- Table of Contents

- Introduction

- What is a Zero Balance Account?

- Table: Zero Balance Account vs. Regular Savings Account

- How Does a Zero Balance Account Work?

- 1. No Minimum Balance Requirement:

- 2. Automatic Transfers:

- 3. Accessibility and Flexibility:

- 4. Financial Management Tools:

- 5. Overdraft Protection:

- 6. Monthly Fees:

- Benefits of Investing in a Zero Balance Account

- Financial Flexibility:

- No Penalty Fees:

- Convenient for Students and Low-Income Earners:

- Simplified Financial Management:

- Encourages Financial Discipline:

- Accessibility and Security:

- Minimal Initial Deposit:

- No Hidden Charges:

- Easy Account Opening Process:

- Disadvantages of a Zero Balance Account

- Limited Interest Earnings:

- Transaction Limits:

- Potential Fees for Other Services:

- Lower Incentives and Rewards:

- Limited Account Features:

- Overdraft Fees:

- Customer Service Quality:

- Accessibility of Physical Branches:

- Restrictions on Account Types:

- Requirements to Open a Zero Balance Account

- 1. Identification Documents:

- 2. Proof of Address:

- 3. Initial Deposit:

- 4. Employment and Income Information:

- 5. Contact Information:

- 6. Online Application Process:

- 7. In-Person Verification:

- 8. Additional Account Features:

- 9. Terms and Conditions:

- How to Apply for a Zero Balance Account

- 1. Research Banks and Account Options:

- 2. Gather Required Documents:

- 3. Complete the Application Form:

- 4. Submit the Application:

- 5. Verification and Approval:

- 6. Activate Your Account:

- 7. Start Using Your Account:

- Conclusion

Introduction

Imagine a financial product that perfectly suits the modern individual's convenience and efficiency needs. A Zero Balance Account (ZBA) is designed to simplify your financial management by ensuring that your funds are optimally utilised. Unlike traditional accounts that require a minimum balance to avoid fees, ZBAs offer flexibility without the worry of always maintaining a set amount of money in your account.

What is a Zero Balance Account?

As the name suggests, a Zero Balance Account is a type of bank account that does not require you to maintain a minimum balance. This means you can operate the account with zero balance without incurring any penalties. ZBAs are typically offered by banks as part of their efforts to attract customers who prefer the ease and flexibility of not having to worry about maintaining a minimum balance.

ZBAs are especially beneficial for individuals who may not have a regular inflow of funds or those who prefer to use their money for other investments rather than keeping it idle in a bank account. They are also popular among students, low-income earners, and anyone who values financial flexibility.

Feature | Zero Balance Account (ZBA) | Regular Savings Account |

Minimum Balance Requirement | None | Typically requires maintaining a minimum balance |

Interest Rates | Lower compared to traditional savings | Higher, tiered based on account balance |

Monthly Maintenance Fees | Often none | May apply if balance falls below minimum |

Transaction Limits | Some may have limits on free transactions | Fewer restrictions on number of transactions |

Accessibility | Offers online and mobile banking tools | Similar digital options may vary by institution |

Table: Zero Balance Account vs. Regular Savings Account

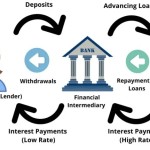

How Does a Zero Balance Account Work?

The mechanics of a ZBA are straightforward yet effective in promoting ease of use and financial efficiency. Here’s a closer look at how they function:

1. No Minimum Balance Requirement:

The cornerstone of a ZBA is the absence of a minimum balance requirement. This feature means that account holders are not obliged to keep a specific amount of money in their account at any given time. Traditional bank accounts often require maintaining a minimum balance to avoid monthly fees or penalties. Failing to meet this balance can result in charges, which can be a financial burden, especially for those with variable incomes or tight budgets. ZBAs eliminate this concern entirely, offering peace of mind and financial freedom. Whether your account has a significant balance or is temporarily at zero, you won't be penalised, allowing for greater flexibility in managing your finances.

2. Automatic Transfers:

ZBAs can be linked to other accounts, such as primary checking, savings, or investment accounts. This linkage facilitates automatic transfers to cover any shortfalls in the ZBA, ensuring seamless transaction processing. For instance, if you write a check or pay from your ZBA that exceeds the current balance, funds are automatically transferred from the linked account to cover the deficit. This system ensures that your transactions are not declined due to insufficient funds, provides a safety net, and enhances convenience. It’s an excellent feature for businesses managing multiple accounts or individuals who want to maintain financial liquidity without constantly monitoring their account balance.

3. Accessibility and Flexibility:

Zero Balance Accounts offer the same level of accessibility as traditional bank accounts, making it easy to manage your finances. Account holders can access various banking channels, including online banking, mobile banking apps, ATMs, and debit cards. This widespread accessibility ensures you can perform transactions, check your balance, transfer money, and pay bills anytime and anywhere. Moreover, the flexibility of a ZBA means you can handle your finances on your terms, without the constraints imposed by minimum balance requirements. This adaptability is particularly beneficial for those with fluctuating cash flow or those who prefer a more hands-on approach to managing their money.

4. Financial Management Tools:

Many banks enhance the functionality of ZBAs by offering a suite offinancial management tools. These tools can include:

- Spending Trackers: Monitor and categorise your expenditures to understand where your money goes. This insight helps create and stick to a budget.

- Budgeting Tools: Set financial goals and create budgets that align with your income and expenses. These tools often provide visual aids like graphs and charts to help you track your progress.

- Alerts and Notifications: Receive alerts for various account activities, such as low balances, large transactions, or upcoming bill payments. These notifications help you stay on top of your finances and avoid overdrafts or missed payments.

- Automated Savings Programs: Some banks offer features that round up your purchases to the nearest dollar and transfer the difference to a linked savings account. This small but consistent saving method can accumulate significant funds over time.

These tools are designed to help account holders manage their finances more effectively and make informed decisions. They can be particularly beneficial for individuals who are new to managing their finances or those who prefer having a clear overview of their financial situation.

5. Overdraft Protection:

While not a standard feature, some banks offer overdraft protection as part of their ZBA services. This protection can come in the form of a linked account that automatically covers overdrafts, or it may be a credit line that acts as a buffer when your account balance goes negative. Understanding the specifics of how overdraft protection works with your ZBA is crucial, as this can prevent unexpected fees and provide an extra layer of financial security.

6. Monthly Fees:

It's important to note that while ZBAs eliminate minimum balance fees, they may still have other associated costs, such as monthly maintenance fees or fees for certain types of transactions (e.g., wire transfers or foreign transactions). Be sure to review the fee schedule provided by your bank to understand all potential costs associated with your ZBA.

By fully understanding these aspects, you can maximise your Zero Balance Account and ensure it aligns with your financial goals and lifestyle.

Benefits of Investing in a Zero Balance Account

Zero Balance Accounts offer numerous benefits, making them an attractive option for many individuals. Here are some compelling reasons to consider opening a ZBA:

Financial Flexibility:

The primary advantage of a ZBA is the unparalleled financial flexibility it offers. Traditional accounts often require maintaining a minimum balance, which can restrict how you use your money. With a ZBA, you can withdraw funds down to the last cent without worrying about penalties or fees. This flexibility is particularly beneficial for individuals with irregular income streams, such as freelancers, gig workers, or seasonal employees, who might not always have a steady cash flow. It allows you to use your money as you need it, whether for daily expenses, emergencies, or investments, without the constant worry of maintaining a specific balance.

No Penalty Fees:

Traditional bank accounts typically impose fees if the account balance falls below a required minimum. These fees can increase over time, especially if you frequently dip below the threshold. ZBAs eliminate this concern entirely. With no minimum balance requirement, you can avoid these penalty fees, allowing you to save money. This aspect is particularly advantageous for those who are budget-conscious or on a fixed income. By not paying these fees, you can allocate more of your money towards your financial goals, such as saving for an emergency fund, investing, or paying off debt.

Convenient for Students and Low-Income Earners:

Students and low-income earners often face challenges in maintaining a minimum balance in their accounts due to limited financial resources. For students, balancing tuition, books, and living expenses can make it difficult to keep a traditional account above the minimum balance threshold. Low-income earners may have similar struggles with their day-to-day expenses. ZBAs provide a practical solution by eliminating the need for a minimum balance, making banking more accessible and less stressful for these groups. This convenience allows them to focus on their studies or work without worrying about incurring fees for low balances.

Simplified Financial Management:

Managing a traditional bank account can sometimes be complex, especially when avoiding falling below the minimum balance. With a ZBA, managing your finances becomes significantly simpler. You can use the account freely without constantly checking to ensure you meet the balance requirement. This simplification lets you focus on other important financial activities, such as budgeting, saving, and investing. Furthermore, without the burden of minimum balance requirements, you can prioritise other financial goals, knowing that your account is free from penalties regardless of its balance.

Encourages Financial Discipline:

Many banks offer ZBAs with built-in financial management tools designed to help account holders track their spending, set budgets, and receive alerts for various account activities. These tools can be invaluable for promoting better financial discipline. For example, spending trackers can help you identify areas where you might be overspending, while budgeting tools can assist in setting realistic financial goals and sticking to them. Alerts for low balances or large transactions inform you about your account status, helping you avoid overdrafts and stay on top of your financial situation. Over time, using these tools can lead to improved financial habits and better overall financial health.

Accessibility and Security:

ZBAs provide the same level of accessibility and security as traditional bank accounts, ensuring that your funds are always within reach and protected. You can manage your finances on the go with access to online banking, mobile apps, ATMs, and debit cards. Whether you need to check your balance, transfer funds, or make a payment, ZBAs offer the convenience of modernbanking technologies. Additionally, ZBAs are subject to the same regulatory safeguards as other bank accounts, meaning your deposits are insured, and robust security measures protect your financial data. This combination of accessibility and security ensures you can confidently manage your money anytime, anywhere.

Minimal Initial Deposit:

Many banks require a significant initial deposit to open a traditional account. In contrast, ZBAs often have minimal or no initial deposit requirements, making them more accessible to a broader range of individuals. This feature is particularly beneficial for those just starting their financial journey or those who might not have much money to deposit upfront.

No Hidden Charges:

While some traditional accounts may have hidden charges associated with various services, ZBAs are generally more transparent with their fee structures. This transparency helps you understand exactly what you're getting into, allowing for better financial planning and management.

Easy Account Opening Process:

Opening a ZBA is typically a straightforward and quick process, often with the option to do so online. This ease of account opening adds to convenience, allowing you to start managing your finances without the hassle of lengthy procedures.

By understanding and appreciating these benefits, you can make an informed decision about whether a Zero Balance Account is right for your financial needs.

Disadvantages of a Zero Balance Account

While Zero Balance Accounts offer many benefits, it’s essential to consider the potential disadvantages before deciding if they are the right choice for you:

Limited Interest Earnings:

One of the primary drawbacks of ZBAs is that they often offer lower interest rates than traditional savings accounts. Traditional savings accounts typically reward higher balances with higher interest rates, enabling you to grow your savings more effectively. However, ZBAs generally prioritise liquidity and flexibility over interest earnings, which can be less appealing if you want to maximise your savings growth. For those prioritising earning interest, this could mean missing out on potential earnings that could have accumulated in a higher-yield account.

Transaction Limits:

Some ZBAs may limit the number of transactions you can perform monthly without incurring fees. These limits might apply to withdrawals, transfers, or other account activities. These restrictions can be inconvenient and potentially costly for individuals who frequently move money in and out of their accounts. For instance, if your ZBA allows only a certain number of free transactions per month, exceeding this limit could result in additional fees, negating some of the benefits of having a zero balance requirement.

Potential Fees for Other Services:

While ZBAs eliminate the need for a minimum balance and the associated fees, they may still charge for other banking services. These fees could include costs for overdraft protection, wire transfers, check issuance, or foreign transactions. Understanding the fee structure associated with your ZBA is crucial to avoid unexpected charges. For example, if you frequently travel internationally and use your ZBA for foreign transactions, the fees for these transactions might add up, making the account less cost-effective than initially perceived.

Lower Incentives and Rewards:

Traditional bank accounts often have incentives such as higher interest rates, rewards points, or cash back on certain transactions. These benefits are designed to encourage account holders to maintain higher balances or use specific banking products and services. ZBAs, on the other hand, might not offer these incentives, as they are typically focused on providing flexibility and convenience without balance requirements. If you value earning rewards or higher interest rates, the lack of these features in a ZBA might be a significant disadvantage.

Limited Account Features:

Depending on the bank, ZBAs may offer fewer features compared to premium or high-balance accounts. These features could include personalised customer service, access to financial advisory services, or the availability of premium banking products such as high-yield savings accounts, certificates of deposit (CDs), or investment options. If you prefer having access to a wide range of banking services and personalised support, a ZBA might not meet all your needs. Additionally, some banks may reserve certain benefits, such as waived fees on other products or preferential treatment, for customers with higher balances or premium accounts.

Overdraft Fees:

While ZBAs can be linked to other accounts to cover shortfalls, they may still incur overdraft fees if the linked account does not have sufficient funds to cover the deficit. Overdraft fees can be significant and add up quickly, especially if multiple transactions are involved. It’s essential to monitor your account balances closely and ensure that linked accounts have adequate funds to avoid these fees.

Customer Service Quality:

Some ZBAs might offer limited customer service options compared to premium accounts. This limitation can be particularly noticeable if you require assistance with complex transactions or need financial advice. Understanding the level of customer service provided with your ZBA is crucial, as high-quality support can significantly impact your overall banking experience.

Accessibility of Physical Branches:

While ZBAs typically offer excellent online and mobile banking options, they may be associated with banks with fewer physical branches. If you prefer in-person banking services, this could be a disadvantage. Limited access to physical branches might be inconvenient for tasks that require direct interaction, such as depositing large amounts of cash or handling more complex banking needs.

Restrictions on Account Types:

Some banks may restrict ZBAs to specific types of accounts, such as basic checking accounts. This restriction can limit your ability to diversify your banking portfolio or take advantage of specialised accounts that better suit your financial goals. If you require multiple account types to manage your finances effectively, ensure that your bank offers the flexibility to open and manage these accounts alongside your ZBA.

Considering these disadvantages, you can weigh them against the benefits to determine if a Zero Balance Account aligns with your financial needs and preferences. This thorough understanding will help you decide and select the best banking solution for your situation.

Requirements to Open a Zero Balance Account

Opening a Zero Balance Account is typically a straightforward process, but it’s essential to meet specific requirements set by the bank. Here’s what you generally need to open a ZBA:

1. Identification Documents:

One of the primary requirements for opening a ZBA is providing valid identification documents. These documents are necessary to verify your identity, comply with regulatory requirements such as anti-money laundering (AML), and know your customer (KYC) regulations. Commonly accepted identification documents include:

- Government-issued ID: This could be a driver’s licence, passport, or national identity card. The ID should be current and have a clear photo and signature.

- Social Security Number (SSN) or Taxpayer Identification Number (TIN): These are used to verify your identity and for tax reporting purposes. Some banks may also accept an Individual Taxpayer Identification Number (ITIN) for non-U.S. citizens.

As for the UK, here are the required documents to open a bank account.

Providing these documents ensures that the bank can accurately identify you and maintain the security of your account.

2. Proof of Address:

Banks typically require proof of your residential address to open the account. This step helps verify your place of residence and is also a regulatory requirement. Acceptable documents for proof of address include:

- Utility Bills: Recent bills for services such as electricity, water, gas, or internet, usually within the last three months.

- Lease or Rental Agreement: A current lease or rental agreement clearly shows your name and address.

- Bank or Credit Card Statements: Recent statements from another bank or credit card company that include your address.

- Government Correspondence: Any official correspondence from a government agency that includes your address.

Having these documents ready can expedite the account opening process and ensure there are no delays.

3. Initial Deposit:

While ZBAs are known for not requiring a minimum balance, some banks may still ask for a nominal initial deposit to activate the account. Depending on the bank's policies, this deposit is usually minimal, ranging from $0 to a small amount like $25 or $50. This initial deposit demonstrates your commitment to the account and helps the bank cover the administrative costs of opening and maintaining it.

4. Employment and Income Information:

Some banks may request information about your employment status and income. This information helps the bank understand your financial situation and ensure that the account fits your needs. While ZBAs are often designed for flexibility, providing employment and income details can sometimes help in accessing additional features or services. Required information may include:

- Employer’s Name and Address: Details of your current employer.

- Job Title and Employment Status: Whether you are full-time, part-time, self-employed, or unemployed.

- Monthly or Annual Income: An estimate of your earnings, which can be used for creditworthiness assessments if you apply for overdraft protection or other services.

5. Contact Information:

Accurate contact information is essential for maintaining communication with your bank. Providing up-to-date contact details ensures you receive important notifications, statements, and updates about your account. Required contact information typically includes:

- Phone Number: A current phone number where you can be reached for account-related matters.

- Email Address: An email address for receiving electronic statements, alerts, and bank communications.

- Mailing Address: Your physical address for any mailed correspondence.

6. Online Application Process:

Many banks offer the convenience of opening a ZBA online. The online application process is typically user-friendly and can be completed in a few simple steps. You’ll need to:

- Fill Out the Application Form: Provide personal details such as your name, date of birth, and contact information.

- Upload Documents: Submit digital copies of your identification and proof of address.

- Review and Submit: Double-check the information you provided, agree to the terms and conditions, and submit your application.

The online application process is usually quicker and allows you to open your account from the comfort of your home.

7. In-Person Verification:

In some cases, especially if you’re opening an account with a bank that doesn’t offer online applications, you might need to visit a branch in person. This visit allows you to present your documents, provide any additional information required, and complete the account opening process with the assistance of a bank representative. In-person verification ensures that all your documents are accurately processed and your questions are addressed immediately.

8. Additional Account Features:

Depending on the bank, you can customise your ZBA with additional features or linked accounts. These features could include:

- Overdraft Protection: Linking a savings account or line of credit to cover overdrafts.

- Debit Card: Requesting a debit card for easy access to your funds.

- Mobile Banking: Setting up mobile banking services for on-the-go account management.

- Direct Deposit: Arrange for your paycheck or other regular payments to be directly deposited into your ZBA.

Understanding the available features can help you tailor the account to meet your financial needs better.

9. Terms and Conditions:

Finally, it’s crucial to review the terms and conditions associated with your ZBA. These terms outline the rights and responsibilities of both you and the bank, including fee structures, account usage policies, and dispute resolution procedures. Reading and understanding these terms ensures that you are fully aware of how the account operates and what is expected of you as an account holder.

By preparing these documents and understanding these requirements, you can streamline the process of opening a Zero Balance Account and ensure that it suits your financial needs and lifestyle.

How to Apply for a Zero Balance Account

Applying for a Zero Balance Account is a straightforward process that can be completed online or at a bank branch. Here’s a step-by-step guide to help you through the application process:

1. Research Banks and Account Options:

Start by researching different banks and the ZBA options they offer. Compare features, fees, and benefits to find the account that best suits your needs.

2. Gather Required Documents:

Ensure you have all the necessary documents, such as identification, proof of address, and any other documents required by the bank.

3. Complete the Application Form:

Fill out the application form provided by the bank. This can usually be done online through the bank’s website or in person at a branch. Provide accurate and complete information to avoid delays in the application process.

4. Submit the Application:

Once you have completed the application form and gathered the required documents, submit your application. If applying online, you may need to upload digital copies of your documents. If applying in person, bring the original documents to the bank.

5. Verification and Approval:

The bank will review your application and verify the information provided. This process may take a few days. Once your application is approved, you will receive confirmation from the bank.

6. Activate Your Account:

After receiving approval, you may need to activate your account. This could involve making an initial deposit, setting up online banking, and ordering a debit card if applicable.

7. Start Using Your Account:

Once your account is active, you can start using it immediately. Take advantage of the bank's financial management tools to monitor your spending and manage your finances effectively.

By following these steps, you can successfully apply for a Zero Balance Account and take full advantage of its features and benefits.

Conclusion

Zero Balance Accounts offer a flexible and convenient banking solution for individuals who prefer not to worry about maintaining a minimum balance. With their ease of access, lack of penalty fees, and financial management tools, ZBAs can be an excellent option for students, low-income earners, and anyone looking for a hassle-free banking experience. However, weighing the benefits against the potential disadvantages is essential, such as lower interest earnings and possible transaction limits. By understanding the requirements and following the application process, you can open a ZBA that meets your financial needs and helps you achieve your financial goals.

To further enhance your understanding of modern banking solutions, consider enrolling in our course "Understanding Digital Banking Innovation and Transformation." This course will provide you with valuable insights into the latest advancements in digital banking and how they can transform your financial management strategies.