Over recent years, there has been an extreme shift in all industries and sectors into the digital world. Many organisations provide a balance of in-person and digital services, and some offer services exclusively online. This change has made it incredibly important for banking organisations to transition to digital platforms to ensure they can continue to meet customer demands.

Technology is constantly evolving, allowing for banking organisations to utilise a variety of methods to digitalise their products and services. Alongside the benefits of digitalisation, there are many challenges to be faced. Those involved in the transformation into digital banking must be competent in the related technologies, understand the necessity of balancing organisational goals with industry standards and maintain effective risk management.

As banking transitions to a digital platform, it will be accompanied by various risks. These need to be accurately assessed and documented, and preventive measures and solutions need to be established. The risks of digital banking have the capacity to be much more detrimental than traditional banking, so ensuring the safety of customer finances is absolutely crucial.

Upon completion of this course, participants will be able to:

- Understand the importance of digitalisation for banking.

- Define the concepts and principles of digital banking and how they influence organisational values.

- Establish an efficient and reliable system to manage the transformation of digitalisation.

- Incorporate new and trending technologies into banking standards.

- Evaluate the advantages and disadvantages of utilising digital banking.

- Assess the variety of products available for digital banking.

- Continuously develop digital systems to stay on top of customer demands.

- Analyse current market trends to predict and prepare for future changes.

This course is designed for anyone responsible for evolving traditional banking services onto a digital platform. It would be most beneficial for:

- Compliance Officers

- Finance Analysts

- Accountants

- Finance Managers

- Digital Marketing Personnel

- Risk Analysts

- Chief Financial Officers (CFOs)

- Business Owners

This course uses a variety of adult learning styles to aid full understanding and comprehension. Participants will review case studies of organisations that have transitioned to digital banking to highlight key features and challenges faced.

They will be provided with all the necessary tools to conduct a variety of learning exercises. Participants will participate in a combination of video materials, presentations, group discussions, and practical activities. These methods will offer ample opportunities for the participants to fully and comprehensively understand the taught content and all related skills.

Day 5 of each course is reserved for a Q&A session, which may occur off-site. For 10-day courses, this also applies to day 10

Section 1: Introduction to Digital Banking

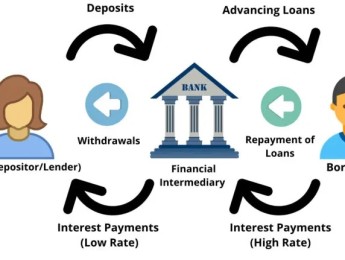

- Understanding traditional banking standards.

- The role of digital banking in modern society.

- The advantages and disadvantages of digitalisation.

- Assessing various types of digital currencies and how they function alongside traditional currencies.

- Common products and services offered through digital banking.

Section 2: Digital Banking Innovations

- Past and current market trends of banking.

- Various successful banking technology innovations.

- Using innovation to create solutions to banking challenges.

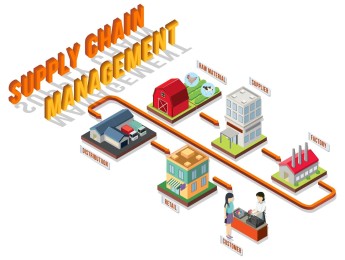

- Aligning organisational goals with product, business requirements and available technology.

- Methods of fostering innovation.

- Creating action plans detailing customer demands, organisational goals, opportunities and limitations.

Section 3: Digital Banking Transformation

- What factors may influence digital transformation?

- Ensuring the customer's needs and safety is always prioritised.

- Establishing goals and objectives for digital banking.

- Analysing data to find the ideal areas for improvement.

- Transforming the customer experience.

- Encouraging collaboration and developing employee skills and knowledge.

Section 4: Risk Management of Digital Services

- Concepts and principles of risk management.

- Explaining why risk management is essential for any banking services.

- Conducting risk assessments to identify major and minor risks.

- Creating risk management plans detailing types of risks, their consequences, solutions, and preventative measures.

- Aligning risk management plans with risk policies.

Section 5: Regulating and Measuring Performance

- Assessing relevant policies and procedures of digital banking.

- Balancing innovation and ‘out of the box’ thinking with industry standards.

- The vitality of regularly measuring organisational performance.

- The various methods of measuring and documenting performance.

- Utilising performance data to encourage service development.

- International recommendations for digital banking.

Upon successful completion of this training course, delegates will be awarded a Holistique Training Certificate of Completion. For those who attend and complete the online training course, a Holistique Training e-Certificate will be provided.

Holistique Training Certificates are accredited by the British Assessment Council (BAC) and The CPD Certification Service (CPD), and are certified under ISO 9001, ISO 21001, and ISO 29993 standards.

CPD credits for this course are granted by our Certificates and will be reflected on the Holistique Training Certificate of Completion. In accordance with the standards of The CPD Certification Service, one CPD credit is awarded per hour of course attendance. A maximum of 50 CPD credits can be claimed for any single course we currently offer.

- Course Code IND12-109

- Course Format Online, Classroom,

- Duration 5 days