- Table of Contents

- Introduction

- Risk Management in Oil and Gas

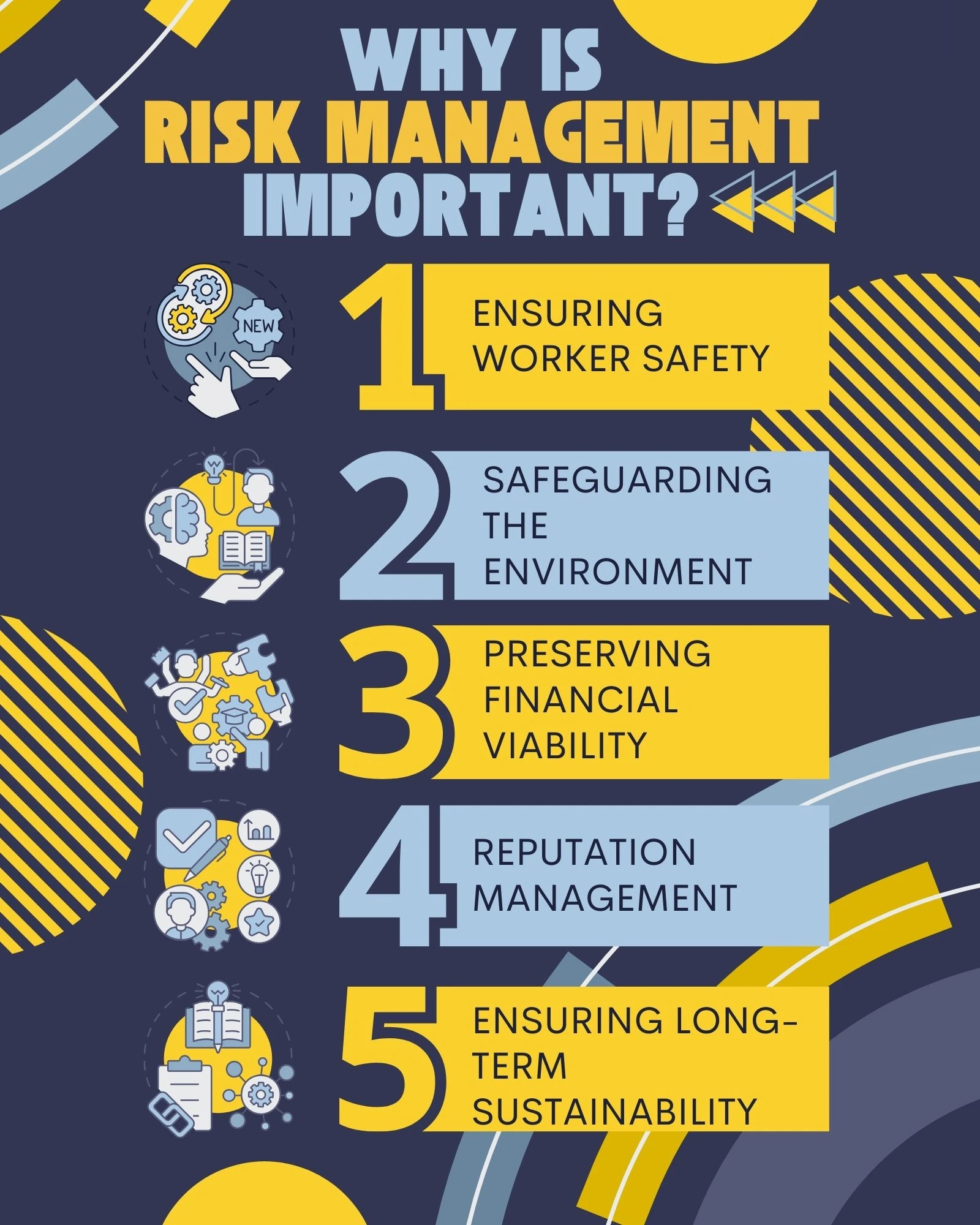

- Why Is Risk Management Important?

- 1. Ensuring Worker Safety

- 2. Safeguarding the Environment

- 3. Preserving Financial Viability

- 4. Reputation Management

- 5. Ensuring Long-term Sustainability

- What are Some of the Risks in the Oil and Gas Industry?

- 1. Health and Safety Risks

- 2. Environmental Risks

- 3. Geopolitical Risks

- 4. Market Risks

- 5. Technological Risks

- 6. Human Error

- Risk Management in Oil and Gas Best Practices

- 1. Comprehensive Risk Assessments

- 2. Robust Safety Culture

- 3. Regulatory Compliance

- 4. Emergency Preparedness and Response

- 5. Asset Integrity Management

- 6. Multi-Layered Risk Mitigation Measures

- 7. Training and Competency Development

- 8. Stakeholder Engagement

- 9. Continuous Improvement and Learning

- 10. Technology and Innovation

- The Future of Risk Management in Oil and Gas

- Sustainability Initiatives

- Digitalisation and Automation

- Climate Change Adaptation

- Social Responsibility and Community Engagement

- Circular Economy Practices

- Conclusion

Introduction

The oil and gas industry is critical in powering economies worldwide. However, its operations are not without risks. Every step in the oil and gas value chain involves inherent hazards that must be effectively managed, from exploration and drilling to transportation and refining. In this blog post, we will delve into the significance of risk management in the oil and gas industry, explore the various risks it faces, and discuss best practices to ensure safety and success.

Risk Management in Oil and Gas

Risk management in the oil and gas industry encompasses identifying, assessing, and mitigating potential hazards to minimise adverse consequences. It is a proactive approach that helps organisations anticipate and respond to risks, thereby safeguarding personnel, assets, and the environment. By implementing robust risk management practices, companies in this industry can enhance operational efficiency, protect their reputation, and ensure sustainable operations.

Why Is Risk Management Important?

Risk management is the cornerstone of the oil and gas industry for multifaceted reasons, each vital to the industry's sustainability, safety, and prosperity. Let’s delve deeper into these reasons:

1. Ensuring Worker Safety

The men and women in the oil and gas industry face various daily dangers. Heavy machinery, hazardous substances, and extreme environmental conditions create a dangerous work environment. The industry becomes a breeding ground for accidents and injuries without robust risk management. Rigorous safety protocols and comprehensive training programmes are not just guidelines but lifelines. They instil a culture where every worker understands the risks, knows how to mitigate them, and prioritises their safety and the safety of their colleagues. By preemptively identifying and addressing potential hazards, risk management significantly reduces the occurrences of accidents, ensuring that the human capital driving the industry remains unharmed.

2. Safeguarding the Environment

The environmental impact of the oil and gas industry can't be overstated. Accidental oil spills, gas leaks, and pollution from various sources pose grave threats to ecosystems, wildlife, and human populations. Risk management acts as a shield against such calamities. The industry minimises the risk of environmental disasters through stringent adherence to safety protocols, regular inspections, and the use of advanced technologies. It ensures that oil and gas exploration and production occur with minimal ecological footprint, preserving biodiversity and safeguarding the delicate balance of our ecosystems.

3. Preserving Financial Viability

Beyond human and environmental costs, the industry's economic health is intricately linked to effective risk management. Costly incidents resulting from inadequate risk mitigation, regulatory non-compliance, or damage to critical infrastructure can cripple a company financially. Legal battles, cleanup costs, and compensation to affected parties can drain resources, affecting the company’s profits and its ability to operate efficiently. By employing robust risk management practices, the industry safeguards its financial stability, ensuring it can weather economic fluctuations and emerge resilient in the face of unforeseen challenges.

4. Reputation Management

In today’s interconnected world, a company’s reputation is invaluable. Any mishap, be it an accident or an environmental disaster, can tarnish the image of an oil and gas company irreparably. Public perception plays a significant role in a company’s success. Effective risk management, by preventing incidents that could damage the environment or harm communities, helps maintain the industry's reputation. The industry can bolster its public image through transparent communication, adherence to ethical practices, and proactive risk mitigation, fostering trust among stakeholders and the general public.

5. Ensuring Long-term Sustainability

Sustainability is not just a buzzword; it's a necessity for the survival of the oil and gas industry. By managing risks effectively, the industry ensures its longevity. A sustainable approach incorporates environmental responsibility, social engagement, and economic viability. In this context, risk management is not just about immediate threats but also about preparing for future challenges, such as climate change, evolving regulations, and the shift towards renewable energy sources. By embracing these challenges through effective risk management strategies, the industry can adapt, innovate, and continue to contribute significantly to global energy needs while safeguarding the planet and its inhabitants.

In essence, risk management in the oil and gas industry is not merely a practice; it's a commitment. It's a commitment to the safety of its workforce, the preservation of the environment, the financial well-being of companies, and the industry's sustainable future as a whole. Through vigilance, innovation, and collaboration, the industry can navigate the complex web of risks it faces, ensuring that it remains a powerful economic force and a responsible steward of the planet’s resources.

What are Some of the Risks in the Oil and Gas Industry?

The oil and gas industry faces many risks throughout its operations. Some of the key risks include:

1. Health and Safety Risks

Working in the oil and gas industry demands physical and mental resilience. Employees are exposed to hazardous substances, heavy machinery, and unforgiving environments, and the potential for accidents, injuries, and health issues looms large. Every step presents a new set of challenges, from the towering drilling rigs to the confined spaces in refineries. Workers are at risk of falls, equipment malfunctions, chemical exposure, and heat-related illnesses. Rigorous safety training, stringent protocols, and constant vigilance are essential to mitigating these risks.

2. Environmental Risks

The environmental impact of oil and gas operations is a cause for global concern. Oil spills, a nightmare scenario, can devastate marine life and coastal ecosystems. Gas leaks pose a threat due to their flammability and their contribution to air pollution. Additionally, the industry's water usage and disposal methods can contaminate water sources, affecting both aquatic life and human populations. Risk management in this context involves preventing incidents and implementing measures for swift containment and effective cleanup, mitigating the damage caused.

3. Geopolitical Risks

Oil and gas exploration often occurs in politically unstable regions. This geopolitical instability brings forth a slew of challenges, including conflicts, trade disputes, and unpredictable changes in government policies. The industry is inherently intertwined with global politics, and any geopolitical event can influence supply chains, production, and prices. Companies must be adept at navigating these complexities, sometimes requiring diplomacy and adaptive strategies to maintain operations smoothly.

Geopolitical Risk | Description | Industry Impact |

Political Instability | Unstable political climate in resource-rich areas | Disruption of supply chains |

Trade Disputes | Conflicts affecting international trade | Price fluctuations and uncertainty |

Regulatory Changes | Sudden shifts in government policies | Compliance costs and legal challenges |

Conflicts | Political and military conflicts in operation areas | Disruption and infrastructure damage |

Economic Sanctions | Imposition of economic sanctions on oil-producing nations | Disruption in global supply |

Table 1: Geopolitical risks and impacts

4. Market Risks

The oil and gas industry operates in a volatile market. Prices fluctuate due to geopolitical tensions, supply and demand imbalances, and unforeseen events. These fluctuations impact revenue streams, profitability, and investment decisions. Moreover, market uncertainties can lead to overproduction or underproduction, both of which have financial repercussions. Risk management here involves comprehensive market analysis, scenario planning, and adaptive financial strategies to cushion the impact of market fluctuations.

5. Technological Risks

The industry's reliance on cutting-edge technology brings its own set of risks. Complex drilling rigs, intricate refining processes, and sophisticated computer systems are susceptible to malfunctions, failures, and cyber threats. A minor glitch can escalate into a catastrophic event. Thus, a robust risk management strategy includes regular equipment maintenance, cybersecurity measures, and contingency plans for technology-related failures.

6. Human Error

Human error is a significant factor contributing to risks in the oil and gas industry. In fact, statistics show that a significant majority, ranging from 70% to 80%, of accidents within enterprises can be attributed to human operator error or illegal operations. Mistakes or lapses in judgement can lead to accidents, equipment failures, and environmental incidents in high-pressure and complex operations. Addressing human error through comprehensive training, clear procedures, and effective supervision is crucial.

Risk Management in Oil and Gas Best Practices

In the multifaceted world of the oil and gas industry, effective risk management is not just a choice; it’s an imperative. The dynamic nature of operations demands a comprehensive and adaptable approach to mitigate the industry's diverse risks. Here are key strategies that oil and gas companies employ to ensure the safety of their workforce, protect the environment, and maintain their financial viability:

1. Comprehensive Risk Assessments

Risk assessments are the bedrock of effective risk management. These assessments delve deep into every operation, identifying potential hazards, evaluating their likelihood, and assessing their potential impact. Companies can prioritise and tailor their mitigation efforts by understanding the risks comprehensively. From the geological challenges of drilling to the intricacies of transportation logistics, a thorough risk assessment ensures no stone is left unturned.

2. Robust Safety Culture

A strong safety culture is not just a guideline; it’s a way of life within the industry. It starts at the top, with leadership setting the tone for the entire organisation. Regular training programmes inform employees about the latest safety protocols and best practices. Safety drills and simulations prepare workers for emergencies, ensuring a swift and coordinated response. Open lines of communication empower employees to voice concerns and report potential hazards without fear of reprisal, fostering an environment where safety is everyone’s responsibility.

3. Regulatory Compliance

The oil and gas industry operates in a highly regulated environment. Staying up-to-date with local, national, and international regulations is essential. Compliance ensures that operations meet legal standards, reducing the risk of fines, penalties, and legal battles. It also demonstrates the company's commitment to responsible practices and building trust with stakeholders and the community.

4. Emergency Preparedness and Response

Preparing for the worst-case scenario is a fundamental aspect of risk management. Companies develop comprehensive emergency response plans, encompassing various potential incidents, from oil spills to fires and natural disasters. Regular drills and simulations ensure that employees are well-versed in emergency procedures, enabling a swift and coordinated response during an actual crisis. These plans are living documents, continuously updated and refined based on lessons learned from real incidents and exercises.

5. Asset Integrity Management

The integrity of equipment and infrastructure is non-negotiable. Implementing stringent maintenance programmes and inspection protocols ensures that every piece of equipment, from drilling rigs to pipelines, is in optimal condition. Regular inspections, preventive maintenance, and adherence to industry standards minimise the risk of equipment failures and accidents, safeguarding both personnel and the environment.

6. Multi-Layered Risk Mitigation Measures

Risk mitigation is not a one-size-fits-all approach. Employing a combination of engineering controls, administrative controls, and personal protective equipment (PPE) creates a multi-layered defence against potential hazards. Safety systems, such as automated monitoring and control systems, provide real-time insights into operations. Administrative controls, including strict protocols and clear procedures, guide employee behaviour. Adequate PPE, tailored to the specific risks of each task, ensures that workers are protected from physical and chemical hazards.

7. Training and Competency Development

Knowledge is power, especially in the high-stakes environment of the oil and gas industry. Comprehensive training programmes equip employees with the skills and knowledge necessary to navigate the complexities of their roles. This includes technical training and education on risk management, safety procedures, emergency response, and the proper use of safety equipment. Regular competency assessments verify employees' abilities, ensuring they can handle risks effectively and efficiently.

8. Stakeholder Engagement

Risk management extends beyond the company’s boundaries. Engaging with stakeholders, including employees, local communities, regulators, and industry associations, fosters transparency, collaboration, and shared responsibility. Regular dialogue helps identify potential risks that might be overlooked internally. It also builds trust and credibility, essential assets in times of crisis. The industry can develop more comprehensive risk mitigation strategies involving all relevant parties, ensuring a holistic approach to safety and sustainability.

9. Continuous Improvement and Learning

In the ever-evolving landscape of risk, complacency is the enemy. Establishing a culture of continuous improvement is essential. Regularly reviewing incidents, near misses, and lessons learned provides valuable insights. Employees are encouraged to report potential risks and provide feedback on risk management processes. These inputs are analysed, and necessary changes are implemented. Learning from past mistakes and near misses ensures that the industry constantly evolves, enhancing its ability to mitigate risks effectively.

10. Technology and Innovation

The digital revolution has not bypassed the oil and gas industry. Leveraging technological advancements and innovative solutions enhances risk management practices. Advanced data analytics provide predictive insights, allowing companies to identify and address risks proactively. IoT (Internet of Things) devices enable real-time monitoring of equipment and operations, minimising response times in case of anomalies. Automation streamlines processes, reducing the potential for human error. Embracing these technologies empowers the industry to stay ahead of emerging risks, ensuring that risk management is effective and future-ready.

The Future of Risk Management in Oil and Gas

The risk management landscape in the oil and gas industry is evolving rapidly. As the world grapples with the challenges of climate change, technological advancements, and the need for sustainable practices, the industry is adapting its risk management strategies to ensure a safe, efficient, and responsible future.

Sustainability Initiatives

With the global spotlight on climate change, the oil and gas industry embraces sustainability initiatives with vigour. Companies are investing in renewable energy sources, such as solar and wind power, to diversify their portfolios and reduce their carbon footprint. Risk management strategies are evolving to accommodate these changes. Assessing the risks associated with renewable energy projects, understanding the intricacies of new technologies, and ensuring a smooth transition from fossil fuels to clean energy alternatives are becoming integral parts of risk management frameworks. This shift aligns the industry with environmental goals and mitigates the risks associated with the transitioning energy landscape.

Digitalisation and Automation

The advent of digital technologies is transforming the industry. IoT (Internet of Things) devices, AI (Artificial Intelligence), and automation are revolutionising operations. Predictive analytics and real-time monitoring systems are becoming essential components of risk management. These technologies offer the ability to foresee potential issues before they escalate, allowing for proactive risk mitigation. Automation, on the other hand, minimises the reliance on manual intervention, reducing the chances of human error. Cybersecurity measures are also at the forefront of digital risk management, ensuring that vital operational data remains protected from cyber threats.

Climate Change Adaptation

Climate change brings a new dimension of risks to the industry. Extreme weather events like hurricanes and floods can disrupt operations and damage infrastructure. Rising sea levels pose a threat to offshore drilling rigs and coastal facilities. Risk management strategies are adapting to include climate change considerations. Companies are investing in resilient infrastructure that can withstand extreme weather conditions. Simulation exercises and scenario planning are used to prepare for potential climate-related disasters. Moreover, the industry is exploring innovative solutions, such as floating platforms and unmanned facilities, to mitigate the risks associated with climate change and ensure uninterrupted operations.

Social Responsibility and Community Engagement

Social responsibility is becoming increasingly important for the oil and gas industry. It is essential to engage with local communities, understand their needs and concerns, and incorporate their feedback into risk management strategies. Building trust and collaborative relationships with local stakeholders can help identify potential risks related to community opposition, regulatory challenges, or social unrest. By integrating community perspectives into risk assessments, companies can develop more comprehensive risk management plans that address both operational and social challenges.

Circular Economy Practices

The concept of a circular economy, where waste is minimised, and resources are reused and recycled, is gaining traction in the industry. Companies are exploring ways to reduce waste generation, reuse materials, and recycle resources. Waste management and recycling initiatives are becoming integral to risk management strategies. Managing the environmental impact of waste disposal and ensuring compliance with waste regulations are crucial aspects of future risk management. Companies are investing in technologies that enable efficient waste management and promote a circular economy, minimising environmental risks associated with waste disposal.

Environmental Risk | Description | Mitigation Strategies |

Oil Spills | Accidental release of oil into water bodies. | Advanced spill response plans. |

Gas Leaks | Uncontrolled release of gases into the air. | Regular equipment integrity checks. |

Water Pollution | Contamination of water sources by chemicals. | Strict adherence to disposal norms. |

Air Pollution | Emission of harmful substances into the air. | Use of advanced emission controls. |

Habitat Disruption | Displacement of wildlife due to drilling. | Environmental impact assessments. |

Table 2: Types of environmental risks and how to mitigate them

In summary, the future of risk management in the oil and gas industry is intertwined with innovation, sustainability, and social responsibility. Embracing renewable energy, leveraging digital technologies, adapting to climate change, engaging with communities, and promoting circular economy practices are the cornerstones of future risk management strategies. By embracing these changes, the industry mitigates risks. It contributes to a more sustainable and resilient future, ensuring the continued growth and success of the oil and gas sector in the years to come.

Conclusion

Risk management is paramount in the oil and gas industry to ensure the safety of workers, protect the environment, and maintain the financial viability of organisations. By adopting best practices and a proactive approach, companies in this sector can effectively identify, evaluate, and mitigate risks. This not only safeguards their operations but also contributes to the sustainable growth and success of the industry as a whole. Through comprehensive risk assessments, robust safety cultures, regulatory compliance, and continuous improvement, the oil and gas industry can navigate its challenges while prioritising safety and sustainability.

Finally, if you want to enhance your understanding of risk management in petroleum projects, consider enrolling in our comprehensive course, ‘Risk Management Procedures on Petroleum Projects.’ It provides practical insights and strategies to navigate the industry's unique challenges, empowering you to contribute to the safety and success of oil and gas operations.