The financial sector is extremely vast and undergoes constant changes and developments for various reasons. Organisations must assess market trends and changes to ensure their products and services can evolve to stay on track and continue to meet customer needs.

Effectively analysing sector development and changes is essential. An organisation must be fully aware of past and present financial market trends to adjust internal practices. This includes positive and negative changes and what influences them. Using this knowledge, management should be able to accurately predict future changes and efficiently strategize, plan, and prepare for them.

Many areas of an organisation need to be thoroughly considered to adjust to change successfully. Finance businesses must ensure risk management is held to the highest degree. All financial affairs come with a level of risk, and these need to be identified and minimised. Utilising various methods of measuring risk is vital to guarantee that all possible consequences are accounted for and preventative measures and solutions are in place.

Upon completion of this course, participants will be able to:

- Understand the importance of reflecting on industry changes.

- Examine key challenges faced within the banking and finance sector.

- Assess shareholder demands, goals, and objectives and determine how to manage them effectively.

- Effectively prioritise and manage strategic changes within the sector.

- Utilise various methods to develop and implement marketing, technology, operations and people strategies.

- Evaluate factors that influence change, attitudes surrounding change and how to manage change.

- Conduct risk assessments to measure and minimise potential risks.

- Comprehend the latest developments in money markets and financial instruments.

This course is designed for anyone with a leadership position within the financial sector who wishes to develop their knowledge about change and development. It would be most beneficial for:

- Senior Executives

- Banking Managers

- Chief Financial Officers (CFOs)

- Strategy and Development Managers

- Risk Managers

- Business Owners

- Sales/Marketing Managers

- Regional Managers

This course uses a variety of adult learning styles to aid full understanding and comprehension. Participants will assess case studies of established businesses within the financial sector to highlight key influencers of change.

Participants will be supplied with all the required tools to effectively participate in the provided learning exercises. Through a combination of seminars, guest speakers, group discussions, and group activities, they will be granted extensive opportunities to develop their knowledge and skills based on the taught content.

Day 5 of each course is reserved for a Q&A session, which may occur off-site. For 10-day courses, this also applies to day 10

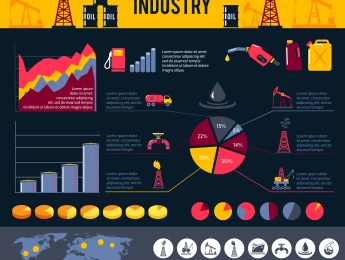

Section 1: Introduction to Financial Markets

- Defining the financial market and financial instruments.

- Assessing international regulations relating to financial markets.

- The necessity of financial documents – balance, off-balance sheets and income statements.

- Typical market services and products offered.

- Analysing past and present market trends and how to predict future changes.

- The role of securitisation and derivatives.

Section 2: Strategic Management

- Common strategic issues faced within the financial sector.

- The vitality of analysing competitors.

- The process of strategic planning, development and implementation.

- Utilise market analysis to strategically plan for future trends.

- Developing specific functional strategies relating to certain areas – marketing, technology, operations, organisation and people.

- Understanding how each area of the financial sector is intertwined.

Section 3: Management and Leadership

- The necessary skills of a leader to guide an organisation through change.

- Examining organisation structure and culture.

- Creating a workplace culture that is open to change.

- The concepts and principles of change management.

- Effectively managing cross functions.

- The benefits of building positive relationships within the workplace and with customers.

Section 4: Financial Management

- Evaluating organisation shareholders and their value within the organisation.

- The advantages and disadvantages of shareholders.

- Maintaining sustainable profit despite negative external and internal influences.

- Monitoring financial performance – profitability, liquidity and capital adequacy.

- The different types of business valuation models and how to analyse them.

Section 5: Risk Management

- The vitality of managing risks within the financial sector.

- Methods of identifying and measuring risk.

- Regulations and requirements of liquidity and capital adequacy.

- Carefully managing assets and liability.

- Risk mitigation in situations of unforeseen circumstances and unpredictable change.

- Analysing current and future challenges in bank management.

Upon successful completion of this training course, delegates will be awarded a Holistique Training Certificate of Completion. For those who attend and complete the online training course, a Holistique Training e-Certificate will be provided.

Holistique Training Certificates are accredited by the British Assessment Council (BAC) and The CPD Certification Service (CPD), and are certified under ISO 9001, ISO 21001, and ISO 29993 standards.

CPD credits for this course are granted by our Certificates and will be reflected on the Holistique Training Certificate of Completion. In accordance with the standards of The CPD Certification Service, one CPD credit is awarded per hour of course attendance. A maximum of 50 CPD credits can be claimed for any single course we currently offer.

- Course Code PF1-133

- Course Format Online, Classroom,

- Duration 5 days