- Table of Contents

- Introduction

- What Is a Project Budget?

- The Importance of Project Budgets

- Risk Management and Mitigation

- Quality Assurance

- Performance Measurement and Evaluation

- Legal and Compliance Requirements

- Vendor and Supplier Management

- Scope Management

- Ensuring Alignment with Project Objectives

- Resource Allocation and Planning

- Financial Control and Tracking

- Stakeholder Communication

- How to Make a Project Budget

- 1- Define Project Scope and Objectives

- 2- Identify and Estimate Costs

- 3- Consult Experts and Historical Data

- 4- Create a Budget Spreadsheet

- 5- Allocate Budget According to Phases

- 6- Review and Refine

- Project Budget Example

- 6 Tips for Assigning a Project Budget as a Project Manager

- Tip #1: Involve Key Stakeholders

- Tip #2: Consider Project Phases

- Tip #3: Maintain Flexibility

- Tip #4: Track Expenses Regularly

- Tip #5: Communicate Transparently

- Tip #6: Learn from Experience

- Budgeting Software Solutions

- Advantages of Budgeting Software

- Notable Examples of Budgeting Software

- Exploring Agile Budgeting in Project Management

- Adapting Budgets to Agile Environments

- Continuous Budget Adjustments

- Embracing Change as a Norm

- The Future of Project Budgeting: AI and Predictive Analytics

- Leveraging AI for Accurate Cost Estimates

- Predicting Budget Deviations and Risks

- Real-time Budget Monitoring with Analytics

- Conclusion

Introduction

Effective project management requires careful planning and execution to achieve desired outcomes. Among the numerous factors contributing to a project's success, project budgeting is a critical element. The ability to allocate resources efficiently and track financial progress throughout the project's life cycle is pivotal in achieving goals, managing risks, and ensuring stakeholder satisfaction. In this comprehensive guide, we will explore the significance of project budgeting, discuss its key components, and provide valuable insights for project managers to create and manage budgets effectively.

What Is a Project Budget?

A project budget is a financial blueprint that outlines the estimated costs and resources required to complete a project successfully. It serves as a roadmap for project managers and stakeholders, enabling them to make informed decisions about resource allocation, manage financial risks, and assess the project's financial feasibility. A well-defined project budget helps align the project's objectives with available resources, ensuring the project remains on track throughout its lifecycle.

The Importance of Project Budgets

A well-executed project budget serves as a crucial foundation for successful project management. Even though a project's success relies on various factors, the budget holds significant importance, with 28% of project failures being attributed to the lack of accurate cost estimates, according to ClearPoint Strategy. Let's delve deeper into the importance of project budgets by exploring additional key reasons:

Risk Management and Mitigation

Project budgets are instrumental in risk management and mitigation. Project managers can identify potential financial risks early in the project lifecycle by thoroughly estimating costs and allocating resources. This proactive approach allows for developing risk mitigation strategies and allocating contingency funds to address unforeseen challenges. With a well-prepared budget, project teams are better equipped to handle unexpected issues without derailing the project.

Quality Assurance

Effective budgeting contributes to quality assurance within a project. When budgets are carefully planned and resources allocated judiciously, there is a direct impact on the quality of project deliverables. Sufficient funds can be allocated to quality control, testing, and validation tasks, ensuring that the project meets or exceeds the expected quality standards. Conversely, inadequate budgeting can lead to shortcuts and compromises that result in lower-quality outcomes.

Performance Measurement and Evaluation

Project budgets serve as a benchmark for performance measurement and evaluation. They provide a baseline against which actual expenses can be compared, enabling project managers to gauge the project's financial health. By continuously monitoring expenses and assessing variances, project teams can identify areas where cost efficiency can be improved. This data-driven approach fosters continuous improvement and allows for informed decision-making to optimise project performance.

Legal and Compliance Requirements

In some industries and projects, adherence to legal and compliance requirements is paramount. A well-documented project budget helps ensure that financial resources are allocated in accordance with relevant regulations and industry standards. Failure to comply with budgetary constraints can result in legal and financial repercussions, making it essential for project managers to align their budgets with legal and compliance obligations.

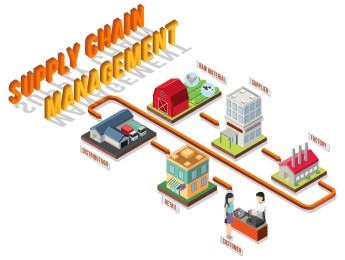

Vendor and Supplier Management

Project budgets also play a crucial role in vendor and supplier management. When projects involve external vendors or suppliers, having a well-defined budget aids in negotiation and contract management. It allows project managers to communicate their financial expectations to vendors clearly and ensures that the agreed-upon services or products are delivered within budget constraints. Effective vendor management, supported by a robust budget, can prevent cost overruns and contractual disputes.

Scope Management

Project scope and budget are closely intertwined. Effective budgeting helps define the limits of the project's scope and ensures that scope changes are appropriately documented and assessed for their impact on costs. By maintaining a clear scope-budget relationship, project managers can prevent scope creep—the uncontrolled expansion of project scope that can lead to cost escalations and timeline delays. A well-managed budget is a fundamental tool for scope control.

Ensuring Alignment with Project Objectives

One of the primary functions of a project budget is to ensure that the project's financial resources are aligned with its objectives. It becomes challenging to allocate resources effectively and prioritise tasks without a budget. This misalignment can lead to resource shortages, project delays, and, ultimately, project failure.

Resource Allocation and Planning

Efficient resource allocation is a cornerstone of project success. A project budget enables project managers to identify the resources required for each task and allocate them effectively. By clearly understanding the budget, project managers can avoid resource shortages, prevent bottlenecks, and ensure smooth project execution. The budget acts as a guide, aligning project objectives with available resources.

Importance | Key Points |

Resource Allocation | Optimal resource allocation is ensured. |

Risk Management | Financial risks can be identified early. |

Quality Assurance | Quality of deliverables is enhanced. |

Performance | Performance measurement is facilitated. |

Legal Compliance | Adherence to regulations is supported. |

Vendor Management | Vendor relationships are strengthened. |

Table 1: The importance of project budgeting

Financial Control and Tracking

Maintaining financial control throughout a project's lifecycle is essential for its overall success. A project budget acts as a control mechanism, allowing project managers to monitor and track actual expenses against the planned budget. This provides valuable insights into the project's financial health and enables timely identification of potential deviations. By actively tracking expenses, project managers can take corrective actions, implement cost-saving measures, and ensure that the project stays within financial boundaries.

Stakeholder Communication

Effective communication is vital for project success, and the project budget serves as a valuable tool in stakeholder communication. It provides transparency and accountability, allowing stakeholders to understand how their investments are being utilised. Regularly sharing budget updates with stakeholders fosters trust and confidence in the project's management. Open communication channels facilitate informed decision-making, align expectations, and ensure that all parties remain updated on the financial aspects of the project.

By recognising the significance of project budgeting in terms of resource allocation, financial control, and stakeholder communication, project managers can lay a solid foundation for project success.

How to Make a Project Budget

Creating a project budget requires careful planning and consideration. By following a systematic approach, project managers can develop a comprehensive budget that aligns with project goals and facilitates effective financial management. Here are the key steps to make a project budget:

1- Define Project Scope and Objectives

Begin by clearly articulating the project's scope, objectives, and deliverables. Understanding the project's goals and timelines enables project managers to accurately identify the necessary resources and estimate associated costs. A well-defined scope serves as the foundation for a realistic and feasible budget.

2- Identify and Estimate Costs

Break down the project into its constituent tasks and identify the required resources. Estimate the costs associated with personnel, equipment, materials, and any external services needed. Consider potential risks and contingencies when estimating costs to ensure the budget accounts for unforeseen circumstances.

3- Consult Experts and Historical Data

Seek input from subject matter experts and leverage historical data from similar projects to enhance the accuracy of your budget estimates. Experts can provide valuable insights into cost drivers and potential areas for optimisation. Historical data serves as a reference point, allowing for more informed decision-making during budgeting.

4- Create a Budget Spreadsheet

Utilise spreadsheet software to organise and categorise your budget components. Include line items for each cost category, such as labour, materials, equipment, overhead, and contingencies. Structure the spreadsheet to be comprehensive, easy to understand, and adaptable to changes throughout the project lifecycle.

5- Allocate the Budget According to the Phases

Consider breaking the project down into distinct phases and allocate resources accordingly. This phased approach helps manage costs more effectively, reduces financial risks, and facilitates focused resource allocation for each project stage. It also allows for better monitoring and control of budget utilisation.

6- Review and Refine

Before finalising the budget, review it for accuracy, completeness, and alignment with project objectives. Seek feedback from relevant stakeholders and make necessary adjustments based on their input. Ensure that the budget accounts for potential changes or modifications in project scope to maintain flexibility.

Following these steps and involving key stakeholders in the budgeting process can help project managers create a robust and realistic project budget.

Project Budget Example

Let's consider a hypothetical project to illustrate the process of creating a project budget. Suppose you are managing a software development project with a team of ten developers and an estimated timeline of six months. Here is a simplified breakdown of the project budget:

Personnel:

Developer Salaries: $250,000

Project Manager Salary: $75,000

Equipment and Software:

Hardware and Software Costs: $30,000

Materials:

Server Hosting: $10,000

External Services:

QA and Testing: $40,000

Contingency:

Risk and Contingency Reserve: $20,000

Total Project Budget: $425,000

In this example, the personnel costs include the salaries of developers and the project manager. The equipment and software costs encompass the expenses associated with acquiring the necessary hardware and software tools for the project. The materials category includes server hosting costs required for the project's infrastructure. External services like QA and testing may also be outsourced to ensure high-quality deliverables. Finally, a contingency amount is included to cover any unexpected risks or changes that may arise during the project's execution.

It's important to note that this example is simplified and based on hypothetical figures. Project budgets may vary significantly depending on the project's complexity, duration, industry, and specific requirements. Project managers must thoroughly analyse their project's needs and consult relevant stakeholders to create a budget that accurately reflects the project's financial landscape.

By referring to examples and tailoring them to the specific project context, project managers can gain valuable insights into structuring and allocating costs effectively within a project budget.

6 Tips for Assigning a Project Budget as a Project Manager

Assigning a project budget as a project manager requires a strategic and informed approach. Consider these tips to effectively allocate resources, manage financial risks, and ensure the success of your project:

Tip #1: Involve Key Stakeholders

Engage key stakeholders early in the budgeting process to gain input and secure commitment. By involving stakeholders from the beginning, you can understand their expectations, align the budget with project objectives, and build a sense of ownership and collaboration.

Tip #2: Consider Project Phases

Break the project down into distinct phases and allocate resources accordingly. This approach enables better cost management, allowing you to allocate resources strategically based on the specific requirements of each phase. By aligning the budget with project milestones, you can track progress more effectively and adjust as needed.

Tip #3: Maintain Flexibility

Anticipate and allow for changes in project scope or requirements. Build flexibility into your budget to accommodate unforeseen circumstances or emerging priorities without compromising the project's financial stability. Having contingency funds or a reserve for unexpected expenses can provide a safety net and minimise disruptions.

Tip #4: Track Expenses Regularly

Establish a robust tracking mechanism to monitor actual expenses against the budgeted amounts. Regularly update your budget spreadsheet and analyse variances to identify potential issues and take timely corrective actions. You can proactively manage the budget and prevent cost overruns by closely monitoring expenses.

Tip #5: Communicate Transparently

Provide regular budget updates to stakeholders, highlighting any changes or deviations. Transparent communication builds trust and fosters collaboration. It allows stakeholders to understand the project's financial health and make informed decisions. Openly discuss budget challenges, progress, and cost-saving measures to ensure everyone is aligned.

Tip #6: Learn from Experience

Document lessons learned from past projects and incorporate them into future budgeting processes. Reflect on what worked well and what could be improved. By leveraging insights from previous experiences, you can refine your budgeting practices, enhance accuracy in estimating costs, and continuously improve your budget management skills.

Implementing these tips can help project managers effectively assign budgets, optimise resource allocation, and mitigate financial risks. Remember, a well-planned and well-managed budget is instrumental in achieving project objectives and ensuring stakeholder satisfaction.

Budgeting Software Solutions

In addition to the core principles of budgeting, project managers can benefit from leveraging budgeting software solutions. These tools are indispensable as they streamline the budgeting process and offer several advantages:

Advantages of Budgeting Software

1. Efficiency and Automation

Budgeting software automates complex budgeting tasks, reducing errors and saving time.

2. Integration and Collaboration

These tools integrate with project management software, fostering collaboration and alignment between budgeting and project planning.

3. Advanced Reporting

Budgeting software provides robust reporting and analytics, enabling informed decision-making.

4. Cost Monitoring and Control

Real-time expense tracking helps prevent cost overruns and allows for prompt corrective actions.

5. Scenario Planning

What-if analysis features aid in adapting to changing project requirements.

Notable Examples of Budgeting Software

Budgeting Software | Description |

Microsoft Excel | Widely used for smaller projects and simple budgets |

QuickBooks | Ideal for small to medium-sized businesses with basic budgeting needs |

Oracle NetSuite | Suited for large organisations with complex budgeting requirements |

Adaptive Insights | Offers comprehensive budgeting capabilities for various organisations |

SAP BPC | An enterprise-level solution for complex financial planning. |

Planful | Scalable cloud-based software suitable for organisations of all sizes. |

Table 2: Examples of Budgeting Software

Selecting the right budgeting software depends on your organisation's specific needs, budget complexity, integration requirements, and scalability goals. These tools significantly enhance budgeting efficiency and accuracy, contributing to project and financial management success.

Exploring Agile Budgeting in Project Management

As the world of project management continues to evolve, Agile methodologies have gained popularity due to their flexibility and adaptability. Agile budgeting is an approach that complements Agile project management, allowing project managers to embrace change as a norm.

Adapting Budgets to Agile Environments

In Agile project management, requirements often change throughout the project's lifecycle. Traditional budgeting approaches may struggle to accommodate these changes. Agile budgeting, on the other hand, allows project managers to revise budgets as requirements evolve. This ensures that financial resources are continuously aligned with project goals.

Continuous Budget Adjustments

Agile budgeting involves regular reassessment and adjustment of the budget. Project managers can allocate funds incrementally based on the most immediate project needs. This approach minimises financial waste and maximises the impact of available resources.

Embracing Change as a Norm

In Agile environments, change is expected and even encouraged. Agile budgeting acknowledges this reality and gives project managers the tools and mindset to adapt to changing circumstances. By embracing change as a norm, project managers can respond swiftly to market shifts and emerging opportunities.

The Future of Project Budgeting: AI and Predictive Analytics

The future of project budgeting is poised to embrace technology, particularly artificial intelligence (AI) and predictive analytics. These tools offer the potential to revolutionise the way project budgets are created and managed.

Leveraging AI for Accurate Cost Estimates

AI can analyse vast amounts of data to provide highly accurate cost estimates. By considering historical data, project specifics, and market trends, AI can generate budgets that are precise and adaptable to changing conditions.

Predicting Budget Deviations and Risks

Predictive analytics can identify potential budget deviations and risks before they materialise. Predictive analytics can provide early warnings by analysing various factors, such as resource allocation, project progress, and market conditions, allowing project managers to take proactive measures.

Real-time Budget Monitoring with Analytics

Traditional budget monitoring often relies on periodic reports. With analytics, project managers can access real-time data on-budget performance. This enables quicker decision-making and a more agile response to budget-related challenges. One such software that helps with this is Rodeo Drive.

Conclusion

Project budgeting is a cornerstone of successful project management. By understanding its importance, following a systematic approach, and embracing innovative tools and methodologies, project managers can ensure that their projects not only stay on budget but also achieve their objectives and deliver value to stakeholders. As the field of project management continues to evolve, staying informed about emerging trends and technologies, such as AI and predictive analytics, is crucial for staying ahead in the competitive landscape.

To help you excel in this crucial aspect of project management, make sure you check out our course, ‘Comprehensive Project Cost Estimating, Budgeting & Value Skills.’ This course will provide you with invaluable insights, techniques, and hands-on experience to successfully navigate the intricacies of project budgeting. Don't miss this opportunity to enhance your skills and drive your projects toward success.

With the right knowledge and tools, you can lead your projects to success, meet stakeholders' expectations, and confidently navigate the ever-changing landscape of project management.