- Table of Contents

- Introduction

- What is AI Fraud Detection in Banking?

- Why is AI Important in Fraud Detection for Banking?

- Volume of Transactions

- Speed of Detection and Response

- Evolving Threat Landscape

- Cost-Effectiveness

- Enhanced Customer Trust and Experience

- Comprehensive Risk Assessment

- Regulatory Compliance

- How Does AI Detect Fraud in Banking?

- 1. Machine Learning Algorithms

- 2. Natural Language Processing (NLP)

- 3. Behavioral Analytics

- 4. Network Analysis

- 5. Real-Time Monitoring

- 6. Anomaly Detection Techniques

- 7. Risk Scoring Models

- 8. Integration with External Data Sources

- AI-Powered vs. Traditional Fraud Detection: What’s the Difference?

- 1. Adaptability

- 2. Scalability

- 3. Accuracy

- 4. Speed of Detection

- 5. Cost Efficiency

- How to Implement AI in Your Financial Institution

- 1. Define Objectives

- 2. Data Collection and Preparation

- 3. Choose the Right Technology

- 4. Develop and Train Models

- 5. Pilot Testing

- 6. Integration with Existing Systems

- 7. Continuous Monitoring and Improvement

- 8. Staff Training and Change Management

- Real-Life Examples of AI Fraud Detection in Banking

- JPMorgan Chase

- HSBC

- American Express

- Mastercard

- Challenges of AI Fraud Detection in Banking

- 1. Ethical Considerations

- 2. Bias in Algorithms

- 3. Transparency and Explainability

- 4. Regulatory Compliance

- 5. Sustainability Concerns

- Conclusion

Introduction

The financial sector is undergoing a significant transformation, driven largely by technological advancements. Among these innovations, artificial intelligence (AI) stands out as a game-changer, particularly in the realm of fraud detection. This blog post delves into the concept of AI fraud detection in banking, exploring its importance, methodologies, and real-life applications. It will also address the challenges associated with implementing AI solutions, including ethical considerations and potential biases. By the end, readers will gain a comprehensive understanding of how AI is reshaping the landscape of banking security.

What is AI Fraud Detection in Banking?

AI fraud detection in banking refers to the use ofartificial intelligence technologies to identify and prevent fraudulent activities within financial institutions. This encompasses a range of techniques, including machine learning, natural language processing, and data analytics. AI systems analyze vast amounts of transaction data in real-time, identifying patterns and anomalies that may indicate fraudulent behavior.

Fraud can manifest in various forms, including credit card fraud, identity theft, account takeover, and money laundering. Traditional methods of fraud detection often rely on rule-based systems, which can be limited in their effectiveness. In contrast, AI systems learn from historical data, continuously improving their detection capabilities over time. This adaptive learning process enables banks to stay ahead of increasingly sophisticated fraud schemes.

Why is AI Important in Fraud Detection for Banking?

The significance of AI in fraud detection cannot be overstated. Several factors contribute to its importance:

Volume of Transactions

The banking industry processes millions of transactions daily, encompassing everything from routine deposits and withdrawals to complex investment trades. The sheer volume of data generated can overwhelm traditional fraud detection systems, which may struggle to keep pace. AI excels in handling large datasets, allowing it to analyze and interpret transaction information at scale. By leveraging machine learning algorithms, banks can sift through vast amounts of data to identify irregularities and potential fraud, something that human analysts would find nearly impossible to achieve in real-time.

Speed of Detection and Response

Fraudulent activities often occur in a matter of seconds. The faster a bank can detect and respond to suspicious transactions, the more effectively it can mitigate potential losses. AI systems operate in real-time, continuously monitoring transactions as they occur. When anomalies are detected, these systems can trigger immediate alerts, allowing banks to take swift action—such as freezing accounts or blocking transactions—before further damage occurs. This rapid response capability not only protects the bank’s assets but also enhances customer confidence in the institution's ability to safeguard their financial information.

Evolving Threat Landscape

Fraudsters are constantly developing new tactics and strategies to exploit vulnerabilities in banking systems. Traditional fraud detection methods, which rely on static rules and historical data, often fall short in addressing these evolving threats. AI, on the other hand, is designed to learn and adapt. By continuously analyzing new data and recognizing emerging patterns, AI systems can update their detection algorithms to stay ahead of fraud trends. This adaptability is crucial in a landscape where fraud techniques are becoming increasingly sophisticated. Alarmingly, cybercrime costs the global economy around$600 billion each year, accounting for approximately 0.8% of the world’s GDP. Furthermore, studies indicate that fraud attempts surged by 149% in the first quarter of 2021 compared to the previous year, largely driven by the increase in online transactions following the Covid-19 pandemic. In response to these challenges, over half of all financial institutions have opted to implement AI solutions for fraud detection and prevention as of 2022.

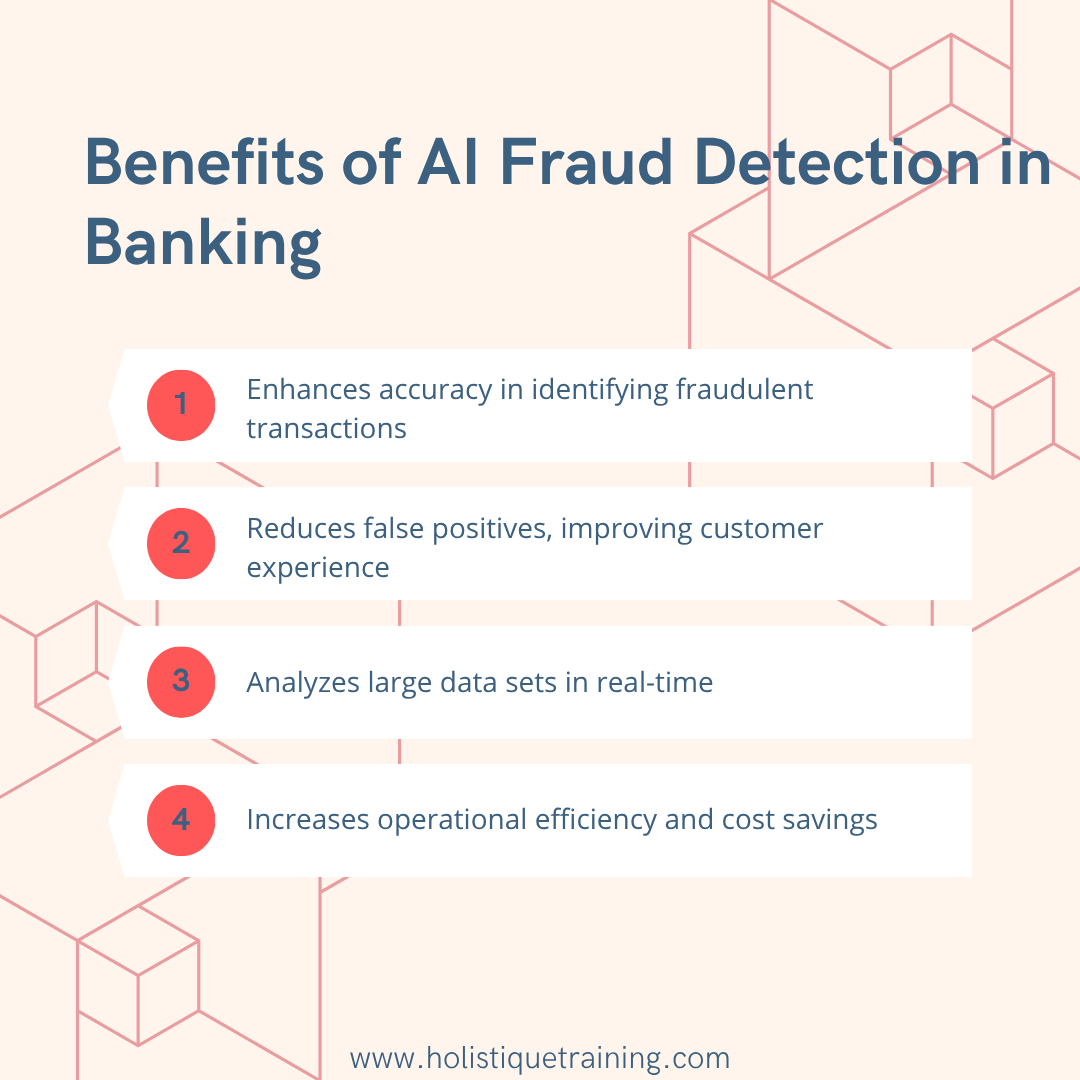

Cost-Effectiveness

ImplementingAI-driven fraud detection can lead to significant cost savings for banks. Traditional methods often require large teams of analysts to manually review transactions, which can be both time-consuming and expensive. By automating these processes, AI reduces the need for extensive human resources dedicated to fraud detection and investigation. Additionally, the reduction in false positives—where legitimate transactions are incorrectly flagged as fraudulent—can lead to lower operational costs and improved customer satisfaction, as fewer customers will face unnecessary account freezes or transaction denials.

Enhanced Customer Trust and Experience

In an era where digital banking is becoming the norm, customers expect their financial institutions to provide secure and seamless services. A robust AI fraud detection system not only protects customers from financial loss but also enhances their overall banking experience. When customers feel confident that their transactions are monitored effectively and that their financial information is secure, they are more likely to maintain their relationship with the bank. This trust can translate into increased customer loyalty, positive word-of-mouth, and ultimately, higher revenues for the institution.

Comprehensive Risk Assessment

AI technologies enable banks to conduct more comprehensive risk assessments by analyzing a broader range of factors beyond just transaction history. For instance, AI can incorporate external data sources, such as social media activity or device information, to build a more holistic view of customer behavior. This multidimensional analysis allows banks to better understand risk profiles and tailor their fraud detection strategies accordingly. By identifying high-risk customers or transactions, banks can implement targeted measures to mitigate potential fraud before it occurs.

Regulatory Compliance

As regulatory requirements around fraud prevention become more stringent, banks must ensure they are compliant with laws and guidelines. AI can assist in this area by automating compliance checks and reporting, reducing the burden on human resources. AI systems can also help banks maintain detailed records of theirfraud detection efforts, demonstrating due diligence in preventing financial crimes. This not only helps banks avoid penalties but also reinforces their commitment to ethical practices and customer protection.

In summary, the importance of AI in fraud detection for banking extends far beyond mere efficiency. It encompasses the ability to manage large volumes of data, respond swiftly to threats, adapt to evolving fraud tactics, and ultimately foster trust and confidence among customers. As the banking industry continues to navigate the complexities of digital transactions, AI will remain a critical component in safeguarding financial institutions and their clients against fraud.

How Does AI Detect Fraud in Banking?

AI fraud detection employs various techniques to identify fraudulent activities. Here are some key methodologies:

1. Machine Learning Algorithms

Machine learning (ML) forms the backbone of AI fraud detection systems. These algorithms enable banks to analyze historical transaction data and identify patterns associated with both legitimate and fraudulent activities.

- Supervised Learning: In this approach, models are trained on labeled datasets, where past transactions are categorized as either fraudulent or legitimate. By learning from these examples, the model can recognize similar patterns in new, unseen data. For instance, if a model identifies that transactions occurring at unusual hours or from unfamiliar locations are often fraudulent, it can flag similar future transactions for review.

- Unsupervised Learning: When labeled data is scarce or unavailable, unsupervised learning comes into play. This technique involves identifying anomalies in transaction patterns without prior knowledge of what constitutes fraud. For example, if a customer who typically makes small purchases suddenly attempts a large transaction, the system can detect this deviation from the norm and raise an alert. This is particularly useful for discovering new types of fraud that have not been previously encountered.

2. Natural Language Processing (NLP)

Natural language processing (NLP) is utilized to analyze unstructured data, such as customer communications, transaction descriptions, and social media interactions. By examining text for specific keywords, phrases, or sentiment, banks can uncover potential fraud that may not be evident through numerical analysis alone.

For instance, if a customer reports a suspicious transaction using language that indicates confusion or distress, NLP algorithms can analyze these communications to assess the risk associated with the transaction. This capability allows banks to proactively investigate potentially fraudulent activities based on customer feedback.

3. Behavioral Analytics

AI systems can create detailed profiles of typical customer behavior based on historical transaction data. These profiles include various factors, such as spending patterns, transaction frequencies, and geographical locations. By continuously monitoring transactions against these established profiles, banks can identify deviations that may indicate fraudulent activity.

For example, if a customer who usually makes small, local purchases suddenly attempts a large international transfer, this anomaly could trigger a fraud alert. Behavioral analytics not only helps in detecting fraud but also enhances the overall customer experience by reducing false positives, as legitimate transactions that align with established behavior are less likely to be flagged.

4. Network Analysis

Fraud often involves networks of individuals working together, making network analysis an invaluable tool in AI fraud detection. AI algorithms can analyze relationships between accounts and transactions to identify suspicious connections and patterns.

Using graph-based techniques, banks can visualize these relationships, uncovering hidden networks of fraudsters collaborating to execute schemes. For example, if multiple accounts are linked through shared addresses, phone numbers, or transaction patterns, the AI system can flag these accounts for further investigation. This holistic view of transactional relationships enhances the ability to detect organized fraud that might otherwise remain concealed.

5. Real-Time Monitoring

One of the most significant advantages of AI in fraud detection is its ability to perform real-time monitoring of transactions. AI systems continuously analyze incoming transaction data, applying machine learning models and algorithms to detect potential fraud as it happens.

When an anomaly is detected, the system can trigger immediate alerts, allowing banks to take swift action—such as freezing accounts, blocking transactions, or notifying customers—before further damage occurs. This proactive approach minimizes losses and enhances the bank's reputation for security and customer care.

6. Anomaly Detection Techniques

Anomaly detection is a critical component of AI fraud detection. These techniques focus on identifying outliers in transaction data that deviate significantly from expected behavior. Various statistical methods and machine learning algorithms can be employed to detect these anomalies.

For instance, clustering algorithms can group similar transactions and identify those that fall outside the established clusters as potential fraud. Additionally, statistical techniques such as z-scores can quantify how far a transaction deviates from the mean, enabling the system to assess the likelihood of fraud.

7. Risk Scoring Models

AI systems often employ risk scoring models to evaluate the likelihood of fraud associated with individual transactions or accounts. These models consider multiple factors, including transaction amount, location, customer behavior, and historical fraud patterns, to generate a risk score.

Transactions that exceed a certain risk threshold can be flagged for further review or automatically blocked. This risk-based approach allows banks to prioritize their resources effectively, focusing on the highest-risk transactions while streamlining the processing of lower-risk ones.

8. Integration with External Data Sources

To enhance fraud detection capabilities, AI systems can integrate with external data sources, such as credit bureaus, social media, and public records. By incorporating this additional information, banks can gain a more comprehensive view of customer behavior and potential risk factors.

For example, if a transaction is initiated from a location that is inconsistent with a customer's historical behavior or if the transaction is linked to an account with a questionable history, the AI system can flag it for further investigation. This integration enriches the data landscape, improving the accuracy and effectiveness of fraud detection efforts.

In short, the methodologies employed by AI in fraud detection are diverse and continually evolving. By leveraging machine learning, natural language processing, behavioral analytics, and real-time monitoring, banks can effectively combat fraud in a fast-paced financial environment. The ability to adapt to new threats and learn from historical data positions AI as a critical tool in safeguarding financial institutions and their customers against fraudulent activities. As technology continues to advance, the potential for AI in fraud detection will only expand, further enhancing the security and integrity of banking operations.

AI-Powered vs. Traditional Fraud Detection: What’s the Difference?

The differences between AI-powered fraud detection and traditional methods are significant:

1. Adaptability

- AI-Powered: AI systems continuously learn from new data, adapting to changing fraud patterns and improving their detection capabilities over time.

- Traditional: Rule-based systems rely on predefined criteria, which can become outdated as fraud techniques evolve.

2. Scalability

- AI-Powered: AI can analyze vast amounts of data quickly, making it suitable for handling the high volume of transactions in modern banking.

- Traditional: Manual review processes are labor-intensive and struggle to keep pace with increasing transaction volumes.

3. Accuracy

- AI-Powered: Machine learning algorithms can achieve higher accuracy rates by identifying subtle patterns that human analysts may overlook.

- Traditional: Rule-based systems often result in higher false positive rates, leading to unnecessary investigations and customer dissatisfaction.

Feature | AI-Powered Fraud Detection | Traditional Fraud Detection |

Adaptability | Continuously learns from new data, adapting to changing fraud patterns | Relies on predefined rules, which can become outdated |

Scalability | Analyzes vast amounts of data quickly and efficiently | Struggles with high transaction volumes due to manual processes |

Accuracy | Higher accuracy rates with fewer false positives through pattern recognition | Often results in higher false positives, leading to unnecessary investigations |

Speed of Detection | Real-time monitoring allows for immediate detection and response | Delayed detection due to manual reviews can lead to significant losses |

Cost Efficiency | Reduces operational costs through automation and streamlined processes | High labor costs associated with manual fraud detection efforts |

4. Speed of Detection

- AI-Powered: Real-time monitoring allows for immediate detection and response to fraudulent activities.

- Traditional: Delayed detection can result in significant financial losses and damage to customer trust.

5. Cost Efficiency

- AI-Powered: Automation reduces the need for extensive human resources, leading to cost savings.

- Traditional: High labor costs associated with manual fraud detection processes can strain financial resources.

How to Implement AI in Your Financial Institution

Implementing AI in a financial institution requires careful planning and execution. Here are key steps to consider:

1. Define Objectives

Before diving into the implementation process, it’s crucial to clearly outline the goals and objectives of your AI fraud detection initiative. This involves identifying specific types of fraud you aim to combat—such as credit card fraud, identity theft, or money laundering—and determining how success will be measured. Consider metrics like reduction in fraud losses, improved detection rates, and customer satisfaction. Establishing clear objectives will guide the entire implementation process and help align resources effectively.

2. Data Collection and Preparation

The effectiveness of AI in fraud detection heavily relies on the quality and quantity of data available. Start by gathering relevant data from various sources, including transaction records, customer profiles, historical fraud cases, and external data (e.g., credit scores, social media activity).

- Data Cleaning: Ensure that the data is clean, structured, and free from errors. This may involve removing duplicates, correcting inaccuracies, and standardizing formats.

- Data Enrichment: Enhance your datasets by incorporating additional information that could be relevant for fraud detection. This could include demographic data, transaction context, and behavioral data.

- Data Privacy and Compliance: Pay close attention to data privacy regulations (such asGDPR or CCPA) to ensure compliance. Implement measures to protect sensitive customer information throughout the data collection and processing stages.

3. Choose the Right Technology

Selecting the appropriate AI technologies and tools is critical for the success of your fraud detection initiative. Evaluate various machine learning frameworks, data analytics platforms, and cloud computing resources that align with your institution's needs and capabilities. Consider factors such as:

- Scalability: Ensure that the chosen technology can handle the volume of transactions your institution processes.

- Integration: Look for solutions that can seamlessly integrate with your existing systems and workflows, minimizing disruptions during implementation.

- Vendor Support: Choose technology partners that offer robust support and training resources to assist with the implementation process.

4. Develop and Train Models

Once the data is prepared and the technology is in place, collaborate with data scientists and machine learning experts to develop machine learning models tailored to your specific fraud detection requirements.

- Model Selection: Choose the appropriate algorithms based on the nature of your data and the types of fraud you are targeting. This could include supervised learning models, unsupervised learning techniques, or ensemble methods.

- Training and Validation: Train the models using historical data to enhance their accuracy. It’s important to validate the models using separate datasets to ensure they can generalize well to new, unseen data.

- Performance Metrics: Establish performance metrics to evaluate the effectiveness of the models. Common metrics include precision, recall, F1 score, and area under the ROC curve (AUC-ROC). Here’s a table describing each:

Metric | Description |

True Positive Rate (TPR) | Measures the proportion of actual fraud cases correctly identified by the AI system |

False Positive Rate (FPR) | Indicates the percentage of legitimate transactions incorrectly flagged as fraudulent |

Precision | Represents the ratio of true positives to the total predicted positives, indicating the accuracy of fraud predictions |

Recall | Measures the ability of the AI system to identify all relevant instances of fraud, calculated as TPR |

F1 Score | The harmonic mean of precision and recall, providing a balance between the two metrics for overall effectiveness |

5. Pilot Testing

Before rolling out the AI fraud detection system on a large scale, conduct pilot tests to evaluate its effectiveness in a controlled environment.

- Test Scenarios: Simulate various fraud scenarios to assess how well the system identifies and responds to suspicious activities.

- Monitor Performance: Closely monitor the performance metrics during the pilot phase. Gather feedback from users and stakeholders to identify areas for improvement.

- Iterate and Refine: Based on the results of the pilot tests, make necessary adjustments to the models, algorithms, or processes to enhance performance.

6. Integration with Existing Systems

Successful implementation requires seamless integration of the AI solution with your existingbanking systems and workflows.

- System Compatibility: Ensure that the AI solution is compatible with your current infrastructure and can communicate effectively with other systems, such as transaction processing platforms, customer relationship management (CRM) systems, and compliance tools.

- Workflow Alignment: Align the AI fraud detection processes with existing operational workflows to ensure that alerts and findings are routed to the appropriate teams for investigation and action.

- User Training: Provide comprehensive training for staff members on how to use the new AI tools and interpret the results. This will empower them to leverage the technology effectively in their day-to-day operations.

7. Continuous Monitoring and Improvement

AI systems require ongoing monitoring and refinement to remain effective.

- Performance Evaluation: Regularly evaluate the performance of the AI fraud detection system against established metrics. Monitor for changes in fraud patterns and adjust the models accordingly.

- Retraining Models: As new data becomes available and fraud tactics evolve, retrain your models to ensure they continue to perform optimally. This iterative process helps maintain the system’s relevance and effectiveness over time.

- Feedback Loops: Establish feedback mechanisms to capture insights from fraud investigations and customer interactions. Use this information to refine algorithms and improve detection capabilities.

8. Staff Training and Change Management

Investing in staff training is essential for the successful adoption of AI technologies.

- Cultural Shift: Foster a culture of collaboration between AI systems and human analysts. Encourage staff to embrace AI as a tool that enhances their capabilities rather than a replacement for their roles.

- Ongoing Education: Provide continuous education and training opportunities for staff to keep them informed about the latest developments in AI technology, fraud detection techniques, and regulatory requirements.

By following these steps, financial institutions can effectively implement AI in their fraud detection strategies, enhancing their ability to identify and mitigate fraudulent activities while maintaining compliance and customer trust. The integration of AI not only strengthens security measures but also positions banks to adapt to the rapidly changing landscape of financial fraud.

Real-Life Examples of AI Fraud Detection in Banking

Several financial institutions have successfully implemented AI fraud detection systems, showcasing the technology's effectiveness:

JPMorgan Chase

JPMorgan Chase employs AI algorithms to analyze transaction patterns and detect anomalies in real-time. Their system has significantly reduced false positives, allowing for quicker responses to potential fraud while enhancing customer satisfaction.

HSBC

HSBC utilizes machine learning to monitor transactions for signs of money laundering and other fraudulent activities. Their AI system continuously learns from new data, improving its detection capabilities and enabling the bank to comply with regulatory requirements more effectively.

American Express

American Express has integrated AI into its fraud detection processes, analyzing customer behavior and transaction histories to identify suspicious activities. This innovative approach has enabled American Express to improve fraud detection by 6%, according toNvidia. The system can alert customers in real-time, allowing them to confirm or deny transactions immediately.

Mastercard

Mastercard employs AI-driven analytics to monitor transactions across its global network. By leveraging machine learning, the company can detect fraud patterns and trends, enhancing its ability to protect cardholders from potential threats.

Challenges of AI Fraud Detection in Banking

While AI fraud detection offers numerous benefits, it also presents several challenges that financial institutions must navigate:

1. Ethical Considerations

The use of AI in fraud detection raises ethical questions regarding privacy and surveillance. Banks must balance the need for security with the rights of customers to maintain their privacy.

2. Bias in Algorithms

AI systems can inadvertently perpetuate biases present in training data. If historical data reflects biased decision-making, AI models may produce skewed results, leading to unfair treatment of certain customer groups.

3. Transparency and Explainability

AI algorithms can be complex and difficult to interpret. Financial institutions must ensure that their systems provide transparent and explainable results, allowing stakeholders to understand how decisions are made.

4. Regulatory Compliance

As AI technologies evolve, so too do regulatory requirements. Banks must stay informed about legal standards related to AI use in fraud detection and ensure compliance to avoid potential penalties.

5. Sustainability Concerns

The energy consumption associated with AI technologies raises sustainability issues. Financial institutions should consider the environmental impact of their AI systems and explore ways to minimize their carbon footprint.

Conclusion

AI fraud detection is transforming the banking industry, offering enhanced security, efficiency, and customer trust. By leveraging advanced technologies, financial institutions can stay one step ahead of fraudsters, protecting their assets and their customers. However, the journey toward effective AI implementation is not without challenges. Ethical considerations, biases, and regulatory compliance must be carefully addressed to ensure that AI systems operate fairly and transparently.

As banks continue to embrace AI, they must remain vigilant in their efforts to improve detection capabilities while fostering a culture of trust and accountability. The future of banking security lies in the successful integration of AI technologies, paving the way for a safer and more secure financial landscape. To further equip your team with the necessary skills and knowledge, consider enrolling in our course, "AI-Driven Fraud Detection in Banking." This comprehensive program provides in-depth insights into AI technologies, practical strategies for implementation, and best practices for overcoming challenges in fraud detection. Empower your organization to harness the full potential of AI and stay ahead in the fight against fraud.