- Table of Contents

- Introduction

- What Is Strategic Financial Planning?

- Benefits of Strategic Financial Planning

- Improved Decision-Making

- Enhanced Financial Stability

- Facilitates Growth and Expansion

- Optimal Resource Allocation

- Risk Mitigation and Contingency Planning

- Improved Stakeholder Confidence

- Long-Term Viability

- Essential Steps for Strategic Financial Planning

- 1. Set Clear Objectives

- 2. Assess Current Financial Position

- 3. Conduct Market Analysis

- 4. Develop Financial Forecast

- 5. Formulate Financial Strategies

- 6. Implement the Plan

- 7. Regularly Monitor and Evaluate

- Technology in Financial Planning

- 1. Advanced Financial Planning Software

- 2. Data Analytics and Business Intelligence

- 3. Enhanced Collaboration and Communication

- 4. Improved Accuracy and Accountability

- 5. Real-Time Decision Support

- The Role of Data Analytics

- 1. Enhanced Forecasting Accuracy

- 2. Real-time Data Integration

- 3. Advanced Scenario Analysis

- 4. Improved Resource Allocation

- 5. Data Visualisation for Decision Support

- 6. Identifying Cost Optimisation Opportunities

- 7. Enhanced Risk Management

- Sustainable Finance in Strategic Financial Planning

- 1. Alignment with Global Goals

- 2. Risk Mitigation

- 3. Capitalising on Opportunities

- 4. Reputation and Stakeholder Trust

- 5. Regulatory Compliance

- 6. Long-Term Resilience

- Conclusion

Introduction

The financial landscape of business is a complex and ever-changing realm that demands strategic planning to ensure success. Strategic financial planning has emerged as a vital practice that enables organisations to align their financial goals with broader business objectives. By adopting a proactive approach to managing finances, businesses can make informed decisions, optimise resource allocation, and foster long-term growth. This comprehensive guide will explore the intricacies of strategic financial planning, uncover its manifold benefits, and delve into the essential steps organisations must undertake to implement it effectively. We will also discuss the role of technology, data analytics, and sustainable finance in strategic financial planning.

What Is Strategic Financial Planning?

Strategic financial planning is a proactive approach to managing an organisation's finances. It encompasses the formulation, implementation, and monitoring of financial strategies that contribute to achieving long-term goals. It involves evaluating an organisation's current financial situation, forecasting future financial needs, and devising strategies to optimise the allocation of resources. Strategic financial planning considers various factors, including market trends, competitive landscape, and internal capabilities, to make informed decisions that drive business growth.

Benefits of Strategic Financial Planning

Strategic financial planning is not just a routine exercise; it's a dynamic process that can yield numerous benefits for organisations willing to embrace it fully. Let's delve deeper into these benefits:

Improved Decision-Making

Strategic financial planning provides decision-makers with a comprehensive and holistic view of the organisation's financial landscape. It acts as a guiding light, helping leaders confidently navigate complex choices. When armed with detailed financial forecasts, risk assessments, and insights into resource allocation, decision-makers can make informed choices that align seamlessly with the organisation's overarching goals. This, in turn, significantly increases the likelihood of success and minimises the risk of making costly missteps.

Enhanced Financial Stability

One of the fundamental goals of strategic financial planning is to enhance financial stability. Organisations can act proactively by forecasting future cash flows and anticipating potential financial gaps or surpluses. They can set aside reserves, create emergency funds, and establish contingency plans to navigate economic turbulence. This preparedness ensures that funds are available when needed and bolsters the organisation's resilience in the face of unexpected financial challenges, safeguarding its long-term viability.

Facilitates Growth and Expansion

Strategic financial planning is a catalyst for growth and expansion. It provides a structured framework for organisations to envision and pursue their long-term growth objectives. By aligning financial strategies with these objectives, businesses can identify investment opportunities, assess the feasibility of expansion projects, and allocate resources wisely. Whether it's entering new markets, developing innovative products, or acquiring strategic assets, a well-crafted financial plan guides organisations on their journey to growth, helping them stay ahead of competitors and capitalise on emerging opportunities.

Optimal Resource Allocation

Resource allocation is a critical aspect of efficient operations, and strategic financial planning excels in this regard. Organisations can prioritise projects that offer the highest growth and profitability potential by conducting thorough analyses of various initiatives and assessing their potential return on investment (ROI). This ensures that both financial and non-financial resources are utilised efficiently. Moreover, it minimises the risk of wasted or misallocated funds, enhancing overall cost-effectiveness.

Risk Mitigation and Contingency Planning

Strategic financial planning goes beyond identifying opportunities; it's also about recognising and mitigating risks. Businesses can identify potential threats to their financial well-being by conducting thorough analyses. This proactive risk assessment allows organisations to develop contingency plans and take preventive measures to mitigate these risks effectively. For instance, if a company forecasts a potential decline in market demand for a product, it can devise strategies like diversification or cost reduction to mitigate the impact on its financial stability.

Improved Stakeholder Confidence

Effective strategic financial planning is a testament to an organisation's competence and commitment to financial prudence. It instils confidence in internal stakeholders like employees and management and garners trust among external stakeholders such as investors, creditors, and partners. When stakeholders see a well-thought-out financial plan, they are more likely to invest, extend credit, or collaborate with the organisation, further fueling its growth and expansion prospects.

Long-Term Viability

Organisations that engage in strategic financial planning are better positioned for long-term viability in an era marked by rapid changes and uncertainties. This planning process encourages adaptability and responsiveness to evolving market conditions. It enables organisations to proactively adjust their financial strategies to remain relevant and competitive in the ever-changing business landscape, ensuring their continued success in the years to come.

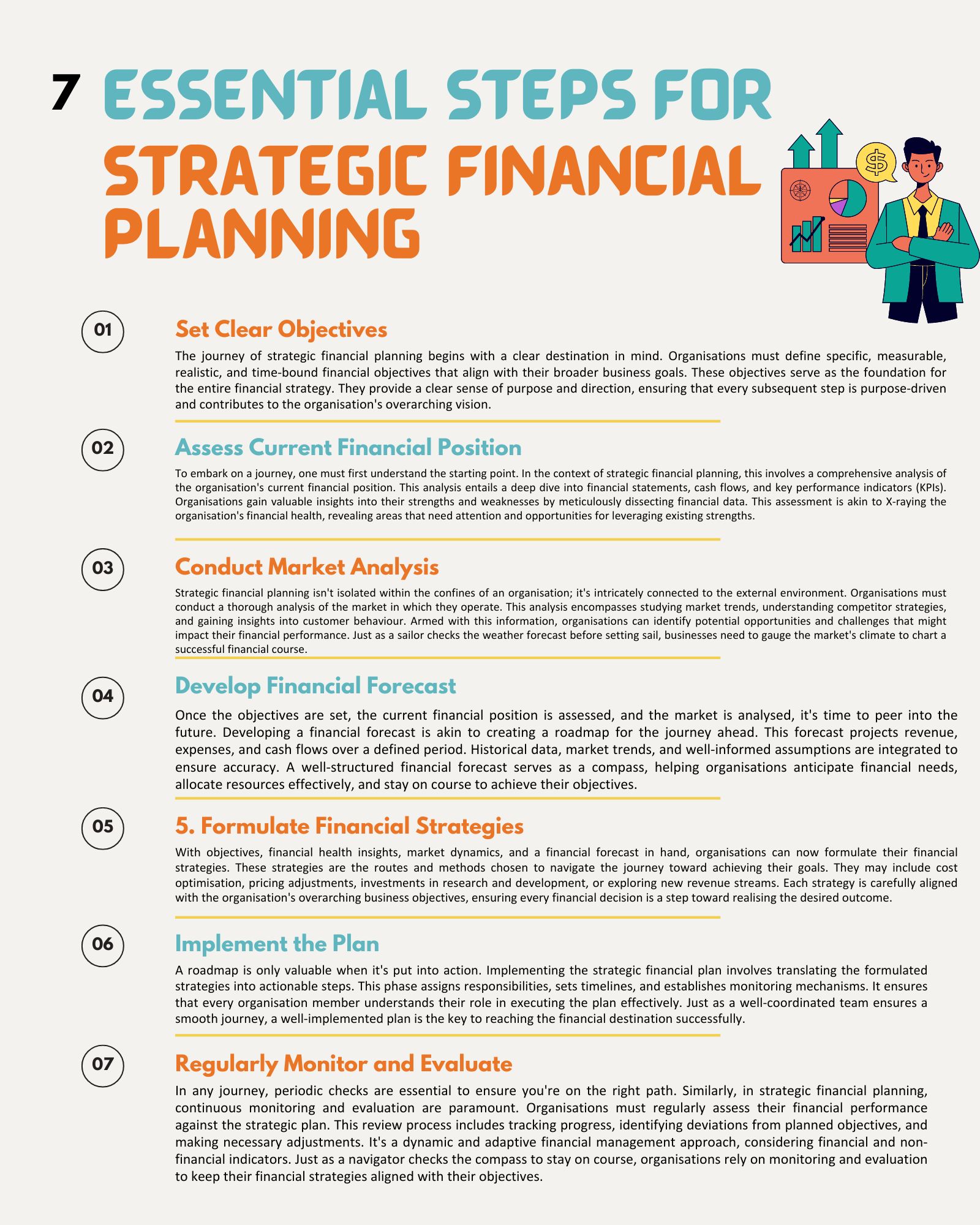

Essential Steps for Strategic Financial Planning

Strategic financial planning is not a one-size-fits-all process; it's a structured journey comprising several essential steps that collectively empower organisations to navigate the complex financial landscape. Let's explore these steps in greater detail:

1. Set Clear Objectives

The journey of strategic financial planning begins with a clear destination in mind. Organisations must define specific, measurable, realistic, and time-bound financial objectives that align with their broader business goals. These objectives serve as the foundation for the entire financial strategy. They provide a clear sense of purpose and direction, ensuring that every subsequent step is purpose-driven and contributes to the organisation's overarching vision.

2. Assess Current Financial Position

To embark on a journey, one must first understand the starting point. In the context of strategic financial planning, this involves a comprehensive analysis of the organisation's current financial position. This analysis entails a deep dive into financial statements, cash flows, and key performance indicators (KPIs). Organisations gain valuable insights into their strengths and weaknesses by meticulously dissecting financial data. This assessment is akin to X-raying the organisation's financial health, revealing areas that need attention and opportunities for leveraging existing strengths.

3. Conduct Market Analysis

Strategic financial planning isn't isolated within the confines of an organisation; it's intricately connected to the external environment. Organisations must conduct a thorough analysis of the market in which they operate. This analysis encompasses studying market trends, understanding competitor strategies, and gaining insights into customer behaviour. Armed with this information, organisations can identify potential opportunities and challenges that might impact their financial performance. Just as a sailor checks the weather forecast before setting sail, businesses need to gauge the market's climate to chart a successful financial course.

4. Develop Financial Forecast

Once the objectives are set, the current financial position is assessed, and the market is analysed, it's time to peer into the future. Developing a financial forecast is akin to creating a roadmap for the journey ahead. This forecast projects revenue, expenses, and cash flows over a defined period. Historical data, market trends, and well-informed assumptions are integrated to ensure accuracy. A well-structured financial forecast serves as a compass, helping organisations anticipate financial needs, allocate resources effectively, and stay on course to achieve their objectives.

5. Formulate Financial Strategies

With objectives, financial health insights, market dynamics, and a financial forecast in hand, organisations can now formulate their financial strategies. These strategies are the routes and methods chosen to navigate the journey toward achieving their goals. They may include cost optimisation, pricing adjustments, investments in research and development, or exploring new revenue streams. Each strategy is carefully aligned with the organisation's overarching business objectives, ensuring every financial decision is a step toward realising the desired outcome.

6. Implement the Plan

A roadmap is only valuable when it's put into action. Implementing the strategic financial plan involves translating the formulated strategies into actionable steps. This phase assigns responsibilities, sets timelines, and establishes monitoring mechanisms. It ensures that every organisation member understands their role in executing the plan effectively. Just as a well-coordinated team ensures a smooth journey, a well-implemented plan is the key to reaching the financial destination successfully.

7. Regularly Monitor and Evaluate

In any journey, periodic checks are essential to ensure you're on the right path. Similarly, in strategic financial planning, continuous monitoring and evaluation are paramount. Organisations must regularly assess their financial performance against the strategic plan. This review process includes tracking progress, identifying deviations from planned objectives, and making necessary adjustments. It's a dynamic and adaptive financial management approach, considering financial and non-financial indicators. Just as a navigator checks the compass to stay on course, organisations rely on monitoring and evaluation to keep their financial strategies aligned with their objectives.

Technology in Financial Planning

According to Mindstream Analytics, numerous companies resort to ERP systems and spreadsheets, often leading to errors and challenges in reaching consensus on plans and budgets. However, high-performance companies distinguish themselves by discarding manual spreadsheet processes favouring powerful multidimensional modelling capabilities and integrated workflows. Adopting these advanced tools minimises errors, enhances control, and amplifies accountability within their planning processes. Here's a deeper dive into the role of technology in financial planning, along with key points to consider:

1. Advanced Financial Planning Software

Advanced financial planning software has become a cornerstone of modern financial planning processes. These software solutions, such as integrated business planning (IBP) systems and financial management platforms, offer a range of capabilities that significantly augment strategic financial planning efforts.

Multidimensional Modelling

These tools provide robust multidimensional modelling capabilities, allowing organisations to create complex financial scenarios and assess the impact of various decisions. This enables more accurate forecasting and better-informed decision-making.

Real-time Data Integration

Advanced software solutions can seamlessly integrate real-time data from various sources, including financial systems, market data, and customer information. This real-time data access enhances financial analysis and reporting accuracy and timeliness.

Benefits | Description |

Multidimensional Modelling | Enables complex financial scenario assessments. |

Real-time Data Integration | Integrates real-time data for accuracy. |

Automated Workflows | Streamlines planning processes, reducing errors. |

Improved Collaboration | Facilitates real-time collaboration among teams. |

Enhanced Data Visualisation | Makes complex financial data more intuitive. |

Table 1: Benefits of advanced financial planning software

Automated Workflows

These tools often feature automated workflows, streamlining the financial planning process. This automation reduces manual data entry and the risk of errors, allowing finance teams to focus on strategic analysis rather than administrative tasks.

2. Data Analytics and Business Intelligence

Data analytics and business intelligence tools are integral to technology-driven financial planning. They provide organisations with the capability to extract actionable insights from their financial data.

Predictive Modelling

Advanced analytics techniques, such as predictive modelling and machine learning, enable organisations to forecast financial trends more accurately. For instance, predictive analytics can help predict customer demand, optimise inventory levels, and identify cost-saving opportunities.

Data Visualisation

Business intelligence tools often include data visualisation features, making it easier for decision-makers to interpret complex financial data. Visualisations like charts and dashboards can convey insights more intuitively.

Scenario Analysis

Technology facilitates scenario analysis, allowing organisations to simulate various financial scenarios and assess their potential impact. This helps in risk management and strategy formulation by understanding how different variables can influence financial outcomes.

3. Enhanced Collaboration and Communication

Modern technology promotes collaboration and communication among various stakeholders involved in the financial planning process.

Cloud-Based Solutions

Cloud-based financial planning tools enable real-time collaboration among team members, even if they are located in different geographical locations. This fosters efficient teamwork and ensures that everyone is working with the most up-to-date information.

Version Control

Technology allows for easy version control, ensuring that multiple iterations of financial plans are organised and accessible. This reduces confusion and enhances transparency in the planning process.

Data Sharing

With secure data sharing capabilities, organisations can easily share financial data with external partners, such as financial advisors, auditors, and investors, while maintaining data security and integrity.

4. Improved Accuracy and Accountability

Technology-driven financial planning significantly improves the accuracy of financial forecasts and budgets.

Reduced Errors

Automation and data validation checks in financial planning software reduce the likelihood of errors in financial models and calculations. This enhances the reliability of financial reports and forecasts.

Accountability

Technology enables organisations to track changes made to financial plans, providing an audit trail of who made what modifications. This accountability ensures that changes are made intentionally and can be traced back to responsible individuals.

5. Real-Time Decision Support

In today's fast-paced business environment, real-time decision support is critical. Technology facilitates access to up-to-the-minute financial data, enabling organisations to make agile and informed decisions.

Instant Insights

Decision-makers can access financial data and reports in real time, allowing them to respond swiftly to changing market conditions or unexpected financial events.

Sensitivity Analysis

Technology enables sensitivity analysis, which assesses how changes in key variables affect financial outcomes. This helps organisations make proactive decisions based on different scenarios.

The Role of Data Analytics

Data analytics has emerged as a powerful and indispensable tool in the realm of strategic financial planning. It enables organisations to make informed decisions, gain deeper insights, and optimise their financial strategies. Here's a comprehensive exploration of the role of data analytics, along with key points to consider:

1. Enhanced Forecasting Accuracy

Data analytics empowers organisations to move beyond traditional forecasting methods. By harnessing historical financial data, market trends, and external variables, organisations can develop more accurate financial forecasts. These forecasts serve as a cornerstone of strategic financial planning, offering a clearer picture of future revenue, expenses, and cash flows. With improved accuracy, organisations can allocate resources more effectively and make informed decisions that align with their long-term objectives.

2. Real-time Data Integration

In today's fast-paced business environment, timely access to data is paramount. Data analytics tools facilitate real-time data integration from various sources, including financial systems, market data, and customer information. This real-time data access ensures that decision-makers have the most up-to-date information at their fingertips. Whether assessing the impact of a recent market development or tracking the performance of a new product launch, real-time data integration enhances the agility and responsiveness of financial planning processes.

3. Advanced Scenario Analysis

Strategic financial planning often involves considering multiple scenarios and their potential impacts. Data analytics enables organisations to conduct advanced scenario analysis with ease. By altering key variables and assumptions, decision-makers can simulate various financial scenarios. This capability is invaluable for risk assessment, strategy formulation, and contingency planning. It allows organisations to anticipate how different market conditions, economic events, or internal changes may affect their financial outcomes, enhancing preparedness and adaptability.

4. Improved Resource Allocation

Effective resource allocation is a core component of strategic financial planning. Data analytics plays a pivotal role in optimising this allocation. Through detailed analyses of various initiatives and their potential return on investment (ROI), organisations can prioritise projects that offer the highest growth and profitability potential. This data-driven approach ensures that resources, both financial and non-financial, are channelled efficiently and effectively, reducing the risk of wasted or misallocated funds.

5. Data Visualisation for Decision Support

Data analytics tools like Tableau, Microsoft Excel, or Qlik, often include robust data visualisation capabilities. Visual representations such as charts, graphs, and dashboards transform complex financial data into easily digestible insights. Decision-makers can quickly grasp trends, patterns, and outliers, aiding in more intuitive and informed decision-making. These visualisations not only enhance comprehension but also facilitate effective communication of financial insights to stakeholders.

6. Identifying Cost Optimisation Opportunities

Data analytics helps organisations uncover cost optimisation opportunities that may have otherwise gone unnoticed. Through in-depth cost analysis, organisations can identify areas where expenses can be reduced or efficiencies can be improved. By pinpointing specific cost drivers and analysing cost structures, organisations can implement targeted cost-saving measures while preserving essential functions and investments necessary for growth.

7. Enhanced Risk Management

Data analytics contributes significantly to risk management within the context of strategic financial planning. By analysing historical data and external factors, organisations can identify potential risks, assess their likelihood and impact, and develop risk mitigation strategies. This proactive risk management approach enhances financial stability and resilience, ensuring that organisations can navigate uncertainties with greater confidence.

Sustainable Finance in Strategic Financial Planning

Sustainability has emerged as a fundamental consideration in strategic financial planning, reflecting the growing recognition of environmental, social, and governance (ESG) factors in business decision-making. Sustainable finance is the integration of these ESG principles into financial strategies and investments. Here's a closer look at the role of sustainable finance in strategic financial planning, along with key points to consider:

1. Alignment with Global Goals

Sustainable finance aligns financial objectives with broader societal and environmental goals. This alignment is essential in today's world, where businesses are expected to contribute positively to social and environmental well-being.

ESG Integration

Organisations incorporate ESG criteria into their financial planning processes. This includes assessing how their activities impact the environment, society, and governance, and taking steps to mitigate negative effects.

SDGs Integration

Sustainable finance often aligns with the United Nations' Sustainable Development Goals (SDGs). By incorporating SDGs into financial strategies, organisations can contribute to global efforts to address pressing challenges, such as climate change and poverty reduction.

2. Risk Mitigation

Sustainable finance is proactive in identifying and mitigating risks associated with environmental and social factors. Organisations can protect themselves from potential financial setbacks by considering these risks in financial planning.

Climate Risk Assessment

Businesses assess their exposure to climate-related risks, such as extreme weather events, regulatory changes, and shifting consumer preferences. This assessment informs strategies to reduce vulnerability.

Supply Chain Resilience

Sustainable finance considers the resilience of supply chains to environmental disruptions. To reduce supply chain risks, this involves diversifying suppliers, enhancing transparency, and identifying alternative sourcing options.

Area of Impact | Description |

Risk Mitigation | Identifies and mitigates environmental risks |

Capitalising on Opportunities | Invests in green technologies and sustainable markets |

Reputation and Stakeholder Trust | Builds brand loyalty and attracts responsible innvestors |

Regulatory Compliance | Ensures compliance with ESG reporting standards |

Long term Resilience | Enhances adaptability and risk diversification |

Table 2: Sustainable finance impact

3. Capitalising on Opportunities

Sustainable finance isn't just about risk mitigation; it's also about seizing opportunities in sustainable markets and business practices.

Investing in Green Technologies

Organisations may allocate funds to research and develop green technologies, such as renewable energy solutions or sustainable agriculture practices. These investments align with sustainability goals while offering potential long-term returns.

Exploring Sustainable Markets

Sustainable finance encourages businesses to explore emerging markets related to clean energy, eco-friendly products, and responsible investing. This diversification can lead to new revenue streams and reduced dependency on volatile industries.

4. Reputation and Stakeholder Trust

Sustainable finance practices enhance an organisation's reputation and build trust among stakeholders.

Brand Loyalty

Consumers increasingly favour brands that demonstrate a commitment to sustainability. Strategic financial planning that incorporates sustainability can boost brand loyalty and customer retention.

Investor Attraction

Sustainable finance practices attract socially responsible investors who seek to align their investments with ethical and sustainable principles. This can lead to increased capital and support for the organisation's initiatives.

5. Regulatory Compliance

Sustainable finance anticipates and complies with evolving regulatory requirements related to ESG factors.

Compliance Frameworks

Organisations establish compliance frameworks that align with international standards and national regulations related to sustainability reporting and disclosure.

Transparency and Accountability

Sustainable finance practices prioritise transparency and accountability in reporting ESG metrics. This not only ensures compliance but also builds trust with stakeholders.

6. Long-Term Resilience

Incorporating sustainable finance principles into strategic financial planning contributes to the long-term resilience of the organisation.

Adaptability

Businesses that consider sustainability are better prepared to adapt to changing market dynamics, including shifts in consumer preferences and regulatory changes.

Risk Diversification

Sustainable finance encourages diversification of risk across various sustainability initiatives and investments, reducing reliance on single revenue streams.

In summary, sustainable finance is a critical component of strategic financial planning. It aligns financial objectives with broader societal and environmental goals, mitigates risks, capitalises on opportunities, enhances reputation, ensures regulatory compliance, and fosters long-term resilience. Organisations that embrace sustainable finance practices are better positioned to thrive in a world where sustainability is not just a choice but an imperative for financial success and societal well-being.

Conclusion

Strategic financial planning serves as a compass for businesses, guiding their financial decisions and paving the way for long-term success. By understanding the concept of strategic financial planning and following the essential steps outlined in this comprehensive guide, organisations can enhance financial stability, make informed decisions, facilitate growth, and optimise resource allocation. Additionally, embracing technology and data analytics can further enhance the effectiveness of strategic financial planning, enabling businesses to stay agile in an ever-evolving financial landscape. Moreover, the integration of sustainable finance principles reflects a commitment to responsible business practices that can lead to sustainable growth and positive societal impact. For those seeking additional guidance in financial planning, consider exploring our Financial Planning & Feasibility Analysis course or contacting us for more information on how to embark on your journey toward financial prosperity.