- Table of Contents

- Introduction

- Who Are Nonprofit Treasurers?

- What Are the Roles and Responsibilities of Nonprofit Treasurers?

- 1. Financial Oversight and Planning

- 2. Record Keeping and Financial Transactions

- 3. Compliance and Risk Management

- 4. Financial Decision Support

- 5. Communication and Transparency

- 6. Investment Management

- 7. Financial Governance

- 8. Continuous Learning and Professional Development

- 10 Qualities Every Great Nonprofit Treasurer Possesses

- 1. Financial Acumen

- 2. Integrity

- 3. Attention to Detail

- 4. Communication Skills

- 5. Adaptability

- 6. Team Player

- 7. Tech Savviness

- 8. Analytical Thinking

- 9. Commitment to the Mission

- 10. Risk Management Skills

- Checklist After Transitioning into the New Role

- 1. Understand the Mission

- 2. Meet with Key Stakeholders

- 3. Review Financial Records

- 4. Familiarise Yourself with Regulations

- 5. Assess Technology Tools

- 6. Build a Support Network

- 7. Develop a Financial Strategy

- 8. Create a Communication Plan

- 9. Educate Yourself Continuously

- 10. Evaluate and Adjust

- Common Mistakes Non Profit Treasurers Commit

- 1. Lack of Communication

- 2. Ignoring Compliance Issues

- 3. Overlooking Risk Management

- 4. Neglecting Professional Development

- 5. Relying Solely on Past Practices

- How to Mitigate These Mistakes:

- How Can Comprehensive Financial Reports Facilitate a Nonprofit Treasurer’s Work?

- Income Statements

- Balance Sheets

- Cash Flow Statements

- Budget vs. Actual Reports

- Program-specific Reports

- How to Know If You’re Well Suited for the Job As a Nonprofit Treasurer

- 1. Passion for the Mission

- 2. Financial Acumen

- 3. Time Commitment

- 4. Collaborative Spirit

- 5. Attention to Detail

- 6. Willingness to Learn

- 7. Leadership Skills

- 8. Integrity and Trustworthiness

- How to Assess Your Suitability:

- The Future of a Nonprofit Treasurer Career

- In Conclusion

Introduction

In the dynamic realm of nonprofit organisations, the role of a treasurer holds a pivotal position. Nonprofit treasurers are the unsung heroes behind the scenes, managing the financial intricacies that fuel the engine of social change. This blog post delves into the world of nonprofit treasurers, exploring their identity, responsibilities, essential qualities, potential pitfalls, and the exciting future that lies ahead for those pursuing a career in this vital field.

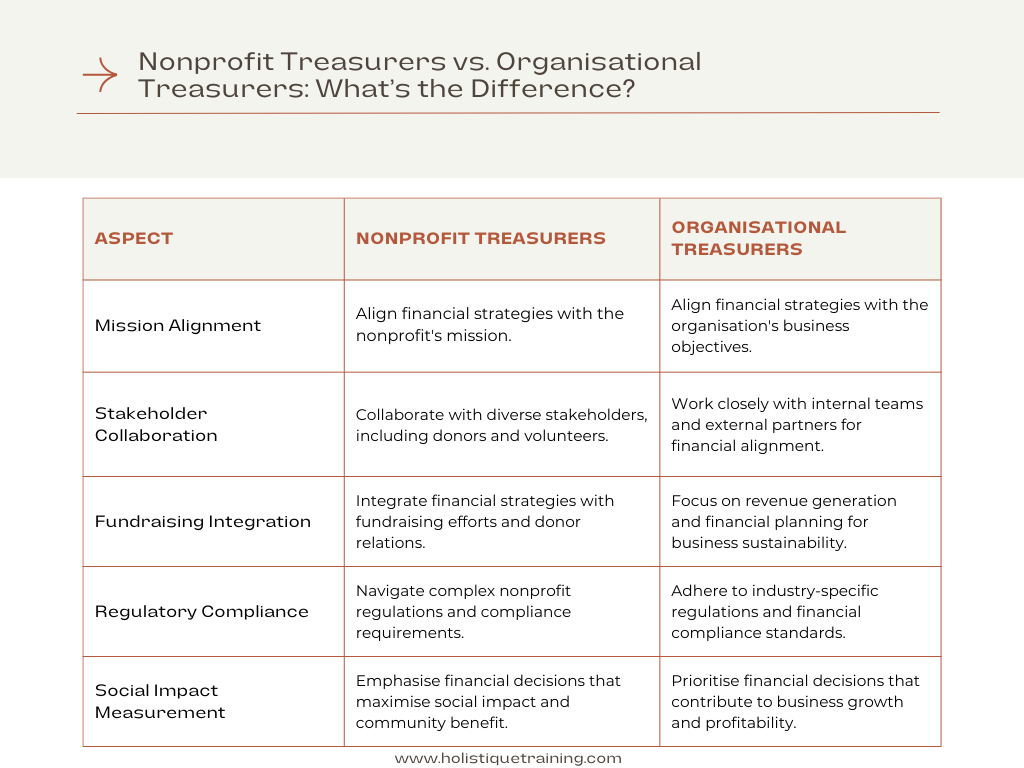

Who Are Nonprofit Treasurers?

Nonprofit treasurers are the financial stewards of organisations dedicated to social causes. They play a crucial role in maintaining the fiscal health of the organisation, ensuring that financial resources are allocated efficiently to support the mission. These individuals are often volunteers or board members with a strong financial acumen and a passion for the organisation's cause.

What Are the Roles and Responsibilities of Nonprofit Treasurers?

1. Financial Oversight and Planning

At the core of the treasurer's responsibilities is the meticulous oversight of the organisation's financial landscape. This involves:

Budget Management

Collaborating with key stakeholders to develop and manage the organisation's budget. Treasurers play a pivotal role in ensuring that financial plans align with the nonprofit's mission and strategic objectives.

Financial Forecasting

Anticipating the organisation's financial needs by developing accurate forecasts. This involves a keen understanding of the nonprofit's income streams, expenses, and potential fluctuations.

2. Record Keeping and Financial Transactions

Ensuring accurate and transparent financial records is paramount for compliance and accountability. Treasurers are tasked with:

Record Maintenance

Overseeing the accurate recording and documentation of all financial transactions, including donations, grants, and expenses.

Financial Reporting

Preparing regular financial statements that provide a clear snapshot of the organisation's fiscal health. These reports are crucial for informing board members, stakeholders, and donors about the organisation's financial performance.

3. Compliance and Risk Management

Navigating the complex landscape of financial regulations is a significant responsibility for treasurers. This involves:

Legal Compliance

Staying informed about and ensuring adherence to relevant financial laws and regulations. Nonprofit treasurers must ensure that the organisation operates within legal boundaries to maintain its reputation and standing.

Risk Assessment

Identifying and mitigating financial risks that could impact the organisation's stability. Treasurers play a key role in safeguarding the nonprofit against potential threats.

4. Financial Decision Support

Treasurers are not merely record keepers; they are strategic partners in decision-making. This includes:

Financial Analysis

Providing insightful analysis of financial data to inform strategic decisions. Treasurers help the board understand the financial implications of various choices and guide them in making informed decisions.

Resource Allocation

Collaborating with other board members to ensure that financial resources are allocated efficiently to support the organisation's programs and initiatives.

5. Communication and Transparency

Effective communication is a cornerstone of the treasurer's role. This encompasses:

Stakeholder Communication

Engaging with stakeholders, including board members, donors, and external partners, to communicate the organisation's financial status transparently.

Educating Board Members

Ensuring that all board members, regardless of their financial expertise, have a clear understanding of the organisation's financial situation. This involves presenting complex financial information in a comprehensible manner.

6. Investment Management

For organisations with substantial assets, treasurers may be involved in:

Investment Oversight

Managing and overseeing the organisation's investments. This includes working with investment advisors to ensure that the nonprofit's assets are growing responsibly.

7. Financial Governance

Treasurers play a critical role in ensuring strong financial governance within the organisation. This involves:

Internal Controls

Implementing and monitoring internal controls to prevent fraud and ensure the integrity of financial information.

Audit Preparation

Coordinating with auditors and preparing for financial audits to validate the accuracy of financial records.

8. Continuous Learning and Professional Development

Given the dynamic nature of the nonprofit sector, treasurers must:

Stay Informed

Continuously educate themselves about changes in financial regulations, emerging trends in nonprofit financial management, and best practices.

Professional Development

Actively seek opportunities for professional development to enhance their financial acumen and leadership skills.

In essence, nonprofit treasurers play a multifaceted role that goes beyond traditional financial management. They are not just stewards of the organisation's funds; they are strategic partners in steering the nonprofit towards financial sustainability and success. Balancing the responsibilities of financial oversight, compliance, communication, and strategic planning, treasurers are instrumental in ensuring that the organisation remains true to its mission and thrives in its pursuit of positive social impact.

Table 1: Day-to-day Key Performance Indicators (KPIs) for Nonprofit Treasurers

KPI | Description |

Cash Flow Monitoring | Ensure liquidity for daily operational needs. |

Expense Variance | Track and analyse budget vs. actual expenses. |

Donor Contribution | Monitor daily donations and contribution trends. |

Invoice Processing | Timely processing of invoices for financial accuracy. |

Compliance Checks | Regularly review and ensure adherence to financial regulations. |

10 Qualities Every Great Nonprofit Treasurer Possesses

The role of a nonprofit treasurer is one of great responsibility, requiring a unique blend of financial acumen, leadership, and passion for the organisation's mission. Successful treasurers possess a distinctive set of qualities that go beyond numbers, reflecting their ability to navigate the complex terrain of nonprofit financial management. Here are the ten qualities that distinguish a great nonprofit treasurer:

1. Financial Acumen

Great treasurers exhibit a profound understanding of financial principles and practices. They are adept at interpreting financial statements, analysing data, and making informed decisions to ensure the organisation's fiscal health.

2. Integrity

Integrity is the bedrock of a nonprofit treasurer's character. Dealing with sensitive financial information and making crucial decisions require unwavering honesty and transparency to maintain the trust of stakeholders.

3. Attention to Detail

Meticulous attention to detail is a non-negotiable quality for treasurers. The ability to spot discrepancies, identify trends, and ensure accuracy in financial records is essential to prevent errors that could have far-reaching consequences.

4. Communication Skills

Effective communication is a cornerstone of successful nonprofit leadership. Treasurers must convey complex financial information in a clear and understandable manner, fostering collaboration with other board members, staff, and external stakeholders.

5. Adaptability

Nonprofit organisations often operate in dynamic environments. Treasurers must be adaptable, capable of adjusting financial strategies to align with changing circumstances, emerging trends, and the evolving needs of the organisation.

6. Team Player

Collaboration is intrinsic to the success of any nonprofit. Great treasurers work seamlessly with other board members and staff, recognising the interconnectedness of financial decisions with the organisation's overarching goals.

7. Tech Savviness

In the era of digital transformation, treasurers need to be comfortable with financial software and technology tools. Proficiency in utilising technology not only streamlines financial processes but also positions treasurers to embraceinnovation in financial management.

8. Analytical Thinking

Nonprofit treasurers must possess stronganalytical skills to critically assess financial data. This involves not only understanding the numbers but also discerning the implications for the organisation and using this insight to inform strategic decision-making.

9. Commitment to the Mission

Passion for the organisation's mission is a driving force behind every great nonprofit treasurer. Beyond financial expertise, treasurers are motivated by a genuine dedication to the cause, inspiring confidence and commitment from other stakeholders.

10. Risk Management Skills

Navigating the uncertain terrain of nonprofit operations requires treasurers to be skilled in risk management. Identifying potential financial risks and implementing strategies to mitigate them safeguards the organisation's financial stability and resilience.

These ten qualities collectively form the foundation of a great nonprofit treasurer. It's not just about the numbers on a balance sheet; it's about embodying a holistic approach that combines financial expertise with ethical leadership, effective communication, and a deep commitment to the organisation's mission. The most successful treasurers seamlessly integrate these qualities into their roles, becoming true catalysts for positive change within the nonprofit sector.

Checklist After Transitioning into the New Role

Transitioning into the role of a nonprofit treasurer can be a significant undertaking. Here's a comprehensive checklist to help navigate this transition:

1. Understand the Mission

Immerse yourself in the organisation's mission and values. Understanding the overarching goals will guide your financial decisions and align them with the nonprofit's core purpose.

2. Meet with Key Stakeholders

Establish connections with key stakeholders, including board members, staff, and external partners. Gain insights into their perspectives on the organisation's financial landscape and foster collaborative relationships.

3. Review Financial Records

Conduct a thorough review of the organisation's financial records. Understand the historical financial performance, identify any outstanding issues, and familiarise yourself with the organisation's fiscal history.

4. Familiarise Yourself with Regulations

Stay abreast of relevant financial regulations and compliance requirements. Ensure a clear understanding of the legal framework within which the organisation operates to avoid potential pitfalls.

5. Assess Technology Tools

Evaluate the efficiency and suitability of existingfinancial management tools. Determine whether upgrades or changes are necessary to enhance the effectiveness of financial processes and reporting.

6. Build a Support Network

Establish a support network within the organisation. Identify mentors, advisors, or colleagues who can provide guidance and insights as you navigate your new role.

7. Develop a Financial Strategy

Collaborate with other board members to develop a comprehensive financial strategy. Ensure that this strategy aligns with the organisation's mission, goals, and long-term vision.

8. Create a Communication Plan

Develop a clear communication plan to keep stakeholders informed about the organisation's financial health. Define how and when financial information will be shared with board members, staff, donors, and other relevant parties.

9. Educate Yourself Continuously

Stay informed about emerging trends and best practices in nonprofit financial management. Dedicate time to ongoing education and professional development to enhance your skills and knowledge.

10. Evaluate and Adjust

Regularly assess the effectiveness of financial strategies. Be open to adjustments and refinements based on the organisation's evolving needs, changing circumstances, and feedback from stakeholders.

Each item on this checklist plays a crucial role in the successful transition into the role of a nonprofit treasurer. By systematically addressing these elements, treasurers can foster a deep understanding of the organisation, build strong relationships, and establish a solid foundation for effective financial leadership.

Common Mistakes Non Profit Treasurers Commit

Despite their best intentions, nonprofit treasurers may inadvertently make mistakes. Being aware of these common pitfalls can help avoid potential missteps:

1. Lack of Communication

One of the most common mistakes is a failure to communicate effectively. Treasurers may become so immersed in financial details that they overlook the importance of transparent communication with other board members, staff, and stakeholders. This lack of communication can lead to misunderstandings, erode trust, and hinder the organisation's overall effectiveness.

2. Ignoring Compliance Issues

Nonprofit organisations are subject to various financial regulations and compliance requirements. Treasurers who neglect to stay informed about these regulations may inadvertently expose the organisation to legal risks. Ignoring compliance issues can lead to financial penalties, damage the organisation's reputation, and even jeopardise its continued operation.

3. Overlooking Risk Management

In the pursuit of financial goals, treasurers might underestimate the importance of risk management. Failing to identify and address potential financial risks can leave the organisation vulnerable to unforeseen challenges, impacting its ability to fulfil its mission.

4. Neglecting Professional Development

The nonprofit sector is dynamic, with evolving financial standards and practices. Treasurers who neglect continuous learning and professional development may fall behind in their understanding of best practices, new regulations, and emerging trends. Stagnation in professional growth can hinder their effectiveness as financial leaders.

5. Relying Solely on Past Practices

Nonprofit organisations often face changing environments and circumstances. Treasurers who solely rely on past practices without adapting to current needs may find their financial strategies outdated and ineffective. Being resistant to change can impede the organisation's ability to respond to new challenges.

How to Mitigate These Mistakes:

1. Prioritise Communication

Establish a robust communication plan that ensures regular updates to board members and stakeholders. Foster an environment where financial information is shared transparently, and encourage questions and discussions.

2. Stay Informed About Compliance

Dedicate time to staying informed about financial regulations and compliance requirements relevant to the nonprofit sector. Consider seeking legal counsel or involving compliance experts to ensure the organisation remains in good standing.

3. Emphasise Risk Management

Conduct regular risk assessments and develop strategies to mitigate potential financial risks. Create a risk management plan that addresses both internal and external factors that could impact the organisation's financial stability.

4. Invest in Professional Development

Commit to continuous learning and professional development. Attend workshops,training programs, seminars, and conferences focused on nonprofit financial management. Stay connected with industry peers to exchange insights and best practices.

5. Embrace Change and Innovation

Be open to change and embrace innovation in financial management. Regularly reassess financial strategies and adapt them to align with the organisation's evolving needs. Encourage a culture of adaptability within the finance team.

How Can Comprehensive Financial Reports Facilitate a Nonprofit Treasurer’s Work?

Comprehensive financial reports are invaluable tools that empower non profit treasurers in their decision-making processes. These reports go beyond simple balance sheets, providing a holistic view of the organisation's financial health. Key components include:

Income Statements

Showcasing revenue and expenses, income statements provide a snapshot of the organisation's financial performance.

Balance Sheets

Offering a summary of assets, liabilities, and equity, balance sheets provide a comprehensive overview of the organisation's financial position.

Cash Flow Statements

Tracking the movement of cash within the organisation, cash flow statements help treasurers anticipate potential liquidity issues.

Budget vs. Actual Reports

Comparing budgeted figures with actual financial performance allows treasurers to identify variances and adjust strategies accordingly.

Program-specific Reports

Segmenting financial data based on specific programs or projects provides insights into the effectiveness of each initiative.

By leveraging these reports, treasurers can make informed decisions, identify areas for improvement, and communicate the organisation's financial story effectively to stakeholders.

How to Know If You’re Well Suited for the Job As a Nonprofit Treasurer

Taking on the role of a nonprofit treasurer is a substantial commitment that goes beyond financial expertise. Successful treasurers possess a unique blend of skills, traits, and passion for the organisation's mission. Here's a comprehensive guide to help individuals assess whether they are well suited for the job of a nonprofit treasurer:

1. Passion for the Mission

A genuine passion for the organisation's mission is a foundational requirement. Treasurers who are aligned with the cause are more likely to approach financial stewardship with dedication and enthusiasm, contributing to the organisation's overall success.

2. Financial Acumen

A solid understanding of financial principles and practices is essential. Treasurers should be comfortable interpreting financial statements, managing budgets, and navigating financial complexities to ensure the organisation's fiscal health.

3. Time Commitment

Being a nonprofit treasurer is not a role for the faint of heart. Assess your ability to dedicate the necessary time to fulfil the responsibilities effectively. Financial management, compliance, and strategic planning demand a significant time commitment.

4. Collaborative Spirit

Nonprofit settings thrive on collaboration. Treasurers must work seamlessly with other board members, staff, and external partners. A collaborative spirit ensures effective communication and alignment of financial strategies with organisational goals.

5. Attention to Detail

Meticulous attention to detail is non-negotiable. Treasurers deal with complex financial data, and even the smallest oversight can have significant repercussions. A keen eye for detail helps in maintaining accuracy and preventing errors.

6. Willingness to Learn

The nonprofit sector is dynamic, with evolving regulations and best practices. Treasurers should have a willingness to learn and stay informed about changes in the sector. An openness to continuous learning ensures adaptability to new challenges.

7. Leadership Skills

While the treasurer may not have a traditional leadership role, leadership skills are vital. Treasurers influence financial decisions that impact the entire organisation. Effective leadership fosters trust and confidence among stakeholders.

8. Integrity and Trustworthiness

Treasurers handle sensitive financial information and must operate with the utmost integrity. Trustworthiness is not just a quality but a foundation of the treasurer's relationship with the organisation, board, and donors.

How to Assess Your Suitability:

1. Reflect on Your Motivations

Ask yourself why you are interested in the role of a treasurer. If your motivation aligns with a genuine desire to contribute to the organisation's mission and not just a focus on financial tasks, you are on the right track.

2. Evaluate Your Financial Literacy

Assess your comfort level with financial concepts. If you have a solid understanding of financial statements, budgeting, and financial management, you are better positioned to navigate the treasurer's responsibilities.

3. Consider Your Availability

Evaluate your current commitments and assess whether you can realistically dedicate the time required for the treasurer's role. Balancing professional, personal, and volunteer commitments is essential for success in this position.

4. Assess Your Communication Skills

Effective communication is key. Reflect on your ability to convey complex financial information in a clear and understandable manner. If you can articulate financial insights to diverse stakeholders, you possess a valuable skill set.

5. Evaluate Your Collaborative Style

Consider your past experiences in collaborative environments. If you enjoy working with others, can foster a positive team dynamic, and appreciate the diversity of perspectives, you are well-suited for the collaborative nature of nonprofit work.

6. Determine Your Commitment Level

Assess your commitment to the organisation's mission. If you feel genuinely connected to the cause and are excited about contributing your financial expertise to support the mission, you are likely to find the role fulfilling.

7. Hone Your Attention to Detail

Reflect on your attention to detail in your past roles. If you have a track record of accuracy and thoroughness, you possess a critical quality for managing the intricate details of financial stewardship.

Becoming a nonprofit treasurer is not just about having financial know-how; it's about possessing a unique blend of passion, collaboration, and leadership. By honestly assessing your motivations, skills, and commitment level, you can determine whether the role of a nonprofit treasurer aligns with your strengths and aspirations. If you find that your values resonate with the mission, and you possess the necessary skills, taking on the role of a treasurer can be a rewarding journey of making a meaningful impact within the nonprofit sector.

The Future of a Nonprofit Treasurer Career

The landscape of nonprofit financial management is evolving, presenting both challenges and opportunities for treasurers. As the sector embraces technology anddata-driven decision-making, treasurers will need to enhance their digital skills. The demand for ethical financial leadership is also on the rise, emphasising the importance of treasurers in maintaining the trust of donors and stakeholders.

Moreover, the increasing complexity of financial regulations requires treasurers to stay informed and adapt their strategies accordingly. Collaborative partnerships between nonprofits and the business sector are also on the horizon, opening up new avenues for treasurers to leverage their skills in diverse settings.

In Conclusion

The role of a nonprofit treasurer is multifaceted and essential for the sustainability of organisations dedicated to social impact. By embodying key qualities, avoiding common pitfalls, and staying abreast of industry trends, treasurers can navigate the complexities of financial management successfully. As we look to the future, the role of nonprofit treasurers will continue to evolve, presenting exciting opportunities for those passionate about driving positive change through effective financial stewardship.