- Table of Contents

- Introduction

- What Is Outsourcing?

- 8 Benefits of Outsourcing Accounting for Small Businesses

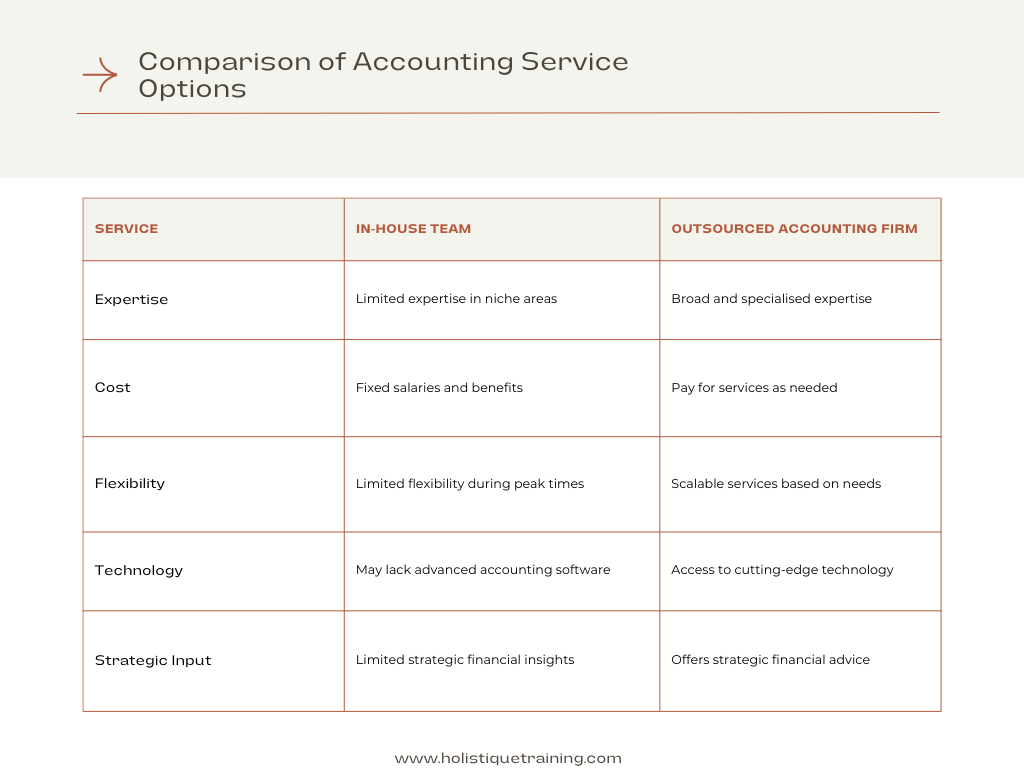

- Expertise and Specialised Knowledge

- Cost-Efficiency and Reduced Overheads

- Time Savings and Increased Productivity

- Enhanced Accuracy and Compliance

- Scalability and Flexibility

- Access to Advanced Technology and Tools

- Strategic Financial Insights

- Risk Mitigation and Data Security

- Accounting Services You Could Outsource

- 1. Bookkeeping

- 2. Tax Preparation and Planning

- 3. Payroll Processing

- 4. Financial Reporting and Analysis

- 5. Accounts Payable and Receivable Management

- 6. Budgeting and Forecasting

- 7. Audit Preparation

- 8. Financial Consultation

- What to Look for in an Accounting Firm

- 1. Professional Expertise and Credentials

- 2. Industry Experience

- 3. Range of Services

- 4. Technological Capabilities

- 5. Communication and Responsiveness

- 6. Client References and Testimonials

- 7. Fee Structure and Transparency

- 8. Proactive Approach

- 9. Data Security and Confidentiality

- 10. Scalability

- Cons of Outsourcing

- Loss of Direct Control

- Communication Challenges

- Data Security Risks

- Quality of Service Discrepancies

- Initial Integration Challenges

- Dependency on External Providers

- Hidden Costs

- Resistance from Internal Staff

- How Outsourcing Can Contribute to Sustainability

- Reduced Carbon Footprint

- Paperless Practices

- Energy-Efficient Technologies

- Environmental Responsibility of Outsourcing Providers

- Supporting Renewable Energy

- Conclusion

Introduction

Managing finances is the heartbeat of any business, especially for small businesses where every penny counts. As an entrepreneur, you're often juggling multiple hats, trying to strike the delicate balance between running your business efficiently and keeping your finances in check. This is where outsourcing accounting for small businesses steps in as a game-changer. In this blog post, we'll explore the nuances of outsourcing accounting services, diving deep into what it entails, why it’s crucial, its myriad benefits, the right time to start, what to look for in an accounting firm, and even the potential cons. By the time you finish reading, you'll have a comprehensive understanding of how outsourcing accounting can empower your business.

What Is Outsourcing?

Outsourcing, in the context of small businesses, refers to the practice of contracting out specific tasks or processes, such as accounting, to external service providers rather than handling them in-house. This strategic move allows businesses to focus on their core competencies while experts manage specialised tasks.

8 Benefits of Outsourcing Accounting for Small Businesses

Small business owners often find themselves in a constant juggling act, trying to manage various aspects of their business simultaneously. From overseeing daily operations to handling customer relationships, there’s a multitude of responsibilities that demand their attention. Amidst these demands, managing finances emerges as a critical yet often overwhelming task. This is when they start thinking about outsourcing accounting. In fact,statistics show that small businesses frequently opt to outsource specific functions, with accounting and IT services leading the pack at 37% in terms of outsourcing prevalence. Here's why outsourcing accounting is a strategic imperative for small businesses:

Expertise and Specialised Knowledge

Outsourcing accounting services means tapping into a pool of experts. Professional accountants bring extensive knowledge and experience to the table. They are well-versed in the complexities of tax laws, financial regulations, and accounting standards. Their expertise ensures that your financial records are not only accurate but also compliant with the latest legal requirements, mitigating the risk of costly errors.

Cost-Efficiency and Reduced Overheads

According to LinkedIn, more than 80% of small businesses are facing financial constraints, actively exploring avenues to curtail costs and trim expenses. This leads to business owners finding themselves in a constant juggling act, trying to manage various aspects of their business simultaneously to save costs. From overseeing daily operations to handling customer relationships, there’s a multitude of responsibilities that demand their attention. Which is when outsourcing accounting comes in handy.

Hiring and training an in-house accounting team can significantly inflate your operational costs. Outsourcing allows you to pay for services on a need-basis, avoiding the burden of full-time salaries, benefits, and training expenses. Additionally, you save on overhead costs such as office space, equipment, and utilities, freeing up capital that can be invested back into your core business activities.

Time Savings and Increased Productivity

Managing financial records, preparing reports, and staying up-to-date with tax regulations demand substantial time and effort. Outsourcing accounting tasks liberate precious hours that can be channelled into more strategic aspects of your business. With professionals handling your financial management, you and your staff can focus on essential tasks that drive productivity and business growth, leading to overall improved efficiency.

Enhanced Accuracy and Compliance

Accuracy in financial reporting is non-negotiable. Outsourced accounting firms employ professionals who are meticulous in their work. They ensure that your financial records are error-free, reducing the risk of financial discrepancies and costly mistakes. Moreover, these experts are well-versed in tax laws and regulations, ensuring that your business stays compliant, thereby avoiding penalties and legal complications.

Scalability and Flexibility

Businesses, especially small ones, often experience fluctuations in workload. Outsourcing provides the flexibility to scale accounting services up or down based on your business needs. During busy seasons, the outsourcing firm can allocate additional resources to handle the increased workload, ensuring that your financial tasks are managed efficiently without the hassle of hiring temporary staff.

Access to Advanced Technology and Tools

Leading accounting firms invest in state-of-the-art accounting software and tools. By outsourcing, you gain access to these technologies without the substantial investment required for in-house implementation. This access not only improves the efficiency of your financial processes but also ensures that your business stays up-to-date with the latest advancements in accounting technology.

Strategic Financial Insights

Outsourced accountants are not just number-crunchers; they are strategic partners. They analyse your financial data to provide valuable insights into your business’s financial health. These insights enable you to make informed decisions, identify cost-saving opportunities, and devise strategies for sustainable growth. Their expert analysis acts as a guiding light, steering your business in the right direction.

Risk Mitigation and Data Security

Outsourcing accounting tasks to reputable firms reduces the risk of financial mismanagement and fraud. These firms implement robust internal controls and security measures to safeguard your financial data. Regular audits, encryption technologies, and secure data storage systems ensure that your sensitive information is protected, providing you with peace of mind and confidence in your financial operations.

In short, outsourcing accounting for small businesses is not just a practical solution; it’s a strategic investment. It empowers businesses with expert knowledge, enhances efficiency, and provides the flexibility needed to adapt to changing business dynamics. By outsourcing, small businesses can ensure accurate, compliant, and insightful financial management, enabling them to focus on their core competencies and achieve long-term success.

Accounting Services You Could Outsource

Determining which accounting services to outsource is a strategic decision that depends on your business’s specific needs, size, and industry. While every business is unique, there are several core accounting functions that are commonly outsourced for maximum efficiency and effectiveness:

1. Bookkeeping

Outsourcing basic bookkeeping tasks such as recording financial transactions, managing accounts payable and receivable, and bank reconciliations is a fundamental step. Bookkeeping lays the foundation for accurate financial reporting and tax filings. Outsourcing these tasks ensures meticulous record-keeping and compliance with accounting standards.

2. Tax Preparation and Planning

Tax laws are complex and ever-changing. Outsourcing tax-related services to professionals well-versed in tax regulations can save your business money and ensure compliance. Tax experts can prepare your tax returns, identify tax deductions and credits, and develop strategic tax planning initiatives that optimise your tax position.

3. Payroll Processing

Managing payroll involves intricate calculations, tax withholdings, and compliance with labour laws. Outsourcing payroll services guarantees accurate and timely payments to employees, as well as compliance with tax regulations. Additionally, it reduces the risk of errors, late filings, and penalties associated with payroll processing.

4. Financial Reporting and Analysis

Outsourcing financial reporting and analysis tasks can provide valuable insights into your business’s performance. Professional accountants can generate detailed financial statements, conduct variance analysis, and create customised reports that offer a deeper understanding of your business’s financial health. These insights are instrumental for strategic decision-making.

5. Accounts Payable and Receivable Management

Effective management of accounts payable (AP) and accounts receivable (AR) is crucial for cash flow optimisation. Outsourcing AP services ensures timely payments to suppliers, leveraging discounts and avoiding late fees. Similarly, outsourcing AR management enhances collections, reducing outstanding invoices and improving your cash flow position.

6. Budgeting and Forecasting

Budgeting and forecasting are essential for business planning and resource allocation. Outsourcing these tasks to financial experts allows for the development of accurate budgets based on historical data and market trends. These professionals can create realistic financial forecasts, aiding in strategic planning and goal setting.

7. Audit Preparation

Preparing for audits, whether internal or external, can be a time-consuming and stressful process. Outsourcing audit preparation tasks ensures that your financial records are accurate, well-organised, and compliant with auditing standards. This not only facilitates a smoother audit process but also instils confidence in stakeholders.

8. Financial Consultation

Outsourcing financial consultation services provides access to expert advice on various financial matters. Whether you need assistance with mergers and acquisitions, financial risk management, or investment strategies, financial consultants can offer tailored solutions to address your specific challenges and opportunities.

By outsourcing these essential accounting services, businesses can focus on their core competencies, confident that their financial operations are in the hands of experts. Tailoring your outsourcing strategy to align with your business’s unique requirements ensures that you receive the specific support needed to thrive in your industry.

What to Look for in an Accounting Firm

Selecting the right accounting firm is a pivotal decision for your business. Your chosen partner will not only manage your financial records but also provide valuable insights that can shape your strategic decisions. Here are crucial factors to consider when choosing an accounting firm:

1. Professional Expertise and Credentials

Ensure the accounting firm’s staff comprises certified professionals, such as Certified Public Accountants (CPAs) or Chartered Accountants (CAs). These designations indicate a high level of expertise and adherence to ethical standards. Verify their qualifications and certifications to guarantee that you are entrusting your finances to knowledgeable and skilled professionals.

2. Industry Experience

Look for an accounting firm that has experience working with businesses in your industry. Different sectors have unique financial requirements and challenges. An accountant familiar with the intricacies of your field will be better equipped to handle your specific needs and offer tailored financial advice.

3. Range of Services

Consider your current and future financial needs. Choose a firm that offers a comprehensive range of services beyond basic bookkeeping, such as tax planning, financial analysis, and business consulting. Having a one-stop-shop for all your financial requirements ensures seamless coordination and a holistic approach to your financial management.

4. Technological Capabilities

In today’s digital age, accounting firms should leverage advanced accounting software and technology to enhance their efficiency and accuracy. Inquire about the software they use and their proficiency in utilising these tools. A technologically adept firm can streamline processes, providing you with real-time financial insights.

5. Communication and Responsiveness

Effective communication is vital for a successful partnership. Evaluate the firm’s communication style and responsiveness. They should be approachable, prompt in their responses, and willing to explain financial matters in a way that you can understand. Transparent communication fosters trust and ensures that you are always informed about your financial situation.

6. Client References and Testimonials

Request client references or testimonials from businesses similar to yours. Hearing about other clients' experiences can provide valuable insights into the firm’s reliability, expertise, and customer service. Positive feedback from businesses in your industry can instil confidence in your decision.

7. Fee Structure and Transparency

Understand the firm’s fee structure and ensure that it aligns with your budget. Transparent pricing is essential. Avoid firms with ambiguous or hidden fees. A clear understanding of the costs involved will help you budget effectively and prevent financial surprises down the road.

8. Proactive Approach

A proactive accounting firm does more than just record transactions; they offer strategic guidance. Seek a firm that actively engages with you, suggesting ways to optimise your financial processes, save on taxes, and improve profitability. Their proactive approach demonstrates their commitment to your business’s success.

9. Data Security and Confidentiality

Your financial data is sensitive and must be handled with the utmost confidentiality and security. Inquire about the firm’s data security protocols, including encryption, regular audits, and secure storage methods. Ensure that they comply with relevant data protection laws to safeguard your information.

10. Scalability

Consider the firm’s ability to scale their services alongside your business. As your business grows, your financial needs will evolve. A scalable accounting firm can adapt to these changes, ensuring that their services remain relevant and effective as your business expands.

In short, choosing the right accounting firm is a strategic investment in your business’s financial health and long-term success. By considering the factors mentioned above, you can make an informed decision, selecting a partner who not only manages your finances proficiently but also contributes significantly to your business’s growth and prosperity.

Cons of Outsourcing

While outsourcing accounting can offer numerous benefits, it's crucial to be aware of the potential drawbacks. Understanding these cons allows businesses to make informed decisions about whether outsourcing is the right choice for them.

Loss of Direct Control

One of the primary concerns businesses have when outsourcing accounting functions is the perceived loss of control. Entrusting an external agency with your financial management means relinquishing direct oversight. For some businesses, especially those accustomed to having an in-house team, this shift can be unsettling. It's essential to establish clear communication channels and regular updates to maintain a sense of control and transparency.

Communication Challenges

Outsourcing often involves working with professionals in different time zones or locations. This can lead to communication challenges, including delays in response and misunderstandings due to cultural differences. Effective communication is crucial, so businesses need to establish robust communication protocols and schedules to bridge these gaps effectively.

Data Security Risks

Outsourcing requires sharing sensitive financial data with external parties. While reputable accounting firms implement stringent security measures, there's always a risk of data breaches. It's imperative to thoroughly vet the outsourcing partner, ensuring they have robust data security protocols in place, including encryption, regular audits, and secure storage methods, to safeguard your confidential information.

Quality of Service Discrepancies

The quality of outsourced services can vary depending on the provider. While established firms often deliver high-quality services, smaller or less experienced providers might lack the necessary expertise. Due diligence is crucial. Research potential firms thoroughly, checking client testimonials and references to ensure the quality of service aligns with your expectations and requirements.

Initial Integration Challenges

When transitioning from in-house accounting to outsourcing, there can be challenges during the initial integration phase. Implementing new processes and ensuring a smooth transition of financial data can be time-consuming and may disrupt normal operations. Businesses need to anticipate these challenges and work closely with the outsourcing partner to mitigate any integration issues effectively.

Dependency on External Providers

Relying entirely on external providers for critical financial functions can create a dependency that, if not managed carefully, can be risky. If the outsourcing firm encounters issues, experiences staffing problems, or faces financial difficulties, your business could be adversely affected. Diversifying services or having contingency plans in place can mitigate this risk, ensuring business continuity in unforeseen circumstances.

Hidden Costs

While outsourcing is often seen as a cost-effective solution, businesses must be wary of hidden costs. Some firms might charge additional fees for services that were not initially discussed. It’s crucial to have a clear understanding of the pricing structure and to establish a comprehensive contract that outlines all services and associated costs to avoid unexpected financial surprises.

Resistance from Internal Staff

Outsourcing accounting functions can lead to resistance or insecurity among internal staff, especially if they fear job loss or reduced job security. Managing this internal resistance through transparent communication, emphasising the benefits of outsourcing, and involving employees in the transition process can help alleviate concerns and ensure a smooth transition.

In conclusion, while outsourcing accounting offers significant advantages, businesses must carefully evaluate these potential drawbacks. By addressing these challenges proactively and selecting a reputable and reliable outsourcing partner, businesses can navigate these cons effectively, ensuring a successful and beneficial outsourcing experience.

How Outsourcing Can Contribute to Sustainability

In an era where environmental consciousness is paramount, businesses are increasingly looking for sustainable practices in every aspect of their operations. Surprisingly, outsourcing accounting services can be a significant contributor to a company’s green initiatives, often in ways that might not be immediately apparent.

Reduced Carbon Footprint

According to Flat Rock Technology, when businesses opt for outsourcing, they embrace a greener approach by cutting down on office space, equipment usage, waste, and transportation emissions, thus significantly reducing their carbon footprint. With a virtual team working remotely, there's a diminished need for extensive office spaces, leading to substantial energy savings. Additionally, employees working from home reduce their reliance on commuting, further cutting down on emissions. This reduction in energy usage and commuting has a direct positive impact on the environment.

Paperless Practices

Outsourcing firms, recognising the environmental implications of paper usage, often adopt paperless practices. Digital documentation, electronic communication, and online collaboration tools replace traditional paper-intensive processes. By minimising paper usage, businesses not only reduce their environmental impact in terms of deforestation but also decrease the energy and resources required for paper production and disposal. This shift toward digital practices aligns with the global push towards a paperless future, contributing significantly to environmental sustainability.

Table 2: Environmental impact of outsourcing practices

Practice | Environmental Impact |

Remote Work | Reduces office space, energy, and commuting emissions |

Paperless Processes | Decreases paper usage, conserving forests and resources |

Energy-Efficient Tech | Lowers energy consumption, promoting sustainable practices |

Cloud-Based Solutions | Reduces physical hardware needs, cutting down e-waste |

Green Data Center Usage | Supports renewable energy, minimising carbon footprint |

Energy-Efficient Technologies

Outsourcing firms, particularly those that specialise in financial services, invest in energy-efficient technologies. Modern servers and data centres are designed with sustainability in mind, utilising advanced cooling systems and energy-efficient hardware. By choosing outsourced services, businesses indirectly support the development and implementation of these green technologies. Additionally, cloud-based accounting solutions, often employed by outsourcing firms, utilise server consolidation techniques, optimising resource usage and reducing overall energy consumption.

Environmental Responsibility of Outsourcing Providers

Reputable outsourcing providers understand the importance of environmental responsibility. Many firms actively adopt eco-friendly practices within their operations. They implement energy-saving initiatives, recycle electronic waste responsibly, and often participate in environmental conservation efforts. By partnering with such providers, businesses indirectly support these environmental initiatives, contributing to the broader global goal of sustainability.

Supporting Renewable Energy

Some outsourcing firms prioritise sourcing their energy from renewable sources such as wind or solar power. By choosing these environmentally conscious partners, businesses contribute to the demand for renewable energy, encouraging its further development and decreasing reliance on fossil fuels.

In summary, outsourcing accounting services not only streamlines business operations but also aligns with environmentally sustainable practices. By reducing carbon emissions, embracing paperless processes, supporting energy-efficient technologies, and collaborating with eco-conscious outsourcing providers, businesses can make significant strides towards reducing their environmental impact. In an age where corporate social responsibility is paramount, these environmentally friendly practices make outsourcing not just a strategic business decision but also a responsible choice that supports a cleaner, greener planet.

Conclusion

Outsourcing accounting for small businesses isn’t just a cost-saving measure; it's a strategic investment in the long-term success of your business. By leveraging the expertise of professional accountants, businesses can navigate the complex financial landscape with confidence, ensuring accuracy, compliance, and strategic financial planning. As you embark on this journey, remember that choosing the right accounting partner is key. With the right firm by your side, you can focus on what you do best – growing your business – while leaving the financial intricacies in capable hands.

And here's an exciting opportunity: consider enhancing your financial acumen further with our exclusive course, ‘Financial Acumen for Non-Finance Experts.’ Designed for entrepreneurs and business leaders, this course demystifies complex financial concepts, empowering you to make informed decisions and master the art of strategic financial management. Gain insights from industry experts, understand financial statements, and learn the nuances of budgeting and forecasting. With this knowledge, you can not only optimise your outsourcing experience but also drive your business to new heights of financial success. Enrol now and unlock the secrets to financial mastery!