- Table of Contents

- Introduction

- What is Gross Margin?

- Formula for Gross Margin

- Steps to Calculate Gross Margin

- Example Calculation

- Why is Calculating Gross Margin Essential for a Business?

- 1. Profitability Assessment

- 2. Benchmarking Against Industry Standards

- 3. Cost Management and Control

- 4. Pricing Strategy Development

- 5. Investment and Financial Planning

- 6. Identifying Operational Inefficiencies

- 7. Strategic Decision-Making

- What is Contribution Margin?

- Formula for Contribution Margin

- Steps to Calculate Contribution Margin

- Example Calculation

- Why is Contribution Margin Important in Business?

- 1. Pricing Decisions and Strategy

- 2. Product Line Evaluation and Optimization

- 3. Break-Even Analysis

- 4. Financial Forecasting and Planning

- 5. Cost Control and Efficiency Improvement

- 6. Resource Allocation Decisions

- 7. Performance Measurement

- 8. Support for Management Decisions

- Gross Margin vs. Contribution Margin: Key Differences

- 1. Definition and Scope

- 2. Cost Components Considered

- 3. Focus on Profitability

- 4. Usefulness in Decision-Making

- 5. Impact on Financial Statements

- Example Comparison

- Gross Margin Calculation:

- Contribution Margin Calculation:

- Other Profit Metrics Useful for Business

- Net Profit Margin:

- Operating Margin:

- EBITDA Margin:

- Return on Sales (ROS):

- Return on Investment (ROI):

- Conclusion

Introduction

Understanding financial metrics is crucial for any business seeking to thrive in a competitive landscape. Among the various metrics that provide insights into a company's profitability, gross margin and contribution margin are two of the most important. While both metrics serve to evaluate a company's financial health, they do so from different perspectives and offer unique insights. This blog post will delve into the concepts of gross margin and contribution margin, exploring their definitions, calculations, significance, and key differences. By the end, you will have a comprehensive understanding of these two metrics and how they can guide decision-making in your business.

What is Gross Margin?

Gross margin is a key financial metric that represents the difference between sales revenue and the cost of goods sold (COGS). It indicates how efficiently a company produces and sells its products. A higher gross margin percentage suggests that a company retains a larger portion of revenue after covering the direct costs associated with production. Essentially, gross margin reflects the profitability of a company's core operations, excluding other expenses such as operating expenses, interest, and taxes.

Formula for Gross Margin

The formula for calculating gross margin is as follows:

Gross Margin =Sales Revenue-Cost of Goods Sold (COGS)Sales Revenue100

This formula provides the gross margin percentage, which is a useful indicator of a company's financial health.

Steps to Calculate Gross Margin

Calculating gross margin involves a few straightforward steps:

- Determine Sales Revenue: This is the total amount generated from sales before any deductions.

- Calculate Cost of Goods Sold (COGS):COGS includes all direct costs associated with the production of goods sold, such as materials and labor.

- Apply the Gross Margin Formula: Subtract COGS from sales revenue, then divide by sales revenue and multiply by 100 to get the percentage.

Example Calculation

For instance, if a company has a sales revenue of $500,000 and a COGS of $300,000, the calculation would be:

Gross Margin=500,000-300,000500,000100=200,000500,000100=40%

This means the company retains 40% of its revenue after covering the direct costs of production.

Why is Calculating Gross Margin Essential for a Business?

Calculating gross margin is vital for various reasons, as it serves as a cornerstone for understanding a company's financial health and operational efficiency. Here are several key reasons why gross margin should be a focal point for businesses:

1. Profitability Assessment

Gross margin provides a clear indicator of how well a company is performing in its core operations. It reveals the percentage of revenue that exceeds the cost of goods sold, allowing businesses to assess their profitability. A higher gross margin indicates that a company is effectively managing its production costs relative to its sales revenue. By regularly analyzing gross margin, businesses can identify trends over time, helping them to gauge whether their profitability is improving or declining.

2. Benchmarking Against Industry Standards

Businesses can use gross margin as a benchmarking tool to compare their performance against industry standards or competitors. By understanding the average gross margin within their sector, companies can identify whether they are operating efficiently or if there are areas for improvement. This comparative analysis can highlight competitive advantages or weaknesses, guiding strategic decisions regarding pricing, cost control, and operational efficiencies.

3. Cost Management and Control

Gross margin analysis helps businesses pinpoint areas where costs can be reduced without sacrificing quality. By breaking down the components of COGS, companies can identify specific cost drivers, such as materials, labor, or overhead expenses. This granular understanding allows businesses to implement targeted cost-control measures that can enhance profitability. For instance, if a company notices that the cost of raw materials is significantly impacting its gross margin, it may explore alternative suppliers or negotiate better pricing.

4. Pricing Strategy Development

Understanding gross margin is crucial for developing effective pricing strategies. Companies must ensure that their pricing covers not only the cost of goods sold but also contributes to covering fixed costs and generating profit. By analyzing gross margin, businesses can determine whether their prices are set appropriately to achieve desired profit levels. If the gross margin is too low, it may prompt a reevaluation of pricing strategies, leading to adjustments that align better with market expectations and profitability goals.

5. Investment and Financial Planning

Investors and stakeholders often look at gross margin as a key indicator of a company's financial health. A consistent or improving gross margin can signal strong operational performance and effective management, making the business more attractive to potential investors. Additionally, understanding gross margin assists in financial planning and forecasting. Companies can project future profits based on expected sales and costs, helping them to make informed decisions about investments, expansions, and resource allocation.

6. Identifying Operational Inefficiencies

Gross margin can also serve as a diagnostic tool for identifying operational inefficiencies. A declining gross margin may indicate issues such as rising production costs, inefficiencies in the supply chain, or changes in market demand. By investigating the underlying causes of a declining gross margin, businesses can take corrective actions to address inefficiencies, streamline operations, and improve overall performance.

7. Strategic Decision-Making

Lastly, gross margin analysis plays a crucial role in strategic decision-making. Whether considering new product launches, entering new markets, or assessing the viability of existing products, understanding gross margin helps businesses evaluate the potential profitability of these decisions. By incorporating gross margin into their strategic planning, companies can make data-driven choices that align with their financial objectives and market opportunities.

In summary, calculating gross margin is essential for businesses as it provides critical insights into profitability, cost management, pricing strategies, and overall financial health. By leveraging this metric, companies can make informed decisions that drive growth and enhance their competitive position in the marketplace. Regularly monitoring and analyzing gross margin empowers businesses to adapt to changing market conditions and continuously improve their operational efficiency.

What is Contribution Margin?

Contribution margin is another essential financial metric that represents the portion of sales revenue that exceeds total variable costs. This metric is particularly useful in understanding how much revenue is available to cover fixed costs and generate profit. Contribution margin focuses on the profitability of individual products or services, making it a valuable tool for pricing strategies and product line decisions.

Formula for Contribution Margin

- The formula for calculating contribution margin is as follows:

Contribution Margin=Sales Revenue- Total Variable Costs

- The contribution margin can also be expressed as a percentage:

Contribution Margin Percentage=Contribution Margin/Sales Revenue × 100

Steps to Calculate Contribution Margin

Calculating contribution margin involves the following steps:

- Determine Sales Revenue: As with gross margin, this is the total revenue generated from sales.

- Identify Total Variable Costs: Variable costs are expenses that vary directly with production volume, such as raw materials and direct labor.

- Apply the Contribution Margin Formula: Subtract total variable costs from sales revenue to find the contribution margin.

Example Calculation

For instance, if a company has a sales revenue of $500,000 and total variable costs of $300,000, the calculation would be:

Contribution Margin=500,000-300,000=200,000

To find the contribution margin percentage:

Contribution Margin Percentage=200,000500,000100=40%

This indicates that 40% of the revenue contributes to covering fixed costs and generating profit.

Why is Contribution Margin Important in Business?

Contribution margin is a critical financial metric that offers valuable insights into a company’s profitability and operational efficiency. Understanding its significance can empower businesses to make informed decisions that drive growth and sustainability. Here are several key reasons why contribution margin is essential for businesses:

1. Pricing Decisions and Strategy

One of the primary uses of contribution margin is in guiding pricing decisions. By analyzing the contribution margin for individual products or services, businesses can determine the minimum price needed to cover variable costs and contribute to fixed costs. This understanding enables companies to set competitive prices that not only attract customers but also ensure profitability. If a product has a low contribution margin, it may prompt a business to reconsider its pricing strategy, potentially leading to price adjustments or reevaluating the product’s value proposition.

2. Product Line Evaluation and Optimization

Contribution margin is invaluable for evaluating the profitability of different products or services within a company’s portfolio. By calculating the contribution margin for each offering, businesses can identify which products contribute most significantly to covering fixed costs and generating profits. This analysis allows companies to make data-driven decisions about product lines, such as discontinuing underperforming products, promoting high-margin items, or reallocating resources toward more profitable offerings. Ultimately, this strategic focus enhances overall profitability.

3. Break-Even Analysis

Contribution margin plays a crucial role in break-even analysis, which determines the sales volume needed to cover total costs (both fixed and variable). By understanding the contribution margin, businesses can calculate the break-even point using the formula:

Break Even Points (in units)=Total Fixed Costs/Contribution Margin per Unit

This analysis helps businesses understand how many units they need to sell to start making a profit. Knowing the break-even point is essential for setting sales targets and assessing the feasibility of new initiatives or product launches.

4. Financial Forecasting and Planning

Contribution margin is a key component of financial forecasting and planning. By analyzing historical contribution margins, businesses can project future profits based on different sales scenarios. This forecasting capability allows companies to prepare for various market conditions, such as changes in demand or fluctuations in variable costs. By understanding how changes in sales volume impact contribution margin, businesses can develop contingency plans and make strategic adjustments to ensure financial stability.

5. Cost Control and Efficiency Improvement

Analyzing contribution margin helps businesses identify and manage variable costs effectively. Since contribution margin focuses on the costs directly associated with production, it allows companies to pinpoint areas where they can reduce expenses without compromising quality. For example, if a company identifies that a specific product has a low contribution margin due to high variable costs, it may explore alternatives such as negotiating better terms with suppliers, optimizing production processes, or finding more efficient materials. This focus on cost control can lead to improved overall profitability.

6. Resource Allocation Decisions

Understanding contribution margin is essential for making informed resource allocation decisions. Companies often face choices regarding where to invest their resources, whether in marketing, production, or new product development. By analyzing the contribution margin of various initiatives, businesses can prioritize investments that are likely to yield the highest returns. This strategic approach ensures that resources are allocated to areas that will maximize profitability and drive growth.

7. Performance Measurement

Contribution margin serves as a key performance indicator (KPI) for assessing the financial health of a business. Regularly monitoring contribution margin allows companies to track their performance over time and measure the impact of strategic decisions. A declining contribution margin may indicate issues such as rising variable costs or decreased sales, prompting further investigation and corrective action. By using contribution margin as a KPI, businesses can maintain a clear focus on profitability and operational efficiency.

Table: Other essential KPIs for profitability and operational efficiency

KPI | Description |

Net Profit Margin | Measures the percentage of revenue remaining after all expenses are deducted, indicating overall profitability. |

Operating Margin | Reflects the percentage of revenue left after covering operating expenses, providing insight into operational efficiency. |

Return on Investment (ROI) | Evaluates the profitability of an investment relative to its cost, helping assess the effectiveness of resource allocation. |

Customer Acquisition Cost (CAC) | Calculates the total cost of acquiring a new customer, essential for understanding marketing efficiency and sales strategy effectiveness. |

Inventory Turnover Ratio | Measures how often inventory is sold and replaced over a period, indicating inventory management efficiency and sales performance. |

8. Support for Management Decisions

Contribution margin provides valuable insights that support management decisions across various levels of the organization. Whether evaluating new market opportunities, assessing the viability of product launches, or determining the feasibility of cost-cutting measures, contribution margin analysis equips management with the data needed to make informed choices. This analytical approach fosters a culture of accountability and strategic thinking within the organization.

In summary, contribution margin is a vital metric that informs various aspects of business operations, from pricing and product evaluation to financial forecasting and resource allocation. By understanding and leveraging contribution margin, businesses can enhance their profitability, make strategic decisions, and ultimately achieve long-term success in a competitive marketplace. Regularly analyzing contribution margin empowers companies to adapt to changing market conditions, optimize their offerings, and drive sustainable growth.

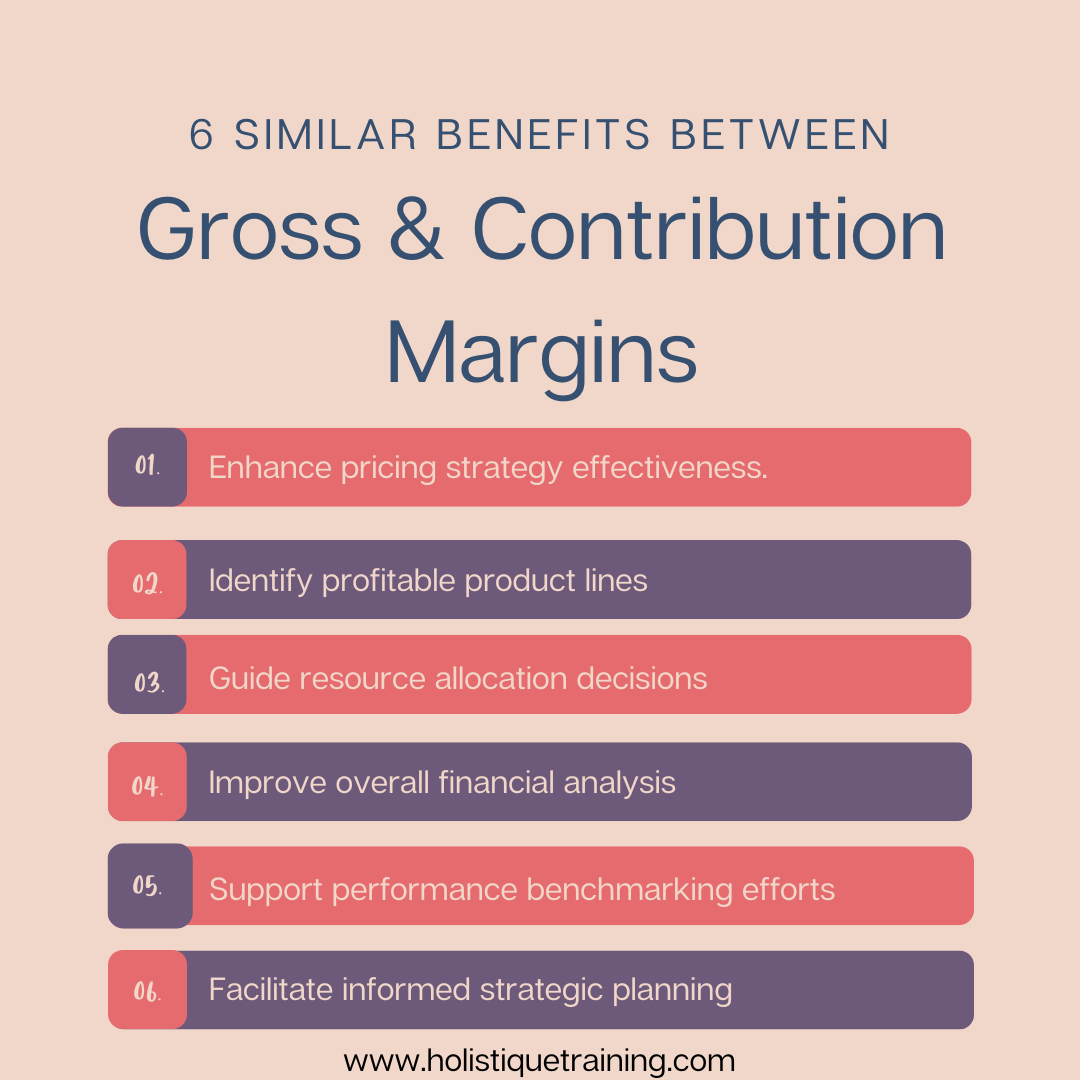

Gross Margin vs. Contribution Margin: Key Differences

While gross margin and contribution margin are both crucial for assessing a company's profitability, they differ in several key ways:

1. Definition and Scope

- Gross Margin: Gross margin represents the difference between sales revenue and the cost of goods sold (COGS). It focuses on the overall profitability of a company's core operations, providing insight into how efficiently a business produces and sells its products. Gross margin encompasses all direct costs associated with production, including materials and labor.

- Contribution Margin: Contribution margin, on the other hand, measures the portion of sales revenue that exceeds total variable costs. It highlights how much revenue is available to cover fixed costs and contribute to profit. Contribution margin is particularly useful for evaluating individual products or services, emphasizing their profitability relative to variable costs.

2. Cost Components Considered

- Gross Margin: The calculation of gross margin includes only direct costs associated with the production of goods sold. This typically encompasses expenses such as raw materials, direct labor, and manufacturing overhead that can be directly attributed to the production process.

- Contribution Margin: Contribution margin considers all variable costs, which may include both direct costs and certain indirect costs that vary with production volume. This broader scope allows businesses to assess profitability more comprehensively, factoring in costs like commissions or shipping that are tied to specific sales.

3. Focus on Profitability

- Gross Margin: The primary focus of gross margin is on the efficiency of production and the pricing strategy. It provides insights into how well a business is managing its production costs relative to sales, which is critical for understanding overall operational performance.

- Contribution Margin: Contribution margin emphasizes the profitability of individual products or services. It helps businesses understand which offerings contribute most to covering fixed costs and generating profit, enabling more informed product line decisions and resource allocation.

4. Usefulness in Decision-Making

- Gross Margin: Gross margin is often used for high-level financial analysis and benchmarking against industry standards. It helps businesses assess their overall performance and identify trends in profitability over time. This metric is particularly useful for strategic planning and evaluating the effectiveness of pricing strategies.

- Contribution Margin: Contribution margin is crucial for tactical decision-making, especially concerning pricing, product evaluation, and break-even analysis. It assists businesses in making decisions about which products to promote, discontinue, or develop further based on their profitability.

5. Impact on Financial Statements

- Gross Margin: Gross margin is prominently featured on the income statement, reflecting the direct profitability of a company's core operations. It provides a clear view of how much revenue remains after covering COGS, which is vital for stakeholders assessing financial health.

- Contribution Margin: Contribution margin is not typically reported on the income statement but is calculated internally for managerial decision-making. This metric is often used in managerial accounting to provide insights that support operational and strategic decisions.

The following table summarizes the primary differences between gross margin and contribution margin:

Aspect | Gross Margin | Contribution Margin |

Definition | Difference between sales revenue and COGS | Difference between sales revenue and total variable costs |

Focus | Overall profitability of core operations | Profitability of individual products or services |

Costs Considered | Only direct costs (COGS) | Variable costs (direct and indirect) |

Usefulness | Evaluates production efficiency and pricing strategies | Assists in pricing, product evaluation, and break-even analysis |

Financial Statement | Found on the income statement | Not typically reported on the income statement |

Example Comparison

Consider a company that sells two products: Product A and Product B.

- Product A:

- Sales Revenue: $300,000

- COGS: $180,000

- Total Variable Costs: $220,000

- Product B:

- Sales Revenue: $200,000

- COGS: $120,000

- Total Variable Costs: $150,000

Gross Margin Calculation:

Product A:

Gross Margin=300,000-180,000300,000100=40%

Product B:

Gross Margin=200,000-120,000200,000100=40%

Contribution Margin Calculation:

Product A:

Contribution Margin=300,000-220,000=80,000

Contribution Margin Percentage=80,000300,000100=26.67%

Product B:

Contribution Margin=200,000-150,000=50,000

Contribution Margin Percentage=50,000200,000100=25%

These calculations illustrate how both metrics provide valuable insights, but from different perspectives. Gross margin helps assess overall production efficiency, while contribution margin focuses on individual product profitability.

Other Profit Metrics Useful for Business

While gross margin and contribution margin are vital, there are several other profit metrics that businesses should consider for a comprehensive understanding of their financial health:

Net Profit Margin:

This metric measures the percentage of revenue that remains as profit after all expenses, including operating expenses, interest, and taxes, have been deducted. It is calculated as:

Net Profit Margin=Net Income/Sales Revenue × 100

Operating Margin:

This reflects the percentage of revenue that remains after covering operating expenses but before interest and taxes. It is calculated as:

Operating Margin=Operating Income/Sales Revenue × 100

EBITDA Margin:

This metric focuses on earnings before interest, taxes, depreciation, and amortization. It provides insight into a company's operational profitability:

EBITDA Margin=EBITDA/Sales Revenue × 100

Return on Sales (ROS):

This measures how efficiently a company turns sales into profits and is calculated as:

Return on Sales=Operating Profit/Sales Revenue × 100

Return on Investment (ROI):

This metric evaluates the profitability of an investment relative to its cost:

Return on Investment=Net Profit/Cost of Investment × 100

These additional metrics, when analyzed alongside gross margin and contribution margin, provide a more detailed picture of a company's financial performance and help inform strategic decision-making.

Conclusion

Understanding the differences between gross margin and contribution margin is essential for any business aiming to enhance profitability and make informed financial decisions. While gross margin focuses on the overall efficiency of production and sales, contribution margin provides insights into the profitability of individual products or services. By effectively calculating and analyzing these metrics, businesses can identify areas for improvement, optimize pricing strategies, and ultimately drive growth.

Incorporating these financial metrics into regular business assessments will not only aid in understanding current performance but also provide a roadmap for future success. As companies navigate an ever-changing market landscape, leveraging the insights gained from gross margin and contribution margin will be invaluable in making strategic decisions that foster long-term profitability and sustainability. To further enhance your financial decision-making skills, consider enrolling in our course, Financial Decision-Making & Communicating Financial Change. This course is designed to equip you with the knowledge and tools necessary to interpret financial metrics effectively, communicate financial changes within your organization, and implement strategies that drive financial success.

Join us to elevate your understanding of financial metrics and empower your organization to thrive in today’s dynamic business environment. By investing in your financial education, you will be better positioned to make sound decisions that lead to improved performance and sustainable growth. Don’t miss this opportunity to transform your financial acumen and contribute meaningfully to your organization’s success.