Banking and finance is a worldwide industry that is constantly changing, particularly as new technologies are frequently emerging. As industry standards evolve, it is important for organisations to remain knowledgeable and continue to meet customer demands.

When it comes to international payments, it is necessary to understand the laws and regulations that overlook them. These regulations set the standard, and organisations must manage their services to align with them. The regulations also ensure that payment methods are completely secure and safe for the user.

Alongside the legalities, an organisation must also be aware of the various payment methods and how to keep them secure. To ensure security for all parties, there must be a strong focus on managing risk throughout every transaction. Fraud is one of the main risks an organisation will encounter, making it crucial to have advanced fraud detection methods and solutions. Furthermore, other risks must be recognised, mitigated, and minimised.

Upon completion of this course, participants will be able to:

- Comprehend the vitality of securing international and secure payment methods.

- Analyse the legal and regulatory framework that governs international banking and payment systems.

- Consider the influences that strengthen the security of international and commercial payment transactions.

- Utilise effective methods of managing major and minor risks associated with payment systems.

- Evaluate past and present market trends and use this knowledge to predict future trends.

- Develop positive relationships with clients, partners and stakeholders.

- Examine emerging technologies and understand how to implement them with minimal disruption to existing services.

This course is designed for anyone within the finance organisation who wishes to develop their knowledge surrounding international payments. It would be most beneficial for:

- Banking Managers

- Finance Managers

- Finance Analyst

- Operations Managers

- Chief Payment Officers (CPOs)

- Compliance Officers

- Commercial and Private Banking Executives

- Senior Executives

This course uses a variety of adult learning styles to aid full understanding and comprehension. Participants will review case studies of established organisations that use various payment systems to highlight key features and what security measures are in place.

They will be provided with all the necessary tools to complete the learning exercises fully. They will also participate in various seminars, video materials, and practical activities, which will ensure that the participants develop an in-depth understanding of the taught content.

Day 5 of each course is reserved for a Q&A session, which may occur off-site. For 10-day courses, this also applies to day 10

Section 1: Introduction to Commercial Payments

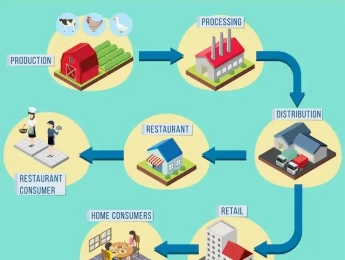

- Understanding what international banking and commercial payments are.

- Examining international payment systems – SWIFT, CHIPS, Fedwire and TARGET2.

- Reviewing international trade financing – trade and supply chain finance.

- How banking has evolved from traditional payment methods to digital methods.

- The purpose of letters of credit (L/Cs) and standby L/Cs.

Section 2: Regulatory Framework for International Payments

- Describing the purpose of the legal and regulatory framework for international banking and payments.

- The various international banking regulations – Basel III, FATCA and Dodd-Frank Act.

- The importance of anti-money laundering (AML) and counter-terrorist financing (CTF).

- Understanding the consequences of poor AML and CTF on the business and customer.

- Ensuring compliance through compliance management and governance.

Section 3: Payment Systems and Technologies

- The most common types of international payment systems – cash in advance, letter of credit, documentary collection, open account terms and trade finance.

- Explain the advantages and disadvantages of each payment type.

- Effectively managing international remittance.

- Modern technologies that heavily impacted payment methods.

- Mobile and e-commerce payment methods.

- Aligning traditional payment systems with digital systems.

Section 4: Operational Risks and Fraud Prevention

- Identifying and measuring risks associated with payment transactions.

- Effectively detect fraudulent transactions and secure the account.

- Ensuring the highest level of information security and cybersecurity.

- The importance of business continuity management when implementing risk management methods.

- Risk prevention, mitigation, disaster recovery and crisis management.

Section 5: Future Trends in International Payments

- Past, present and predicting future trends of international payments.

- Emerging technologies that increase security, efficiency and accessibility of payment systems.

- Blockchain and distributed ledger technology (DLT).

- How artificial intelligence and machine learning will impact the industry.

Upon successful completion of this training course, delegates will be awarded a Holistique Training Certificate of Completion. For those who attend and complete the online training course, a Holistique Training e-Certificate will be provided.

Holistique Training Certificates are accredited by the British Assessment Council (BAC) and The CPD Certification Service (CPD), and are certified under ISO 9001, ISO 21001, and ISO 29993 standards.

CPD credits for this course are granted by our Certificates and will be reflected on the Holistique Training Certificate of Completion. In accordance with the standards of The CPD Certification Service, one CPD credit is awarded per hour of course attendance. A maximum of 50 CPD credits can be claimed for any single course we currently offer.

- Course Code IND12-113

- Course Format Classroom, Online,

- Duration 5 days