- Table of Contents

- Introduction

- What is AI in Finance?

- The Building Blocks of Financial AI

- Machine Learning

- Natural Language Processing

- Deep Learning

- Why is AI Important in Finance?

- Efficiency and Cost Reduction

- Enhanced Decision-Making

- Personalization

- Fraud Detection and Prevention

- Regulatory Compliance

- Risk Management

- Competitive Advantage

- How is AI Changing Accounting and Auditing?

- 1. Automation of Routine Tasks

- 2. Real-Time Analytics

- 3. Improved Audit Processes

- 4. Enhanced Fraud Detection

- 5. Predictive Analytics

- 6. Enhanced Client Interactions

- 7. Continuous Monitoring and Compliance

- 8. Skill Enhancement and Workforce Transformation

- 9. Cost Savings and Increased Profitability

- Steps to Start Adopting AI in the Finance Sector

- 1. Assess Organizational Readiness

- 2. Define Clear Objectives

- 3. Invest in Data Management

- 4. Choose the Right AI Technologies

- 5. Train Employees

- 6. Start with Pilot Projects

- 7. Monitor and Evaluate Performance

- 8. Foster a Culture of Innovation

- Challenges and Considerations for AI in Accounting and Auditing

- 1. Data Privacy and Security

- 2. Ethical Considerations

- 3. Integration with Legacy Systems

- 4. Skill Gaps

- 5. Resistance to Change

- The Future of AI in Finance

- 1. Increased Automation

- 2. Enhanced Personalization

- 3. Greater Focus on Risk Management

- 4. Integration of Blockchain and AI

- 5. Regulatory Developments

- Conclusion

Introduction

The financial sector is undergoing a profound transformation, driven largely by advancements in artificial intelligence (AI). This blog post delves into the multifaceted role of AI in finance, exploring its definition, the foundational technologies that power it, and its significant impact on accounting and auditing. We will also discuss the essential steps for adopting AI in the finance sector, the challenges that organizations may face, and the promising future of AI in this critical industry.

What is AI in Finance?

AI in finance refers to the integration of artificial intelligence technologies into various financial services and operations. This includes a broad spectrum of applications, from algorithmic trading and risk management to customer service and fraud detection. The goal of AI in finance is to enhance efficiency, improve decision-making, and create personalized experiences for clients.

AI encompasses several technologies, including machine learning (ML), natural language processing (NLP), and deep learning. These tools enable financial institutions to analyze vast amounts of data, uncover patterns, and make predictions that were previously impossible with traditional methods. By leveraging AI, financial organizations can streamline processes, reduce costs, and enhance customer satisfaction.

The Building Blocks of Financial AI

Machine Learning

Machine learning is a subset of AI that focuses on developing algorithms that allow computers to learn from and make predictions based on data. In finance, ML algorithms can analyze historical data to identify trends and forecast future market movements. For instance, hedge funds and investment firms utilize ML models to predict stock prices and optimize trading strategies. By continuously learning from new data, these models can adapt to changing market conditions, providing a competitive edge.

Natural Language Processing

Natural language processing (NLP) enables machines to understand and interpret human language. In the financial sector, NLP is used to analyze news articles, social media posts, and other textual data to gauge market sentiment. For example, financial analysts can use NLP tools to extract insights from earnings reports or regulatory filings, helping them make informed investment decisions. Additionally, chatbots powered by NLP can enhance customer service by providing instant responses to client inquiries.

Aspect | Machine Learning (ML) | Natural Language Processing (NLP) | Deep Learning (DL) |

Definition | A subset of AI that enables systems to learn from data and improve over time. | A field of AI focused on the interaction between computers and human language. | A subset of ML that uses neural networks with multiple layers to analyze data. |

Data Type | Structured and unstructured data | Primarily unstructured text and speech data | Structured, unstructured, and image data |

Techniques Used | Algorithms like decision trees, regression, and clustering | Techniques like tokenization, sentiment analysis, and language modeling | Neural networks, convolutional networks, and recurrent networks |

Applications | Predictive analytics, recommendation systems, and fraud detection | Chatbots, language translation, and sentiment analysis | Image recognition, speech recognition, and autonomous vehicles |

Complexity | Generally less complex, easier to implement | Moderate complexity, requires linguistic knowledge | Highly complex, requiring significant computational power and data |

Deep Learning

Deep learning, a subset of machine learning, involves neural networks with multiple layers that can analyze complex data patterns. In finance, deep learning is particularly useful for tasks such as image recognition in document processing and fraud detection. For instance, banks can use deep learning algorithms to analyze transaction patterns and flag suspicious activities, significantly reducing the risk of fraud. The ability of deep learning models to process unstructured data, such as images and audio, opens new avenues for innovation in financial services.

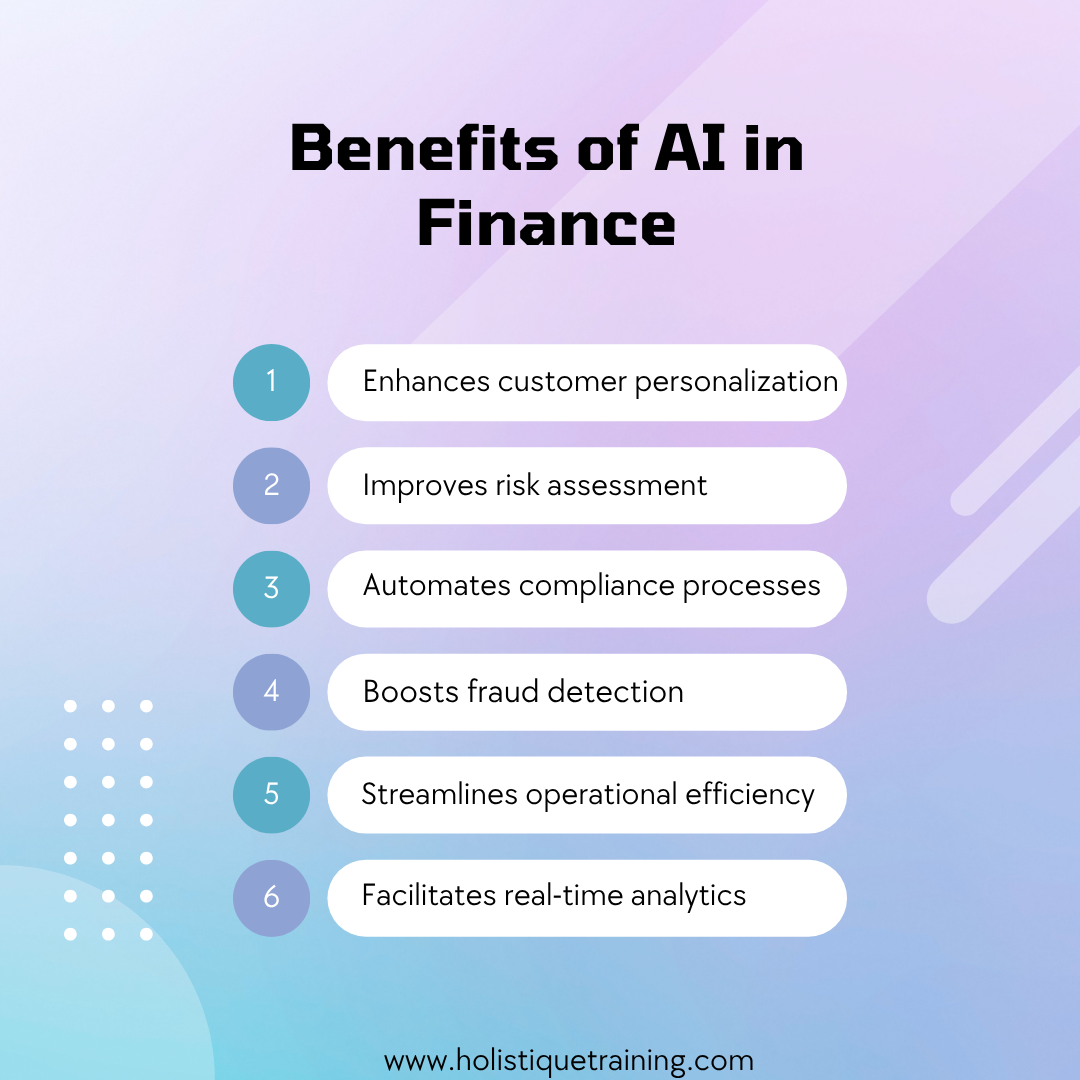

Why is AI Important in Finance?

The importance of AI in finance cannot be overstated. In early 2024, KPMG surveyed 1,800 business leaders from 10 countries, revealing that AI currently accounts for about 10% of IT budgets, with significant investment increases expected soon. In fact, statistics show that the global AI in the finance market is expected to reach $190.33 Billion in 2030. Several factors contribute to this growing significance:

Efficiency and Cost Reduction

AI significantly enhances operational efficiency by automating repetitive and time-consuming tasks. Functions such as data entry, transaction processing, and compliance checks can be performed by AI systems at a fraction of the time and cost. For example, robotic process automation (RPA) can handle high-volume tasks without human intervention, allowing financial professionals to redirect their efforts toward more strategic initiatives. This shift not only reduces operational costs but also minimizes the risk of human error, leading to improved accuracy in financial reporting and analysis.

Enhanced Decision-Making

AI’s ability to analyze vast datasets quickly and accurately empowers financial institutions to make informed decisions. Traditional decision-making processes often rely on historical data and human intuition, which can be slow and prone to biases. In contrast, AI algorithms can process real-time data from various sources—such as market trends, economic indicators, and customer behavior—providing insights that facilitate timely and data-driven decision-making. This capability is especially critical in areas like trading, where split-second decisions can lead to significant financial gains or losses.

Personalization

The rise of AI has ushered in a new era of personalized financial services. By analyzing customer data, AI can help financial institutions tailor products and services to meet individual client needs. For instance, AI algorithms can assess a customer's spending habits and financial goals to recommend suitable investment options or savings plans. This level of personalization not only enhances customer satisfaction but also fosters loyalty, as clients feel valued and understood by their financial service providers.

Fraud Detection and Prevention

Fraud remains a significant concern in the financial sector, costing institutions billions each year. AI plays a pivotal role in combating fraud by employing advanced algorithms that detect anomalies in transaction patterns. Machine learning models can learn from historical fraud cases and adapt to new tactics used by fraudsters. For instance, if a customer's transaction deviates from their usual behavior—such as a sudden large withdrawal from an unfamiliar location—AI systems can flag this activity for further investigation. This proactive approach allows organizations to mitigate risks and protect both their assets and their customers.

Regulatory Compliance

The financial industry is heavily regulated, and compliance with various laws and regulations is paramount. AI can streamline the compliance process by automating the monitoring of transactions and ensuring adherence to regulatory requirements. For example, AI systems can analyze transaction data to identify potential money laundering activities, flagging them for review before they escalate into larger issues. By leveraging AI for compliance, financial institutions can reduce the likelihood of regulatory penalties and enhance their reputation in the marketplace.

Risk Management

Effective risk management is essential for financial institutions to thrive in a volatile environment. AI enhances risk assessment by providing advanced analytics that can predict and quantify risks based on historical data and current market conditions. For example, credit scoring models powered by AI can assess a borrower’s creditworthiness more accurately by considering a broader range of factors than traditional methods. This leads to better lending decisions and reduces the risk of defaults, ultimately contributing to the overall stability of the financial system.

Competitive Advantage

As AI continues to evolve, financial institutions that adopt these technologies early gain a competitive edge over their peers. By leveraging AI for various functions—such as customer service, investment strategies, and operational efficiency—organizations can differentiate themselves in a crowded marketplace. The ability to offer innovative solutions, respond quickly to market changes, and provide exceptional customer experiences positions these institutions favorably in an increasingly competitive landscape.

In summary, AI is not merely a technological tool; it is a transformative force that is reshaping the finance industry. By improving efficiency, enhancing decision-making, personalizing services, detecting fraud, ensuring compliance, managing risks, and providing a competitive advantage, AI is proving to be indispensable for financial institutions aiming to thrive in the modern economy. As the technology continues to advance, its importance in finance will only grow, driving further innovation and reshaping the future of financial services.

How is AI Changing Accounting and Auditing?

AI is revolutionizing accounting and auditing practices by enhancing accuracy, efficiency, and transparency. Here are some key changes:

1. Automation of Routine Tasks

One of the most significant impacts of AI on accounting is the automation of repetitive and time-consuming tasks. Traditionally, accountants spend substantial time on manual processes such as data entry, invoice processing, and reconciliation. AI technologies, particularly robotic process automation (RPA), can handle these tasks with remarkable speed and accuracy. For instance, RPA can automatically extract data from invoices and input it into accounting systems, drastically reducing the time spent on these tasks and minimizing human error. This automation allows accountants to focus on more strategic activities, such as financial analysis and advisory services, ultimately increasing productivity and job satisfaction.

2. Real-Time Analytics

AI enables real-time data analysis, a game changer for accountants and auditors. With traditional accounting practices, financial data is often reviewed periodically, leading to delays in decision-making. AI-powered tools can analyze data continuously, providing up-to-the-minute insights into a company’s financial health. This capability allows accountants to identify trends, anomalies, and opportunities as they arise, facilitating timely interventions and more informed decision-making. For example, real-time analytics can help businesses adjust their budgeting and forecasting based on current financial conditions, improving overall financial management.

3. Improved Audit Processes

The auditing process is undergoing a significant transformation due to AI. Traditional audits often rely on sampling methods, which can overlook critical issues. AI allows auditors to analyze entire datasets, identifying anomalies and potential risks more effectively. Machine learning algorithms can detect patterns in financial transactions that may indicate fraud or misstatements. For example, AI tools can flag unusual transactions, such as those that deviate significantly from historical patterns, prompting auditors to investigate further. This shift to data-driven audits enhances the thoroughness and effectiveness of the audit process, ultimately leading to greater assurance in financial reporting.

4. Enhanced Fraud Detection

Fraud detection is a critical concern in accounting and auditing, and AI is proving to be an invaluable ally in this fight. AI algorithms can analyze transaction data to identify patterns indicative of fraudulent activity. By learning from historical fraud cases, these algorithms can adapt to new tactics employed by fraudsters. For instance, if a particular pattern of transactions is associated with fraudulent behavior, the AI system can flag similar transactions for review. This proactive approach allows auditors to address potential fraud before it escalates, thereby protecting the organization’s assets and reputation.

5. Predictive Analytics

AI’s predictive capabilities are reshaping how accountants and auditors approach financial forecasting and risk assessment. By analyzing historical data and identifying trends, AI can provide insights into future financial performance. For example, predictive analytics can help organizations forecast cash flow, assess the likelihood of defaults, or anticipate changes in market conditions. This foresight enables accountants to make informed recommendations regarding budgeting, investment strategies, and resource allocation. Additionally, auditors can use predictive analytics to assess the risk of material misstatements in financial statements, allowing for a more focused and effective audit approach.

Aspect | AI in Accounting | AI in Auditing |

Data Processing | Automates data entry and reconciliations, reducing manual effort | Analyzes large datasets for anomalies and trends, enhancing accuracy |

Reporting | Generates real-time financial reports and dashboards for better insights | Provides automated audit reports with insights on compliance and risk |

Transaction Analysis | Uses machine learning to categorize and analyze transactions efficiently | Employs AI to assess transaction patterns and identify potential fraud |

Error Detection | Identifies discrepancies in financial statements promptly | Detects irregularities and compliance issues during audits |

Decision Support | Offers predictive analytics for budgeting and forecasting | Enhances decision-making by providing risk assessments and audit trails |

6. Enhanced Client Interactions

AI is also transforming how accountants interact with clients. Chatbots and virtual assistants powered by natural language processing (NLP) can handle routine client inquiries, providing instant responses and freeing up accountants to focus on more complex issues. These AI-driven tools can assist clients with basic questions about their accounts, transaction histories, or tax filings, improving customer service and satisfaction. Furthermore, AI can analyze client data to provide personalized financial advice, helping accountants offer tailored solutions that meet individual client needs.

7. Continuous Monitoring and Compliance

AI facilitates continuous monitoring of financial transactions and compliance with regulatory requirements. Traditional compliance processes often involve periodic reviews, which can lead to missed violations or delayed responses to regulatory changes. AI systems can monitor transactions in real-time, flagging potential compliance issues as they arise. For example, AI can analyze transactions for signs of money laundering or other illegal activities, ensuring that organizations adhere to regulatory standards. This continuous monitoring not only reduces the risk of penalties but also enhances the organization’s reputation for integrity and transparency.

8. Skill Enhancement and Workforce Transformation

As AI takes over routine tasks, the skill sets required for accountants and auditors are evolving. Professionals in these fields must adapt to new technologies and develop skills in data analysis, AI tool utilization, and strategic advisory services. This transformation creates opportunities for accountants to focus on higher-value tasks, such as providing strategic insights and financial planning. Organizations must invest in training and development programs to equip their workforce with the necessary skills to thrive in an AI-driven environment.

9. Cost Savings and Increased Profitability

By automating routine tasks and enhancing efficiency, AI can lead to significant cost savings for accounting firms and departments. Reduced labor costs, fewer errors, and improved productivity contribute to increased profitability. Furthermore, the ability to offer enhanced services, such as real-time analytics and personalized financial advice, can attract new clients and retain existing ones, further boosting revenue.

In short, AI is fundamentally changing the landscape of accounting and auditing. By automating routine tasks, providing real-time analytics, improving audit processes, enhancing fraud detection, and facilitating continuous monitoring, AI empowers accountants and auditors to operate more efficiently and effectively. As these technologies continue to evolve, they will undoubtedly play an increasingly critical role in shaping the future of financial services. Embracing AI not only enhances operational capabilities but also positions accounting and auditing professionals as strategic partners in driving organizational success.

Steps to Start Adopting AI in the Finance Sector

For financial institutions looking to adopt AI, a systematic approach is essential. Here are the key steps to consider:

1. Assess Organizational Readiness

Before embarking on the AI journey, financial institutions must evaluate their current capabilities and readiness for change. This assessment involves:

- Technology Infrastructure: Review existing IT systems and infrastructure to determine if they can support AI technologies. Identify any gaps in hardware, software, or data storage that may need to be addressed.

- Data Quality: Evaluate the quality and accessibility of data within the organization. High-quality, well-structured data is essential for effective AI implementation. Organizations should assess data completeness, accuracy, and consistency.

- Employee Skills: Analyze the current skill set of employees to identify gaps in knowledge related to AI and data analytics. Understanding the existing capabilities will help in planning training and hiring needs.

2. Define Clear Objectives

Establishing clear objectives is crucial for guiding AI adoption efforts. Organizations should consider:

- Business Goals: Identify specific business goals that AI can help achieve, such as improving customer service, enhancing risk management, or increasing operational efficiency.

- Measurable Outcomes: Define measurable outcomes for AI initiatives, such as expected cost savings, increased revenue, or improved customer satisfaction scores. These metrics will help assess the success of AI projects.

- Scope of Implementation: Determine the scope of AI adoption, whether it will be a pilot project in a specific department or a broader implementation across the organization.

3. Invest in Data Management

Data is the lifeblood of AI, and organizations must invest in robust data management practices to ensure high-quality data for AI applications. Key considerations include:

- Data Governance: Establish data governance frameworks to ensure data integrity, security, and compliance with regulations. This includes defining roles and responsibilities for data management.

- Data Integration: Implement systems that integrate data from various sources, including internal databases, external market data, and customer interactions. A unified data platform will enhance the effectiveness of AI algorithms.

- Data Cleansing: Regularly cleanse and update data to remove inaccuracies and inconsistencies. High-quality data is essential for training AI models and generating reliable insights.

4. Choose the Right AI Technologies

Selecting the appropriate AI technologies is critical for successful implementation. Organizations should consider:

- Technology Landscape: Research the various AI tools and platforms available in the market, including machine learning frameworks, natural language processing tools, and robotic process automation solutions.

- Vendor Evaluation: Evaluate potential AI vendors based on their expertise, track record, and alignment with organizational goals. Consider factors such as scalability, ease of integration, and support services.

- Customization Needs: Determine whether off-the-shelf solutions meet the organization’s needs or if custom development is necessary. Custom solutions may provide a better fit for specific business requirements.

5. Train Employees

Employee training is vital for the successful adoption of AI technologies. Organizations should focus on:

- Skill Development: Invest in training programs that enhance employees' skills in data analytics, AI tool usage, and machine learning concepts. This training will empower staff to leverage AI effectively.

- Cross-Functional Collaboration: Foster collaboration between IT, finance, and other departments to ensure a comprehensive understanding of AI applications. Cross-functional teams can drive innovation and share insights.

- Continuous Learning: Encourage a culture of continuous learning where employees stay updated on the latest AI trends and technologies. This approach will help organizations remain competitive in a rapidly evolving landscape.

6. Start with Pilot Projects

Launching pilot projects allows organizations to test AI applications on a smaller scale before full implementation. Key steps include:

- Selecting Use Cases: Identify specific use cases for pilot projects that align with organizational goals and have the potential for high impact. Examples might include automating invoice processing or implementing a chatbot for customer service.

- Monitoring and Evaluation: Establish metrics to evaluate the success of pilot projects. Monitor performance against predefined objectives, and gather feedback from users to identify areas for improvement.

- Iterative Learning: Use insights gained from pilot projects to refine AI strategies and scale successful initiatives across the organization. This iterative approach minimizes risks and enhances overall effectiveness.

7. Monitor and Evaluate Performance

Once AI solutions are implemented, organizations should continuously monitor and evaluate their performance. This involves:

- Performance Metrics: Track key performance indicators (KPIs) related to AI initiatives, such as cost savings, efficiency gains, customer satisfaction, and compliance rates. Regularly review these metrics to assess the impact of AI.

- Feedback Mechanisms: Establish feedback mechanisms to gather input from employees and customers regarding their experiences with AI tools. This feedback can inform ongoing improvements.

- Adjustments and Scaling: Be prepared to make adjustments to AI strategies based on performance evaluations. Successful pilot projects can be scaled up, while underperforming initiatives may require reevaluation or discontinuation.

8. Foster a Culture of Innovation

Creating a culture that embraces innovation is essential for the long-term success of AI adoption. Organizations should:

- Encourage Experimentation: Promote an environment where employees feel empowered to experiment with new ideas and technologies. Encourage teams to explore innovative applications of AI.

- Recognize and Reward Innovation: Acknowledge and reward employees who contribute to successful AI initiatives. Recognizing innovation fosters motivation and encourages others to engage in creative problem-solving.

- Leadership Support: Ensure that leadership is actively involved in promoting AI initiatives and fostering a culture of innovation. Leadership support is critical for driving organizational change and overcoming resistance.

Adopting AI in the finance sector is a multifaceted process that requires careful planning, investment, and commitment. By assessing organizational readiness, defining clear objectives, investing in data management, choosing the right technologies, training employees, starting with pilot projects, monitoring performance, and fostering a culture of innovation, financial institutions can successfully navigate the complexities of AI adoption. Embracing AI not only enhances operational efficiency and decision-making but also positions organizations to thrive in an increasingly competitive and dynamic financial landscape.

Challenges and Considerations for AI in Accounting and Auditing

While the benefits of AI in finance are substantial, several challenges and considerations must be addressed:

1. Data Privacy and Security

The use of AI in finance raises concerns about data privacy and security. Organizations must ensure that they comply with data protection regulations and implement robust security measures to protect sensitive financial information.

2. Ethical Considerations

AI algorithms can inadvertently perpetuate biases present in historical data. Financial institutions must be vigilant in addressing ethical considerations related to AI, ensuring that their algorithms promote fairness and transparency.

3. Integration with Legacy Systems

Many financial institutions rely on legacy systems that may not be compatible with modern AI technologies. Integrating AI solutions with existing systems can be a complex and costly process, requiring careful planning and execution.

4. Skill Gaps

The successful implementation of AI requires a skilled workforce. Financial institutions may face challenges in finding and retaining talent with the necessary expertise in AI, data science, and analytics.

5. Resistance to Change

Cultural resistance to change can hinder AI adoption. Organizations must foster a culture that embraces innovation and encourages employees to adapt to new technologies and processes.

The Future of AI in Finance

The future of AI in finance is promising, with several trends poised to shape the industry:

1. Increased Automation

As AI technologies continue to evolve, we can expect further automation of financial processes. This trend will lead to greater efficiency, reduced costs, and improved accuracy in financial operations.

2. Enhanced Personalization

AI will enable financial institutions to deliver even more personalized services to clients. By leveraging advanced analytics and customer data, organizations can tailor products and services to meet individual preferences and needs.

3. Greater Focus on Risk Management

AI will play an increasingly vital role in risk management, helping organizations identify and mitigate potential risks more effectively. Advanced analytics will enable proactive risk assessment and management strategies.

4. Integration of Blockchain and AI

The integration of blockchain technology with AI has the potential to revolutionize financial transactions and data management. This combination can enhance transparency, security, and efficiency in financial services.

5. Regulatory Developments

As AI becomes more prevalent in finance, regulatory bodies will likely introduce new guidelines and frameworks to govern its use. Financial institutions must stay abreast of these developments to ensure compliance and mitigate risks.

Conclusion

The integration of AI in finance is transforming the industry, offering unprecedented opportunities for efficiency, accuracy, and personalized service. As financial institutions embrace AI technologies, they must navigate challenges related to data privacy, ethical considerations, and workforce readiness. By taking a systematic approach to AI adoption and staying attuned to emerging trends, organizations can position themselves for success in the evolving financial landscape. The future of finance is undoubtedly intertwined with AI, and those who adapt will thrive in this dynamic environment.