- Table of Contents

- Introduction

- What is Cost Allocation in Accounting?

- Why is Cost Allocation Important?

- 1. Financial Reporting Accuracy

- 2. Informed Pricing Strategies

- 3. Effective Budgeting and Forecasting

- 4. Enhanced Performance Evaluation

- 5. Strategic Decision-Making

- 6. Regulatory Compliance and Accountability

- 7. Resource Optimization

- 8. Facilitating Internal Communication and Collaboration

- Challenges of Cost Allocation

- 1. Complexity of Indirect Costs

- 2. Subjectivity in Allocation Decisions

- 3. Data Availability and Quality

- 4. Changing Business Environment

- 5. Resistance to Change

- 6. Regulatory Considerations

- 7. Impact on Performance Metrics

- 8. Balancing Accuracy and Simplicity

- The 7 Cost Allocation Methods: Definition, Steps, and When to Use Each

- 1. Direct Allocation Method

- 2. Step-Down Allocation Method

- 3. Reciprocal Allocation Method

- 4. Activity-Based Costing (ABC)

- 5. Absorption Costing

- 6. Variable Costing

- 7. Joint Cost Allocation

- Which Cost Allocation Method Works Best for You?

- Conclusion

Introduction

Understanding the financial health of an organization requires a deep dive into the various costs associated with its operations. One crucial aspect of financial management is cost allocation, which involves distributing costs to different departments, projects, or products. This blog post will explore the concept of cost allocation methods in accounting, emphasizing their importance, challenges, and various methodologies. By the end, you will have a comprehensive understanding of how to effectively allocate costs and identify the best method for your organization.

What is Cost Allocation in Accounting?

Cost allocation in accounting refers to the process of assigning indirect costs—those not directly tied to a specific product or service—to different cost objects, such as departments, projects, or products. This process is essential for determining the true cost of operations and ensuring accurate financial reporting.

Indirect costs can include overhead expenses such as utilities, rent, administrative salaries, and depreciation. Unlike direct costs, which can be easily traced to specific products or services, indirect costs require a systematic approach to allocation. Cost allocation helps organizations understand how resources are consumed and provides insights into profitability and cost control.

The primary goal of cost allocation is to provide a clearer picture of an organization’s financial performance. By accurately distributing costs, businesses can make informed decisions regarding pricing, budgeting, and resource allocation. This clarity is vital for both internal management and external stakeholders, such as investors and creditors.

Why is Cost Allocation Important?

The significance of cost allocation extends beyond mere accounting procedures. It plays a pivotal role in several key areas:

1. Financial Reporting Accuracy

Accurate financial reporting is essential for stakeholders, including investors, creditors, and management. Cost allocation ensures that financial statements reflect the true cost of operations, providing a clear view of profitability. By allocating costs correctly, organizations can avoid misrepresentation of their financial health, which could lead to poor investment decisions or loss of stakeholder trust. For example, if overhead costs are not allocated properly, a product may appear more profitable than it truly is, misleading management and investors alike.

2. Informed Pricing Strategies

Setting the right price for products and services is crucial for competitiveness and profitability. Cost allocation provides insights into the total cost associated with producing goods or delivering services. By understanding the full cost structure, businesses can establish pricing strategies that not only cover costs but also generate desired profit margins. Without accurate cost allocation, organizations risk underpricing their products, which can erode profits, or overpricing them, which may lead to lost sales and market share.

3. Effective Budgeting and Forecasting

Cost allocation plays a vital role in the budgeting process. By providing a detailed breakdown of costs associated with different departments, projects, or products, organizations can create more realistic budgets. This detailed understanding of cost behavior helps in forecasting future expenses and revenues, enabling better resource planning. For instance, if a company recognizes that certain departments consistently exceed their budgets due to unallocated indirect costs, it can adjust future budgets to account for these variances, leading to more effective financial management.

4. Enhanced Performance Evaluation

Performance evaluation is essential for continuous improvement within an organization. Cost allocation allows for a more accurate assessment of departmental or product performance by comparing allocated costs to generated revenues. This analysis helps identify which areas are performing well and which are not, facilitating targeted interventions. For example, if a specific product line shows low profitability despite high sales, a detailed cost allocation may reveal hidden costs that need to be addressed, such as excessive overhead or inefficient processes.

5. Strategic Decision-Making

Cost allocation provides valuable insights that inform strategic decision-making. Whether considering launching a new product, entering a new market, or discontinuing an unprofitable line, understanding the cost implications is critical. For instance, a company contemplating a new product launch must evaluate whether the projected sales will cover the allocated costs. Accurate cost allocation helps organizations make informed decisions that align with their financial goals and operational capabilities.

6. Regulatory Compliance and Accountability

Many organizations are subject to regulatory requirements that mandate accurate financial reporting and cost allocation practices. Compliance with standards such as Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS) often requires detailed cost allocation methods. Failure to comply can result in legal consequences, fines, or damage to reputation. By implementing robust cost allocation practices, organizations can ensure accountability and transparency in their financial reporting.

7. Resource Optimization

Effective cost allocation helps organizations understand how resources are utilized across different activities. This understanding enables better resource optimization, ensuring that investments are directed toward the most profitable areas. For instance, if cost allocation reveals that certain departments consume disproportionate resources without delivering corresponding value, management can take corrective actions, such as reallocating resources or implementing efficiency improvements.

8. Facilitating Internal Communication and Collaboration

Cost allocation fosters better communication and collaboration among departments. When each department understands how costs are allocated and the impact of their activities on overall expenses, it encourages a culture of accountability and cooperation. Departments are more likely to work together to identify cost-saving opportunities and improve processes when they recognize the interconnectedness of their functions.

In summary, cost allocation is not just a technical accounting process; it is a strategic tool that influences multiple facets of an organization. By ensuring accurate financial reporting, informing pricing strategies, enhancing budgeting and forecasting, and supporting effective decision-making, cost allocation is integral to achieving long-term financial success and operational efficiency.

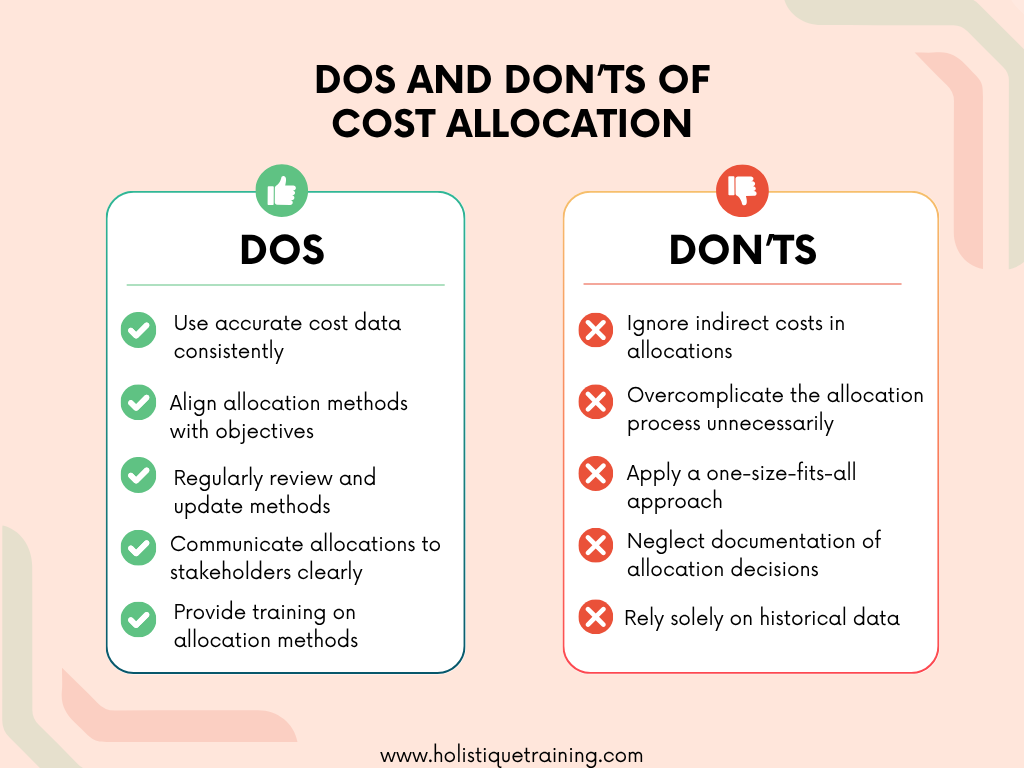

Challenges of Cost Allocation

While cost allocation is essential, it is not without its challenges. Organizations often face several obstacles when implementing cost allocation methods:

1. Complexity of Indirect Costs

One of the primary challenges in cost allocation is the complexity involved in identifying and categorizing indirect costs. Unlike direct costs, which can be easily traced to specific products or services, indirect costs encompass a wide range of expenses, such as utilities, rent, administrative salaries, and depreciation. These costs can be incurred across multiple departments and functions, making it difficult to determine how to allocate them fairly. The lack of a straightforward method for identifying and categorizing these costs can lead to inconsistencies and inaccuracies in cost allocation.

2. Subjectivity in Allocation Decisions

Cost allocation often involves subjective judgments about how costs should be distributed among various cost objects. Different allocation methods can yield different results, leading to potential disputes and inconsistencies in financial reporting. For example, when allocating overhead costs, one department may argue for a different basis of allocation than another, resulting in conflicts over perceived fairness. This subjectivity can undermine the credibility of financial reports and lead to distrust among stakeholders.

3. Data Availability and Quality

Accurate cost allocation relies heavily on the availability and quality of detailed financial data. Organizations may face challenges in gathering the necessary data to support their cost allocation methods, especially if their accounting systems are outdated or not designed to capture detailed cost information. Inadequate or inaccurate data can lead to misallocation of costs, which can distort financial statements and hinder decision-making. Ensuring data integrity is crucial for effective cost allocation, but achieving this can be resource-intensive.

4. Changing Business Environment

The dynamic nature of the business environment presents another challenge for cost allocation. As organizations evolve, their cost structures may change due to factors such as new product lines, shifts in operational strategies, or changes in market conditions. Adapting cost allocation methods to reflect these changes can be challenging and may require continuous monitoring and adjustment. Organizations must remain agile and responsive to ensure their cost allocation processes align with current business realities.

5. Resistance to Change

Implementing new cost allocation methods or adjusting existing ones may face resistance from employees who are accustomed to established practices.Change management is crucial in overcoming this resistance and ensuring that stakeholders understand the rationale behind the changes. Employees may be concerned about how changes in cost allocation could impact their departments or performance evaluations.Effective communication andtraining are essential to facilitate a smooth transition and foster acceptance of new methods.

6. Regulatory Considerations

Organizations in certain industries may be subject to specific regulatory requirements regarding cost allocation. Navigating these regulations can complicate the cost allocation process and necessitate additional resources to ensure compliance. For example, government contractors often face stringent rules about how costs must be allocated to projects. Failure to adhere to these regulations can result in penalties, legal issues, or damage to reputation. Organizations must stay informed about relevant regulations and ensure their cost allocation practices align with compliance requirements.

7. Impact on Performance Metrics

The choice of cost allocation method can significantly influence performance metrics, potentially leading to misinterpretations of departmental or product performance. For instance, if a method allocates costs disproportionately to certain departments, it may create a perception that those departments are underperforming when, in reality, they are simply bearing a larger share of indirect costs. This distortion can affect decision-making, resource allocation, and employee morale. Organizations must carefully consider the implications of their chosen cost allocation methods on performance evaluation.

8. Balancing Accuracy and Simplicity

Organizations often face the challenge of balancing the need for accuracy in cost allocation with the desire for simplicity. More complex methods, such as activity-based costing, can provide detailed insights but may require significant time and resources to implement and maintain. Conversely, simpler methods may lack the precision needed for informed decision-making. Finding the right balance between accuracy and simplicity is crucial for effective cost allocation, and organizations must assess their specific needs and capabilities when choosing a method.

In summary, while cost allocation is vital for financial management, it is not without its challenges. Organizations must navigate the complexities of indirect costs, address subjectivity in allocation decisions, ensure data availability and quality, and adapt to a changing business environment. By recognizing these challenges and implementing strategies to mitigate them, organizations can enhance their cost allocation processes, leading to more accurate financial reporting and better decision-making.

The 7 Cost Allocation Methods: Definition, Steps, and When to Use Each

Understanding the various cost allocation methods is essential for effective financial management. Here, we will explore seven common methods, detailing their definitions, steps for implementation, and appropriate contexts for use.

1. Direct Allocation Method

Definition: The direct allocation method assigns direct costs to specific cost objects without allocating any indirect costs. This method is straightforward and easy to implement.

Steps:

- Identify all direct costs associated with each cost object (e.g., materials, labor).

- Allocate these costs directly to the respective cost objects based on actual usage or consumption.

When to Use: This method is most effective in manufacturing environments where direct costs, such as raw materials and direct labor, are significant. It is ideal for companies with a limited number of products or services where costs can be easily traced.

2. Step-Down Allocation Method

Definition: The step-down allocation method allocates service department costs to production departments sequentially, recognizing that service departments also provide services to one another.

Steps:

- Rank service departments based on the extent of services provided to other departments.

- Allocate costs from the first-ranked department to other departments before moving to the next, ensuring that some costs are allocated back to the service departments that provide support.

When to Use: This method is suitable for organizations with multiple service departments that interact with each other, such as hospitals or universities. It provides a more accurate representation of the costs incurred by each department.

3. Reciprocal Allocation Method

Definition: The reciprocal allocation method recognizes the mutual services provided among service departments and allocates costs accordingly. It is the most accurate but also the most complex method of allocation.

Steps:

- Create a system of equations to represent the relationships between service departments, capturing how much each department provides to and receives from others.

- Solve the equations to determine the total costs for each department, considering all interdepartmental services.

- Allocate costs based on the calculated totals.

When to Use: This method is ideal for complex organizations where service departments provide significant support to one another, such as large corporate structures or governmental agencies. It ensures that all interdependencies are accounted for, leading to more accurate cost distribution.

4. Activity-Based Costing (ABC)

Definition: Activity-Based Costing allocates costs based on the activities that drive costs, rather than traditional methods that might allocate costs based on volume or direct labor hours.

Steps:

- Identify the various activities that incur costs within the organization.

- Determine cost drivers for each activity (e.g., machine hours, number of setups).

- Collect data on the extent to which each product or service consumes these activities.

- Allocate costs to products or services based on their consumption of activities.

When to Use: ABC is particularly useful in environments where overhead costs are high and products consume resources in varying amounts, such as in manufacturing or service industries. It provides a more nuanced understanding of cost behavior, helping identify profitable and unprofitable products or services.

Cost Allocation Method | Definition | Advantages | Disadvantages |

Direct Allocation | Assigns direct costs to specific cost objects. | Simple to implement; clear cost tracing. | Ignores indirect costs; may lead to inaccurate overall cost representation. |

Activity-Based Costing | Allocates costs based on activities that drive costs. | Provides detailed insights into cost drivers; improves accuracy in product costing. | More complex to implement; requires detailed data collection. |

Absorption Costing | Allocates all manufacturing costs to products. | Complies with GAAP; useful for external reporting. | Can obscure fixed costs; may encourage overproduction. |

5. Absorption Costing

Definition: Absorption costing allocates all manufacturing costs, both fixed and variable, to the product. This method ensures that each unit produced bears a portion of all costs incurred during production.

Steps:

- Identify total manufacturing costs (including direct materials, direct labor, and both fixed and variable overhead).

- Allocate these costs to units produced based on production volume, typically using a predetermined overhead rate.

When to Use: This method is commonly used forexternal financial reporting, as it complies with Generally Accepted Accounting Principles (GAAP). It is suitable for manufacturing companies that need to report inventory and cost of goods sold accurately.

6. Variable Costing

Definition: Variable costing allocates only variable manufacturing costs to products, treating fixed costs as period expenses. This provides a clearer picture of the contribution margin.

Steps:

- Identify variable costs associated with production (direct materials, direct labor, and variable overhead).

- Allocate only these variable costs to products, while treating fixed costs as expenses incurred in the period.

When to Use: This method is useful for internal management decisions, as it provides insights into the contribution margin and helps assess profitability on a per-unit basis. It is beneficial in environments where management needs to understand the impact of production volume on profitability.

7. Joint Cost Allocation

Definition: Joint cost allocation is used when multiple products are produced simultaneously from a single process, necessitating the allocation of shared costs incurred up to a split-off point.

Steps:

- Identify joint costs incurred before the split-off point (the point at which products become separately identifiable).

- Allocate these costs to individual products based on a chosen method, such as physical units produced or sales value at the split-off point.

When to Use: This method is applicable in industries like petroleum refining or food processing, where multiple products are derived from a single input. It helps organizations understand the cost structure of each product and make informed pricing and production decisions.

In short, each of these cost allocation methods serves a unique purpose and is suited to different organizational contexts. By understanding the definitions, steps, and appropriate applications of each method, businesses can select the most effective approach for their specific needs. Proper cost allocation not only enhances financial reporting accuracy but also supports strategic decision-making, ultimately contributing to improved operational efficiency and profitability.

Table: Metrics to measure the effectiveness of a cost allocation method

Metric | Description |

Accuracy | Measures how closely allocated costs reflect actual costs incurred |

Transparency | Assesses how clearly the allocation method communicates cost sources and allocations to stakeholders |

Relevance | Evaluates whether the allocated costs provide useful information for decision-making and performance evaluation |

Consistency | Checks if the method produces similar results over time, ensuring reliability in financial reporting |

Flexibility | Assesses the method's ability to adapt to changes in business operations or cost structures |

Which Cost Allocation Method Works Best for You?

Choosing the most suitable cost allocation method depends on various factors, including the nature of the business, the complexity of operations, and specific financial reporting requirements. Here are some considerations to guide your decision:

- Nature of Costs: Analyze whether your costs are primarily direct or indirect. If most costs are direct, simpler methods like direct allocation may suffice. Conversely, if indirect costs dominate, more sophisticated methods like ABC may be necessary.

- Business Structure: Consider the organizational structure. For companies with multiple service departments or complex interdependencies, methods like step-down or reciprocal allocation may provide more accurate insights.

- Regulatory Requirements: Ensure compliance with relevant accounting standards and regulations. If external reporting is a priority, absorption costing may be required.

- Management Needs: Determine the primary purpose of cost allocation. For internal decision-making, variable costing or ABC may offer better insights into profitability and cost control.

- Data Availability: Assess the availability and reliability of data. Some methods, like ABC, require detailed data on activities and cost drivers, while others may be less data-intensive.

- Cost-Benefit Analysis: Weigh the benefits of a more complex method against the costs of implementation and maintenance. Sometimes, simpler methods may provide adequate insights without the burden of complexity.

- Flexibility: Consider whether your chosen method can adapt to changes in the business environment. As organizations evolve, their cost structures may change, necessitating adjustments in allocation methods.

Conclusion

Cost allocation is a fundamental aspect of accounting that influences financial reporting, decision-making, and overall organizational performance. Understanding the various cost allocation methods enables businesses to choose the most appropriate approach for their unique circumstances. While challenges exist in implementing these methods, the benefits of accurate cost allocation far outweigh the difficulties.

By exploring the seven cost allocation methods—direct allocation, step-down, reciprocal, activity-based costing, absorption costing, variable costing, and joint cost allocation—organizations can tailor their strategies to meet their specific needs. Ultimately, effective cost allocation not only enhances financial transparency but also supports informed decision-making, driving long-term success and profitability.

In a world where financial data is paramount, mastering cost allocation will empower organizations to navigate complexities, optimize resources, and achieve their strategic objectives. As businesses continue to evolve, the importance of accurate and effective cost allocation will only grow, underscoring the need for ongoing education and adaptation in this critical area of accounting. To further enhance your understanding and skills in this essential field, consider enrolling in our course, "Advanced Budget Management and Cost Allocation." This comprehensive program offers in-depth insights into cost allocation methodologies, practical applications, and strategic budgeting techniques, equipping you with the tools necessary to drive your organization’s financial success. Join us to elevate your expertise and make a lasting impact on your organization’s financial health.