- Table of Contents

- Introduction

- What Are International Financial Reporting Standards (IFRS)?

- Why IFRS Matters?

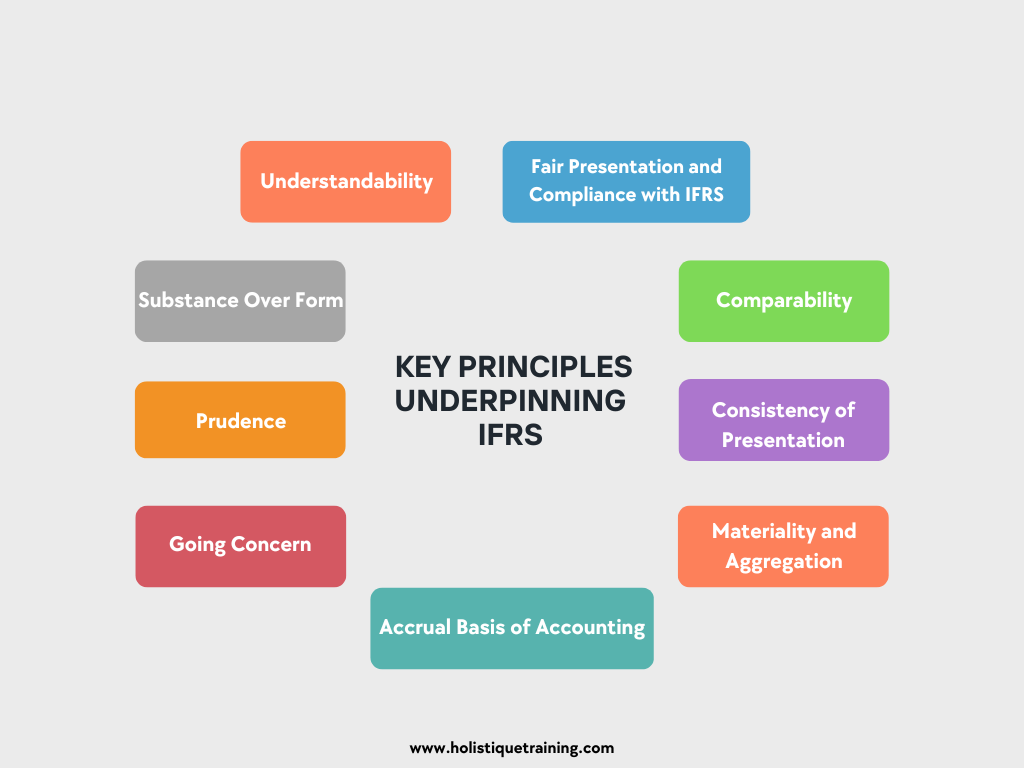

- What Key Principles Underpin IFRS?

- 1. Fair Presentation and Compliance with IFRS

- 2. Going Concern

- 3. Accrual Basis ofAccounting

- 4. Materiality and Aggregation

- 5. Consistency of Presentation

- 6. Prudence

- 7. Substance Over Form

- 8. Comparability

- 9. Understandability

- Who Needs to Comply with IFRS and Where Is It Mandatory?

- Entities Required to Comply with IFRS

- Geographic Mandates

- Voluntary Adoption

- How Does IFRS Differ from Other Accounting Standards?

- 1. Conceptual Approach

- 2. Development and Governance

- 3. Adoption and Use

- 4. Comprehensive Income

- 5. Inventory and Costing Methods

- 6. Revenue Recognition

- 7. Lease Accounting

- What Are the Major Challenges in Implementing IFRS?

- 1.Trainingand Expertise:

- 2. System and Process Adjustments:

- 3. First-Time Adoption Complexities:

- 4. Cost Implications:

- 5. Differences in Tax Implications:

- 6. Cultural and Organizational Resistance:

- 7. Fair Value Measurement:

- 8. International Variations and Interpretations:

- 9. Keeping Up with Changes:

- 10. Comparability and Consistency:

- What Impact Does IFRS Have on Financial Reporting and Analysis?

- 1. Enhanced Global Comparability:

- 2. Increased Transparency:

- 3. Higher Quality Financial Statements:

- 4. Impact on Financial Metrics and Ratios:

- 5. Greater Emphasis on Fair Value:

- 6. Challenges in Cross-jurisdictional Analysis:

- 7. Influence on Corporate Strategy and Operations:

- 8. Need for Enhanced Analytical Skills:

Introduction

International Financial Reporting Standards (IFRS) represent a pivotal shift towards unifying global accounting practices. Developed to enhance transparency, comparability, and understanding across international borders, IFRS seeks to bridge the gaps between different accounting systems, making it easier for companies to compete globally and for investors to make informed decisions. This introduction explores the essence, importance, and global impact of IFRS, shedding light on its role in modern financial reporting and the challenges and benefits it brings to the international business landscape.

What Are International Financial Reporting Standards (IFRS)?

International Financial Reporting Standards (IFRS) are a set of accounting standards developed by the International Accounting Standards Board (IASB) that serve as a global framework for preparing financial statements. The primary goal of IFRS is to create a common accounting language to ensure transparency, accountability, and efficiency in financial markets worldwide, making it easier for companies to conduct business across borders and for investors to compare financial statements of companies from different countries.

Why IFRS Matters?

1. Global Consistency: IFRS promotes consistency in financial reporting across different countries. This standardization is crucial in today’s globalized economy, where businesses operate and compete on an international scale. It allows investors, regulators, and other stakeholders to understand and compare the financial performance of companies from different jurisdictions more easily.

2. Enhanced Transparency and Reliability: IFRS requires companies to provide detailed and comprehensive disclosures in their financial statements. This enhances the transparency and reliability of financial information, helping stakeholders make more informed decisions.

3. Improved Efficiency in Capital Markets: By providing a single set of high-quality global standards, IFRS contributes to the efficiency of capital markets. Investors can more readily assess investment opportunities without having to understand the nuances of different accounting regimes, leading to more efficient allocation of capital and reduced transaction costs.

4. Facilitates Cross-border Investment: The adoption of IFRS lowers barriers to investment across borders by reducing the complexity and cost associated with financial statement analysis. It makes it easier for investors to diversify their portfolios internationally, promoting cross-border capital flows.

5. Regulatory Compliance: In many jurisdictions, compliance with IFRS is a legal requirement for publicly listed companies, making it essential for these entities to understand and implement the standards correctly. Even in countries where IFRS is not mandatory, many businesses voluntarily adopt these standards to enhance the credibility and comparability of their financial statements.

6. Enhanced Stakeholder Confidence: Uniform financial reporting standards like IFRS build confidence among stakeholders, including investors, creditors, and customers, by ensuring that the financial statements they rely on are prepared using a globally recognized framework.

7. Adaptability and Responsiveness:TheIASB continuously reviews and updates IFRS to reflect changing economic realities, new types of transactions, and evolving business practices. This adaptability ensures that the standards remain relevant and responsive to the needs of users of financial statements.

What Key Principles Underpin IFRS?

International Financial Reporting Standards (IFRS) are built upon a set of fundamental principles designed to ensure clarity, relevance, and consistency in the financial reporting landscape across the globe. These principles help in making financial statements comparable, transparent, and reliable for investors, regulators, and other stakeholders. Here are the key principles underpinning IFRS:

1. Fair Presentation and Compliance with IFRS

Financial statements must present fairly the financial position, financial performance, and cash flows of an entity. Adherence to IFRS is presumed to result in financial statements that achieve fair presentation, requiring faithful representation of the effects of transactions, other events, and conditions in accordance with the definitions and criteria for recognition of assets, liabilities, income, and expenses set out in the Framework.

2. Going Concern

An entity preparing financial statements is presumed to be a going concern, implying that it will continue its operations in the foreseeable future. This assumption is critical for the valuation of assets and liabilities and for avoiding the presentation of assets at their liquidation value.

3. Accrual Basis of Accounting

IFRS mandates that an entity should prepare its financial statements, except for cash flow information, using the accrual basis of accounting. Under this principle, transactions and events are recognized when they occur, not necessarily when cash is received or paid, and they are recorded in the financial statements of the periods to which they relate.

4. Materiality and Aggregation

Financial statements should disclose all material information, items that could influence the decision-making process of users. Information is considered material if omitting it or misstating it could impact the economic decisions users make. Moreover, each material class of similar items must be presented separately, while items of a dissimilar nature or function may be aggregated.

5. Consistency of Presentation

The presentation and classification of items in the financial statements should remain consistent from one period to the next, enabling users to compare financial statements across periods easily. If a change is made, it must be justified and its effects disclosed.

6. Prudence

The preparation of financial statements requires management to make judgments, estimates, and assumptions that affect the reported amounts of assets, liabilities, income, and expenses. Prudence or conservatism requires that these judgments and estimates be made with a degree of caution under conditions of uncertainty, so assets or income are not overstated, and liabilities or expenses are not understated.

7. Substance Over Form

Transactions and other events should be accounted for and presented according to their substance and financial reality, not merely their legal form. This principle ensures that the economic intentions of the parties involved in the transaction are reflected in the financial statements.

8. Comparability

Users must be able to compare the financial statements of an entity through time to identify trends in its financial position and performance. Furthermore, the standards aim for comparability between the financial statements of different entities, facilitating the evaluation of financial position, performance, and cash flows relative to others.

9. Understandability

Financial statements should be presented in a manner that makes it easy for users to understand the information contained within them. While IFRS sets high standards for the quality of information, it also considers the common knowledge and abilities of a wide range of users.

Who Needs to Comply with IFRS and Where Is It Mandatory?

International Financial Reporting Standards (IFRS) are designed to bring consistency, transparency, and efficiency to financial statements globally, making them comprehensible and comparable across international boundaries. Compliance with IFRS varies by jurisdiction, with some countries requiring them mandatorily for certain entities, while others allow or encourage their use.

Entities Required to Comply with IFRS

1. Publicly Listed Companies:

In many jurisdictions, publicly listed companies are required to prepare their consolidated financial statements in accordance with IFRS. This requirement ensures that investors, regulators, and other stakeholders have access to high-quality, transparent, and comparable financial information.

2. Financial Institutions:

Banks, insurance companies, and other financial institutions may also be required to comply with IFRS, given their significant role in the global financial system. This compliance ensures uniformity in reporting financial performance and risk management practices.

3. Large Private Companies:

Some countries mandate or encourage large private companies, especially those with significant foreign operations or those considering public listing, to adopt IFRS for their financial reporting. This practice aids in benchmarking against global peers and facilitates access to international capital markets.

4. Subsidiaries of IFRS-reporting Entities:

Subsidiaries of companies that report under IFRS are often required to prepare their financial statements using IFRS to streamline the consolidation process and maintain consistency within the group.

Geographic Mandates

1. European Union (EU):

The EU mandates all listed companies to prepare their consolidated financial statements using IFRS. This requirement, effective since 2005, was one of the significant steps towards the global adoption of IFRS.

2. Asia-Pacific:

Countries like Australia, Hong Kong, and Singapore require IFRS compliance for publicly listed companies, while others like India and Japan have adopted or are transitioning to standards that are closely aligned with IFRS.

3. Africa:

Many African countries, including South Africa and Nigeria, have adopted IFRS for listed companies, financial institutions, and large entities.

4. Americas:

Canada requires publicly accountable enterprises to use IFRS. Brazil has also adopted IFRS standards for all companies. The United States allows foreign public companies to report in IFRS but has not fully adopted IFRS for domestic issuers, who use USGenerally Accepted Accounting Principles (GAAP).

Voluntary Adoption

In addition to mandatory requirements, some jurisdictions allow companies to voluntarily adopt IFRS, especially if they are part of multinational groups or are seeking to attract foreign investment.

How Does IFRS Differ from Other Accounting Standards?

International Financial Reporting Standards (IFRS) and other accounting standards, particularly the United States Generally Accepted Accounting Principles (US GAAP), are the two predominant financial reporting frameworks used globally. While both sets aim to provide high-quality, transparent, and comparable financial information, there are fundamental differences in their approach, principles, and specific requirements. Here’s how IFRS differs from other accounting standards:

1. Conceptual Approach

IFRS: IFRS is based on principles, providing a conceptual basis for financial reporting that focuses on the substance over form. This approach allows for greater flexibility and requires significant professional judgment to interpret the standards in the context of specific transactions.

Other Standards (e.g., US GAAP): In contrast, US GAAP is more rule-based, with detailed rules and specific guidance for a wide array of scenarios. This can reduce the amount of judgment required but may also lead to complexity and a focus on compliance with specific rules rather than the overall substance of transactions.

2. Development and Governance

IFRS: The International Accounting Standards Board (IASB) develops IFRS with the aim of creating globally accepted standards. The process involves extensive consultation with stakeholders worldwide to ensure the standards are globally relevant.

Other Standards: National standards, such as US GAAP, are developed by national standard setters (e.g., the Financial Accounting Standards Board for US GAAP) with a primary focus on the needs of stakeholders within those jurisdictions.

3. Adoption and Use

IFRS: Over 140 countries either require or permit the use of IFRS for financial reporting by public companies. The adoption of IFRS is particularly widespread in countries outside the United States, making it the most globally accepted set of accounting standards.

Other Standards: US GAAP, as an example of another accounting standard, is required for public companies in the United States. Other countries have their own local accounting standards, though many are increasingly aligning with or adopting IFRS.

4. Comprehensive Income

IFRS: IFRS allows for two methods of presenting comprehensive income: in a single statement of comprehensive income or in two separate statements (a statement of profit and loss and a statement of comprehensive income).

Other Standards: US GAAP also allows for both presentation methods but has specific presentation requirements for certain items that might not be as prescriptive under IFRS.

5. Inventory and Costing Methods

IFRS: IFRS prohibits the use of the Last-In, First-Out(LIFO) method for inventory costing, which can affect the cost of goods sold and inventory valuation on the balance sheet.

Other Standards: US GAAP permits the use of LIFO, which can lead to different financial outcomes, especially in periods of significant price fluctuations.

6. Revenue Recognition

IFRS: IFRS 15 provides a comprehensive revenue recognition model based on the transfer of control, which applies to most revenue-generating transactions.

Other Standards: US GAAP also has a detailed revenue recognition standard (ASC 606) that is similar to IFRS 15 due to a joint project between the IASB and FASB to align the standards. Despite this, some differences remain in the application and implementation.

7. Lease Accounting

IFRS: IFRS 16 requires lessees to recognize nearly all leases on the balance sheet, which significantly changes the accounting for leases.

Other Standards: US GAAP has similar requirements under ASC 842, but there are differences in the scope and exemptions that can affect the recognition and measurement of leases.

What Are the Major Challenges in Implementing IFRS?

Implementing International Financial Reporting Standards (IFRS) poses several challenges for businesses transitioning from their national accounting standards or from other international frameworks like US GAAP. These challenges stem from differences in principles, the scope of application, and the need for a comprehensive understanding of IFRS. Here are some of the major challenges in implementing IFRS:

1.Trainingand Expertise:

- The shift to IFRS requires extensive training for accounting and finance professionals to understand and apply the new standards correctly. This challenge includes developing a deep understanding of the principles-based approach of IFRS, which demands significant judgment and interpretation.

2. System and Process Adjustments:

- Adapting existing financial reporting systems and processes to accommodate IFRS requirements can be time-consuming and costly. Companies often need to update or replace financial software, redesign workflows, and establish new internal controls to ensure compliance.

3. First-Time Adoption Complexities:

- The initial transition to IFRS is particularly challenging, as it requires restating previous financial statements according to IFRS for comparative purposes. This process involves a thorough review and possible adjustments to historical financial data, which can be resource-intensive.

4. Cost Implications:

- The transition to and ongoing compliance with IFRS can be costly. Expenses include training costs, system upgrades, hiring or consulting with IFRS experts, and the potential operational impacts of changing accounting practices.

5. Differences in Tax Implications:

- Changes in accounting and reporting practices under IFRS can lead to differences in taxable income calculations, affecting a company's tax liability. Navigating these differences requires careful planning and consultation with tax professionals.

6. Cultural and Organizational Resistance:

- Shifting to a new set of accounting standards can meet resistance within organizations, especially from those accustomed to the previous framework. Overcoming this resistance requires effective change management and communication strategies.

7. Fair Value Measurement:

- IFRS often emphasizes fair value measurement for financial instruments and certain other assets and liabilities, which can introduce volatility into financial statements. Estimating fair values accurately requires sophisticated models and market data, posing a challenge for many entities.

8. International Variations and Interpretations:

- Although IFRS is designed for global application, variations in interpretation and application can arise due to cultural, legal, and regulatory differences across countries. These variations can complicate the preparation of consolidated financial statements for multinational corporations.

9. Keeping Up with Changes:

- IFRS standards are subject to continuous review and update by the IASB to address emerging financial reporting issues and economic changes. Keeping up with these changes and implementing them in a timely manner remains a challenge for businesses.

10. Comparability and Consistency:

- Achieving comparability and consistency in financial reporting across entities and jurisdictions, one of the primary goals of IFRS, remains challenging in practice. The application of judgment and estimates can lead to differences in how entities apply the standards.

Table 1: Challenges of Implementing International Financial Reporting Standards (IFRS)

Challenge | Description |

Training and Expertise | Transitioning to IFRS requires training for professionals to grasp the principles-based approach, demanding significant judgment and interpretation. |

System and Process Adjustments | Adapting financial reporting systems and processes for IFRS compliance can be costly and time-consuming, often requiring system updates or replacements. |

First-Time Adoption Complexities | Initial transition involves restating previous financial statements according to IFRS, requiring a review and adjustments of historical data. |

Cost Implications | Transitioning to and maintaining IFRS compliance incurs expenses such as training, system upgrades, and consulting fees. |

Differences in Tax Implications | IFRS can affect taxable income calculations, leading to potential changes in tax liabilities that require strategic planning. |

Cultural and Organizational Resistance | Resistance within organizations may occur due to the shift from a previous framework, necessitating effective change management. |

Fair Value Measurement | The emphasis on fair value measurement under IFRS introduces volatility and requires sophisticated estimation models. |

International Variations and Interpretations | Global application of IFRS may face challenges due to variations in interpretation and application across different jurisdictions. |

Keeping Up with Changes | The need to stay updated with continuous IFRS revisions and implement changes timely poses a challenge. |

Comparability and Consistency | Achieving uniform financial reporting across entities and jurisdictions is difficult due to judgment and estimates, despite being a primary goal of IFRS. |

What Impact Does IFRS Have on Financial Reporting and Analysis?

The adoption of International Financial Reporting Standards (IFRS) significantly impacts financial reporting and analysis, shaping the way companies record, report, and interpret financial information. The global convergence towards IFRS aims to enhance comparability, transparency, and the overall quality of financial statements. Here are several key impacts of IFRS on financial reporting and analysis:

1. Enhanced Global Comparability:

- IFRS facilitates the comparison of financial statements of companies across different countries by standardizing the accounting language used globally. This uniformity allows investors, analysts, and other stakeholders to make more informed decisions by comparing financial data across borders without needing to adjust for local accounting variations.

2. Increased Transparency:

- IFRS requires detailed disclosures that provide a comprehensive view of a company's financial health, risks, and future prospects. These disclosures include extensive information about financial instruments, revenue recognition, and the effects of judgments and estimates on financial statements, contributing to greater transparency and trust among stakeholders.

3. Higher Quality Financial Statements:

- The principle-based nature of IFRS encourages the preparation of financial statements that truly reflect the economic reality of transactions, rather than merely adhering to a checklist of rules. This approach improves the overall quality of financial reporting, leading to financial statements that are more meaningful and useful for analysis.

4. Impact on Financial Metrics and Ratios:

- Transitioning to IFRS can lead to changes in how certain items are recognized and measured, affecting key financial metrics such as revenue, profits, assets, and liabilities. These changes may impact financial ratios and other performance indicators, altering how companies are evaluated by investors and analysts.

5. Greater Emphasis on Fair Value:

- IFRS often emphasizes fair value measurement for financial instruments, property, plant, and equipment, and investment properties, among others. While this can provide more relevant and timely information, it also introduces volatility into financial statements and requires robust systems for fair value estimation and disclosure.

6. Challenges in Cross-jurisdictional Analysis:

- Despite the widespread adoption of IFRS, variations in application and enforcement across jurisdictions can pose challenges for cross-border financial analysis. Analysts must be aware of these differences and may need to adjust their approaches when comparing companies from different regulatory environments.

7. Influence on Corporate Strategy and Operations:

- The adoption of IFRS can influence corporate decision-making and strategy, particularly in areas such as mergers and acquisitions, tax planning, and cross-border investments. Companies may need to reassess their strategies in light of IFRS requirements and their impact on financial statements.

8. Need for Enhanced Analytical Skills:

- Financial analysts and other users of financial statements need to develop a deep understanding of IFRS standards to effectively interpret and analyze financial data. This includes being able to understand the implications of the standards on financial reporting and being adept at analyzing the extensive disclosures that IFRS requires.

Conclusion

Adopting International Financial Reporting Standards (IFRS) significantly reshapes financial reporting, aiming for global consistency, enhanced transparency, and increased stakeholder trust. Despite challenges such as the need for extensive training and system modifications, the benefits, including improved comparability and decision-making for international investors, underscore IFRS's importance in today's globalized economy. As entities navigate the transition, the emphasis on high-quality, comparable financial information promises to strengthen financial markets and support economic growth worldwide.