- Table of Contents

- Introduction

- 1. Corporate Finance Essentials by Coursera

- 2. Financial Management Specialization by Coursera

- 3. Corporate Finance Professional Certificate by edX

- 4. Advanced Valuation and Strategy - M&A, Private Equity, and Venture Capital by Coursera

- 5. Corporate Finance and Portfolio Management Course by Holistique Training

Introduction

Learning corporate finance provides a crucial foundation for understanding the financial principles and practices that drive business decision-making. It encompasses a range of topics, including financial analysis, capital budgeting, risk management, and investment strategies. By mastering corporate finance, individuals can make informed financial decisions, optimize resource allocation, and enhance their strategic planning capabilities. This knowledge is invaluable for finance professionals, business managers, and anyone looking to advance their career in the financial sector. Whether you're managing a company's finances or making investment choices, a solid grasp of corporate finance principles is essential for achieving long-term success.

1. Corporate Finance Essentials by Coursera

Summary about course : This course provides a comprehensive introduction to the principles of corporate finance. It covers key topics such as time value of money, risk and return, cost of capital, capital budgeting, and capital structure.

Duration : 4 weeks, 3-4 hours per week

Language : English

Level : Beginner

What does a Corporate Finance Essentials Course teach you? This course teaches you the fundamental concepts and tools necessary for understanding corporate finance. It focuses on the theoretical aspects and practical applications of finance in corporate settings.

Who should take the Corporate Finance Essentials course? This course is ideal for beginners in finance, business students, and professionals seeking a foundational understanding of corporate finance.

Why should take the Corporate Finance Essentials course? Taking this course will equip you with essential finance knowledge and skills, which are critical for making informed business decisions and advancing your career in finance.

2. Financial Management Specialization by Coursera

Summary about course : This specialization consists of five courses that cover a wide range of topics in financial management, including corporate finance, valuation, risk management, and mergers and acquisitions.

Duration : 6 months, 5-6 hours per week

Language : English

Level : Intermediate

What does a Financial Management Specialization Course teach you? The course teaches advanced financial management concepts and practices, including corporate valuation, financial analysis, and strategic financial planning.

Who should take the Financial Management Specialization course? This course is suitable for finance professionals, business managers, and MBA students who want to deepen their understanding of financial management.

Why should take the Financial Management Specialization course? You should take this course to gain a comprehensive understanding of financial management, improve your strategic decision-making skills, and enhance your professional qualifications in finance.

3. Corporate Finance Professional Certificate by edX

Summary about course : This professional certificate program provides in-depth knowledge of corporate finance. It covers financial analysis, investment strategies, capital structure, and corporate governance.

Duration : 3 months, 4-6 hours per week

Language : English

Level : Advanced

What does a Corporate Finance Professional Certificate Course teach you? The course teaches advanced concepts in corporate finance, including financial analysis, investment decision-making, corporate governance, and risk management.

Who should take the Corporate Finance Professional Certificate course? This course is designed for finance professionals, senior managers, and executives who need an advanced understanding of corporate finance.

Why should take the Corporate Finance Professional Certificate course? You should take this course to enhance your expertise in corporate finance, develop strategic financial management skills, and increase your potential for leadership roles.

4. Advanced Valuation and Strategy - M&A, Private Equity, and Venture Capital by Coursera

Summary about course : This course focuses on advanced topics in valuation and strategy, particularly in the context of mergers and acquisitions, private equity, and venture capital.

Duration : 6 weeks, 2-3 hours per week

Language : English

Level : Advanced

What does an Advanced Valuation and Strategy Course teach you? This course teaches advanced valuation techniques, strategic decision-making in M&A, private equity, and venture capital investments.

Who should take the Advanced Valuation and Strategy course? This course is ideal for finance professionals, investment bankers, consultants, and entrepreneurs involved in M&A, private equity, or venture capital.

Why should take the Advanced Valuation and Strategy course? You should take this course to gain specialized knowledge in valuation and strategic finance, which is essential for high-level decision-making in finance and investment.

5. Corporate Finance and Portfolio Management Course by Holistique Training

Summary about course :This course offers advanced decision-making techniques to enhance your financial strategy. It differentiates between active and passive portfolio management, guiding you in creating robust investment portfolios for stakeholders. The course emphasizes building beneficial relationships with key stakeholders, identifying financial risks, and developing mitigation strategies. It also covers business continuity planning based on accurate data, sourcing finances for projects, and understanding the drivers behind dividend and capital decisions.

Duration : 5 days

Language : English

Level : Intermediate to Advanced

What does a Corporate Finance and Portfolio Management Course teach you? This course teaches sophisticated financial decision-making techniques, the distinctions between active and passive portfolio management, strategies for building solid investment portfolios, identifying and mitigating financial risks, and understanding the drivers behind dividend and capital decisions.

Who should take the Corporate Finance and Portfolio Management course? This course is ideal for finance professionals, investment analysts, portfolio managers, and individuals seeking to enhance their knowledge of corporate finance and investment management, as well as those aiming to create strong financial strategies and manage investments effectively.

Why should take the Corporate Finance and Portfolio Management course? You should take this course to develop a comprehensive understanding of corporate finance and portfolio management, enhance your financial decision-making skills, build robust investment portfolios, and effectively manage financial risks and stakeholder relationships. This knowledge is crucial for advancing your career in finance and achieving strategic financial goals.

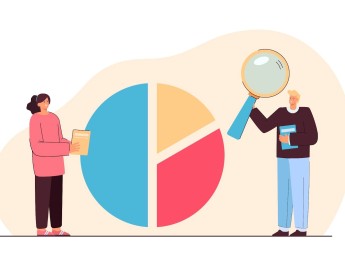

Table: Summary of Best Corporate Finance Courses in 2024

Course Name | Duration | Language | Level |

Corporate Finance Essentials (Coursera) | 4 weeks, 3-4 hours/week | English | Beginner |

Financial Management Specialization (Coursera) | 6 months, 5-6 hours/week | English | Intermediate |

Corporate Finance Professional Certificate (edX) | 3 months, 4-6 hours/week | English | Advanced |

Advanced Valuation and Strategy (Coursera) | 6 weeks, 2-3 hours/week | English | Advanced |

Corporate Finance and Portfolio Management (Holistique Training) | 12 weeks, 6-8 hours/week | English | Intermediate to Advanced |