- Table of Contents

- Introduction

- What Is an Inflation Hedge?

- How Inflation Hedging Works

- Hard Assets and Tangible Value

- Financial Instruments with Built-In Adjustments

- Equity Investments and Pricing Power

- Currency Diversification and Global Exposure

- Alternative and Real Assets

- Strategies of Inflation Hedging

- 1. Precious Metals

- 2. Real Estate

- 3. Commodities

- 4. Inflation-Protected Securities

- 5. Stocks and Equities

- 6. Foreign Currencies and International Diversification

- 7. Alternative Investments

- 8. Cryptocurrencies

- Blending Strategies for Maximum Effect

- Benefits of Inflation Hedging

- 1. Preservation of Purchasing Power

- 2. Wealth Protection for Retirees and Fixed-Income Earners

- 3. Portfolio Stability in Uncertain Times

- 4. Diversification Benefits

- 5. Long-Term Growth Potential

- 6. Protection Against Currency Depreciation

- 7. Psychological and Strategic Confidence

- Limitations of Inflation Hedging

- 1. No Perfect Hedge Exists

- 2. High Costs of Entry

- 3. Volatility Risks

- 4. Opportunity Costs

- 5. Complexity of Instruments

- 6. Short-Term Ineffectiveness

- 7. Policy and Market Uncertainty

- Real-World Examples of Inflation Hedging

- Example 1: Gold During the 1970s Inflation Crisis

- Example 2: Real Estate as a Long-Term Protector

- Example 3: TIPS During the 2008 Financial Crisis

- Example 4: Commodities in Emerging Economies

- Example 5: Bitcoin as a Modern Experiment

- Example 6: Diversification in Multi-Asset Portfolios

- Conclusion

Introduction

Periods of economic uncertainty often remind individuals, businesses, and governments of one of the most persistent forces in finance—inflation. As the cost of goods and services rises over time, purchasing power diminishes, and wealth can erode if it remains unprotected. Investors, savers, and institutions alike constantly seek ways to shield their assets from this gradual but relentless force. That is where the concept of inflation hedging comes into play.

This blog post explores the concept of inflation hedging in detail. We will examine what it means, how it works, and why it is considered a vital component of financial planning and investment strategy. We will also look into the different strategies used to hedge against inflation, the benefits and limitations of these approaches, and finally, some real-world examples that demonstrate how inflation hedging works in practice.

By the end of this discussion, you will gain a comprehensive understanding of how individuals and institutions can protect wealth from inflation, what tools are available, and what challenges accompany these strategies.

What Is an Inflation Hedge?

The current inflation rate is 2.7%, and it’s increasing. To help mitigate against it, inflation hedging comes into play. Aninflation hedge refers to any investment, asset, or financial strategy that is designed to protect against the declining value of money caused by rising inflation. Inflation, by definition, is the general increase in prices of goods and services over time, reducing the purchasing power of currency. If left unchecked, inflation can severely erode savings and diminish the value of fixed-income investments.

An inflation hedge works by either:

- Retaining value during inflationary periods (e.g., gold, real estate).

- Growing at a rate faster than inflation, thereby offsetting the loss of purchasing power (e.g., stocks, inflation-indexed bonds).

For instance, if annual inflation is running at 5%, and your investment grows by 7%, the real return is 2%. On the other hand, if your savings are sitting idle in cash, their effective value decreases by that same 5%. The fundamental idea of hedging is not necessarily to eliminate inflation’s effects entirely, but tominimize the negative impact and preserve wealth.

How Inflation Hedging Works

At its core, inflation hedging relies on the principle ofvalue preservation through asset behavior. Different asset classes respond differently to inflationary pressures, and understanding these responses is essential.

Hard Assets and Tangible Value

Physical or “hard” assets such as real estate, gold, or other commodities typically increase in value during inflationary periods. For example, when the costs of construction materials and labor rise, the market price of properties often climbs in tandem. Similarly, gold is viewed as a store of value because it is not tied to any government currency—when inflation undermines paper money, investors often flock to gold, driving its price higher.

Financial Instruments with Built-In Adjustments

Certain government-issued bonds, likeTreasury Inflation-Protected Securities (TIPS) in the United States, are explicitly designed to adjust in response to inflation. Their principal value rises with theConsumer Price Index (CPI), and interest payments adjust accordingly. This mechanism guarantees that investors’ returns are not eroded by rising prices. It is an example of a “direct hedge” because it is structurally linked to inflation rates.

Equity Investments and Pricing Power

Not all companies suffer equally during inflation. Businesses that produce essential goods—such as food, energy, or healthcare—often possesspricing power, meaning they can pass increased costs on to consumers without losing demand. For example, grocery chains can raise the price of bread and milk in line with inflation, ensuring their revenues grow as fast (or faster) than the rate of inflation. By investing in equities of such companies, investors indirectly hedge against inflation.

Currency Diversification and Global Exposure

Inflation is not uniform across all countries. For instance, one nation may experience double-digit inflation while another maintains price stability. Investors can hedge by holding assets denominated in stronger currencies, such as the Swiss franc or U.S. dollar, or by investing in global companies with revenues diversified across markets. This geographical spread cushions portfolios against localized inflation shocks.

Alternative and Real Assets

Investments such as infrastructure projects (toll roads, utilities, airports) often have contracts or pricing models that automatically rise with inflation. For example, toll fees or utility rates may be indexed to inflation, which ensures steady and inflation-protected cash flows for investors.

In short, inflation hedging works by combiningasset behavior, structural design, and market dynamics to counteract the erosion of purchasing power. Some hedges, like gold or real estate, rely on intrinsic value that moves in line with inflation. Others, like inflation-linked securities, rely on contractual mechanisms. And still others, such as equities, leverage the ability of businesses to adapt and grow in inflationary environments.

Strategies of Inflation Hedging

There is no universal or single perfect hedge against inflation. Instead, investors and institutions typically use acombination of strategies to balance risk and ensure protection against rising prices. Each approach comes with its own advantages, challenges, and suitability depending on the investor’s goals, time horizon, and risk appetite. Below are the most widely adopted and effective strategies for hedging against inflation:

1. Precious Metals

Gold has historically been regarded as theclassic inflation hedge. It carries intrinsic value, is universally recognized, and tends to move inversely with the U.S. dollar. When currencies lose purchasing power, demand for gold rises as people look for stability, which pushes its price higher. For instance, during the high inflation of the 1970s, gold prices surged dramatically.

Other metals such as silver, platinum, and palladium also function as inflation hedges, though they are more influenced by industrial demand, making them somewhat more volatile than gold. Investors can access precious metals through physical holdings, exchange-traded funds (ETFs), or mining company stocks.

2. Real Estate

Real estate is atangible asset that often appreciates in value as inflation rises. Rising construction costs, increased demand for housing, and higher rental rates tend to push property prices upward. Additionally, landlords often adjust rents to keep pace with inflation, which creates a natural income-based hedge.

Commercial real estate, in particular, can be an effective inflation hedge because leases often include clauses that allow for rent adjustments tied to inflation indices. Investors can gain exposure directly by owning property or indirectly throughReal Estate Investment Trusts (REITs), which offer more liquidity.

Aspect | Gold (Precious Metals) | Real Estate |

Asset Type | Tangible, physical metal | Tangible property or land |

Response to Inflation | Historically rises as currency loses value | Property values and rental income increase over time |

Volatility | Moderate, can fluctuate in short term | Lower short-term volatility, but market dependent |

Income Potential | None (capital gains only) | Rental income and potential appreciation |

Accessibility | High liquidity via ETFs, coins, and bullion | Requires significant capital and management effort |

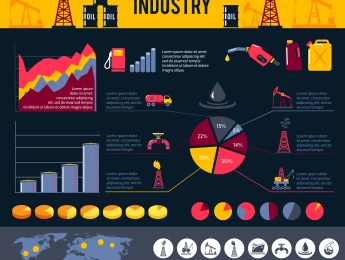

3. Commodities

Commodities such as oil, natural gas, agricultural products, and industrial metals usually experience direct price increases during inflationary periods. For example, rising fuel costs increase transportation expenses across industries, making energy commodities one of the most reliable hedges.

Investors can access commodities through futures contracts, commodity ETFs, or shares in commodity-producing companies. The key advantage is that commodities tend to have a strong positive correlation with inflation, making them highly responsive to inflationary pressures.

4. Inflation-Protected Securities

Government-issued instruments likeTreasury Inflation-Protected Securities (TIPS) in the U.S., or similar inflation-linked bonds in other countries, are designed specifically to hedge inflation. The principal value of these bonds rises with inflation, and interest payments adjust accordingly.

Because they are backed by governments, these securities offerlow-risk protection and are particularly attractive to conservative investors, retirees, or institutions with fixed-income liabilities. Their predictability and transparency make them one of the most direct and reliable hedges available.

5. Stocks and Equities

Equities can act as a hedge, but not all companies respond to inflation equally. Firms with strong pricing power, meaning they can pass rising costs onto consumers without losing demand, tend to perform best. For example, companies in sectors like consumer staples (food, beverages, household items), energy, and healthcare often weather inflation well.

Dividend-paying stocks can also provide a steady income stream that rises over time, helping offset inflation’s impact. Moreover, equity markets, in general, tend to grow faster than inflation in the long run, making them an essential component of any hedging strategy.

6. Foreign Currencies and International Diversification

When inflation erodes the value of a domestic currency, holding foreign currencies or assets denominated in those currencies can act as a hedge. For instance, investors in high-inflation economies often hold U.S. dollars, Swiss francs, or euros to preserve value.

Similarly, investing in international equities or bonds provides exposure to economies where inflation may be more controlled, creating a natural balancing effect. Global diversification spreads risk across multiple markets and currencies, reducing vulnerability to domestic inflation shocks.

7. Alternative Investments

Alternative assets such as private equity, hedge funds, and infrastructure investments are increasingly popular as inflation hedges. Infrastructure projects, like toll roads, pipelines, or utilities, often haveinflation-linked contracts that allow them to increase fees as inflation rises, ensuring stable and protected cash flows.

Hedge funds may use complex strategies, such as commodities trading or currency hedging, to deliver returns that are less correlated with inflation. While these options may not be easily accessible to all investors, they can offer significant inflation protection for institutions and high-net-worth individuals.

8. Cryptocurrencies

Although still controversial, cryptocurrencies—particularly Bitcoin—have been marketed as “digital gold.” Their appeal lies in theirlimited supply; for example, Bitcoin’s supply is capped at 21 million coins. This scarcity is seen as protection against the inflationary effects of governments printing money.

However, cryptocurrencies are highly volatile, speculative, and lack the long historical track record of traditional hedges like gold or real estate. For some investors, they may complement inflation-hedging strategies, but they should be approached with caution and only as part of a diversified portfolio.

Blending Strategies for Maximum Effect

No single strategy provides complete protection from inflation. A well-balanced inflation hedge usually involves ablend of assets. For instance, an investor may combine real estate for tangible growth, TIPS for guaranteed inflation protection, and equities for long-term appreciation. This layered approach balances security with opportunity, ensuring resilience across various inflationary environments.

Table: Metrics to measure the effectiveness of inflation hedging strategies

Metric | Description |

Real Return | The investment’s return after adjusting for inflation to assess true growth. |

Correlation with Inflation | Measures how closely the asset’s performance aligns with inflation rates. |

Volatility | Assesses the stability of the hedge and risk of price fluctuations. |

Purchasing Power Preservation | Evaluates how well the hedge maintains the investor’s buying power over time. |

Income Growth | Tracks whether cash flows (e.g., rent, dividends, bond interest) increase with inflation. |

Benefits of Inflation Hedging

The practice of inflation hedging offers numerous advantages for both individuals and institutions:

1. Preservation of Purchasing Power

The most fundamental benefit of inflation hedging is that it helps protect thereal value of money. For example, if annual inflation runs at 6% and your investments only grow at 2%, you are effectively losing 4% of your wealth in purchasing power. By holding assets that rise in value alongside or ahead of inflation—such as real estate or inflation-indexed bonds—you maintain your ability to buy the same goods and services tomorrow as you can today.

2. Wealth Protection for Retirees and Fixed-Income Earners

Inflation is especially damaging for retirees who depend on fixed pension payments or bond income. As prices rise, their ability to afford daily expenses shrinks. Inflation hedging strategies, such as investing in dividend-paying stocks or TIPS, provide a buffer by ensuring that income streams adjust or grow to keep pace with inflation, safeguarding retirement security.

3. Portfolio Stability in Uncertain Times

Inflationary spikes often bring volatility to markets, creating uncertainty for investors. By incorporating hedging strategies—like commodities, precious metals, or international assets—portfolios become more resilient. These hedges act asshock absorbers, reducing the risk of sharp declines in overall wealth during inflationary episodes.

4. Diversification Benefits

Many inflation hedges, such as commodities, real estate, and alternative investments, havelow correlation with traditional assets like stocks and bonds. This means they often move in different directions under certain economic conditions. Adding them to a portfolio not only protects against inflation but also enhances diversification, creating a more balanced risk-return profile.

5. Long-Term Growth Potential

Some hedges do more than just preserve value—they provide opportunities for wealth creation. For instance, real estate not only keeps up with inflation but can also appreciate significantly over time, generating rental income along the way. Similarly, equities in growth-oriented companies may outpace inflation by wide margins, turning a defensive strategy into a wealth-building one.

6. Protection Against Currency Depreciation

Inflation often leads to currency weakening. By holding assets like gold, foreign currencies, or international investments, individuals can offset the impact of domestic currency depreciation. This is particularly critical in countries experiencinghyperinflation, where traditional savings can lose value almost overnight.

7. Psychological and Strategic Confidence

Lastly, hedging provides something less tangible but equally valuable:peace of mind. Investors who have taken measures to shield their portfolios from inflation worry less about rising costs, allowing them to focus on long-term financial goals rather than reacting to short-term market turbulence. Businesses, too, can plan more confidently when they know their assets and revenues are safeguarded against inflationary shocks.

Limitations of Inflation Hedging

While the advantages are compelling, inflation hedging is not without drawbacks.

1. No Perfect Hedge Exists

Every asset that is commonly used as a hedge has weaknesses. Gold, for instance, may preserve value in the long term but can go through long stretches of stagnation. Stocks can grow faster than inflation, yet during periods of stagflation (slow growth with high inflation), equity markets often underperform. This means investors must accept that hedging can reduce but not completely remove the impact of inflation.

2. High Costs of Entry

Many of the most reliable hedges—such as real estate, infrastructure projects, or precious metals—require significant capital to access. Not all investors can afford to buy property or allocate large sums to commodities. Even financial products like inflation-linked bonds can be more accessible to institutional investors than to individuals in certain countries.

3. Volatility Risks

Some hedging assets come with their own risks. Commodities and cryptocurrencies, for example, can beextremely volatile. While they may rise during inflationary periods, they can also drop suddenly due to factors unrelated to inflation, such as geopolitical shifts or speculative trading. This volatility can undermine their role as steady hedges.

4. Opportunity Costs

By allocating money into inflation hedges, investors may miss out on higher returns elsewhere. For example, an investor who puts too much capital into gold—an asset that does not generate income—may lose opportunities to invest in equities or businesses that could yield greater long-term gains. The balance between safety and growth is not always easy to strike.

5. Complexity of Instruments

Some inflation-hedging tools, like TIPS, commodity futures, or hedge fund strategies, can bedifficult for average investors to understand and manage. Misusing these instruments, or entering them without full knowledge of their risks, may lead to unexpected losses. This complexity can also create barriers to access for retail investors compared to institutional players.

6. Short-Term Ineffectiveness

Not all hedges respond immediately to inflation. Real estate, for instance, may protect against inflation over decades, but in the short term, property values can stagnate or even decline due to interest rate hikes or reduced demand. Similarly, equities can lag during sudden inflation spikes before companies adjust pricing strategies.

7. Policy and Market Uncertainty

Governments and central banks often intervene in ways that complicate inflation dynamics. For example, interest rate hikes aimed at curbing inflation may depress certain hedges like real estate or equities. This unpredictability makes it difficult to rely on a single hedge as a guaranteed safeguard.

So, while inflation hedging is essential, it should be seen as part of abalanced financial plan. Hedging works best when combined with diversification, realistic expectations, and a clear understanding of both the benefits and the trade-offs involved.

Real-World Examples of Inflation Hedging

The concept of inflation hedging becomes much clearer when viewed through the lens of history and real-world financial markets. Different assets and strategies have shown their effectiveness during various inflationary periods across the globe. Below are some illustrative examples that demonstrate how investors have successfully used hedges in practice:

Example 1: Gold During the 1970s Inflation Crisis

The 1970s in the United States were characterized by soaring inflation due to oil shocks, wage pressures, and loose monetary policies. Inflation peaked at over 13% in 1979. During this decade, gold prices skyrocketed from about $35 an ounce in the early 1970s to nearly $850 an ounce by 1980. Investors turned to gold as a safe-haven asset, illustrating its long-standing reputation as a hedge against inflation and currency devaluation.

Example 2: Real Estate as a Long-Term Protector

In many major cities—London, New York, Singapore, and Hong Kong—real estate values have consistently outpaced inflation over multiple decades. Property not only retained its value but also generated rental income, which landlords were able to increase in response to rising living costs. For example, in London during the 1990s and 2000s, property prices surged far beyond inflation, rewarding long-term holders with both income and appreciation. This case underscores why real estate remains one of the most enduring inflation hedges.

Example 3: TIPS During the 2008 Financial Crisis

While the 2008 global financial crisis was more about credit markets and deflationary risks, it sparked investor anxiety about potential future inflation as governments engaged in massive stimulus spending. U.S. Treasury Inflation-Protected Securities (TIPS) became a go-to solution for conservative investors seeking guaranteed inflation protection. Their mechanism of adjusting principal and interest in line with inflation reassured investors and highlighted the role of structured financial products in hedging strategies.

Example 4: Commodities in Emerging Economies

Countries like Brazil and Russia, with economies heavily reliant on commodities, offer strong examples of how resources can act as inflation hedges. In Brazil, during periods of high domestic inflation, agricultural exports like soybeans and coffee provided investors with significant gains, offsetting local currency depreciation. Similarly, in Russia, oil and gas revenues surged during inflationary cycles, rewarding investors tied to these sectors.

Example 5: Bitcoin as a Modern Experiment

The 2010s and early 2020s brought a new kind of inflation hedge into focus—cryptocurrencies. Bitcoin, in particular, has been marketed as “digital gold” because of its capped supply of 21 million coins. During the COVID-19 pandemic, when governments injected trillions into economies, many investors flocked to Bitcoin as a hedge against potential inflation. While its volatility makes it a risky choice, the growing adoption of digital assets demonstrates how perceptions of hedging are evolving in the modern era.

Example 6: Diversification in Multi-Asset Portfolios

Large institutional investors, such as pension funds and endowments, often rely on diversified portfolios that combine multiple hedges. For example, theYale Endowment Model, pioneered by David Swensen, allocated substantial portions of the portfolio to real assets like real estate and commodities. This approach shielded the endowment from inflationary shocks while ensuring long-term growth, offering a model for how blending hedges can be more effective than relying on one asset class alone.

These examples demonstrate that inflation hedging is not theoretical—it is a practical necessity shaped by different times, places, and asset classes. From the timeless appeal of gold to the experimental use of Bitcoin, investors have continually sought tools to preserve wealth in the face of rising prices.

Conclusion

Inflation is an unavoidable economic reality that steadily erodes the value of money and undermines the security of unprotected savings. To counter this, individuals and institutions employinflation hedging strategies that aim to preserve purchasing power, stabilize portfolios, and secure long-term financial health.

While no single hedge is flawless, combining tools such as precious metals, real estate, inflation-protected securities, equities, and even newer instruments like cryptocurrencies can provide robust protection against inflation’s impact. The key lies in balancing benefits with limitations, understanding market dynamics, and aligning strategies with one’s financial goals and risk tolerance.

Ultimately, inflation hedging is not merely a defensive move—it is a proactive strategy that ensures wealth can withstand one of the most persistent challenges in economics. Whether for individuals planning retirement, businesses safeguarding assets, or governments stabilizing economies, the principle remains the same:protect today’s wealth to secure tomorrow’s prosperity.