In a landscape where finance intersects seamlessly with technology, a term has taken centre stage—Fintech, a portmanteau of "financial" and "technology." This fusion encapsulates the integration of cutting-edge technological innovations into the traditional realm of finance, resulting in a paradigm shift that goes beyond transactional processes. This article delves deep into the transformative realm of Fintech, exploring its profound implications for the future of banking and shedding light on the dynamic interplay between technological advancements and the financial industry.

What Is Fintech and Why Is It Popular?

At its core, Fintech encompasses a range of innovative technologies that leverage data, automation, artificial intelligence, and blockchain to optimise financial services. The primary goal of Fintech is to enhance efficiency, accessibility, and user experience in various financial activities. The popularity of Fintech stems from its ability to democratise finance, making it more inclusive and convenient for individuals and businesses worldwide.

Traditional financial services often involved time-consuming processes, manual paperwork, and rigid structures. Fintech disrupts these norms by offering real-time solutions that allow users to manage their finances, make transactions, and access services seamlessly through digital platforms and applications. The convenience and flexibility offered by Fintech have propelled its rise, attracting a broad spectrum of users who seek modern solutions to age-old financial challenges.

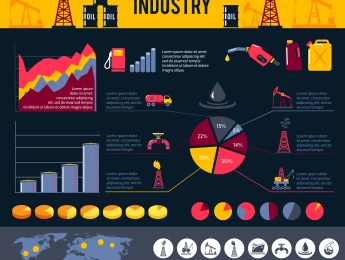

Table 1: A brief overview of the Fintech landscape

Technology/Component | Description |

Data Analytics | Utilises data to provide insights and drive decision-making in financial services. |

Artificial Intelligence | Employs machine learning algorithms to automate tasks, personalise services, and enhance user experience. |

Blockchain | Provides a secure and transparent way to record and verify financial transactions. |

Automation | Streamlines financial processes, reducing the need for manual intervention and minimising errors. |

The Importance of Fintech in Banking

In the landscape of modern finance, Fintech has emerged as a catalyst, driving the evolution of banking practices in unprecedented ways. In fact, as per the findings of the EY Fintech Adoption Index 2019, a remarkable 92% of Chinese banks and 52% of their US counterparts swiftly embraced fintech innovations. That being said, let’s discuss why Fintech is vital in the banking industry and is still going strong nowadays:

Enhanced Efficiency and Accessibility

Fintech's role in enhancing efficiency cannot be overstated. Traditional banking processes often involved paperwork, lengthy wait times, and physical visits to branches. Fintech, however, has introduced digital platforms and mobile apps that streamline these processes, making banking accessible from anywhere at any time. Users can transfer funds, pay bills, and even apply for loans with a few taps on their smartphones. This convenience not only caters to tech-savvy consumers but also bridges the gap for individuals who were previously underserved by traditional banking methods.

Innovation in Customer Experience

Fintech has ushered in a new era of customer-centricity. Through AI-powered algorithms and data analytics, banks can gain valuable insights into customer behaviours and preferences. This data-driven approach enables banks to offer personalised services that resonate with individual needs. Whether it's suggesting investment options, providing tailored financial advice, or simplifying budgeting, Fintech empowers customers to take greater control of their financial journey. As a result, customer loyalty is nurtured, and trust between consumers and financial institutions deepens.

Financial Inclusion

Fintech's impact extends beyond convenience; it also fosters financial inclusion. The traditional banking model often excluded marginalised communities due to geographical barriers and high fees. Fintech disrupts this by offering cost-effective digital solutions that enable people without access to brick-and-mortar banks to engage in financial activities. Digital wallets, mobile money, and microfinance platforms have made it possible for individuals in remote areas to engage in secure transactions and savings. This inclusive approach not only empowers individuals but also contributes to economic growth on a broader scale.

Reduced Costs and Increased Competitiveness

For both consumers and financial institutions, Fintech translates to reduced costs. With the elimination of physical branches and a shift towards digital processes, banks can operate with lower overhead expenses. These cost savings can then be passed on to customers in the form of reduced fees and better interest rates. Moreover, Fintech has introduced healthy competition within the industry. Traditional banks are compelled to innovate and offer competitive services to retain their customer base in the face of emerging digital banking alternatives.

Enhanced Financial Literacy

Fintech platforms are not just tools for transactions; they are educational platforms as well. Many Fintech applications come with built-in financial education modules. These modules empower users with knowledge about budgeting, investing, and managing credit. Through interactive interfaces and informative content, users can enhance their financial literacy, making informed decisions about their money. This educational aspect of Fintech contributes significantly to empowering consumers, enabling them to make wise financial choices and plan for their future effectively.

Streamlined Regulatory Compliance

Financial institutions, especially banks, are burdened with stringent regulatory requirements. Ensuring compliance with these regulations is a complex and time-consuming task. Fintech solutions, powered by advanced algorithms, simplify regulatory compliance processes. They automate data gathering, analysis, and reporting, reducing the workload on financial institutions. By automating compliance procedures, Fintech not only saves time and resources but also ensures that banks adhere to legal standards, reducing the risk of penalties and legal issues.

Enhanced Risk Management

Risk management is a core aspect of banking operations. Fintech tools leverage big data analytics and artificial intelligence to assess risks more accurately. By analysing vast datasets in real-time, Fintech algorithms can identify potential risks and anomalies, allowing financial institutions to respond swiftly and proactively. This enhanced risk management capability minimises the likelihood of financial fraud, default, and other risks, safeguarding both the institutions and their customers. Moreover, by predicting risks effectively, Fintech tools enable banks to adjust their strategies, ensuring a more stable and resilient financial ecosystem.

How Are Big Businesses Responding to Fintech?

According to BCG, the fintech sector is projected to surge to a substantial $1.5 trillion in yearly revenue by 2030. This emergence has prompted established financial institutions to recalibrate their strategies. Traditional banks have recognised the importance of incorporating technology to remain competitive. Many have invested heavily in digital transformation, developing their own apps and online platforms to cater to the evolving preferences of their customers.

Collaboration is another key theme in the relationship between Fintech startups and established businesses. Rather than perceiving Fintech as a threat, many big players have embraced partnerships with innovative startups to leverage their expertise and agility. This approach not only accelerates the development of new services but also fosters a culture of innovation within the industry.

Case Study: JPMorgan Chase & Co.

To illustrate the approach of established banks to Fintech, let's take a closer look at JPMorgan Chase & Co., one of the largest and most influential banks globally. JPMorgan has not only recognised the significance of Fintech but has actively engaged with it to enhance its own services and customer experience.

In 2019, the bank launched "Finn by Chase," a mobile banking app aimed at providing a digital-first banking experience. This app allowed customers to open accounts, make mobile payments, and set savings goals. JPMorgan's approach demonstrates a commitment to keeping pace with Fintech trends and adapting to changing customer expectations.

How Is Fintech Shaping the Future of Banking?

The future of banking is undergoing a profound transformation, largely steered by the innovations emerging from the Fintech sphere. Let's delve deeper into the pivotal role Fintech plays in shaping the landscape of banking in the years to come:

Personalised Banking

Fintech is leading the charge in dismantling the one-size-fits-all approach to banking. Through sophisticated data analytics and artificial intelligence, banks are now able to craft highly personalised banking experiences for individual customers. These systems analyse vast amounts of data, from spending habits to investment preferences, enabling banks to understand their customers on an unprecedented level. Armed with this knowledge, financial institutions can offer tailored financial products and services.

Imagine receiving investment recommendations based on your risk tolerance, financial goals, and market trends, all delivered via a user-friendly app. Personalised banking goes beyond the generic offerings of the past, ensuring that every customer interaction is relevant, valuable, and aligned with their unique needs and aspirations.

Open Banking

Open banking, facilitated by Fintech, is reshaping the very architecture of the financial industry. It allows for the secure sharing of financial data between banks and authorised third-party providers. This collaboration encourages innovation by allowing Fintech startups and traditional financial institutions to create interconnected ecosystems of services.

Customers, armed with the power to share their financial data securely, can now manage their finances across multiple platforms seamlessly. For instance, an individual can view their account balances from different banks in a single app, initiate transactions, and even compare financial products effortlessly. Open banking not only fosters competition but also encourages the development of innovative, customer-centric solutions, ensuring a vibrant and evolving financial marketplace.

Neobanks

Neobanks, born out of Fintech disruption, represent a radical departure from traditional banking models. These digital-only institutions operate without physical branches, relying entirely on cutting-edge technology to deliver banking services. By eliminating the overhead costs associated with brick-and-mortar establishments, neobanks can offer lower fees, higher interest rates on savings, and more competitive lending rates to their customers.

One of the key advantages of neobanks is their agility. Traditional banks often grapple with legacy systems and bureaucratic processes, which can hinder innovation. Neobanks, unencumbered by these constraints, can swiftly adapt to changing market demands. They can introduce innovative features, such as round-the-clock customer support via chatbots, intuitive budgeting tools, and instant digital account creation, providing users with a seamless and delightful banking experience.

Contactless Payments and Digital Currencies

Fintech is driving the evolution of payment methods, making transactions more secure, faster, and efficient. Contactless payments, facilitated by technologies like near-field communication (NFC), enable users to make transactions swiftly and securely without the need for physical contact. These payments are not only convenient but also reduce the risk of fraud, ensuring a safer financial environment for consumers.

Moreover, Fintech is at the forefront of exploring digital currencies, including cryptocurrencies like Bitcoin and Ethereum, as well as central bank digital currencies (CBDCs). Cryptocurrencies, based on blockchain technology, offer decentralisation, anonymity, and reduced transaction fees. CBDCs, on the other hand, are digital forms of a country's official currency, regulated by the central bank. Both innovations, supported by Fintech, are reshaping the future of money, potentially revolutionising how we transact, invest, and store value.

Table 2: The Evolution of contactless payments

AI in Fintech

Artificial Intelligence (AI) has emerged as a transformative force within the realm of Fintech, reshaping the way financial services are offered, managed, and experienced. Its multifaceted applications are driving innovation and efficiency, making AI a cornerstone of Fintech solutions. In fact, in 2021, the global market size for AI in Fintech stood at $8.23 billion. Projections indicate a significant growth trajectory, with an anticipated increase to $61.30 billion by 2031, according to Allied Market Research.

Risk Assessment and Fraud Detection

AI algorithms, fueled by vast datasets and machine learning capabilities, have revolutionised risk assessment and fraud detection in the financial sector. Traditional methods of risk evaluation often struggled to process the sheer volume of data available, leaving financial institutions vulnerable to various forms of fraud. AI systems can analyse immense datasets in real-time, identifying intricate patterns and anomalies that might indicate potential risks or fraudulent activities. By swiftly recognising these patterns, financial institutions can take immediate action, preventing financial losses and safeguarding their customers' assets.

Algorithmic Trading

AI-driven algorithms have revolutionised trading practices. These algorithms process large volumes of market data, historical trends, and real-time information at incredible speeds. By analysing this data, AI can optimise trading strategies, execute trades, and even predict market movements, allowing for intelligent, data-driven decision-making. Algorithmic trading not only ensures efficient use of resources but also provides a level playing field for both individual investors and institutional traders. AI-powered trading systems respond to market fluctuations in fractions of a second, making transactions more accurate and responsive to changing market dynamics.

Customer Service Chatbots

AI-powered chatbots are transforming customer service within the banking sector. These intelligent bots, available 24/7, provide immediate and accurate responses to customer queries and concerns. Through natural language processing (NLP) and machine learning algorithms, these chatbots can understand the context of customer inquiries, providing tailored and helpful responses. This not only enhances customer satisfaction but also significantly reduces the burden on human customer service agents, allowing them to focus on more complex tasks that require human intervention. The result is a more efficient and responsive customer service experience, benefiting both consumers and financial institutions.

Predictive Analytics

Predictive analytics, driven by AI, mines vast datasets to identify patterns and trends, enabling financial professionals to make data-driven decisions. By analysing historical data and real-time market information, predictive analytics tools can forecast market trends, customer behaviours, and investment opportunities. This foresight is invaluable in the financial sector, helping banks and investors anticipate market movements and adjust their strategies proactively. Predictive analytics not only enhances portfolio management but also aids in risk mitigation, enabling financial institutions to make informed decisions and optimise their financial performance.

In the ever-evolving landscape of Fintech, AI stands as a powerful ally, enabling financial institutions to offer more secure, efficient, and personalised services. As AI technology continues to advance, its applications within Fintech are likely to become even more sophisticated, further revolutionising the financial industry and providing consumers with unparalleled levels of convenience and security.

The Ethical Implications of Fintech

The rapid advancements in Fintech have ushered in unprecedented convenience and efficiency in the financial world, but they have also raised crucial ethical questions. As we embrace these innovative technologies, it becomes imperative to navigate the ethical landscape and strike a balance between innovation and responsibility.

Data Privacy and Security

One of the most pressing ethical concerns in Fintech revolves around data privacy. Fintech applications gather vast amounts of personal and financial data to deliver personalised services. While this data is crucial for enhancing user experience, it raises concerns about how this information is stored, processed, and shared. Ensuring robust data encryption, implementing stringent access controls, and being transparent about data usage policies are essential steps for Fintech companies to safeguard user privacy and maintain their trust.

Algorithmic Bias and Fairness

AI-driven algorithms, while powerful, can inherent biases present in the data they are trained on. In the context of Fintech, this bias can manifest in lending decisions, insurance premiums, or investment recommendations. If algorithms favour certain demographics over others, it can perpetuate societal inequalities. Fintech companies must actively work towards identifying and mitigating these biases. This can involve diversifying the data used for training, regularly auditing algorithms for fairness, and developing ethical guidelines to ensure that the technology is applied equitably.

Financial Inclusion vs. Exclusion

While Fintech has made significant strides in fostering financial inclusion, it's vital to recognise that not all individuals have equal access to technology. Vulnerable communities, the elderly, or those in remote areas might face barriers in adopting digital financial services. In the pursuit of innovation, Fintech companies must not inadvertently exclude these groups. Collaborative efforts between governments, financial institutions, and tech companies are essential to bridge this digital divide. Initiatives like digital literacy programmes and affordable technology access can ensure that the benefits of Fintech are inclusive and accessible to everyone.

Ethical Use of AI

Artificial Intelligence, a driving force in Fintech, raises ethical concerns regarding its decision-making processes. How AI algorithms arrive at decisions, especially those impacting individuals' financial lives, needs to be transparent and explainable. Understanding the rationale behind decisions becomes crucial, not only for regulatory compliance but also for building trust. Fintech companies must invest in technologies that enable "Explainable AI," ensuring that their algorithms can be understood and scrutinised, thereby fostering accountability and ethical use of this technology.

Consumer Consent and Education

Informed consent is pivotal in the ethical use of Fintech services. Users must fully understand the extent of data collection, how their information will be used, and who will have access to it. Fintech companies should invest in user education, explaining complex financial terms, data usage policies, and potential risks associated with digital financial services. Transparent communication and easy-to-understand terms of service empower consumers to make informed decisions about their financial interactions, promoting ethical conduct within the industry.

Regulatory Compliance and Ethical Standards

Regulatory bodies play a crucial role in establishing ethical standards within the Fintech sector. Governments and international organisations are increasingly focusing on crafting regulations that ensure ethical behaviour, data protection, and consumer rights. Fintech companies must not view these regulations as mere compliance burdens but as essential guidelines for ethical practices. Proactive adherence to these standards not only fosters trust with consumers but also contributes to the industry's overall credibility and sustainability.

In navigating the ethical implications of Fintech, a collaborative approach is vital. Industry players, regulatory bodies, and consumers must engage in ongoing dialogues to ensure that innovation continues to thrive while upholding ethical standards. By striking this delicate balance, Fintech can truly fulfil its potential as a force for positive change, empowering individuals and fostering a financial ecosystem that is both innovative and ethically responsible.

Conclusion

Fintech is the architect of a financial revolution, ushering in a new era of convenience, accessibility, and innovation. The fusion of financial services and cutting-edge technology has given rise to a host of benefits that span across industries and demographics. From personalised banking experiences to the adoption of AI-powered solutions, Fintech has made its indelible mark on the future of banking. As we stand on the precipice of even more groundbreaking advancements, the synergy between finance and technology promises to reshape the world of money as we know it. So, as we move forward, let us embrace the Fintech wave and embark on a journey toward a more interconnected, efficient, and inclusive financial world.

To delve even deeper into this transformative journey, make sure to check out our course ‘Understanding Digital Banking Innovation and Transformation,’ where you can explore the intricacies of Fintech, digital banking trends, and strategies for embracing the future of finance.