- Table of Contents

- What Is a Digital Asset?

- 1. Cryptocurrencies

- 2. Stablecoins

- 3. Non-Fungible Tokens (NFTs)

- 4. Intellectual Property and Digital Rights

- 5. Digital Collectibles and Virtual Real Estate

- What Is the Difference Between Digital Assets and Other Files?

- Importance of Digital Assets

- Financial Inclusion and Accessibility

- Decentralisation and Trust

- Empowering Artists and Creators

- Intellectual Property Protection

- Streamlined Cross-Border Transactions

- Financial Innovation and Accessibility

- Transparency and Trust

- Digital Asset Management and Custody Services

- How to Manage Digital Assets

- 1. Secure Digital Wallets

- 2. Regular Backups

- 3. Stay Informed

- 4. Diversification

- 5. Be Mindful of Scams

- Leadership and Digital Assets

- 1. Embracing Innovation

- 2. Strategic Integration

- 3. Risk Management

- 4. Fostering a Culture of Learning

- 5. Sustainable Growth and Social Impact

- The Rise of Central Bank Digital Currencies (CBDCs)

- The Metaverse and Digital Asset Ownership

- Environmental Concerns and Digital Asset Sustainability

- Conclusion

Introduction

The term "digital assets" has become increasingly prevalent in today's digital age. As technology continues evolving, so does how we perceive, own, and exchange value. Digital assets represent a new frontier in the world of finance, art, and beyond, enabling us to unlock endless possibilities. In this comprehensive guide, we will explore the concept of digital assets, delve into their various types, like stablecoins and non-fungible tokens (NFTs), understand their significance, and explore how to manage these assets effectively.

What Is a Digital Asset?

A digital asset is any form of data, content, or information that holds intrinsic or extrinsic value to its owner. Unlike physical assets, digital assets exist purely electronically, residing on various digital networks, databases, or blockchain platforms. These assets can represent financial instruments, digital currency, art, music, intellectual property, and more. Their underlying ownership and potential for exchange distinguish them from traditional files.

Type of Digital Asset | Examples |

Cryptocurrencies | Bitcoin, Ethereum |

Stablecoins | USDC, DAI |

Non-Fungible Tokens (NFTs) | CryptoKitties, Beeple's artwork |

Intellectual Property | Patents, copyrights |

Digital Collectibles | NBA Top Shot, CryptoPunks |

Table 1: Types of Digital Assets

1. Cryptocurrencies

Cryptocurrencies are perhaps the most well-known and widely discussed digital assets. They are decentralised digital currencies that leverage blockchain technology to secure transactions and control the creation of new units. Bitcoin, often called digital gold, pioneered the cryptocurrency space, but thousands of other cryptocurrencies have since emerged, each with unique features and use cases.

Bitcoin (BTC): The first and most renowned cryptocurrency, Bitcoin serves as a store of value and a digital alternative to traditional currencies. Its scarcity and security features make it a popular choice for investors seeking a hedge against inflation.

Ethereum (ETH): Ethereum is a cryptocurrency and a platform for decentralised applications (DApps). Ether (ETH) is the native cryptocurrency of the Ethereum network, fueling smart contracts and decentralised finance (DeFi) applications.

2. Stablecoins

Stablecoins are digital assets designed to maintain a stable value by pegging their worth to external assets such as fiat currencies (e.g., USD, EUR) or commodities (e.g., gold, silver). The primary goal of stablecoins is to reduce price volatility, making them suitable for everyday transactions and remittances as a store of value.

USDC (USD Coin): USDC is a widely used stablecoin backed 1:1 by US dollars held in reserve by regulated financial institutions. This ensures that USDC's value remains stable and can be redeemed for an equivalent amount of US dollars.

DAI: DAI is a decentralised stablecoin on the Ethereum blockchain that maintains its stability through a system of collateralised assets and smart contracts. It is known for its algorithmic stability mechanism.

3. Non-Fungible Tokens (NFTs)

Non-fungible tokens (NFTs) represent a paradigm shift in the world of digital assets. Unlike cryptocurrencies, NFTs are unique and indivisible digital assets, making them the perfect solution for certifying the authenticity and ownership of digital creations. NFTs have gained immense popularity as they provide artists, musicians, and content creators a way to tokenise their work, creating a new market for digital art and collectables.

CryptoKitties: One of the early NFT success stories, CryptoKitties is a blockchain-based game where players collect and breed unique virtual cats. Each CryptoKitty is an NFT with distinct characteristics and value.

NBA Top Shot: NBA Top Shot is an NFT platform that allows users to buy, sell, and trade officially licensed NBA collectable highlights. Each highlight is represented as an NFT, making them verifiable and scarce digital collectables.

4. Intellectual Property and Digital Rights

Digital assets can also encompass intellectual property rights, including patents, copyrights, trademarks, and licences. These digital intellectual property representations allow creators and rights holders to protect their work and facilitate licensing and monetisation.

Digital Copyrights: Creators can tokenise their digital content, such as music or written works, as NFTs to establish ownership and facilitate royalty payments when their content is used or sold.

Patent Tokens: In the world of innovation, patent tokens can represent patent ownership. These tokens can be traded or licensed, streamlining the process of sharing and protecting intellectual property.

5. Digital Collectibles and Virtual Real Estate

Beyond art and collectables, digital assets extend to virtual collectables and real estate within virtual worlds and metaverse platforms. Users can purchase, trade, and develop digital assets in these virtual spaces.

Decentraland (MANA): Decentraland is a virtual world built on the Ethereum blockchain where users can buy, sell, and develop parcels of virtual land. The ownership of these parcels is represented by NFTs called LAND tokens.

Virtual Trading Cards: Various blockchain-based games and platforms offer virtual trading cards as NFTs. These cards can represent characters, items, or other in-game assets and can be collected, traded, or used within their respective ecosystems.

These diverse types of digital assets are transforming the way we perceive, own, and exchange value in the digital age. As technology continues to evolve, the possibilities for digital assets are only expanding, and their significance in finance, art, and intellectual property rights continues to grow. Understanding these various digital asset types is essential for individuals and businesses looking to navigate and leverage the digital asset landscape effectively.

What Is the Difference Between Digital Assets and Other Files?

It's crucial to understand the distinction between digital assets and regular digital files. While both may be stored electronically, the key difference lies in ownership and uniqueness. Digital assets can be owned and transferred and often have intrinsic value, while regular digital files lack these properties.

For example, a simple text document or an image on your computer is just a regular digital file. It holds information, but it does not necessarily have value the way a digital asset does, like a cryptocurrency or an NFT. Owning a digital asset means having the right to use, transfer, and, sometimes, even profit from that asset.

Aspect | Digital Assets | Other files |

Ownership & Value | Can be owned & valued | Lack intrinsic value |

Unique | Often unique & scarce | Replicable & common |

Exchangeability | Tradable & transferable | May not be transferable |

Proof of Authenticity | Verified on blockchain | No inherent verification |

Financial Potential | Potential for profit | Limited financial potential |

Intellectual Property | Represents IP rights | Contains IP content |

Use in Blockchain | Utilised on Blockchain | Not tied to blockchain |

Table 2: Digital assets vs. other files

Importance of Digital Assets

The rise of digital assets has brought about profound changes in various sectors, and its impact is only expected to grow. Let's explore the significance of digital assets in today's world:

Financial Inclusion and Accessibility

Digital assets, particularly stablecoins, hold immense importance in promoting financial inclusion. In many parts of the world, traditional banking services are inaccessible or costly for many of the population. Digital assets provide a viable alternative, allowing individuals without access to banking infrastructure to participate in the global economy. With a smartphone and internet connection, people can transfer money, make purchases, and even save without relying on traditional banks. This democratisation of financial services empowers individuals, especially in developing countries, to take control of their financial future.

Decentralisation and Trust

Digital assets, particularly those built on blockchain technology, contribute to decentralisation, reshaping how we perceive ownership and trust. In traditional financial systems, transactions often require intermediaries like banks or payment processors to validate and settle transactions. This centralisation creates single points of failure and can be susceptible to manipulation or fraud. However, blockchain-based digital assets operate on decentralised networks, eliminating the need for intermediaries and ensuring transparency and security in transactions. The trustless nature of blockchain allows participants to verify and validate transactions independently, reducing the chances of fraud and manipulation.

Empowering Artists and Creators

The emergence of non-fungible tokens (NFTs) has revolutionised the art and creative industries, bestowing significant importance on digital assets. Artists, musicians, writers, and content creators can now tokenise their work as NFTs, proving their ownership and authenticity on the blockchain. This new paradigm empowers creators with direct access to their audiences, cutting out middlemen and granting them more control over the distribution and monetisation of their creations. NFTs have transformed digital art into valuable collectables, enabling artists to receive royalties each time their works are resold. As a result, artists now have sustainable revenue streams and the opportunity to establish a lasting legacy in the digital world.

Intellectual Property Protection

Digital assets are critical in safeguarding intellectual property rights in the digital era. With the ease of replicating and sharing digital content, creators often face challenges in protecting their original works from unauthorised distribution and piracy. However, by using blockchain technology to mint NFTs, creators can establish an immutable record of ownership and provenance. This strengthens copyright enforcement and ensures that creators are appropriately credited and compensated for their creations. The advent of digital assets has raised awareness about the importance of protecting intellectual property rights and fostering a more equitable creative ecosystem.

Streamlined Cross-Border Transactions

Digital assets, particularly stablecoins, offer a practical solution for international transactions, addressing the inefficiencies and costs associated with cross-border payments. Traditional international money transfers can involve multiple intermediaries, high fees, and long processing times. In contrast, stablecoins can be transferred quickly and securely globally, eliminating the need for currency conversions and reducing transaction fees. This increased efficiency in cross-border transactions benefits businesses, travellers, and individuals sending remittances to their families in different countries.

Financial Innovation and Accessibility

Digital assets are at the forefront of financial innovation, driving the development of new financial products and services. They provide a fertile ground for experimentation, fostering the creation of decentralised finance (DeFi) platforms such as Uniswap, lending protocols, and yield-generating opportunities that were previously unimaginable in traditional finance.

Moreover, the accessibility offered by digital assets extends beyond financial services. It enables individuals to access a wide range of digital products and services, from online education to e-commerce, without the need for traditional banking intermediaries. This democratisation of access empowers people to engage in a global digital economy, regardless of their geographic location or financial status.

Transparency and Trust

Blockchain-based digital assets, in particular, contribute to transparency and trust in various industries. By recording transactions on an immutable and transparent public ledger, blockchain technology ensures that all stakeholders have access to the same information. This transparency can revolutionise supply chains, making them more efficient and reducing fraud and counterfeiting.

For instance, in the food industry, blockchain can be used to track a product's journey from its source to the consumer, ensuring the authenticity of organic certifications or tracing the origin of contaminated goods. This level of transparency can lead to safer, more accountable, and sustainable practices across industries.

Digital Asset Management and Custody Services

The increasing adoption of digital assets has given rise to specialised digital asset management and custody services. These services offer individuals and institutions secure solutions for storing and managing their digital assets, addressing concerns about asset protection and regulatory compliance.

Digital asset custodians employ advanced security measures, including cold storage solutions and multi-signature authentication, to safeguard clients' assets from theft and cyberattacks. They also assist with compliance, helping clients navigate the evolving regulatory landscape surrounding digital assets.

Institutional adoption of these services is a significant step towards mainstream acceptance of digital assets, as it provides traditional investors and financial institutions with the confidence and infrastructure needed to incorporate digital assets into their portfolios and services.

As we continue to witness the transformative power of digital assets, it's evident that their importance extends far beyond the financial realm. They have the potential to reshape industries, empower individuals, enhance transparency, and foster innovation in once-inconceivable ways. Understanding and harnessing the potential of digital assets will undoubtedly shape the future of value, technology, and society as a whole.

How to Manage Digital Assets

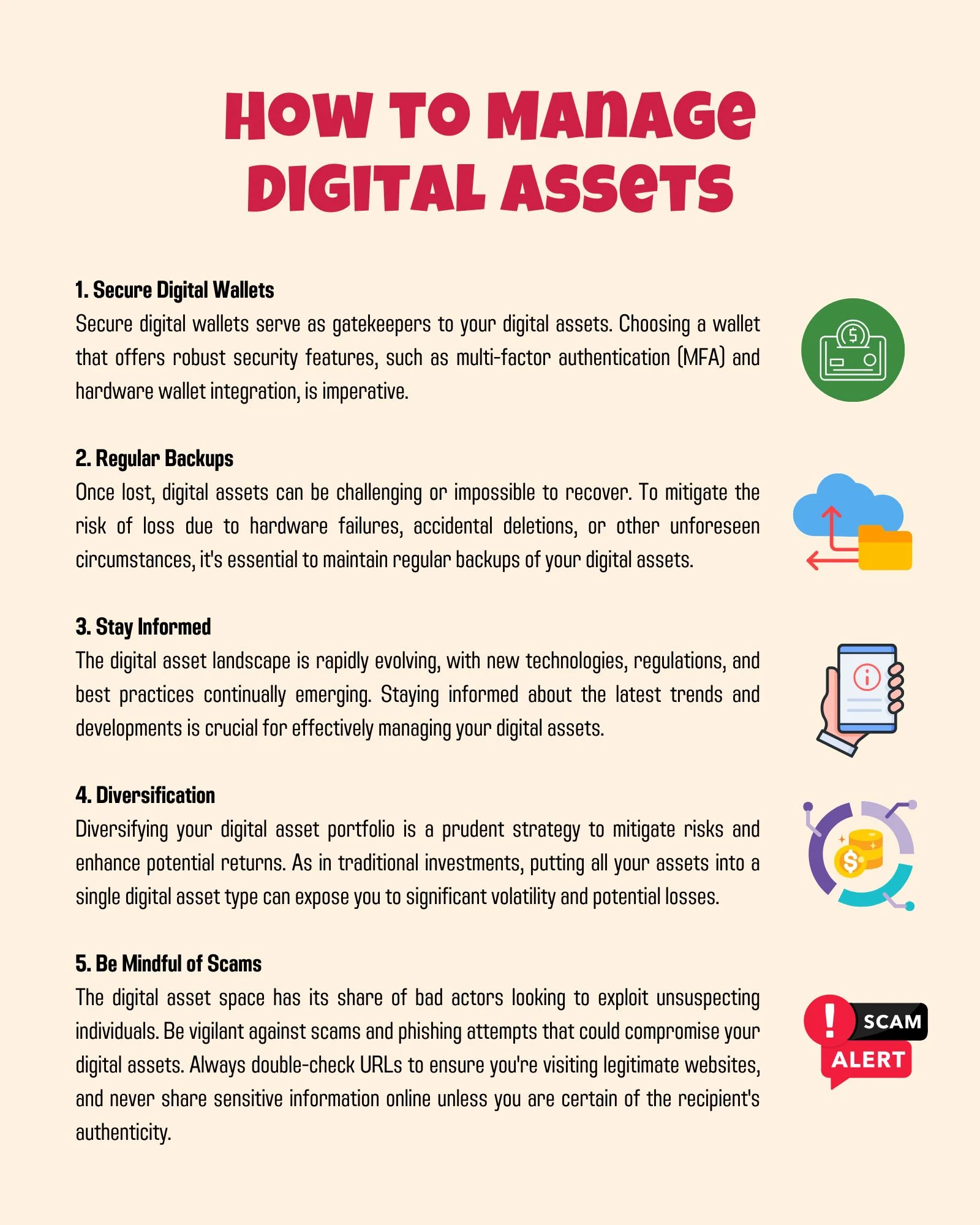

As digital assets continue to gain popularity, it becomes crucial for individuals and organisations to understand how to manage and secure them effectively. Here, we delve deeper into essential tips for managing digital assets, providing valuable insights for safeguarding your digital wealth:

1. Secure Digital Wallets

Secure digital wallets serve as the gatekeepers to your digital assets. Choosing a wallet that offers robust security features, such as multi-factor authentication (MFA) and hardware wallet integration, is imperative. Multi-factor authentication adds an extra layer of protection by requiring you to provide two or more verification forms, such as a password and a one-time code sent to your mobile device, before gaining access to your wallet. On the other hand, hardware wallets are physical devices that store your digital assets offline, making them highly resistant to online threats like hacking.

Additionally, ensure that you only download wallets from trusted sources and regularly update your wallet software to patch any security vulnerabilities that may arise.

2. Regular Backups

Digital assets, once lost, can be challenging or impossible to recover. To mitigate the risk of loss due to hardware failures, accidental deletions, or other unforeseen circumstances, it's essential to maintain regular backups of your digital assets. Backup solutions vary depending on the type of assets you hold:

Cryptocurrencies: Many cryptocurrency wallets provide backup phrases or private keys that you must securely store. These can be used to recover your assets if your wallet is lost or damaged.

NFTs and digital collectables: For NFTs and digital collectables, ensure that you have copies or records of the associated blockchain transactions and NFT ownership certificates. This documentation serves as proof of ownership.

For added security, consider using offline or hardware-based backup solutions. These backups should be stored in physically secure locations, such as a safe or a bank's safety deposit box.

3. Stay Informed

The digital asset landscape is rapidly evolving, with new technologies, regulations, and best practices continually emerging. To effectively manage your digital assets, staying informed about the latest trends and developments is crucial. Joining online forums, subscribing to reputable news sources, and participating in digital asset communities can help you keep up with the latest information.

Moreover, be aware of the regulatory environment in your jurisdiction. Digital asset regulations can vary widely from one country to another, impacting how you can legally use, transfer, and manage your assets. Staying informed about regulatory changes can help you avoid legal issues and ensure compliance with local laws.

4. Diversification

Diversifying your digital asset portfolio is a prudent strategy to mitigate risks and enhance potential returns. As in traditional investments, putting all your assets into a single digital asset type can expose you to significant volatility and potential losses.

Consider spreading your investments across various types of digital assets, such as cryptocurrencies, stablecoins, NFTs, and others, based on your risk tolerance and investment goals. Diversification can help balance the risk associated with the sometimes unpredictable fluctuations of individual assets, reducing the overall risk of your digital asset portfolio.

5. Be Mindful of Scams

The digital asset space has its share of bad actors looking to exploit unsuspecting individuals. Be vigilant against scams and phishing attempts that could compromise your digital assets. Always double-check URLs to ensure you're visiting legitimate websites, and never share sensitive information online unless you are certain of the recipient's authenticity.

Educate yourself about common scams and red flags, such as offers that seem too good to be true or unsolicited requests for personal information. Use secure communication channels and strong passwords to protect your digital assets from unauthorised access.

By implementing these advanced strategies for managing digital assets, you can confidently navigate the complex digital asset landscape, ensuring the safety and growth of your digital wealth while staying informed about emerging opportunities and challenges.

Leadership and Digital Assets

As the world transitions into the digital age, leaders across industries recognise digital assets' significance and potential to reshape traditional business models. In fact, according to Blockdata's findings, up until the close of 2022, 39 out of the top 100 companies, based on market capitalisation, have ventured into the NFT market. Embracing digital assets requires visionary leadership and an understanding of their unique opportunities and challenges. Let's explore how leaders can navigate this evolving landscape:

1. Embracing Innovation

Leadership in the realm of digital assets requires a proactive approach to innovation. It's essential for leaders to stay informed about the latest developments in blockchain technology, cryptocurrencies, and NFTs. By understanding the capabilities and limitations of these assets, leaders can identify new opportunities for their organisations and leverage them to gain a competitive advantage.

2. Strategic Integration

Digital assets offer various advantages to businesses, such as streamlining payment processes, reducing costs, and providing new revenue streams. However, their integration into existing business models requires thoughtful planning. Leaders must identify areas within their organisations where digital assets can create value and strategically integrate them into their operations. Whether it's accepting cryptocurrencies as payment or exploring NFT partnerships, a well-thought-out approach is essential.

3. Risk Management

As with any emerging technology, digital assets come with inherent risks. Market volatility, security concerns, and regulatory uncertainties are some of the challenges that leaders must address. An effective leader takes a proactive approach to risk management, identifying potential threats and implementing measures to mitigate them. This may involve robust security protocols, compliance with relevant regulations, and staying vigilant against market fluctuations.

4. Fostering a Culture of Learning

Leaders play a crucial role in shaping the culture of their organisations. Embracing digital assets often requires a shift in mindset and a willingness to explore new possibilities. Leaders can foster a culture of innovation and learning by encouraging their teams to experiment with digital assets, providing training and resources, and celebrating successful implementations. A culture that values adaptability and continuous learning will be better positioned to embrace the potential of digital assets.

5. Sustainable Growth and Social Impact

Digital assets have the potential to not only drive economic growth but also create positive social impact. Leaders who prioritise sustainability and social responsibility can leverage digital assets to support financial inclusion, environmental conservation, and social welfare initiatives. By aligning their organisations' goals with broader societal needs, leaders can demonstrate the ethical use of digital assets and contribute to a better future.

The Rise of Central Bank Digital Currencies (CBDCs)

In recent years, central banks worldwide have been exploring the concept of Central Bank Digital Currencies (CBDCs), a form of digital asset issued and regulated by governments. Unlike cryptocurrencies or stablecoins issued by private entities, CBDCs are backed by the full faith and credit of the issuing government. These digital currencies aim to combine the benefits of digital assets, such as fast and efficient transactions, with the stability and trust associated with traditional fiat currencies.

CBDCs can potentially revolutionise how we conduct monetary policy, financial transactions, and even cross-border trade. They could provide a secure and convenient means for individuals and businesses to transact with digital currency while also enabling governments to monitor and regulate economic activity more effectively.

The adoption of CBDCs represents a significant shift in the landscape of digital assets, blurring the lines between traditional finance and the digital world. As central banks continue to explore and pilot CBDC initiatives, it will be fascinating to see how these digital assets integrate into the broader financial ecosystem.

The Metaverse and Digital Asset Ownership

The metaverse concept, a virtual shared space where users can interact, create, and own digital assets, has gained substantial attention recently. Users can buy, sell, and trade digital assets within the metaverse, including NFTs, virtual real estate, and even digital fashion items for their avatars.

This emerging digital landscape introduces intriguing possibilities for the ownership and monetisation of digital assets. Imagine owning a virtual piece of land in a metaverse, which you can develop, rent, or sell to other users. Similarly, digital fashion items for avatars can be bought and sold, allowing users to express their unique style in the virtual world.

As the metaverse continues to evolve and expand, digital asset ownership becomes a matter of financial value and a means of self-expression and participation in a burgeoning digital society. The intersection of digital assets and the metaverse is exciting, blurring the lines between the physical and virtual worlds.

Environmental Concerns and Digital Asset Sustainability

While digital assets offer numerous advantages, they also have environmental considerations, especially with cryptocurrencies like Bitcoin. Mining cryptocurrencies consume significant amounts of electricity and have raised concerns about carbon emissions and sustainability.

Efforts are underway to address these environmental concerns, with some cryptocurrencies exploring more energy-efficient consensus mechanisms. Additionally, a growing trend of green cryptocurrencies prioritises sustainability by utilising renewable energy sources for mining operations.

The sustainability of digital assets is becoming increasingly important as environmental consciousness becomes a key factor in decision-making for investors and organisations. As the digital asset space matures, it will be intriguing to see how sustainability considerations shape the development and adoption of these assets, potentially leading to a more eco-friendly future for digital finance.

Conclusion

In conclusion, digital assets represent a groundbreaking convergence of finance, art, and technology, offering endless possibilities for those who grasp their potential. Whether you're an investor, a creator, or a leader guiding your organisation through this transformative era, understanding and effectively harnessing the power of digital assets is essential. To embark on a journey of technological leadership in this digital era, explore our comprehensive course, 'Technological Leadership for the Digital Era,' where you'll gain the knowledge and skills needed to navigate, innovate, and thrive in the rapidly evolving landscape of digital assets and technology. Don't miss this opportunity to stay at the forefront of the digital revolution and unlock new horizons of success.