- Table of Contents

- Introduction

- What Is Risk Management?

- Why Is Risk Management Important?

- Safeguarding Assets

- Enhancing Decision-Making

- Seizing Opportunities

- Ensuring Business Continuity

- Building Stakeholder Trust

- Complying with Regulations

- The Steps of a Risk Management Plan

- 1. Establish the Context

- 2. Identify Risks

- 3. Assess Risks

- 4. Develop Risk Mitigation Strategies

- 5. Monitor and Review

- How Is Risk Management Different from Risk Assessment?

- Risk Appetite vs. Risk Tolerance

- Risk Appetite

- Risk Tolerance

- What Is the Difference Between Traditional and Enterprise Risk Management?

- Traditional risk management

- Enterprise risk management

- Risk Management Best Practices

- Foster a risk-aware culture

- Involve stakeholders

- Implement a structured risk management framework

- Conduct regular risk assessments

- Establish robust monitoring and reporting mechanisms

- Continuously improve

- Risk Management in Different Industries

- 1. Oil and Gas Industry

- 2. Human Resources (HR)

- 3. Finance Industry

- 4. Healthcare Industry

- 5. Information Technology (IT)

- Conclusion

Introduction

In today's dynamic and unpredictable business landscape, organisations face numerous uncertainties and potential hazards hindering their progress or even leading to failure. To navigate these challenges effectively, businesses must implement a proactive and strategic approach known as risk management. A well-crafted risk management plan enables organisations to safeguard their operations, enhance decision-making, and seize opportunities by identifying, assessing, and mitigating risks. In this blog post, we will delve into the core concepts of risk management, explore its significance, outline the steps involved in developing a risk management plan, differentiate it from risk assessment, and shed light on best practices to achieve optimal risk management outcomes.

What Is Risk Management?

Risk management can be defined as the systematic process of identifying, analysing, and responding to uncertainties and potential threats that may impact an organisation's objectives. It encompasses a set of activities aimed at minimising negative consequences and maximising opportunities. By understanding and managing risks effectively, organisations can enhance their resilience, protect their assets, and optimise their performance.

Why Is Risk Management Important?

The importance of risk management cannot be overstated. With 36% of organisations planning to boost their investments in risk management in the next two years, this clearly shows how vital it is. Risk management is a critical tool for organisations to navigate uncertainties and ensure the achievement of their goals. Here are several key reasons why risk management is vital:

Safeguarding Assets

Risk management plays a pivotal role in safeguarding an organisation's assets, both tangible and intangible. Tangible assets include physical properties, equipment, and inventory, while intangible assets comprise intellectual property, brand reputation, and financial resources. By identifying potential risks, organisations can implement preventive measures and contingency plans to protect these valuable assets from threats such as theft, natural disasters, cyber-attacks, or economic downturns. For instance, implementing cybersecurity protocols can safeguard sensitive data from cyber threats, ensuring the integrity and confidentiality of valuable information.

Enhancing Decision-Making

A robust risk management framework empowers decision-makers within an organisation to make informed choices. By assessing potential risks and their impacts, decision-makers gain valuable insights into the potential consequences of various courses of action. This informed decision-making process is critical for strategic planning, project execution, and resource allocation. For instance, understanding the risks associated with entering a new market allows businesses to evaluate the venture's feasibility and make decisions on market entry strategies, product pricing, and marketing campaigns, leading to more successful outcomes.

Seizing Opportunities

Risk management isn't merely about mitigating threats; it's also about identifying and capitalising on opportunities. By conducting a thorough risk analysis, organisations can identify emerging market trends, customer preferences, or technological advancements that present opportunities for growth and innovation. By embracing calculated risks, businesses can venture into new markets, launch innovative products, or invest in research and development, thereby gaining a competitive edge. Risk management enables organisations to weigh the potential rewards against the associated risks, allowing them to make strategic decisions that lead to business expansion and increased market share.

Ensuring Business Continuity

Disruptions can occur unexpectedly, ranging from natural disasters to supply chain disruptions or global pandemics. Effective risk management prepares organisations for these unexpected events, ensuring business continuity even in the face of crises. By developing contingency plans, organisations can minimise downtime, recover quickly, and resume operations. For example, having backup suppliers in place or establishing remote work protocols enables businesses to continue their activities during unforeseen circumstances, maintaining customer satisfaction and preventing revenue loss.

Building Stakeholder Trust

A proactive approach to risk management builds trust among stakeholders, including customers, investors, and employees. When stakeholders perceive that an organisation has a strong risk management strategy in place, they are more likely to invest in or engage with the business. Customers trust companies prioritising data security and product quality, leading to brand loyalty. Similarly, investors are more confident in organisations demonstrating effective risk management practices, indicating prudent financial management and sustainable growth. Furthermore, employees feel secure in their jobs when they know the organisation is prepared to handle uncertainties, fostering a positive work environment and higher productivity.

Complying with Regulations

Many industries are subject to stringent regulations and compliance standards. Risk management ensures that organisations adhere to these regulations, avoiding legal penalties and reputational damage. By identifying potential risks related to compliance, organisations can implement internal controls and policies to meet regulatory requirements. Compliance with regulations mitigates legal risks and enhances the organisation's reputation as a responsible and trustworthy entity, attracting customers and partners who prioritise ethical and compliant business practices.

Risk management is the cornerstone of a resilient and thriving organisation. By safeguarding assets, enhancing decision-making, seizing opportunities, ensuring business continuity, building stakeholder trust, and complying with regulations, businesses can confidently navigate uncertainties, enabling sustained growth and long-term success.

The Steps of a Risk Management Plan

Developing a comprehensive risk management plan involves several key steps. While the specific approach may vary depending on the organisation's size, industry, and objectives, the following general steps provide a solid foundation for creating an effective risk management plan:

1. Establish the Context

The first step in developing a risk management plan is establishing the context within which the organisation operates. This involves defining the organisational objectives, understanding stakeholder expectations, and identifying relevant legal, regulatory, and industry requirements. The risk management plan can be tailored to specific needs and challenges by gaining a comprehensive understanding of the organisational landscape.

2. Identify Risks

This phase involves identifying potential risks that may impact the organisation's objectives. Techniques such as brainstorming, conducting risk assessments, analysing historical data, and engaging stakeholders are employed. Organisations can generate a comprehensive list of risks specific to their operations and environment by considering internal and external factors. These risks can range from financial uncertainties to operational inefficiencies or even reputational damage.

3. Assess Risks

Once risks are identified, they need to be assessed regarding their potential impacts and likelihood of occurrence. Risk assessment allows organisations to prioritise risks based on severity and determine the most critical ones requiring immediate attention. Through quantitative or qualitative analysis, organisations can evaluate the potential consequences of each risk scenario. This step is crucial for effectively focusing resources on managing the most significant threats.

4. Develop Risk Mitigation Strategies

In this step, organisations design and implement appropriate risk mitigation strategies based on the assessed risks. These strategies can include risk avoidance (eliminating the risk altogether), risk transfer (shifting the risk to another party through insurance or contracts), risk reduction (implementing process improvements or controls to minimise the impact), and risk acceptance (acknowledging the risk and making informed decisions). Organisations may choose a combination of these approaches based on the nature and complexity of the risks identified.

5. Monitor and Review

Risk management is an ongoing and dynamic process that requires continuous monitoring and periodic review. Organisations should establish a robust monitoring system to detect emerging risks, track the effectiveness of risk mitigation strategies, and make necessary adjustments to the risk management plan when needed. Regular reviews ensure that the risk management plan remains relevant and responsive to evolving circumstances, effectively allowing organisations to adapt to changing market conditions and emerging threats.

By following these steps, organisations can create a robust risk management plan tailored to their specific needs and challenges. This proactive approach enables businesses to identify potential risks, assess their impact, implement appropriate mitigation strategies, and continuously monitor their effectiveness. As a result, organisations can navigate uncertainties with confidence, ensuring the protection of valuable assets, informed decision-making, and the ability to capitalise on opportunities.

How Is Risk Management Different from Risk Assessment?

Risk management and risk assessment are often used interchangeably but represent distinct stages within the broader risk management process. While risk assessment focuses on identifying and evaluating risks, risk management encompasses a more comprehensive approach that includes risk assessment and risk mitigation, monitoring, and review.

Risk assessment is a crucial component of risk management. It involves systematically identifying, analysing, and evaluating risks based on their likelihood and potential impact. Risk assessment provides organisations with a quantitative or qualitative understanding of the risks they face, enabling them to prioritise and allocate resources effectively.

On the other hand, risk management goes beyond risk assessment by incorporating risk mitigation strategies, monitoring mechanisms, and a continuous improvement cycle. It encompasses the entire risk lifecycle, from identification to response, and aims to minimise the negative consequences of risks while maximising opportunities.

Risk Appetite vs. Risk Tolerance

Two key concepts in risk management are risk appetite and risk tolerance. While they are related, they represent distinct perspectives on an organisation's approach to risk:

Risk Appetite

Risk appetite refers to the level of risk an organisation is willing to accept to pursue its objectives. It represents the organisation's strategic decisions regarding how much risk it is willing to take on to achieve its goals. Risk appetite is influenced by factors such as the organisation's risk culture, industry, regulatory requirements, and capacity to absorb potential losses.

Risk Tolerance

Risk tolerance, on the other hand, relates to the organisation's ability to withstand the impact of specific risks. It is the amount of risk an organisation is willing to tolerate before taking action to reduce or mitigate the risk. Risk tolerance is often quantified in terms of financial metrics, such as the maximum acceptable loss or the level of volatility that the organisation is comfortable with.

Understanding the difference between risk appetite and risk tolerance is crucial for organisations to align their risk management strategies with their overall objectives and constraints. By establishing clear risk appetite and risk tolerance statements, organisations can ensure that their risk management efforts align with their strategic goals and align with their risk-taking capacity.

KPIs | Description | Significance |

Risk Exposure Index | Quantifies overall organisational risk exposure | Provides a holistic view of risk levels |

Incident Response Time | Time taken to respond to risk incidents | Measures organisational agility in crisis |

Risk Mitigation Effectiveness | Evaluates success of risk mitigation strategies | Indicates the efficiency of risk management efforts |

Compliance Adherence Rate | Percentage of regulatory compliance met | Reflects adherence to legal and industry standards |

Stakeholder Confidence Index | Measures trust in the organisation's risk management | Indicates stakeholder faith in the organisation's ability to manage risks |

Table 1: Risk Management Key Performance Indicators (KPIs)

What Is the Difference Between Traditional and Enterprise Risk Management?

Traditional risk management and enterprise risk management (ERM) represent two approaches to managing organisational risks. While both aim to identify and mitigate risks, they differ in scope and strategic focus:

Traditional risk management

Traditional risk management typically focuses on managing risks within specific functions or departments of an organisation. It often operates in silos, with individual departments or business units responsible for identifying and mitigating risks related to their specific operations. This approach tends to be more reactive, focusing on operational risks and immediate threats.

Enterprise risk management

Enterprise risk management (ERM) takes a broader and more integrated approach by considering risks across the entire organisation. It encompasses strategic, financial, operational, and compliance risks and seeks to align risk management efforts with the organisation's overall objectives and risk appetite. ERM emphasises a proactive approach to risk management, considering both threats and opportunities, and promotes a risk-aware culture throughout the organisation.

While traditional risk management is effective in managing risks within specific areas, ERM provides a more holistic and strategic perspective. It allows organisations to understand the interdependencies between different risks and make informed decisions at an enterprise level.

Risk Management Best Practices

To achieve optimal outcomes in risk management, organisations can adopt the following best practices:

Foster a risk-aware culture

Establish a culture that recognises and values risk management as an integral part of decision-making. Encourage open communication, accountability, and a proactive risk identification and mitigation approach.

Involve stakeholders

Engage stakeholders across different levels and functions within the organisation. This inclusivity ensures diverse perspectives are considered, promotes ownership of risks, and facilitates effective risk response strategies.

Implement a structured risk management framework

Develop and implement a formal risk management framework that outlines clear roles, responsibilities, and processes. This framework should align with industry standards and regulatory requirements while being tailored to the organisation's specific context.

Conduct regular risk assessments

Assess risks regularly to identify emerging threats, evaluate the effectiveness of existing controls, and identify new risks that may arise due to changes in the organisation's environment. This ongoing assessment helps ensure the risk management plan remains relevant and responsive to evolving circumstances.

Establish robust monitoring and reporting mechanisms

Implement a robust system for monitoring and reporting risks. This will allow for early detection of emerging risks, facilitate timely risk response, and enable informed decision-making at all levels of the organisation.

Continuously improve

Embrace a culture of continuous improvement in risk management. Regularly review and evaluate the effectiveness of risk mitigation strategies, learn from past experiences, and adapt the risk management plan as necessary. It would also be helpful to stay up-to-date on all the latest risk management strategies to evolve and adapt as needed–by joining training programmes and courses occasionally.

Risk Management in Different Industries

Risk management is a universal concept that transcends industry boundaries. While the core principles of identifying, assessing, and mitigating risks remain consistent, the specific risks and strategies employed can vary significantly across different sectors. Here, we'll explore how risk management is applied in five diverse industries.

1. Oil and Gas Industry

The Oil and Gas industry is known for its exposure to various risks, from environmental and safety hazards to volatile commodity prices. Risk management is integral to ensuring the safety of employees and protecting the environment while also managing financial volatility. Key risk management practices in this industry include:

Health, Safety, and Environment (HSE) Risk

Mitigating risks associated with workplace safety and environmental regulations is a top priority. Comprehensive safety protocols, emergency response plans, and adherence to environmental standards are essential.

Market and Price Risk

Given the highly volatile nature of oil and gas prices, risk management strategies include hedging, diversification, and monitoring market trends.

Operational Risk

Effective maintenance, equipment reliability, and quality control are critical to minimising operational risks, ensuring uninterrupted production, and preventing accidents.

2. Human Resources (HR)

Risk management in the HR field minimises legal, financial, and operational risks related to personnel management. Key considerations include:

Employment Law Compliance

Adhering to labour laws and regulations to avoid costly legal disputes or penalties.

Workforce Planning

Ensuring an appropriate workforce size and skill mix to meet business needs and mitigate the risks of talent shortages.

Data Privacy and Security

Protecting sensitive employee information to prevent data breaches and maintain trust.

Performance Management

Identifying and addressing performance issues promptly to mitigate productivity and morale risks.

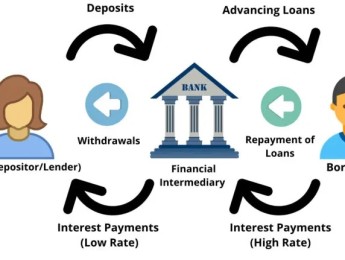

3. Finance Industry

In the finance sector, risk management is paramount, as financial institutions handle substantial amounts of money and investments. Key risk areas include:

Credit Risk

Assessing and managing the risk of borrower defaults, particularly in lending institutions.

Market Risk

Monitoring and managing the risks associated with fluctuations in financial markets, including interest rates, foreign exchange rates, and stock prices.

Operational Risk

Focusing on internal processes and systems to prevent fraud, errors, and disruptions.

Regulatory Compliance

Ensuring adherence to strict financial regulations to avoid legal and reputational risks.

4. Healthcare Industry

Healthcare organisations face unique risks associated with patient safety, regulatory compliance, and the complexity of medical procedures. Key risk management practices in healthcare include:

Patient Safety

Implementing protocols and guidelines to minimise medical errors and improve patient care.

Regulatory Compliance

Staying up-to-date with healthcare regulations like HIPAA to avoid fines and legal consequences.

Malpractice Risk

Managing risks associated with medical malpractice claims through thorough documentation, peer reviews, and insurance coverage.

Cybersecurity

Protecting patient data from data breaches and cyberattacks to maintain trust and compliance.

5. Information Technology (IT)

The IT industry faces various risks related to data security, technology advancements, and project management. Key risk management considerations include:

Cybersecurity Risk

Protecting systems and data from cyber threats, including viruses, malware, and data breaches.

Project Risk

Ensure that IT projects are delivered on time and within budget while meeting performance expectations.

Compliance Risk

Adhering to industry and data protection regulations, such as GDPR, to avoid legal and financial consequences.

Technology Obsolescence

Managing risks associated with rapidly evolving technology by keeping systems and software up-to-date.

Each industry's unique characteristics and challenges demand tailored risk management strategies. Organisations in these diverse fields can enhance their resilience and improve their long-term prospects for success by effectively identifying and mitigating sector-specific risks.

Conclusion

In today's complex and uncertain business landscape, risk management is crucial for organisations seeking to thrive and remain resilient. By implementing a well-designed risk management plan, organisations can identify, assess, and mitigate risks, protect valuable assets, informed decision-making, and capitalise on opportunities. By understanding the steps involved in developing a risk management plan, differentiating it from risk assessment, and embracing best practices, organisations can cultivate a risk-aware culture and enhance their overall performance in the face of evolving challenges and uncertainties.