- Table of Contents

- Introduction

- Understanding Financial Reporting

- Types of Financial Reports

- 1- Income Statements

- 2- Balance Sheets

- 3- Cash Flow Statements

- Who Uses Financial Reports?

- The 3 Main Goals of Financial Reporting

- 1- Providing Information to Investors

- 2- Tracking Cash Flow

- 3- Analysing Assets, Liabilities, and Owner's Equity

- Statistics on the Use of Financial Reporting

- What Is Included in Financial Reporting?

- a) Audited Financial Statements

- b) Management Discussion and Analysis (MD&A)

- c) Notes to Financial Statements

- d) Other Supplementary Reports

- Why Is Financial Reporting Important?

- Informed Decision-Making for Stakeholders

- Building Trust and Confidence

- Facilitating Strategic Decision-Making

- Ensuring Compliance with Regulations

- Fostering Accountability

- Attracting Investors and Capital

- Benchmarking and Performance Evaluation

- Meeting Stakeholder Expectations

- Who Regulates Financial Reporting?

- What Is SORP?

- The Importance of SORP in Financial Reporting

- Tailoring Reporting Standards to the Non-Profit Landscape

- Enhancing Transparency and Accountability

- Addressing Complexities of Fund Accounting

- Navigating Regulatory Requirements

- Aligning Financial Reporting with Organisational Goals

- Ensuring Consistency and Comparability

- Guiding SORP-Making Bodies

- Facilitating Stakeholder Understanding

- How Can a Business Be Identified As a SORP-making Body?

- How Technology Is Facilitating Financial Reporting

- Automated Accounting Software

- Cloud-Based Platforms

- Data Analytics and Business Intelligence

- Artificial Intelligence (AI) and Machine Learning (ML)

- Blockchain Technology

- Integrated Financial Management Systems

- Mobile Reporting Apps

- Cybersecurity Measures

- Enhanced Visualisation Tools

- Regulatory Technology (RegTech)

- Conclusion

Introduction

In the complex world of business, where every decision carries financial implications, the importance of robust financial reporting cannot be overstated. This practice is not just a routine exercise; it's a crucial tool that enables stakeholders to comprehend a company's financial health, make informed decisions, and ensure accountability. To dive into this intricate web of numbers and analyses, it's essential to explore the core concepts of financial reporting and the significant role played by the Statement of Recommended Practice (SORP) in this dynamic field.

Understanding Financial Reporting

At its core, financial reporting is the process of summarising and communicating a company's financial performance and position. This goes beyond mere bookkeeping; it involves the meticulous compilation of financial data into comprehensive reports that provide a snapshot of a business's economic activities. These reports serve as the cornerstone for various stakeholders, offering insights into the company's past performance, current standing, and future prospects.

Types of Financial Reports

Financial reports come in various forms, each serving a distinct purpose. The most common types include:

1- Income Statements

The income statement, often referred to as the profit and loss statement, is a dynamic document that unveils a company's profitability over a specific period. This crucial report details the revenues generated and the expenses incurred during that time frame. It provides stakeholders with a snapshot of how well the company converted its sales into profit.

In dissecting an income statement, one encounters various components. Revenue, the lifeblood of any business, sits at the top, followed by the cost of goods sold (COGS), which represents the direct costs associated with producing goods or services. Subtracting COGS from revenue yields gross profit. Operating expenses, such as salaries, rent, and utilities, are then deducted to arrive at operating profit. Finally, after accounting for taxes and other non-operating expenses, net income is revealed—the bottom line that signifies the company's overall profitability.

2- Balance Sheets

While the income statement focuses on a specific period, the balance sheet provides a static snapshot of a company's financial position at a given moment. Often likened to a financial snapshot, the balance sheet articulates the company's assets, liabilities, and owner's equity.

Assets, comprising tangible and intangible elements like cash, inventory, and intellectual property, represent what the company owns. Liabilities, on the other hand, encompass debts and obligations, indicating what the company owes. The difference between assets and liabilities results in owner's equity, portraying the residual interest of the owners in the company. Thus, the balance sheet serves as a financial map, illustrating how a company's resources are financed and allocated.

3- Cash Flow Statements

Cash is the lifeblood of any business, and the cash flow statement is the document that tracks its circulation within the company. This report categorises the cash inflows and outflows into three main activities: operating, investing, and financing.

Operating activities involve cash transactions related to the core business operations, such as payments to suppliers and receipts from customers. Investing activities encompass cash flows related to the acquisition and disposal of long-term assets, like property and equipment. Financing activities include cash transactions with the company's owners and creditors, such as issuing stock, repurchasing shares, or paying dividends.

By meticulously tracking cash movements, the cash flow statement provides valuable insights into a company's liquidity and ability to meet short-term obligations. It acts as a financial compass, guiding stakeholders through the ebbs and flows of the company's financial currents.

In essence, these three types of financial reports—income statements, balance sheets, and cash flow statements—work in tandem, providing stakeholders with a comprehensive understanding of a company's financial performance, position, and liquidity. Together, they form the cornerstone of financial reporting, enabling investors, creditors, and management to make informed decisions and navigate the intricate landscape of business finance.

Who Uses Financial Reports?

The audience for financial reports extends beyond the company's internal team. Investors, creditors, regulatory bodies, and even employees use these reports to gauge different aspects of the business. Investors, for instance, rely on financial reports to make informed investment decisions and assess the potential returns and risks associated with a company.

The 3 Main Goals of Financial Reporting

Financial reporting serves three primary goals, each contributing to a comprehensive understanding of a company's financial landscape:

1- Providing Information to Investors

At the heart of financial reporting lies the commitment to providing essential information to investors. Investors, whether existing shareholders or potential stakeholders considering investment, rely on financial reports to make informed decisions. These decisions span a spectrum of considerations, from assessing the company's past performance to gauging its potential for growth.

Financial reports, particularly audited financial statements, serve as a window into the company's financial health. Investors scrutinise key metrics such as revenue growth, profit margins, and return on investment to evaluate the company's overall performance. The income statement, balance sheet, and cash flow statement collectively empower investors to assess the risks and rewards associated with their investment. This goal underscores the principle that transparency breeds confidence, fostering a trusting relationship between the company and its investors.

2- Tracking Cash Flow

Cash is the lifeblood of any business, and its efficient management is critical to sustained operations. The second goal of financial reporting is to provide a clear and detailed track record of a company's cash flow. The cash flow statement, a dedicated report for this purpose, meticulously categorises cash inflows and outflows into operating, investing, and financing activities.

By analysing the cash flow statement, stakeholders gain insights into the company's liquidity—its ability to meet short-term obligations. A positive cash flow signals financial health, indicating that the company generates more cash than it spends. On the flip side, a negative cash flow may suggest potential challenges in meeting immediate financial commitments. This goal ensures that stakeholders, including management and creditors, can navigate the liquidity waters with a clear understanding of the company's cash position.

3- Analysing Assets, Liabilities, and Owner's Equity

The third goal of financial reporting revolves around a comprehensive analysis of a company's balance sheet, unravelling the intricate dance between assets, liabilities, and owner's equity. This analysis is crucial for understanding the financial structure and solvency of the business.

Assets, representing what the company owns, can include tangible assets like property and inventory and intangible assets like patents and trademarks. Liabilities, comprising debts and obligations, showcase what the company owes to external parties. The difference between assets and liabilities results in owner's equity, reflecting the residual interest of the owners in the company.

By dissecting the balance sheet, stakeholders gain insights into the company's financial leverage, risk exposure, and overall financial health. This goal ensures that investors and creditors can evaluate the company's ability to meet long-term obligations and weather financial challenges.

In essence, the triad of financial reporting goals—providing information to investors, tracking cash flow, and analysing assets, liabilities, and owner's equity—paints a holistic picture of a company's financial landscape. It goes beyond the numbers, fostering transparency, accountability, and informed decision-making. As businesses navigate the dynamic currents of the financial world, these goals serve as a guiding triad, illuminating the path toward sustainable growth and financial well-being.

Statistics on the Use of Financial Reporting

In a recent survey by Deloitte, it was found that 35% of respondents prioritise financial reporting objectives related to data gathering and analysis across diverse industries. The survey highlights a predominant reliance on annual financial statements for statutory purposes, with a significant 74% utilising these reports to meet the needs of stakeholders such as owners, lenders, and fiscal administration. Interestingly, 54% of respondents indicated the lowest use of financial reporting for regulatory purposes. Furthermore, the survey unveils that email is the primary mode of receiving financial reports, with 36% favouring this method. Additionally, 36% use web interfaces, while 33% turn to the National Business Center website as a source for accessing periodic financial statements. These insights underscore the diverse ways organisations leverage financial reporting to fulfil distinct objectives and communicate with stakeholders.

What Is Included in Financial Reporting?

Financial reports typically include:

a) Audited Financial Statements

At the heart of financial reporting are the audited financial statements. These documents, including the income statement, balance sheet, and cash flow statement, undergo rigorous examination by external auditors to ensure accuracy and compliance with accounting standards. The income statement details revenues, expenses, and profits over a specific period. The balance sheet provides a snapshot of assets, liabilities, and owner's equity at a given moment. The cash flow statement tracks the movement of cash within the business. Together, these statements form the foundation of financial transparency, offering stakeholders a detailed look into a company's financial performance.

b) Management Discussion and Analysis (MD&A)

While financial statements provide the numbers, the Management Discussion and Analysis (MD&A) offers the narrative context. This section, often found in annual reports, serves as a bridge between the raw financial data and the strategic decisions made by the company. Here, management provides insights into the reasons behind financial results, outlines future plans, and addresses potential risks and challenges. MD&A transforms the numbers on the page into a coherent story, helping stakeholders understand the company's journey, its challenges, and its strategic vision.

c) Notes to Financial Statements

The devil is in the details, and the Notes to Financial Statements unveil the fine print behind the numbers. These supplementary notes provide additional information and explanations for specific line items in the financial statements. Whether it's detailing accounting policies, explaining contingent liabilities, or disclosing related-party transactions, the Notes section ensures transparency and clarity. Stakeholders seeking a deeper understanding of the financial statements can find valuable insights in this detailed commentary.

d) Other Supplementary Reports

In addition to the core components, financial reporting may include various supplementary reports, depending on the nature and complexity of the business. These reports could range from segment reporting and earnings per share calculations to environmental, social, and governance (ESG) disclosures. The goal is to offer stakeholders a holistic view of the company's financial and non-financial performance, aligning with the evolving expectations for transparency and accountability.

As financial reporting evolves, especially in response to changing regulatory landscapes and stakeholder demands, the inclusion of non-financial information becomes increasingly relevant. Modern financial reports may incorporate sustainability reports, diversity and inclusion metrics, and other key performance indicators that extend beyond traditional financial measures.

In summary, financial reporting is a comprehensive tapestry woven from audited financial statements, management narratives, supplementary notes, and evolving reporting practices. It goes beyond the numbers, incorporating qualitative and quantitative elements to provide stakeholders with a nuanced and holistic understanding of a company's financial position and performance. This intricate blend of information forms the basis for sound decision-making, fostering transparency and trust in the dynamic world of business.

Table 1: Steps of financial reporting

Step | Description |

1. | Compile financial data from diverse sources. |

2. | Prepare and analyse income, balance, cash statements. |

3. | Implement technology for accuracy and efficiency. |

4. | Adhere to regulatory standards and compliance. |

5. | Communicate findings transparently to stakeholders. |

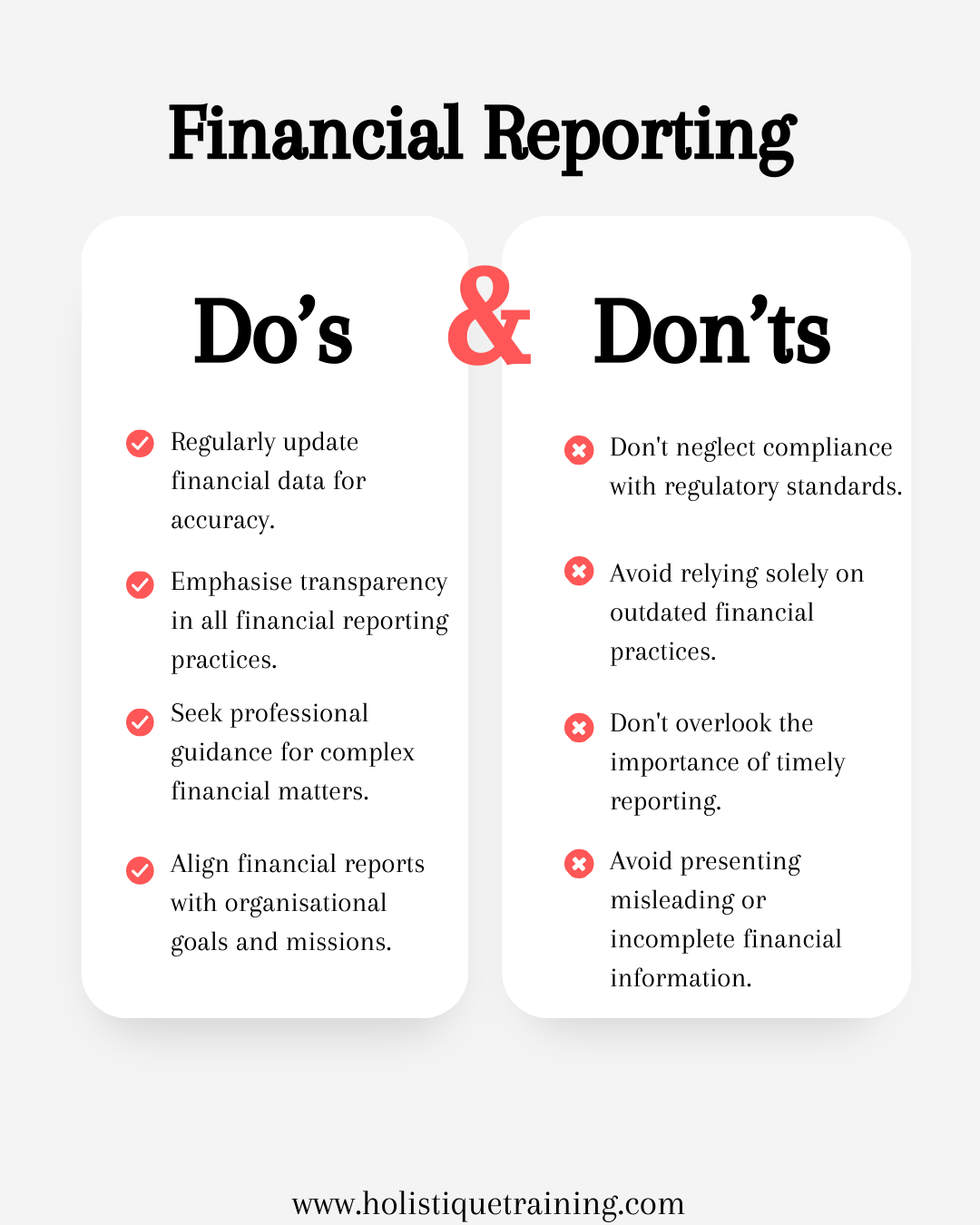

Why Is Financial Reporting Important?

Financial reporting is not a mere bureaucratic exercise or a ritualistic disclosure of numbers; rather, it serves as the cornerstone of transparency and accountability in the business world. Its importance extends far beyond regulatory compliance, shaping the way stakeholders perceive, engage with, and make decisions regarding a company. Let's delve into the reasons why financial reporting holds such paramount significance:

Informed Decision-Making for Stakeholders

Financial reports are the primary tools that investors, creditors, and other stakeholders use to makeinformed decisions. Investors, for instance, rely on these reports to assess the company's financial health, past performance, and growth potential. By analysing financial statements, they can gauge the risks and rewards associated with investing in the company. Similarly, creditors use financial reports to evaluate a company's creditworthiness before extending loans or credit.

Building Trust and Confidence

Trust is the bedrock of any successful business relationship. Financial reporting, by providing a transparent view of a company's financial position and performance, builds trust among stakeholders. When investors and creditors have access to accurate and timely financial information, they are more likely to trust the company and its leadership. Trust, in turn, enhances the company's reputation and credibility in the market.

Facilitating Strategic Decision-Making

For management and decision-makers within the company, financial reports are indispensable tools for strategic planning. These reports offer insights into the company's strengths, weaknesses, opportunities, and threats. By understanding financial trends, identifying areas of improvement, and forecasting future performance, management can make informed decisions that drive the company's growth and sustainability.

Ensuring Compliance with Regulations

Financial reporting is subject to a web of regulations and standards set by regulatory bodies such as the Securities and Exchange Commission (SEC) in the United States and the Financial Reporting Council (FRC) in the United Kingdom. Adherence to these standards ensures that companies operate within the legal framework and meet the expectations of regulatory authorities. Compliance, therefore, safeguards against legal repercussions and reinforces the company's commitment to ethical and responsible business practices.

Fostering Accountability

Financial reports serve as a tool for holding companies accountable to their stakeholders. Shareholders, employees, customers, and the public at large have a vested interest in understanding how a company manages its resources and finances. By making financial information publicly accessible, companies demonstrate a commitment to accountability and transparency, reinforcing their dedication to responsible corporate governance.

Attracting Investors and Capital

In the competitive landscape of business, attracting investors and securing capital is often crucial for growth and expansion. Well-prepared financial reports, showcasing a company's financial strength and growth potential, can attract investors looking for viable opportunities. Moreover, financial reports provide the necessary information forinitial public offerings (IPOs) and other fundraising activities.

Benchmarking and Performance Evaluation

Financial reports enable benchmarking, allowing companies to compare their financial performance with industry peers and competitors. This comparative analysis provides valuable insights into a company's relative standing, helping stakeholders identify areas of improvement or competitive advantage.

Meeting Stakeholder Expectations

In an era where stakeholders, including customers and employees, are increasingly interested in the broader impact of a company beyond financial metrics, financial reporting has expanded to include non-financial information. This may include environmental, social, and governance (ESG) disclosures, showcasing a company's commitment to sustainability, diversity, and ethical practices. Meeting these expectations enhances the company's reputation and resonates positively with socially conscious investors and consumers.

In short, financial reporting is a dynamic and integral aspect of corporate governance, playing a pivotal role in shaping stakeholder relationships, fostering trust, and driving strategic decision-making. Beyond its regulatory obligations, financial reporting is a powerful instrument for companies to communicate their narrative, demonstrate accountability, and navigate the complexities of the business landscape with transparency and integrity.

Who Regulates Financial Reporting?

Financial reporting is subject to stringent regulations and standards set by regulatory bodies. In the United States, the Securities and Exchange Commission (SEC) oversees financial reporting for public companies, while the Financial Accounting Standards Board (FASB) establishes accounting standards. In the United Kingdom, the Financial Reporting Council (FRC) plays a pivotal role in setting accounting and auditing standards.

What Is SORP?

The Statement of Recommended Practice (SORP) is a set of guidelines specifically designed to govern the financial reporting of non-profit entities, particularly those in the charitable sector. SORP offers a specialised framework to address the unique challenges faced by organisations driven by social or benevolent missions. Its primary aim is to ensure that financial reports accurately reflect the financial activities and position of these entities, aligning with the distinct nature of their operations.

SORP provides comprehensive guidance on various aspects of financial reporting, including fund accounting, disclosure requirements, and reporting practices tailored to the non-profit landscape. By adhering to SORP, organisations in the non-profit sector can communicate their financial narratives in a manner that goes beyond traditional reporting standards, offering transparency and clarity to stakeholders, donors, and the wider community. The adoption of SORP reflects a commitment to ethical financial practices, aligning financial reporting with the mission-driven objectives of non-profit entities.

The Importance of SORP in Financial Reporting

In the intricate realm of financial reporting, SORP stands out as a guiding beacon, especially for entities within the charitable and non-profit sector. Here’s why:

Tailoring Reporting Standards to the Non-Profit Landscape

The non-profit sector operates on a different plane compared to for-profit entities, driven by a mission to serve a cause rather than generate profits for shareholders. SORP recognises this distinction and tailors reporting standards to suit the specific needs and nuances of non-profit organisations. By providing specialised guidance, SORP ensures that financial reports for these entities are not only compliant with regulatory standards but also reflective of their unique operational structures and objectives.

Enhancing Transparency and Accountability

Transparency andaccountability are paramount in the non-profit sector, where organisations often rely on public trust and support. SORP plays a pivotal role in enhancing these qualities by offering a standardised framework for financial reporting. By adhering to SORP guidelines, non-profit organisations can communicate their financial activities in a clear and understandable manner, fostering trust among donors, beneficiaries, and the wider community.

Addressing Complexities of Fund Accounting

Non-profit organisations often engage in fund accounting, where resources are designated for specific purposes or projects. SORP recognises the complexities associated with fund accounting and provides guidance on how to appropriately report and disclose these activities. This ensures that financial reports accurately portray how funds are allocated, spent, and managed, allowing stakeholders to understand the impact of their contributions.

Navigating Regulatory Requirements

Financial reporting in the non-profit sector is subject to regulatory scrutiny, and SORP serves as a compass to navigate the evolving landscape of reporting standards. By staying abreast of SORP guidelines, non-profit organisations can ensure compliance with regulations and demonstrate a commitment to sound financial governance. This is particularly crucial in maintaining the organisation's reputation and standing within the sector.

Aligning Financial Reporting with Organisational Goals

SORP recognises that financial reporting is not just a compliance exercise but a strategic tool that should align with an organisation's mission and goals. It encourages non-profit entities to go beyond the numbers and provide contextual information that helps stakeholders understand the broader impact of their activities. This alignment ensures that financial reports become a comprehensive narrative, reflecting the organisation's commitment to its cause and the effective utilisation of resources.

Ensuring Consistency and Comparability

Standardisation is key to ensuring that financial reports are consistent and comparable across different non-profit organisations. SORP establishes a common language for reporting, making it easier for stakeholders, including donors, regulators, and researchers, to assess and compare the financial performance and impact of various organisations. This consistency contributes to the credibility of the non-profit sector as a whole.

Guiding SORP-Making Bodies

SORP is not a one-size-fits-all framework. It recognises the diversity within the nonprofit sector and allows for the development of specific SORPs tailored to different types of organisations. SORP-making bodies are responsible for creating and updating these guidelines. The guidance provided by SORP ensures that these bodies follow a structured approach, incorporating best practices and reflecting the evolving needs of the sector.

Facilitating Stakeholder Understanding

SORP goes beyond financial experts and accountants; it aims to make financial reporting accessible and understandable to a broader audience. By providing clear guidelines and promoting transparent communication, SORP facilitates a deeper understanding of financial reports among a diverse range of stakeholders, including board members, staff, volunteers, and the communities served by non-profit organisations.

In summary, SORP stands as a crucial instrument in the realm of financial reporting, offering tailored guidance for organisations committed to making a positive impact on society. Its importance goes beyond compliance, extending into the realms of transparency, accountability, and strategic communication. Through SORP, the nonprofit sector can navigate the intricacies of financial reporting with precision, ensuring that the true essence of their missions is reflected in the numbers and narratives they present to the world.

How Can a Business Be Identified As a SORP-making Body?

Identifying a business as a SORP-making body involves meeting specific criteria outlined by the relevant accounting authority. Generally, entities that fall under the charitable or non-profit sector and follow accrual accounting principles are required to adhere to SORP guidelines. This includes entities engaged in activities like education, healthcare, and social services.

How Technology Is Facilitating Financial Reporting

In the ever-evolving landscape of finance and accounting, technology has emerged as a transformative force, revolutionising the way financial reporting is conducted. From automation to data analytics, technological advancements are streamlining processes, enhancing accuracy, and providing real-time insights. Let's delve into the ways technology is facilitating financial reporting and reshaping the traditional paradigms of number crunching.

Automated Accounting Software

The advent of automated accounting software has been a game-changer in financial reporting. These robust systems automate routine bookkeeping tasks, such as data entry, reconciliation, and the generation of financial statements. By reducing the manual workload, these tools not only save time but also minimise the risk of human error, ensuring greater accuracy in financial reporting.

Cloud-Based Platforms

Cloud technology has ushered in a new era of collaboration and accessibility in financial reporting. Cloud-based platforms allow for real-time data sharing and collaboration among team members, even if they are geographically dispersed. This not only streamlines the financial reporting process but also enhances the transparency and efficiency of collaboration among different stakeholders involved in the reporting cycle.

Data Analytics and Business Intelligence

The rise of data analytics andbusiness intelligence tools has empowered organisations to derive meaningful insights from vast datasets. These tools enable financial professionals to analyse trends, identify patterns, and make data-driven decisions. In the context of financial reporting, data analytics enhances the depth and precision of analysis, providing stakeholders with a more nuanced understanding of financial performance.

Artificial Intelligence (AI) and Machine Learning (ML)

AI and ML technologies are reshaping financial reporting by automating complex tasks and predictive analysis. These systems can learn from historical data, identify anomalies, and predict future trends. In financial reporting, AI and ML contribute to forecasting accuracy, risk management, and fraud detection, thereby enhancing the reliability and predictive power of financial reports.

Blockchain Technology

Blockchain, primarily known for its role in cryptocurrencies, is finding applications in financial reporting, particularly in ensuring the integrity and security of financial data. The decentralised and tamper-resistant nature of blockchain makes it a robust tool for recording and verifying financial transactions. This can significantly reduce the risk of fraud and errors in financial reporting.

Integrated Financial Management Systems

Modern organisations are adopting integrated financial management systems that consolidate various financial functions into a unified platform. These systems seamlessly connect accounting, budgeting, forecasting, and reporting processes. By breaking down silos and fostering data continuity, integrated systems provide a holistic view of financial data, promoting consistency and accuracy across the entire reporting spectrum.

Mobile Reporting Apps

The proliferation of mobile reporting apps allows stakeholders to access financial information on-the-go. Executives, investors, and decision-makers can stay informed about key financial metrics and reports in real-time, enhancing agility and responsiveness. This mobile accessibility is particularly valuable in a business environment where quick decision-making is paramount.

Cybersecurity Measures

As financial reporting increasingly relies on digital platforms, robust cybersecurity measures have become essential. Technologies such as encryption, multi-factor authentication, and secure cloud protocols safeguard sensitive financial data from unauthorised access and cyber threats, ensuring the integrity and confidentiality of financial reports.

Enhanced Visualisation Tools

Visualisation tools are transforming how financial data is presented and interpreted. Dashboards and interactive graphs provide a visual representation of complex financial information, making it more accessible and comprehensible for stakeholders. This visual storytelling aspect enhances the communication of financial insights within the organisation.

Regulatory Technology (RegTech)

The intersection of technology and regulatory compliance, known as RegTech, is simplifying the adherence to evolving financial reporting standards. Automated compliance checks, monitoring tools, and data validation processes streamline the compliance journey, ensuring that financial reports align with regulatory requirements.

In short, the integration of technology into financial reporting processes is a paradigm shift that transcends mere digitisation. It represents a holistic transformation, enhancing efficiency, accuracy, and the overall quality of financial reporting. As organisations continue to embrace technological advancements, the future of financial reporting promises to be not only more technologically sophisticated but also more insightful, transparent, and responsive to the dynamic needs of the business environment.

Conclusion

Financial reporting is not just a routine chore but a dynamic process that shapes the way stakeholders perceive and engage with a company. From the intricacies of income statements to the guidelines provided by SORP, every facet contributes to building a transparent and accountable financial ecosystem. As technology continues to evolve, businesses must leverage these advancements to ensure their financial reporting remains not only compliant but also a valuable tool for strategic decision-making. In the intricate dance of numbers and narratives, financial reporting emerges as the compass guiding businesses through the ever-changing currents of the financial world.

Finally, if you’re looking to master the art of transparent and strategic financial reporting, make sure to check out our course, ‘Financial Reporting with Excel.’ Unlock the power of technology, understand the nuances of SORP, and transform routine reporting into a strategic advantage. From automating processes to mastering Excel's capabilities, this course equips you with the skills to navigate the complexities of modern financial reporting. Elevate your financial storytelling, ensuring your reports not only comply with standards but also become a catalyst for informed decision-making. Enrol now and chart a course toward financial excellence!