of business efficiency and financial acumen.

Automating Mundane Tasks

Traditionally, managing costs involved an array of tedious and time-consuming tasks. From manually recording expenses to cross-referencing invoices with budgets, these processes were laborious and prone to human errors. Cost control software automates these mundane tasks, ensuring accuracy and efficiency at every step. By eliminating the need for manual data entry, businesses can redirect human resources towards more strategic and value-added activities, enhancing overall productivity. Not only that, but also, according to Columbus, using cost control software can shorten your billing cycles by gaining control over unbilled receivables. This empowers organisations to swiftly convert these receivables into revenues, improving financial liquidity and stability.

Real-time Insights and Data Analytics

One of the most significant advantages of cost control software is its ability to provide real-time insights into financial data. Businesses no longer have to wait for end-of-month reports to assess their financial health. With just a few clicks, they can access comprehensive dashboards that display up-to-the-minute information about their expenses, budget adherence, and cost-saving opportunities. Moreover, these software solutions often come equipped with advanced data analytics tools. These tools can sift through vast amounts of data, identifying patterns, trends, and anomalies that human analysis might miss. This data-driven approach empowers businesses to make informed decisions swiftly based on a deep understanding of their financial landscape.

Streamlining Communication and Collaboration

Effective cost control involves seamless communication and collaboration among various departments and stakeholders within an organisation. Cost control software is a centralised platform where teams can collaborate in real-time. It facilitates instant communication, allowing team members to discuss budgetary concerns, approve expenses, or strategise cost-saving initiatives regardless of their physical location. This enhanced collaboration accelerates decision-making processes and ensures everyone is on the same page, working towards common financial objectives.

Customisation and Scalability

Every business is unique, with its own set of financial processes, objectives, and challenges. Cost control software recognises this diversity and offers a high degree of customisation. Businesses can tailor the software to align with their specific needs, defining workflows, setting approval hierarchies, and configuring reporting parameters. Moreover, these solutions are highly scalable. Whether a business is a startup with modest financial needs or a multinational corporation managing complex global expenses, cost control software can scale up or down to accommodate the organisation's requirements. This scalability ensures businesses do not outgrow their financial management systems, making them future-proof against expansion and evolving market demands.

Feature | Descriptioon | Benefit |

Real-time monitoring | Instant insights inito cose perfoormance | Timely decision-making |

Expense tracking | Automated tracking oof expenses | Reducedd manual data entry |

Variance analysis | In -depth analysis of budget variances | Pinpoint areas for coost control |

Data analytics | Advanced data analysis for insights | Data-driven decision-making |

Integration capability | Seamlessly integrates with other systems | Streamlined data flow |

Table 2: Key features of cost control software

Enhanced Compliance and Security

In an era where data breaches and compliance violations pose significant threats, cost control software provides robust security features. These solutions often incorporate advanced encryption protocols, multi-factor authentication, and secure cloud storage, safeguarding sensitive financial data from unauthorised access or cyber-attacks. Additionally, they are designed to adhere to industry-specific regulations and compliance standards, ensuring that businesses can confidently navigate the complex landscape of financial regulations without fear of penalties or legal repercussions.

Integration Capabilities

Cost control software does not operate in isolation. It seamlessly integrates with other essential business systems such as accounting software, ERP (Enterprise Resource Planning) systems, and CRM (Customer Relationship Management) platforms. This integration ensures a smooth flow of financial data across various departments, eliminating data silos and enhancing overall organisational efficiency. For instance, when an expense is approved in the cost control software, it can automatically be reflected in the accounting system, reducing the chances of errors associated with manual data entry and reconciliation.

Cost Efficiency and Rapid ROI

Investing in sophisticated cost control software might initially seem like a significant financial commitment. However, the efficiency gains and cost-saving opportunities it unlocks quickly translate into a rapid Return on Investment (ROI). Businesses can optimise costs and maximise profitability by automating processes, reducing errors, and enabling data-driven decision-making. Moreover, the time saved by employees, who would otherwise be engaged in manual and time-consuming financial tasks, can be redirected towards revenue-generating activities, further enhancing the organisation’s overall cost efficiency.

Cost control software is not just a tool; it’s a strategic asset that empowers businesses to navigate the complexities of financial management with confidence and precision. It is revolutionising how businesses operate by automating mundane tasks, providing real-time insights, facilitating collaboration, ensuring compliance, and seamlessly integrating with other business systems. In a world where efficiency is synonymous with competitiveness, businesses embracing these technological solutions are not just staying ahead of the curve but setting new benchmarks for excellence and innovation in financial management.

The Cost Control Process: Step by Step

Cost control isn't a one-time action; it's a systematic and ongoing process that requires careful planning, implementation, and monitoring. Let’s break down the cost control process into distinct steps, each playing a crucial role in ensuring the financial health and sustainability of a business:

1. Establishing Clear Cost Objectives

The journey of effective cost control begins with clarity. Businesses need to define their cost objectives with precision. These objectives should align with the organisation's overall strategy, financial goals, and market conditions. For instance, a business aiming for market expansion might focus on reducing operational costs to invest in marketing and sales efforts. Clear objectives set the stage for a focused and targeted cost control strategy.

2. Comprehensive Budgeting

Budgeting is the architectural blueprint of cost control. It involves developing a detailed plan that allocates resources to different departments or cost centres. This budget should align closely with the established cost objectives. A well-structured budget serves as a financial roadmap and provides a framework for monitoring and controlling expenses. It's a dynamic document that evolves with the business, reflecting changing market conditions and internal strategies.

3. Rigorous Monitoring of Expenses

Once the budget is in place, businesses must diligently monitor their expenses. This step involves recording costs, verifying invoices, and comparing actual expenditures with the predetermined budgeted amounts. Regular and meticulous tracking of expenses is imperative to identify any deviations early on. Automated expense tracking systems and software play a vital role here, ensuring accuracy and providing real-time updates.

4. In-depth Variance Analysis

Variance analysis serves as the detective work of cost control. It involves a thorough examination of the differences between actual costs and budgeted costs. Variances can be positive or negative, indicating overperformance or underperformance concerning the budgeted figures. Identifying these variances is essential, but understanding the underlying causes is equally crucial. Was the deviation due to increased material costs, unexpected operational challenges, or inefficient processes? Pinpointing the root causes is the key to informed decision-making.

5. Identifying Cost-saving Opportunities

Armed with the insights from variance analysis, businesses can thoroughly explore their cost drivers. This involves examining every aspect of the business operation, from procurement and production to distribution and administration. Potential cost reduction or optimisation areas may include renegotiating supplier contracts, streamlining processes, improving operational efficiency, or adopting new technologies. It’s not just about cutting costs; it’s about optimising them intelligently.

6. Implementing Strategic Measures

Based on the findings of variance analysis and the identification of cost-saving opportunities, businesses must implement strategic measures promptly. This could involve renegotiating supplier contracts for better terms, reducing waste through lean manufacturing principles, implementing energy-saving initiatives, optimising inventory management to reduce carrying costs, or even investing in employee training to enhance productivity. Strategic measures are the actionable steps that translate plans into reality, driving the organisation closer to its cost control objectives.

7. Continuous Monitoring and Reporting

Cost control is not a one-shot deal; it’s an ongoing effort. Continuous monitoring of implemented measures is essential to ensure they are effective and sustainable. Regular reports generated by cost control software provide insights into cost performance, highlight areas of improvement, and facilitate data-driven decision-making. Continuous monitoring also allows businesses to adapt swiftly to changing market conditions or internal dynamics, ensuring their cost-control efforts align with their overarching goals.

8. Periodic Review and Adjustment

Business environments are dynamic, with variables constantly shifting. Periodic review of cost control measures is paramount. It involves assessing the effectiveness of implemented strategies against predefined benchmarks. If the measures achieve the desired results, they might be reinforced or expanded. If not, adjustments are made. These adjustments could be in the form of exploring new cost-saving avenues, fine-tuning existing strategies, or even revising the cost objectives to align with the evolving business needs. Periodic reviews ensure that the cost control process remains responsive and adaptive, enabling the business to stay agile in the face of change.

In essence, the cost control process is a cyclical and iterative journey. It begins with setting clear objectives, navigates through budgeting and rigorous monitoring, dives into the depths of variance analysis and cost-saving opportunities, culminates in implementing strategic measures, and continues with continuous monitoring and periodic adjustments. This systematic approach ensures financial stability and positions businesses to thrive in the ever-shifting landscapes of the global market. Through meticulous planning and agile adaptation, businesses can master the art of cost control, turning it into a powerful catalyst for sustained growth and unparalleled success.

The Human Element in Cost Control

In the realm of cost control, where numbers and algorithms often take the spotlight, it’s easy to overlook the indispensable human element. Yet, the people within an organisation breathe life into cost control strategies, transforming abstract theories into practical, actionable initiatives. Here, we delve into the pivotal role of employees in the cost control process and explore how investing in the human element can amplify the effectiveness of cost-saving endeavours:

Employee Training and Awareness

Imagine a scenario where every employee understands the impact of their actions on the company's finances. This scenario isn't just a dream; it’s a reality in businesses prioritising employee training and awareness programmes. Educating employees about cost control principles, the significance of budget adherence, and the consequences of financial waste equips them with a deeper understanding of their roles in the cost-saving equation. An informed employee is empowered; they become active participants in the cost control process, identifying inefficiencies, suggesting improvements, and championing frugality within their respective departments.

Cultivating a Cost-Conscious Culture

Cost control isn’t a task confined to the finance department; it's a culture that should permeate every corner of the organisation. Cultivating a cost-conscious culture involves instilling frugality as a core value. Employees who recognise the company’s efforts to control costs are more likely to contribute actively. Celebrating cost-saving initiatives, no matter how small, reinforces this culture. Acknowledging employees for their contribution not only boosts morale but also encourages a continuous stream of cost-saving ideas. This collective effort can result in a significant reduction in unnecessary expenses and a substantial increase in overall efficiency.

Incentivising Cost-Saving Initiatives

Incentives have a remarkable way of motivating employees. Recognising and rewarding employees for their cost-saving ideas instils a sense of pride and encourages a culture of innovation. Consider implementing a reward system where employees who propose viable cost-saving measures are acknowledged publicly and, perhaps, given incentives. These incentives don’t always have to be monetary; they could be in the form of recognition, additional paid time off, or opportunities for professional development. When employees know their efforts are valued and appreciated, they are more likely to find innovative ways to cut costs and improve processes proactively.

Fostering Cross-Departmental Collaboration

Cost control is a collaborative effort that transcends departmental boundaries. Encouraging collaboration between departments fosters a holistic approach to cost reduction. For instance, the procurement department, armed with insights from frontline employees, can negotiate better deals with suppliers. Similarly, in collaboration with the sales department, the production team can optimise inventory levels to avoid overstocking or stockouts. Breaking down silos and promoting open communication channels between departments allows for the free flow of cost-saving ideas, leading to streamlined processes and reduced expenditures.

Employee Empowerment Through Technology

Empowering employees in the digital age involves providing them with cutting-edge tools. Cost control software with user-friendly interfaces and real-time data analytics can transform employees into cost control champions. When employees have access to detailed financial data and analytics, they can make data-driven decisions. For instance, armed with real-time expense data, a department head can make on-the-spot decisions to curb unnecessary expenses, ensuring budget adherence. This empowerment through technology enhances efficiency and nurtures a sense of responsibility among employees towards the company’s financial health.

Continuous Learning and Skill Development

The business landscape constantly evolves, and employees need to evolve with it. Continuous learning and skill development initiatives ensure that employees have the knowledge and expertise necessary to navigate the complexities of cost control in a rapidly changing environment. Training programmes, workshops, and seminars focused on financial literacy, procurement strategies, and process optimisation empower employees with the skills needed to identify inefficiencies, explore cost-saving opportunities, and implement best practices. Moreover, a skilled workforce is adaptable, capable of responding effectively to new challenges and contributing significantly to the organisation's overall cost control efforts.

Incorporating the human element into cost control isn’t just about making employees aware of budgets and expenditures; it’s about fostering a culture of financial responsibility and empowerment. Employees who are educated, motivated, and equipped with the right tools and skills become catalysts for positive change. They not only identify cost-saving opportunities but also actively contribute to the implementation of effective strategies. In essence, the human element in cost control isn’t just an adjunct; it’s the driving force that propels businesses towards sustainable financial health and enduring success.

Conclusion

Cost control is an indispensable practice for businesses striving for financial stability, growth, and sustainability. By understanding the fundamentals of cost control, leveraging cost control software, and following a systematic cost control process, businesses can achieve optimal cost efficiency, enhance profitability, and stay ahead in a competitive market. That’s where we come in. We’re offering a course titled ‘EPCIC Cost Control Measures’, where you–or your team–will get acquainted with cost management, cost control, and more. Don’t miss out and make sure to get in touch with us today for more information.