Introduction

In today's rapidly evolving business landscape, organizations face a multitude of risks that can impact their operations, financial integrity, reputation, and regulatory compliance. Among these risks, control risk stands out as a critical consideration, encompassing the potential for internal control failures to lead to material misstatements, operational disruptions, cybersecurity incidents, and compliance breaches. As we look ahead to the future, several trends are reshaping the landscape of control risk management, driven by technological advancements, regulatory developments, changing business environments, and emerging risk factors. This article explores the key future trends in control risk management and examines how organizations can proactively navigate tomorrow's risk landscape to safeguard against evolving threats and uncertainties.

What Is Control Risk?

Control risk refers to the likelihood that an organization's internal controls, designed to ensure accurate financial reporting and compliance, may fail to detect or prevent material misstatements. It encompasses the risk that errors, fraud, or omissions could go undetected due to weaknesses in control mechanisms. High control risk increases the potential for inaccuracies in financial statements, impacting investor confidence, regulatory compliance, and overall organizational reputation. Effectively managing control risk involves robust risk assessment, implementation of control activities, continuous monitoring, and remediation of control deficiencies. Auditors play a crucial role in evaluating control risk through rigorous testing and assessment of internal control effectiveness, providing valuable insights to guide organizations in enhancing their control environments.

What Are the Different Types of Control Risk?

The different types of control risk can be categorized based on their underlying causes and manifestations within an organization's internal control environment:

Design Control Risk:

This type of risk relates to deficiencies in the design of internal controls. It occurs when control procedures are not adequately structured to mitigate specific risks or when there are inherent flaws in the control framework. For example, if segregation of duties is not appropriately implemented, leading to the possibility of unauthorized transactions going undetected, it represents a design control risk.

Operating Control Risk:

Operating control risk arises from failures or weaknesses in the execution or operation of internal controls. Even if control procedures are well-designed, they may not be consistently applied or effectively executed in practice. This can occur due to human error, lack of training, or inadequate supervision. For instance, if management does not enforce control procedures consistently across departments, it increases the risk of operational control failures.

Detection Control Risk:

Detection control risk pertains to the risk that internal controls may not effectively detect errors or irregularities when they occur. Even if controls are designed and operated correctly, if they lack sufficient monitoring or testing mechanisms, they may fail to identify issues in a timely manner. For example, inadequate reconciliation processes or insufficient data validation checks can lead to heightened detection control risk.

IT Control Risk:

With the increasing reliance on information technology (IT) systems, IT control risk has become a distinct category. It encompasses risks associated with IT controls, including cybersecurity vulnerabilities, data integrity issues, system downtime, and inadequate IT governance. Weaknesses in IT controls can significantly impact overall control effectiveness and increase the risk of data breaches or system failures.

Compliance Control Risk:

Compliance control risk refers to the risk of non-compliance with regulatory requirements, industry standards, or internal policies and procedures. Organizations must establish controls specifically aimed at ensuring compliance, such as regulatory reporting procedures, anti-money laundering measures, and ethical conduct policies. Failure to effectively manage compliance control risk can result in regulatory penalties, legal liabilities, and reputational harm.

Understanding and addressing these different types of control risk are crucial for organizations to enhance their internal control environments, mitigate vulnerabilities, and safeguard against financial misstatements, operational disruptions, and compliance breaches.

How Can Control Risk Be Managed?

Control risk can be effectively managed through a comprehensive approach that integrates robust risk assessment, implementation of control activities, continuous monitoring, and remediation of control deficiencies. Here are key strategies for managing control risk:

Risk Assessment:

Conduct thorough risk assessments to identify potential control weaknesses, vulnerabilities, and areas of heightened risk within the organization. Consider both internal and external factors that could impact control effectiveness, such as regulatory changes, technological advancements, operational complexities, and industry-specific risks.

Control Activities:

Implement and strengthen control activities designed to mitigate identified risks. This includes:

- Segregation of Duties: Ensure proper segregation of duties to prevent individuals from having incompatible responsibilities that could lead to errors or fraud.

- Authorization and Approval Processes: Establish clear authorization and approval procedures for transactions, expenditures, and access to sensitive information.

- Reconciliation and Review Procedures: Implement regular reconciliation processes and review mechanisms to detect discrepancies, anomalies, or irregularities in financial data and operational activities.

- Physical Controls: Implement physical controls, such as security measures and access controls, to protect assets and sensitive information from unauthorized access or theft.

Monitoring and Testing:

Continuously monitor and test the effectiveness of internal controls to ensure they are operating as intended and are capable of detecting and preventing risks. This includes:

- Internal Audits: Conduct regular internal audits to assess control effectiveness, identify control deficiencies, and provide recommendations for improvement.

- Data Analytics: Utilize data analytics tools and techniques to analyze large volumes of data for anomalies, trends, and potential control issues.

- Management Reviews: Engage management in regular reviews and discussions regarding control performance, risk mitigation strategies, and control environment enhancements.

Remediation of Control Deficiencies:

Promptly address and remediate identified control deficiencies to strengthen the control environment. This may involve:

- Action Plans: Develop and implement action plans to address specific control weaknesses, allocate resources effectively, and track progress toward remediation.

- Training and Awareness: Provide training and awareness programs for employees to ensure they understand control objectives, procedures, and their roles in maintaining effective controls.

- Technology Enhancements: Leverage technology solutions, such as automated controls, monitoring tools, and risk management software, to enhance control capabilities and streamline control processes.

Continuous Improvement:

Foster a culture of continuous improvement and risk awareness within the organization. Encourage feedback, collaboration, and knowledge sharing among departments to identify emerging risks, best practices, and opportunities for enhancing control effectiveness.

Table 1: Integrated Strategies for Control Risk Management

|

|

Risk Assessment: | Control Activities: |

Conduct thorough risk assessments to identify potential control weaknesses, vulnerabilities, and areas of heightened risk within the organization. Consider both internal and external factors that could impact control effectiveness, such as regulatory changes, technological advancements, operational complexities, and industry-specific risks. | Implement and strengthen control activities designed to mitigate identified risks. This includes: |

|

|

Monitoring and Testing: | Remediation of Control Deficiencies: |

Continuously monitor and test the effectiveness of internal controls to ensure they are operating as intended and are capable of detecting and preventing risks. This includes: | Promptly address and remediate identified control deficiencies to strengthen the control environment. This may involve: |

|

|

Continuous Improvement: |

|

Foster a culture of continuous improvement and risk awareness within the organization. Encourage feedback, collaboration, and knowledge sharing among departments to identify emerging risks, best practices, and opportunities for enhancing control effectiveness. |

|

By adopting these strategies and integrating them into the organization's risk management framework, control risk can be managed proactively, reducing the likelihood of material misstatements, operational disruptions, compliance breaches, and other adverse outcomes.

What Challenges Does Control Risk Present in the Digital Era?

The digital era has introduced several challenges related to control risk, primarily due to the increased complexity, interconnectedness, and rapid pace of technological advancements. Here are some of the key challenges that control risk presents in the digital era:

Cybersecurity Threats:

- One of the foremost challenges is the heightened risk of cybersecurity threats. With the proliferation of digital systems, cloud computing, and interconnected networks, organizations face threats such as data breaches, ransomware attacks, phishing scams, and malicious software vulnerabilities. Control risk in this context involves ensuring robust cybersecurity controls, data encryption, access management, and incident response protocols to mitigate cyber risks effectively.

Data Integrity and Quality:

- Maintaining data integrity and quality is another significant challenge. In the digital age, organizations generate vast amounts of data from multiple sources, including IoT devices, social media, and online transactions. Control risk arises from potential data inaccuracies, inconsistencies, or manipulation, which can lead to erroneous reporting, decision-making errors, and compliance violations. Implementing data governance frameworks, data validation processes, and data quality controls is essential to address these risks.

Compliance Complexity:

- Compliance with regulatory requirements and industry standards has become increasingly complex in the digital era. Organizations must navigate a multitude of regulations, such as GDPR, CCPA, HIPAA, and cybersecurity frameworks, while also addressing evolving privacy concerns, data protection laws, and cross-border data transfers. Control risk includes ensuring compliance with diverse regulatory mandates, conducting regular audits, and adapting control frameworks to meet changing regulatory landscapes.

Cloud and Third-Party Risks:

- The adoption of cloud services and reliance onthird-party vendors introduce additional control risk challenges. Organizations must manage risks associated with data storage, data access, service availability, and contractual obligations when using cloud platforms and outsourcing services. Control risk in this context involves assessing third-party security measures, conducting due diligence, establishing service level agreements (SLAs), and monitoring vendor performance to mitigate cloud and third-party risks effectively.

Emerging Technologies and Automation:

- Rapid advancements in emerging technologies such as artificial intelligence (AI), machine learning (ML), robotic process automation (RPA), and blockchain present both opportunities and challenges for control risk management. While these technologies offer efficiency gains and innovative solutions, they also introduce risks related to algorithmic biases, data privacy, system complexity, and control automation failures. Control risk entails implementing controls specific to these technologies, conducting risk assessments, and ensuring ethical use and governance of AI/ML algorithms and automated processes.

Skills and Talent Gap:

- Addressing control risk in the digital era requires specialized skills and expertise in cybersecurity, data analytics, IT governance, risk management, and regulatory compliance. Organizations often face challenges in recruiting and retaining talent with the necessary technical knowledge and experience to effectively manage control risks in a rapidly evolving digital landscape. Investing in training programs, talent development, and cross-functional collaboration can help bridge the skills and talent gap related to control risk management.

Navigating these challenges requires a proactive and strategic approach to control risk management, encompassing technological solutions, governance frameworks, risk assessments, compliance measures, and talent development initiatives tailored to the digital era's complexities and uncertainties.

What Are the Future Trends in Control Risk?

Several future trends are shaping the landscape of control risk management, driven by technological advancements, regulatory developments, changing business environments, and emerging risk factors. Here are some key future trends in control risk:

Increased Emphasis on Cybersecurity Controls:

- As cyber threats continue to evolve and pose significant risks to organizations, there will be an increased emphasis on strengthening cybersecurity controls. This includes implementing advanced threat detection technologies, enhancing data encryption and access controls, conducting regular penetration testing and vulnerability assessments, and fostering a cybersecurity-aware culture across the organization.

Integration of Artificial Intelligence and Automation in Control Monitoring:

- The adoption of artificial intelligence (AI), machine learning (ML), and automation technologies will revolutionize control monitoring and risk detection processes. AI-powered analytics tools can analyze vast amounts of data in real-time, identify patterns, anomalies, and potential control failures, and provide actionable insights for risk mitigation and decision-making.

Enhanced Data Privacy and Protection Controls:

- With the proliferation of data privacy regulations such asGDPR, CCPA, and evolving global privacy standards, organizations will focus on enhancing data privacy and protection controls. This includes implementing robust data encryption, anonymization techniques, data access controls, privacy impact assessments, and compliance monitoring mechanisms to safeguard sensitive information and ensure regulatory compliance.

Adoption of Agile and Flexible Control Frameworks:

- Traditional control frameworks are evolving to become more agile, adaptable, and responsive to dynamic business environments. Organizations are moving towards flexible control frameworks that can quickly adjust to changes in technology, market conditions, regulatory requirements, and organizational strategies. Agile control frameworks emphasize continuous monitoring, risk assessment, and iterative improvements to control effectiveness.

Integration of ESG (Environmental, Social, Governance) Factors into Risk Management:

- Environmental, social, and governance (ESG) considerations are increasingly becoming integral to risk management and control frameworks. Organizations are integrating ESG factors into their risk assessments, control activities, reporting mechanisms, and stakeholder disclosures to address sustainability risks, social impact issues, ethical concerns, and regulatory expectations.

Collaboration and Integration of Risk Management Functions:

- There is a growing trend towards greater collaboration and integration of risk management functions, including internal audit, compliance, cybersecurity, operational risk, and financial risk management. Integrated risk management (IRM) approaches facilitate a holistic view of risks, synergies in risk identification and mitigation efforts, and enhanced alignment with organizational objectives and strategic priorities.

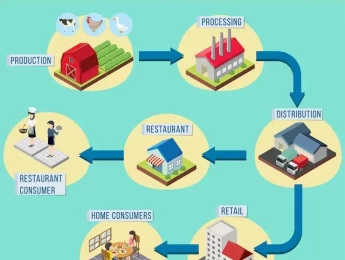

Focus on Resilience and Business Continuity Controls:

- The COVID-19 pandemic has underscored the importance of resilience and business continuity controls. Organizations will prioritize enhancing their resilience strategies, crisis management plans, remote work controls, supply chain resilience, and disaster recovery capabilities to mitigate disruptions, ensure operational continuity, and adapt to unforeseen risks and challenges.

Overall, the future of control risk management will be characterized by technological innovation, regulatory evolution, cross-functional collaboration, and a proactive approach to addressing emerging risks and uncertainties in an increasingly complex and interconnected business landscape.

Conclusion

In conclusion, as organizations navigate the complex and dynamic risk landscape of the future, effective control risk management will be paramount to ensuring resilience, sustainability, and success. The future trends outlined in this article, including advancements in cybersecurity controls, integration of AI and automation, enhanced data privacy measures, agile control frameworks, ESG integration, collaborative risk management approaches, and a focus on resilience and business continuity, present both challenges and opportunities. By embracing these trends, leveraging innovative technologies, fostering a risk-aware culture, and adopting proactive risk management strategies, organizations can strengthen their control environments, mitigate emerging risks, and seize competitive advantages in an increasingly interconnected and unpredictable business environment. As we continue to adapt to evolving risk dynamics, staying informed, agile, and forward-thinking will be essential for effective control risk management in the years to come.